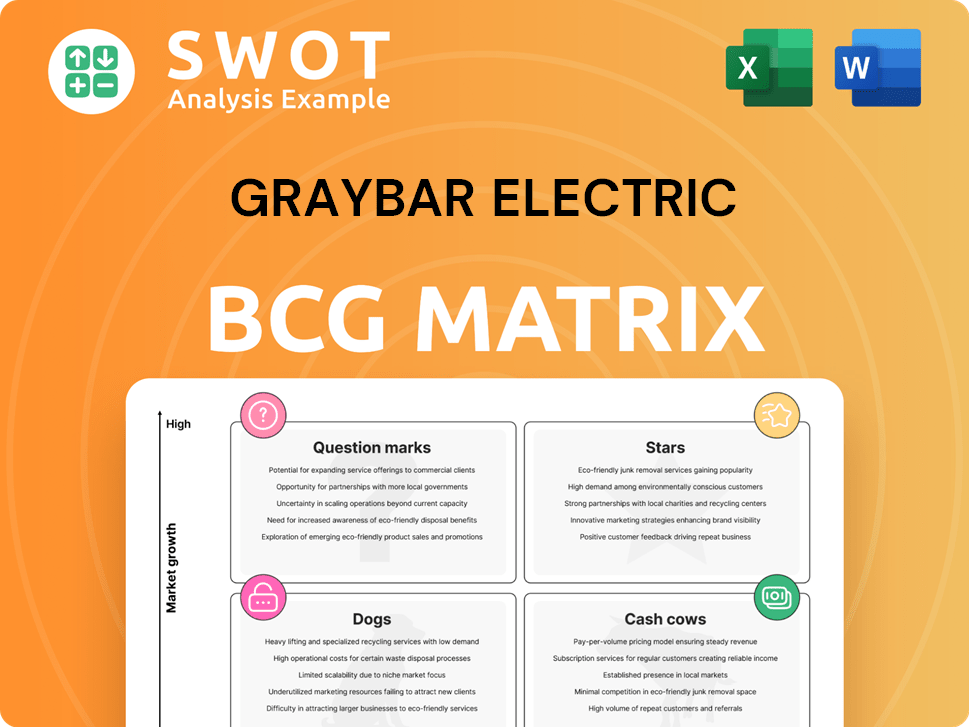

Graybar Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graybar Electric Bundle

What is included in the product

Strategic Graybar's BCG Matrix: product portfolio assessment and investment recommendations.

Clean, distraction-free view optimized for C-level presentation.

Full Transparency, Always

Graybar Electric BCG Matrix

The Graybar Electric BCG Matrix preview is identical to the purchased file. Get the full strategic analysis instantly; it's ready for immediate application in your business plan.

BCG Matrix Template

Graybar Electric's BCG Matrix offers a snapshot of its diverse product portfolio. Understanding its Stars, Cash Cows, Question Marks, and Dogs reveals strategic strengths and weaknesses. Identifying these quadrants allows for informed resource allocation and growth planning. This preliminary view only scratches the surface of Graybar's market positioning. Dive deeper into its BCG Matrix and gain strategic insights you can act on.

Stars

Electrical distribution is a "Star" for Graybar, holding a strong market share in a growing sector. The U.S. electrical distribution market reached $163.4 billion in 2024. Grid modernization and rising electricity demands boost growth. Investing here secures Graybar's leadership.

Graybar's data communication products shine as a star in its portfolio. The market for data centers and networking is booming, fueled by digital transformation and IoT expansion. In 2024, the global data center market was valued at over $500 billion, with projected annual growth exceeding 10%. Investing here will boost Graybar's market leadership.

Industrial automation is booming, fueled by the push for higher efficiency and output in factories. Graybar's control systems and robotics solutions are key growth areas. For example, the industrial automation market was valued at $195.7 billion in 2023. Increased investment and innovation are vital to strengthen Graybar's position. The market is expected to reach $330.7 billion by 2030.

Supply Chain Management Services

Graybar's supply chain management services are a star in its BCG matrix. Their expertise offers a key competitive edge, especially in today's market. Customers rely on efficient logistics and prompt deliveries, crucial for construction and industrial endeavors.

- In 2023, Graybar reported revenues of $10.3 billion, highlighting the importance of its services.

- Graybar's on-time delivery rate consistently exceeds 95%, demonstrating operational excellence.

- The company invested $100+ million in technology to enhance supply chain efficiency by 2024.

- Customer satisfaction scores for logistics services average 4.7 out of 5, showcasing strong loyalty.

Strategic Acquisitions

Graybar's strategic acquisitions, like Blazer Electric Supply and Valin Corporation, enhance its market reach and product lines. These moves are designed to boost revenue and expand market share. In 2024, Graybar's revenue reached approximately $10.7 billion, reflecting growth from these acquisitions. Successful integration of these acquisitions remains key for continued expansion.

- Revenue growth is a key indicator of successful acquisitions.

- Market share expansion validates the strategic rationale.

- Integration efficiency impacts long-term profitability.

- Acquisitions support diversification and resilience.

Graybar's stars show strong market positions in growing sectors. Electrical distribution, worth $163.4B in 2024, and data communication, exceeding $500B, are prime examples. Supply chain services, marked by a 95%+ on-time delivery rate, also shine. Strategic acquisitions boost revenue.

| Star Category | Market Size (2024) | Graybar's Strategy |

|---|---|---|

| Electrical Distribution | $163.4 Billion | Capitalize on grid modernization. |

| Data Communications | $500+ Billion | Invest in digital transformation and IoT. |

| Supply Chain | $10.7 Billion (Revenue) | Enhance logistics and technology investments. |

Cash Cows

Traditional electrical supplies, like wiring and lighting, are cash cows for Graybar. They have a strong market share in these mature markets, ensuring stable demand. The focus is on efficiency and profit extraction, not rapid expansion. In 2024, Graybar's revenue was over $10 billion, highlighting the stability of this segment.

Lighting solutions are a cash cow for Graybar, generating consistent revenue despite LED advancements. Graybar's strong market position and loyal customers ensure a stable income stream. In 2024, traditional lighting still accounted for about 30% of the market. Inventory optimization and distribution efficiency are key to maximizing profits in this area.

Utility infrastructure products, like transformers, are in steady demand due to constant maintenance and upgrades. Graybar benefits from its established relationships with utility companies, ensuring market stability. For 2024, the utility sector is projected to spend billions on infrastructure. Efficient supply chain management is key to maintaining profitability in this segment. Graybar's revenue in 2023 was $10.7 billion, with a solid market share in the electrical distribution industry.

Government Contracts

Graybar's government contracts are a cash cow, offering a consistent revenue stream. Their strong reputation and regulatory compliance are key advantages. Maintaining solid relationships with government agencies secures ongoing business. In 2023, the U.S. government spent over $600 billion on contracts. Electrical and communication products represent a significant portion of this spending.

- Consistent Revenue: Government contracts provide a dependable income source.

- Competitive Advantage: Graybar's reputation and compliance are critical.

- Relationship Focus: Strong agency ties ensure continued business.

- Market Size: The U.S. government's contract spending exceeds $600 billion.

MRO (Maintenance, Repair, and Operations) Supplies

MRO supplies are crucial for industrial and commercial operations, ensuring smooth functioning. Graybar excels in this area, offering a vast selection and extensive distribution. Customer satisfaction and efficient order processing are key to maintaining a strong market position. These factors are critical for sustaining profitability and growth.

- Graybar reported over $10 billion in revenue in 2023.

- MRO products include electrical, lighting, and networking items.

- Efficient distribution minimizes downtime for clients.

- Customer service boosts customer loyalty.

Cash cows for Graybar are stable revenue sources like wiring and lighting, boasting strong market shares. Utility infrastructure products, such as transformers, also contribute consistently. Government contracts and MRO supplies are steady income streams too.

| Product | Market Share | 2024 Revenue (Est.) |

|---|---|---|

| Wiring & Lighting | Dominant | $3B+ |

| Utility Products | Significant | $2B+ |

| Government Contracts | Stable | $1.5B+ |

Dogs

Legacy telecommunication products, like analog phone systems, are experiencing declining demand due to the rise of digital and wireless technologies. In 2024, sales of traditional telecom equipment decreased by approximately 10% compared to the previous year, reflecting this shift. Graybar should reduce investments in these products. Consider phasing them out or focusing on specialized niche markets.

Outdated inventory at Graybar ties up capital and leads to storage expenses. In 2024, excess inventory costs could be up to 15% of total inventory value. To mitigate this, Graybar should liquidate old stock, for example, through clearance sales, which can improve cash flow. Regular audits are essential to identify and manage slow-moving items, reducing potential losses.

Low-margin products can drain resources. Graybar must assess each product's profitability. In 2023, the electrical equipment market saw margins fluctuate, with some sectors underperforming. Consider discontinuing or outsourcing low-profit items. This strategic move can boost overall profitability and efficiency.

Regions with Poor Performance

Some Graybar Electric geographic regions might struggle, perhaps due to tough local economies or intense competition. Graybar should thoroughly evaluate each location's performance, looking closely at sales figures and profit margins. They might need to consider closing or restructuring underperforming branches to improve overall profitability. For example, in 2024, regions with declining construction activity saw reduced demand for Graybar's products.

- Analyze sales figures and profit margins.

- Assess the impact of local economic conditions.

- Evaluate competitive pressures in the area.

- Consider branch restructuring or closure.

Products Facing Technological Disruption

In the Graybar Electric BCG Matrix, "Dogs" represent products threatened by technological advancements. Traditional lighting is an example, potentially facing obsolescence. Graybar needs to track tech trends to adapt. Focus on newer, efficient alternatives to stay competitive. For instance, the global smart lighting market was valued at $16.7 billion in 2023.

- Identify and phase out outdated products.

- Invest in training for new technologies.

- Prioritize sales of advanced lighting solutions.

- Monitor market trends closely for emerging tech.

In the Graybar Electric BCG Matrix, "Dogs" include products with low market share and growth. Outdated items like traditional lighting face obsolescence. Focus on phasing out these products while investing in innovative alternatives to remain competitive.

| Product Category | Market Share | Growth Rate |

|---|---|---|

| Traditional Lighting | Low | Declining |

| Legacy Telecom | Low | Declining (approx. -10% in 2024) |

| Low-Margin Items | Variable | Depends on sector |

Question Marks

Smart grid tech, like AMI and grid automation, is in a high-growth phase. Graybar's market share might be low initially, but these are key for grid modernization. The smart grid market is projected to reach $61.3 billion by 2024. Partnerships and pilot projects can help Graybar grow.

Renewable energy solutions, like solar panel distribution, are seeing rapid growth. Graybar's market share might be small initially. Government incentives and environmental concerns fuel this trend. Graybar can build expertise and partnerships here. In 2024, the global renewable energy market was valued at over $880 billion.

The EV charging infrastructure market is booming due to rising EV adoption. Graybar's market share in this area is currently uncertain. Collaborating with EV charger makers and providing installation services could boost Graybar's presence. The global EV charging infrastructure market was valued at $23.8 billion in 2023, projected to reach $116.3 billion by 2030.

Advanced Cybersecurity Solutions

Advanced cybersecurity solutions fit the "Question Mark" category for Graybar. The rising cyber threats to infrastructure create growing demand. Graybar's current market share in this niche might be small. Enhancing cybersecurity expertise and partnering with specialists can boost Graybar's offerings.

- Cybersecurity spending is projected to reach $210 billion globally in 2024.

- The industrial cybersecurity market is expected to grow significantly.

- Graybar's strategic partnerships could include firms like Palo Alto Networks.

- Investing in specialized training programs for employees is key.

IoT (Internet of Things) Solutions

The Internet of Things (IoT) solutions represent a promising area for Graybar Electric. Increased adoption of IoT devices in industrial and commercial sectors fuels demand for related services. Graybar's market share in this segment is likely developing. Offering IoT products and services positions Graybar to capitalize on this expanding market.

- Market growth for IoT is substantial; the global IoT market was valued at $212.1 billion in 2019 and is projected to reach $1,386.0 billion by 2027.

- Graybar can provide sensors and connectivity solutions.

- Data analytics services are also part of the IoT offerings.

- This area could represent a "Star" or "Question Mark" in the BCG matrix.

Advanced cybersecurity solutions fit the "Question Mark" category for Graybar.

Demand for cybersecurity is growing due to infrastructure cyber threats.

Graybar's niche market share might be small; investing in cybersecurity expertise is vital.

| Area | Market Size (2024) | Graybar Strategy |

|---|---|---|

| Cybersecurity | $210B (global spending) | Partnerships (Palo Alto Networks), training |

| Industrial Cybersecurity | Significant Growth | Specialized training programs |

| IoT | $1.3T (by 2027) | Sensors, connectivity, data analytics |

BCG Matrix Data Sources

Graybar's BCG Matrix uses financial statements, sales figures, market share analysis, and industry reports to ensure accurate insights.