Granite Construction Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Granite Construction Bundle

What is included in the product

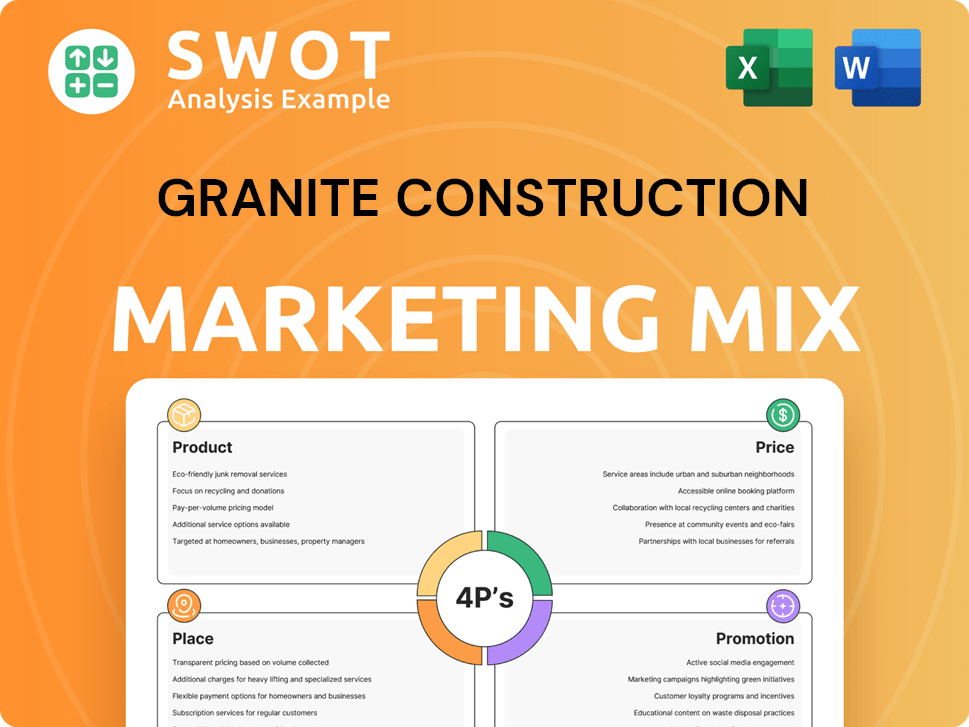

Analyzes Granite Construction's marketing through Product, Price, Place, and Promotion. Provides examples and strategic implications.

Summarizes Granite Construction's 4Ps, enabling fast understanding and streamlined strategic discussions.

Full Version Awaits

Granite Construction 4P's Marketing Mix Analysis

The preview reflects the Granite Construction 4Ps Marketing Mix analysis you’ll receive. It’s the complete document, fully analyzed. You can review every detail before you commit. No hidden sections; it's exactly what you get!

4P's Marketing Mix Analysis Template

Granite Construction dominates the infrastructure industry. Its success is built on a cohesive marketing strategy. Analyzing its Product offerings, pricing, Place, and Promotion is key. We can see the building blocks of their brand's effectiveness.

Discover how Granite aligns marketing for competitive gains. The full analysis breaks down each "P" clearly, using real-world data and formatting. This in-depth view is perfect for application and benchmarking.

Product

Granite Construction excels in heavy civil construction, focusing on vital infrastructure projects. Their portfolio includes transportation, water, and power projects. In 2024, Granite secured $2.1 billion in new project awards, demonstrating strong market demand. This includes roads, bridges, and mass transit systems. Their diverse services support essential public works.

Granite Construction's construction materials, like aggregates and asphalt, are key. In 2024, Granite's materials revenue was substantial, contributing significantly to overall earnings. They control quarries and plants, ensuring supply for projects and external sales. This vertical integration boosts efficiency and profitability, reflected in their financial performance.

Granite Construction's Specialty Infrastructure Services focuses on niche markets. They provide services for mining, oil and gas, and renewable energy sectors. In 2024, Granite's revenue in these areas was approximately $1.5 billion. This includes infrastructure for oil and gas, plus civil and mechanical services for renewable projects.

Site Preparation and Development

Granite Construction's site preparation and development services cater to private sector clients, encompassing a broad range of projects. These projects include commercial and industrial sites, railways, and residential developments. Granite's expertise in infrastructure is crucial for various private sector ventures. This segment's revenue was approximately $1.6 billion in 2024, reflecting its significance.

- Commercial and industrial site development.

- Railway construction and upgrades.

- Residential land development.

- Infrastructure services.

Sustainable Construction Practices

Granite Construction prioritizes sustainable construction, integrating eco-friendly practices. This involves green building techniques, cutting carbon emissions, and using recycled materials. Energy-efficient designs are also a key focus. In 2024, the global green building materials market was valued at $362.5 billion.

- Green building practices reduce environmental impact.

- Carbon emission reduction lowers the carbon footprint.

- Recycled materials promote resource efficiency.

- Energy-efficient designs decrease energy consumption.

Granite Construction's product offerings span heavy civil construction, materials production, specialty infrastructure services, and site preparation. Revenue in 2024 was boosted by transportation projects and materials sales. The company's focus on sustainable construction integrates green building methods.

| Product Category | Key Features | 2024 Revenue (approx. USD Billions) |

|---|---|---|

| Heavy Civil Construction | Roads, bridges, transit systems | 2.1 (new awards) |

| Construction Materials | Aggregates, asphalt | Significant contribution to overall earnings |

| Specialty Infrastructure Services | Mining, oil & gas, renewable energy | 1.5 |

| Site Preparation | Commercial, industrial, railways, residential | 1.6 |

Place

Granite Construction's geographic focus is mainly within the U.S. In 2024, around 70% of its revenue came from the Western U.S. states. They have a strong presence in California, Nevada, and Arizona. Granite also has projects in states like Florida and Illinois.

Granite Construction's regional offices and facilities, including quarries and plants, form a crucial part of its 'home market' strategy. This localized structure ensures efficient material supply. For example, in 2024, about 70% of Granite's revenues came from projects within their regional operational areas. The strategic placement of these resources reduces transportation costs and enhances project timelines.

Granite Construction's direct sales focus on major clients like construction firms and government entities for large-scale projects. This approach streamlines the supply chain, ensuring efficiency. Direct communication enables tailored solutions. In 2023, infrastructure projects accounted for 45% of Granite's revenue, showing the importance of this channel.

Sales to Third Parties

Granite Construction's sales to third parties are a key revenue stream. This involves selling construction materials like aggregates and asphalt to external contractors. For 2024, Granite reported approximately $1.2 billion in materials sales to third parties. This diversified revenue strategy supports Granite's overall profitability.

- 2024 Materials Sales: ~$1.2 billion

- Revenue Stream: Key component of total revenue

- Customer Base: External contractors

Project-Specific Operations

Granite Construction's 'place' strategy is project-specific, dictated by awarded construction sites. They deploy resources to these locations across their operational areas. This approach requires efficient logistics and supply chain management. In 2024, Granite secured approximately $6.6 billion in new construction contracts, influencing their operational 'place'.

- Project locations vary widely, impacting resource allocation.

- Logistics and supply chain are critical for timely execution.

- 2024 new contract wins: ~$6.6 billion, affecting project locations.

- Geographic diversification mitigates regional risks.

Granite Construction's place strategy centers on strategic site deployments across operational regions. The company's ability to secure contracts, such as the roughly $6.6 billion in new deals during 2024, influences project locations. Effective logistics and supply chain management are essential for timely project execution and resource allocation, given project-specific needs.

| Aspect | Details | Data (2024) |

|---|---|---|

| Contract Wins | New construction contracts | ~$6.6 billion |

| Geographic Focus | Western U.S. revenue | ~70% |

| Material Sales | Sales to third parties | ~$1.2 billion |

Promotion

Granite Construction actively engages in industry conferences and trade shows. This includes events like the Associated General Contractors of America (AGC) Convention. Participation boosts visibility and fosters networking with clients and partners. In 2024, the construction industry saw a 6% increase in event attendance. Granite's strategic presence is crucial for securing projects.

Granite Construction's website is key for displaying projects and abilities. Digital marketing helps them reach a wider audience. In 2024, construction firms saw a 15% rise in website traffic. Digital communication boosts brand visibility.

Granite Construction actively promotes itself through professional networking. They engage on LinkedIn and foster direct contact with industry peers. In 2024, Granite's marketing spend reached $65 million, reflecting their commitment. This includes efforts to build strong relationships for business growth. Their LinkedIn presence saw a 15% increase in engagement during Q4 2024.

Targeted Marketing to Client Segments

Granite Construction's targeted marketing focuses on key client segments. These include government agencies, state transportation departments, municipal infrastructure authorities, and private commercial developers. This approach allows for tailored communication and resource allocation. In 2024, infrastructure spending in the U.S. reached $400 billion, showing the importance of these segments.

- Government contracts accounted for 65% of Granite's revenue in 2024.

- State transportation projects represented 30% of the company's backlog.

- Private developers contributed 15% to the overall revenue.

Sustainability and Innovation Marketing

Granite Construction highlights sustainability and innovation in its marketing. They use corporate reports and industry publications to showcase these efforts. Technical conferences also serve as a platform to discuss advancements. This approach aligns with growing investor and stakeholder interest in ESG factors.

- Granite Construction's 2023 Sustainability Report details these initiatives.

- The company invested $35 million in innovative technologies in 2024.

- They aim to reduce carbon emissions by 30% by 2030.

Granite Construction uses diverse promotional methods. They attend industry events and have a strong digital presence. Targeted marketing focuses on key client segments. Investments in innovation and sustainability are highlighted.

| Promotion Strategy | Description | Impact |

|---|---|---|

| Events | Conferences, trade shows (AGC). | Increased visibility, networking. |

| Digital | Website, online marketing, LinkedIn. | Wider reach, brand visibility. |

| Targeting | Govt, transport, private devs. | Tailored communication. |

Price

Granite Construction's success hinges on competitive bidding. They meticulously calculate costs and strategically price bids to secure projects. In 2024, infrastructure spending increased, boosting their opportunities. Granite's revenue in Q1 2024 was $1.6 billion, reflecting successful bids. Their focus remains on winning profitable contracts.

Granite Construction employs value-based pricing for materials, considering production costs, demand, and perceived value. In Q1 2024, they increased asphalt and aggregate prices due to higher input expenses. The gross profit margin for materials was approximately 20% in 2023, reflecting pricing strategies. Recent price hikes aim to maintain profitability amidst rising operational costs.

Granite Construction's pricing strategy hinges on project complexity and scale. Average project values fluctuate substantially based on infrastructure type. In 2024, Granite's revenue from heavy civil projects, which often involve higher complexity, reached $2.8 billion. This reflects the impact of project scope on pricing.

Economic and Market Conditions

Economic and market conditions significantly influence Granite Construction's pricing. Overall economic health, construction market demand, and competitor pricing dynamics directly affect the company's pricing strategies. For instance, in 2024, the U.S. construction spending reached $2.07 trillion, indicating robust market demand. Fluctuations in material costs, like a 10% increase in steel prices, also force pricing adjustments.

- U.S. construction spending in 2024: $2.07 trillion.

- Steel price increase impact: ~10% in 2024.

- Market demand: Directly impacts pricing strategies.

Strategic Investments and Cost Management

Granite Construction's pricing strategy involves strategic investments and cost management. Their focus on automation and production cost management directly influences their pricing competitiveness. In Q1 2024, Granite's operating expenses decreased, indicating improved efficiency. This efficiency allows them to offer competitive bids on projects. These measures are crucial for maintaining profitability.

- Q1 2024 operating expenses decreased.

- Focus on automation and production cost management.

- Competitive bids on projects.

Granite's pricing hinges on bids, value-based for materials. They adjust based on complexity, market, and economic factors. Efficient cost management enables competitive offerings. In Q1 2024, revenue was $1.6B.

| Aspect | Details | Impact |

|---|---|---|

| Competitive Bidding | Focus on cost calculations and strategic bids. | Securing profitable projects, as seen in Q1 2024. |

| Value-Based Pricing | Materials pricing aligned with production cost. | Maintained gross profit margins, approx. 20% (2023). |

| Project Complexity | Pricing affected by project scale and type. | 2024, heavy civil projects brought $2.8B revenue. |

4P's Marketing Mix Analysis Data Sources

Granite Construction's 4P's analysis uses verified information from SEC filings, company websites, investor presentations, and industry reports.