Grocery Outlet Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grocery Outlet Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio. Clear descriptions and strategic insights.

Simplified Grocery Outlet BCG Matrix for easy shareability, boosting painless team discussions.

Delivered as Shown

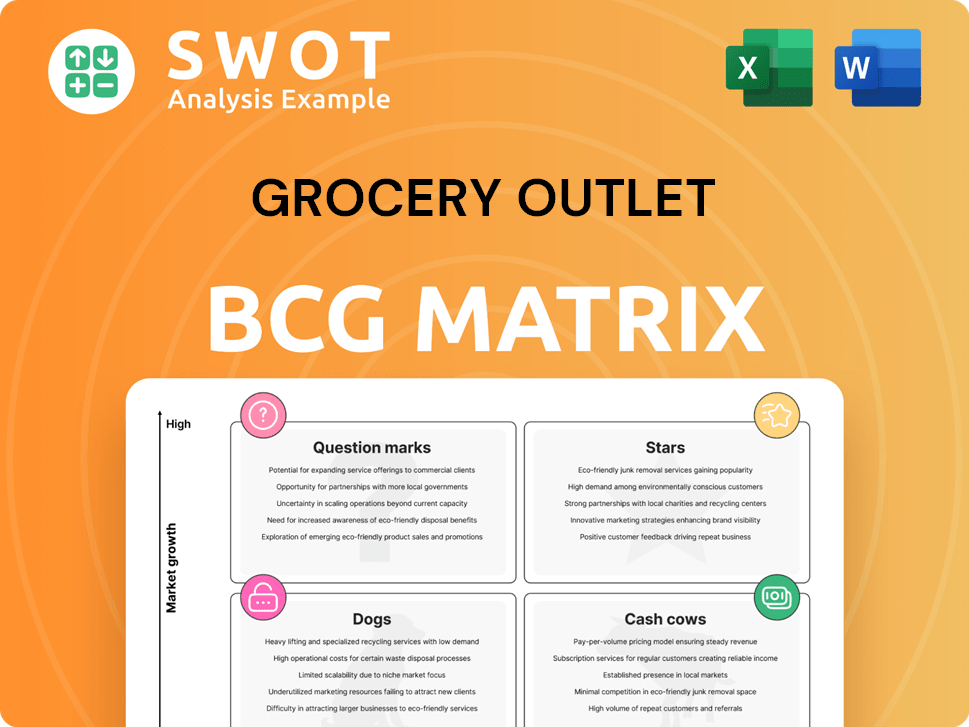

Grocery Outlet BCG Matrix

The preview showcases the identical Grocery Outlet BCG Matrix you'll receive upon purchase. Download the full, ready-to-use report with clear market insights and strategic recommendations.

BCG Matrix Template

Grocery Outlet navigates a diverse product landscape, from bargain groceries to unique finds. Its "Stars" could include high-demand, rapidly growing items. "Cash Cows" might be core, established product lines. "Dogs" and "Question Marks" reveal opportunities for optimization. Understanding the BCG Matrix unlocks strategic decisions. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Grocery Outlet's opportunistic buying model, a cornerstone of its strategy, leverages its unique sourcing to acquire surplus inventory. This approach allows them to offer brand-name products at prices significantly lower than competitors. In 2024, this model enabled Grocery Outlet to secure inventory at prices 30-50% below standard wholesale. This strategy attracts value-conscious consumers.

Grocery Outlet's extreme value proposition centers on deep discounts, typically 40-70% off name-brand products. This appeals to value-conscious shoppers, fostering loyalty. Their sales reached $4.0 billion in 2023, showcasing strong consumer demand for these deals. This approach aligns with their strategy of providing a "treasure hunt" shopping experience.

Grocery Outlet's Independent Operator (IO) model, with locally owned stores, creates a community-focused shopping experience. These IOs personalize service, adapting product selections to meet local needs. IOs are incentivized for sales and profit, aligning with the company's goals. As of 2024, this model supports over 450 stores across the US.

Expansion into New Markets

Grocery Outlet's expansion strategy focuses on entering new markets for growth. The acquisition of United Grocery Outlet (UGO) in 2024 shows a commitment to the Southeast. Clustered growth in cities like Cleveland, Las Vegas, and Baltimore enhances market penetration. This approach boosts brand visibility and operational efficiency.

- UGO acquisition provided a platform for expansion in the Southeast.

- Clustered growth strategy focuses on density and brand building.

- Expansion helps Grocery Outlet reach new customer bases.

- The approach supports economies of scale.

Private Label Program (GO Brands)

Grocery Outlet's GO Brands, including SimplyGO and others, are a strategic move. These private label products boost customer value by offering savings on essentials. Increased private label SKUs improve margins and attract budget shoppers. This strategy is key, as in 2024, private label sales grew, reflecting a shift in consumer preferences.

- GO Brands, like SimplyGO, offer value on basics.

- Private label expansion boosts margins.

- Attracts budget-conscious consumers.

- Private label sales are rising in 2024.

Grocery Outlet's strategic initiatives, particularly in sourcing, pricing, and market expansion, position it as a Star within the BCG Matrix. The company's strong revenue growth, reaching $4.0 billion in 2023, and the continuous expansion of its private label offerings highlight its potential. Grocery Outlet’s ability to capitalize on its business model for sustained growth is evident.

| Category | Details | Data (2024) |

|---|---|---|

| Revenue Growth | Sales increase indicates market success | $4.2B (projected) |

| Private Label Sales | GO Brands are expanding | 18% of total sales |

| Store Count | Increasing national presence | 480 stores |

Cash Cows

Grocery Outlet's strong foothold in key areas, especially the Western US, is a major advantage. They've built a solid customer base and brand recognition in California, Oregon, and Washington. This established presence allows them to utilize their existing infrastructure, like distribution centers to serve these markets efficiently. In 2024, Grocery Outlet operates over 400 stores, with a significant portion in these core states, according to company reports.

Grocery-anchored real estate is a Cash Cow for Grocery Outlet, benefiting from consistent tenant demand and stable, long-term leases. In Q4 2024, vacancy was 3.5%, down 10 bps from Q4 2023. Investment hit $7.0 billion in 2024, exceeding 2023 figures. This sector's stability provides a reliable income stream.

Grocery Outlet distinguishes itself with strong community engagement, unlike conventional grocers. They create a neighborhood feel through localized products and personalized service. This approach fosters customer loyalty, attracting bargain hunters. In 2024, the company's customer satisfaction scores showed a 7% increase.

Brand Name Recognition

Grocery Outlet's strong brand recognition stems from offering name-brand products at discounted prices. This strategy is supported by its opportunistic buying model, which allows the company to secure products at significant discounts. In 2024, Grocery Outlet reported a 10.7% increase in net sales, showing the strength of its brand. This approach resonates with consumers seeking value.

- Grocery Outlet's net sales increased by 10.7% in 2024.

- The company leverages opportunistic buying to offer lower prices.

- Brand recognition is a key factor in its success.

Mobile App and Customization

Grocery Outlet's GO Mobile App and personalized shopping experiences are key. This customization helps customers find exclusive deals and stay informed. The app boosts customer convenience and enhances their shopping journey. In 2024, mobile app usage in retail grew, with 60% of consumers using apps for shopping.

- Mobile apps drive customer loyalty and sales.

- Personalized offers increase customer engagement.

- Convenience boosts customer satisfaction.

- Mobile shopping is a growing trend.

Grocery Outlet is a Cash Cow due to its established presence and strong brand recognition, especially in the Western US. The company's real estate, with low vacancy rates, generates consistent income. Its community engagement and personalized shopping experience further strengthen customer loyalty. In 2024, net sales increased by 10.7%.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Presence | Western US Focus | Over 400 stores |

| Real Estate | Low vacancy, reliable income | 3.5% vacancy in Q4 |

| Sales Growth | Strong performance | 10.7% increase |

Dogs

Grocery Outlet's inventory shrinkage presents a challenge, affecting profitability. In 2024, this issue impacted gross margins. The company's supply and pricing of eggs also affected gross margins by roughly 50 basis points. Effective inventory management is crucial to mitigate these financial impacts.

Grocery Outlet's gross margin faced challenges. It dropped to 30.2% in fiscal 2024 from 31.3% the year before. System conversions, competitive pricing, and supply chain issues contributed to this decline. Addressing these pressures needs strategic adjustments to pricing, sourcing, and operational efficiency.

Grocery Outlet's tech upgrade in late 2023 hit operations, impacting gross margins and same-store sales. The company is still navigating the systems conversion, aiming for a real-time order guide rollout in Q2 2025. These tech challenges are creating financial pressure. In Q3 2024, same-store sales growth was just 0.5%. Stabilizing the systems by Q2 2025 is crucial.

Overly Ambitious Store Growth

Grocery Outlet's overly ambitious store growth strategy has faced headwinds. Initially, the company aimed for aggressive expansion, which strained execution and performance. The company scaled back its 2025 store opening target from over 50 to 33-35 stores. This shift demands a more disciplined expansion plan, prioritizing existing markets and adjacent areas.

- The company's stock has faced volatility, reflecting investor concerns about growth.

- Reduced store opening targets indicate a strategic recalibration.

- Focus will shift to optimizing existing stores and nearby territories.

Class Action Lawsuit

Grocery Outlet currently faces a class-action lawsuit, alleging investor misrepresentation regarding the tech transition's financial effects. Such lawsuits can severely damage a company's reputation, potentially impacting stock performance. Defending against these claims is resource-intensive, often involving significant legal fees and management time. The possibility of substantial financial settlements further complicates the situation.

- The lawsuit accuses Grocery Outlet of misleading investors about the financial impact of its tech transition.

- Class-action lawsuits often result in reputational damage and require a strong defense.

- Legal fees and potential settlements can create financial burdens.

- Investors may react negatively, affecting stock prices.

Grocery Outlet's issues like tech glitches and lawsuits classify them as "Dogs". These problems, compounded by inventory shrinkage and margin declines, hinder growth. Specifically, the stock's volatility and reduced store targets in 2025 (33-35 openings) show underperformance.

| Category | Impact | Details |

|---|---|---|

| Financials | Gross Margin Drop | 30.2% in 2024 vs. 31.3% in 2023 |

| Operational | System Conversion | Real-time order guide rollout delayed to Q2 2025 |

| Strategic | Store Growth | 2025 target reduced to 33-35 stores |

Question Marks

Grocery Outlet's net sales are up, but comparable store sales growth is slowing down. In Q3 2024, it only grew by 1.2%, a decrease from previous quarters. This indicates the need for strategies to boost foot traffic and spending in existing stores. The company must focus on improving sales in current locations.

Grocery Outlet's expansion into non-adjacent markets presents challenges. New stores outside existing areas haven't matched the success of those in familiar territories. This underperformance necessitates a strategic pivot. The company must concentrate on markets where brand recognition is high. Operational efficiencies and synergies are critical for success.

Grocery Outlet is consolidating its supply chain, particularly in the Pacific Northwest. This strategic move involves streamlining its distribution network to boost efficiency and reduce expenses. A new, modern facility, slated to be fully operational by late 2025, is key to these improvements. Successful implementation is crucial to realize the intended benefits, optimizing the flow of goods.

Value Messaging

Grocery Outlet is focusing on enhancing its value messaging to highlight its price benefits. The company experienced challenges in effectively communicating value earlier in 2024, influenced by pricing strategies and competitor actions. A more focused approach is needed, emphasizing value and weekly promotions in its messaging. In Q1 2024, Grocery Outlet's comparable store sales decreased by 0.7%. This strategic shift aims to boost sales.

- Grocery Outlet's comparable store sales decreased by 0.7% in Q1 2024.

- The company plans to improve its value messaging.

- Focus on weekly deals and value-oriented communication is key.

- Pricing and competition affected early 2024 performance.

Executive Leadership Transition

Grocery Outlet's recent executive leadership shift, with Jason Potter as CEO and Chris Miller as CFO, is a pivotal factor. Effective leadership is vital to address operational hurdles and foster sustained expansion and profitability. Their experience is crucial for navigating market dynamics. This transition could significantly influence the company's strategic direction and financial outcomes.

- Jason Potter brings over 30 years of grocery experience.

- Chris Miller has 40 years of finance experience.

- Leadership changes can affect strategic direction.

- The transition impacts operational efficiency.

Grocery Outlet's "Question Marks" involve initiatives with high potential but uncertain outcomes. These include new market expansions and leadership transitions that require careful management. They must monitor these investments closely to ensure a positive ROI. The situation demands adaptable strategies.

| Aspect | Challenge | Impact |

|---|---|---|

| New Markets | Expansion outside core areas | Slower sales growth. |

| Leadership Transition | New CEO and CFO | Potential shifts in strategy. |

| Value Messaging | Communicating value | Improved store sales, competitive advantage. |

BCG Matrix Data Sources

Grocery Outlet's BCG Matrix relies on financial statements, market growth data, industry reports, and expert analysis for comprehensive insights.