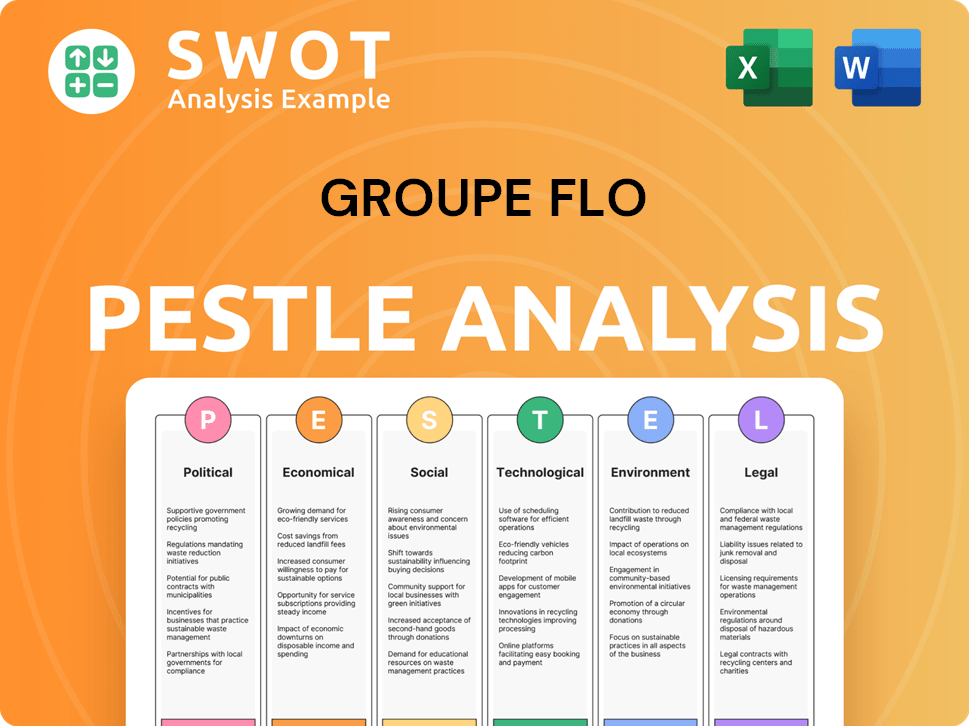

Groupe Flo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupe Flo Bundle

What is included in the product

Evaluates external factors impacting Groupe Flo via Political, Economic, Social, Technological, Environmental, and Legal lenses.

Helps identify crucial external factors to formulate targeted and practical strategic solutions.

Same Document Delivered

Groupe Flo PESTLE Analysis

The preview is the actual Groupe Flo PESTLE Analysis. See its layout, content, and structure before buying.

It’s fully formatted and ready to download.

No surprises here.

Get this finished document instantly.

What you’re seeing is the exact final version.

PESTLE Analysis Template

Groupe Flo faces evolving challenges and opportunities. Their success depends on navigating the political climate, economic fluctuations, and technological advancements. Social trends and legal regulations also play a crucial role. Understanding the complete external landscape is key to future success.

Our in-depth PESTLE Analysis equips you with the intelligence needed to thrive. This actionable analysis offers a strategic roadmap, providing insights you won’t find elsewhere. Buy the full version and stay ahead.

Political factors

Groupe Flo must adapt to evolving food safety standards and hygiene rules. Stricter regulations can lead to changes in food prep, sourcing, and kitchen operations. For example, the EU's food safety authority, EFSA, regularly updates guidelines. In 2024, the global food safety market was valued at $19.5 billion, expected to reach $28.8 billion by 2029. Compliance is key to avoiding fines and keeping customers.

Political instability in regions where Groupe Flo has operations or sources ingredients can disrupt supply chains. Tourist locations are especially vulnerable. For example, in 2024, political unrest decreased tourism in certain areas by up to 30%. A stable political environment supports the hospitality industry. This contributes to business growth.

Changes in VAT, corporate taxes, and fiscal policies directly impact Groupe Flo. Alterations in VAT rates affect pricing strategies and profitability. Corporate tax adjustments influence operational costs, as seen in France's 25% corporate tax rate. Fiscal policy changes impact consumer spending, a key factor for Groupe Flo's sales; for example, in 2024, France's government plans to address inflation and budget deficits, potentially impacting consumer behavior.

Labor Laws and Employment Policies

Changes in labor laws, minimum wage, and employment policies significantly affect Groupe Flo's operational costs and employee relations. Compliance with these regulations, such as the 2024 French minimum wage increase to €1,766.92 gross per month, is essential for financial stability. Adapting to evolving labor standards ensures efficiency and avoids penalties. Groupe Flo must navigate these changes to maintain profitability and a positive work environment.

- French minimum wage in 2024: €1,766.92 gross per month.

- Labor law adjustments impact staffing costs.

- Compliance is crucial for operational efficiency.

Trade Policies and Import/Export Regulations

Changes in trade policies, tariffs, and import/export regulations directly impact Groupe Flo's operational costs, especially for restaurants dependent on imported ingredients. For instance, in 2024, increased tariffs on key food imports led to a 3% rise in ingredient costs for some restaurant chains. This can affect product availability.

- 2024 saw a 2.5% average increase in food import tariffs.

- Imported goods account for 20% of restaurant supplies on average.

- Regulatory changes in 2025 could further impact supply chains.

Groupe Flo faces food safety regulations from authorities like EFSA. Political instability can disrupt supply chains and decrease tourism. Tax policies and labor laws, like France's €1,766.92 minimum wage, impact costs and pricing strategies.

Trade policies, tariffs, and import/export rules affect ingredient costs.

| Political Factor | Impact on Groupe Flo | Data Point (2024) |

|---|---|---|

| Food Safety Regulations | Increased compliance costs | Global food safety market: $19.5B |

| Political Instability | Supply chain disruption, decreased tourism | Tourism decrease in certain areas up to 30% |

| VAT & Taxes | Affects pricing and operational costs | France's 25% corporate tax rate |

| Labor Laws | Impact on operational costs | France's min wage: €1,766.92 gross/month |

| Trade Policies | Influence costs and availability | 2.5% average rise in food import tariffs |

Economic factors

Consumer spending and disposable income are key for Groupe Flo. High disposable income boosts demand for dining out. In 2024, consumer spending in France increased, but inflation remains a concern. Any economic dip could hurt Groupe Flo's sales.

Rising inflation, especially in food, boosts Groupe Flo's costs. This squeezes profit margins, possibly needing price hikes. In 2024, food inflation hit about 2.5%. Higher prices can hurt competitiveness in the market.

Exchange rate volatility directly affects Groupe Flo's costs and revenues. A stronger Euro, for instance, could make imported ingredients cheaper, boosting margins. However, if Groupe Flo has international ventures, a weaker Euro would reduce the value of profits when converted back. The Euro's exchange rate against the USD has fluctuated recently; in 2024, it traded between $1.07 and $1.10. These fluctuations demand careful currency hedging strategies.

Interest Rates and Access to Capital

Interest rates significantly influence Groupe Flo's financial strategy. Higher rates increase borrowing costs, potentially impacting investment plans. Access to capital is crucial for expansion and managing existing debt. The European Central Bank (ECB) maintained key interest rates in its April 2024 meeting, but future decisions will affect Groupe Flo. These rates impact the company's financial health.

- ECB deposit facility rate: 4.00% (April 2024).

- Eurozone inflation: 2.4% (March 2024).

- Groupe Flo's debt levels and financing strategies are key.

Economic Growth and Market Trends

Economic growth significantly impacts Groupe Flo's operational environment and consumer behavior. Positive economic trends typically boost consumer spending in the hospitality sector, which Groupe Flo is a part of. Adapting to the latest market trends is crucial for Groupe Flo to maintain a competitive edge. For instance, in 2024, the global food service market was valued at $3.2 trillion.

- Increased consumer spending due to economic growth.

- Adaptation to evolving consumer preferences.

- The food service market is growing, creating opportunities.

- Groupe Flo must stay competitive.

Groupe Flo's success hinges on economic stability. Consumer spending, influenced by disposable income, drives sales. Inflation and interest rates significantly shape costs and financial strategies. Market dynamics are reflected in the global food service market, valued at $3.2T in 2024.

| Factor | Impact | 2024 Data |

|---|---|---|

| Inflation | Higher costs, margin pressure | Eurozone: 2.4% (Mar) |

| Interest Rates | Affect borrowing and investment | ECB Deposit: 4.00% (Apr) |

| Consumer Spending | Drives demand | French spending rose |

Sociological factors

Consumer preferences are shifting, with a growing interest in diverse diets. Vegetarian and vegan options are gaining traction, reflecting a broader health and sustainability focus. According to a 2024 report, the plant-based food market is projected to reach $77.8 billion by 2025. Groupe Flo must adapt its menus to stay competitive and meet these evolving demands.

Shifting lifestyles, including busier routines and an increased desire for casual meals or takeout, significantly influence consumer dining choices. Groupe Flo must adapt to these evolving preferences. In 2024, the online food delivery market is projected to reach $250 billion globally, reflecting the growing demand for convenience. This trend necessitates strategic adjustments to menu offerings and service models.

Cultural factors significantly shape consumer preferences in the food industry. The enduring appeal of French cuisine, a cornerstone of Groupe Flo's offerings, highlights this. In 2024, French restaurants saw a 5% increase in revenue compared to 2023, demonstrating continued popularity. This trend underscores the importance of cultural relevance in maintaining customer interest and driving sales.

Demographic Shifts

Shifting demographics significantly influence Groupe Flo's customer base. Urbanization trends affect restaurant locations and accessibility, while changes in age distribution determine menu preferences and marketing strategies. Household composition, including family sizes and single-person households, shapes dining habits and demand for different meal options. Adapting to these demographic shifts is crucial for effective target marketing and sustained growth. In 2024, urban population growth is estimated at 1.2%, and single-person households comprise 28% of the total.

- Urbanization rates in key regions where Groupe Flo operates.

- Age distribution changes, focusing on the growth of specific age groups.

- Household income distribution and its impact on dining frequency.

Awareness of Health and Well-being

Growing consumer emphasis on health and wellness significantly impacts food choices. This trend pushes Groupe Flo to showcase the health benefits and quality of its products. Consumers are increasingly seeking transparency in food sourcing and preparation methods. This shift necessitates clear communication about ingredients and production processes.

- Global health and wellness market reached $7 trillion in 2023.

- Consumers prioritize natural and organic food options.

- Demand for plant-based foods continues to rise, with a projected market value of $77.8 billion by 2025.

Consumer values significantly drive food choices, including sustainability. The emphasis on ethically sourced products grows; for example, Fairtrade sales rose by 7% in 2024. Social media also shapes trends; 60% of consumers now get dining ideas from social platforms.

| Factor | Impact | Data |

|---|---|---|

| Consumer Values | Sustainability & Ethics | 7% Fairtrade Sales Rise (2024) |

| Social Media | Influences Dining | 60% of consumers get ideas there |

| Cultural Trends | Fusion Cuisine & Global Tastes | 20% increase in global food interest (2024) |

Technological factors

Groupe Flo can leverage advancements in kitchen tech to boost efficiency, cut costs, and boost food quality. Modern tech, like smart ovens and automated systems, can streamline operations. Investing in such tech offers a competitive edge. For example, the global smart kitchen appliances market is expected to reach $42.6 billion by 2025, according to Statista.

Online ordering and delivery platforms have significantly reshaped the food industry. Groupe Flo must adapt to these digital trends to stay competitive. In 2024, online food delivery sales reached $67.2 billion in the US. This requires a robust online presence and efficient delivery logistics.

Groupe Flo must leverage digital marketing and social media to connect with customers. In 2024, digital ad spending is projected to reach $800 billion globally. This approach boosts brand recognition and highlights promotions. Active digital engagement is vital for success.

Data Analytics and Customer Relationship Management (CRM)

Groupe Flo can leverage data analytics and CRM to enhance customer understanding and tailor marketing. This approach allows for personalized experiences, boosting customer loyalty. Data-driven strategies are crucial for informed business decisions, as seen with the 2024 CRM market, valued at $75 billion. Implementing such systems can lead to significant revenue growth; reports indicate up to a 25% increase in sales for companies using CRM effectively.

- 2024 CRM Market Value: $75 billion

- Potential Sales Increase with CRM: Up to 25%

- Improved Customer Loyalty: Enhanced by personalized marketing

Technology in Restaurant Management

Technology significantly impacts restaurant management. Groupe Flo can use tech for point-of-sale systems, inventory management, and staff scheduling. Streamlined operations can boost efficiency and reduce costs. In 2024, the global restaurant tech market was valued at $29.6 billion.

- POS systems can cut order errors by up to 30%.

- Inventory management software reduces food waste by 15%.

- Staff scheduling tools can improve labor cost management by 10%.

Groupe Flo can boost operations with tech, focusing on smart kitchens and automation, with a projected $42.6 billion market by 2025. Digital platforms and online orders are key, with $67.2 billion in 2024 U.S. sales. Effective tech also covers data analytics and CRM, impacting areas like customer relations and personalized experiences.

| Aspect | Details | Impact |

|---|---|---|

| Kitchen Tech | Smart ovens, automated systems | Efficiency, cost reduction |

| Digital Platforms | Online ordering & delivery | Competitive edge, revenue |

| CRM | Data analytics, marketing | Customer understanding, sales |

Legal factors

Groupe Flo must strictly follow food safety laws. This includes sourcing, handling, and storing food properly. Failure to comply leads to fines and legal issues. In 2024, food safety violations resulted in $500,000+ in penalties for similar businesses. Reputational damage can severely impact sales.

Groupe Flo must adhere to employment laws regarding minimum wage, working hours, and employee benefits. In 2024, minimum wage increases in France impacted operating costs. Workplace safety regulations are also crucial for compliance. Changes in labor laws, like those concerning remote work, can affect Groupe Flo's strategies.

Groupe Flo needs licenses and permits. This includes food service and alcohol permits. They must also follow building regulations. These legal requirements are crucial for their operations. Failing to comply can lead to fines or closures. As of late 2024, these regulations vary by location.

Consumer Protection Laws

Groupe Flo must adhere to consumer protection laws, which include truth in advertising, food labeling, and data privacy. Compliance is critical for building and maintaining customer trust. For instance, the EU's General Data Protection Regulation (GDPR) and similar regulations globally require businesses to protect consumer data, potentially impacting Groupe Flo's operational costs. Non-compliance can lead to hefty fines and reputational damage.

- GDPR fines can reach up to 4% of global annual turnover.

- Food labeling regulations vary by country, requiring detailed ingredient lists.

- Truth in advertising laws mandate accurate product claims.

- Consumer data breaches increased by 11% in 2024.

Intellectual Property Laws

Groupe Flo must legally protect its brand through trademarks, covering its name and logos. This protection is crucial for preventing brand dilution and imitation. Legal measures also extend to copyrights for menus and marketing materials. These strategies safeguard its unique identity and market position.

- Trademark registrations can cost from $225 to $400 per class of goods or services.

- Copyright registration with the U.S. Copyright Office costs $45 to $65 per application.

- In 2024, trademark infringement lawsuits resulted in over $1 billion in damages.

Groupe Flo's legal obligations include strict adherence to food safety laws to avoid penalties and safeguard its reputation. Employment laws, such as minimum wage regulations, significantly affect operating costs, with workplace safety being equally crucial.

They need licenses, permits, and must meet building codes, ensuring operational legality. Consumer protection is another area. Groupe Flo's branding must be legally secured through trademarks.

Data from 2024 highlights rising GDPR fines and the impacts of wage hikes. Maintaining these compliance measures secures the business's legal and financial stability, protecting it from potential pitfalls.

| Legal Aspect | Impact | Financial Consequence (2024 Data) |

|---|---|---|

| Food Safety | Non-compliance | Fines exceeding $500,000, reputational damage |

| Employment Laws | Wage/Benefit Changes | Increased operational costs (min. wage), labor disputes |

| Consumer Protection | Non-compliance | GDPR fines (up to 4% of turnover), lawsuits |

Environmental factors

Groupe Flo faces increasing pressure regarding sustainability. Consumers favor eco-friendly practices, with 68% willing to pay more for sustainable products. Regulations like the EU's Green Deal impact sourcing. Sustainable sourcing, potentially increasing costs by 5-10%, boosts brand value.

Groupe Flo must comply with waste management and recycling regulations, impacting how they handle food waste and packaging. Effective waste reduction and recycling programs are crucial for sustainability. In 2024, the EU's Waste Framework Directive sets targets for recycling and waste reduction, influencing Groupe Flo's strategies. Companies face penalties for non-compliance. In 2025, the focus will be on circular economy initiatives, driving the need for innovative waste solutions.

Groupe Flo's environmental strategy includes energy efficiency. By using energy-efficient equipment and conservation practices, the company aims to lower its carbon footprint. This is crucial as energy costs continue to fluctuate. In 2024, the restaurant sector saw a 5% increase in energy prices.

Water Usage and Conservation

Water scarcity and regulations on water usage directly affect restaurant operations, especially in regions with water restrictions. This can lead to increased operational costs through higher water bills or investments in water-saving technologies. Groupe Flo, like other businesses, must adapt to these challenges by prioritizing water conservation. Implementing water-saving measures is crucial for long-term sustainability and cost management.

- Water scarcity is a growing concern globally, with regions like the Southwestern United States facing severe shortages.

- Water-efficient equipment, such as low-flow dishwashers and faucets, can reduce water consumption by up to 50%.

- The average restaurant uses approximately 3,000 to 5,000 gallons of water per day.

Carbon Footprint and Emissions

Climate change awareness is increasing, pushing businesses to cut emissions. Groupe Flo, operating in the restaurant industry, faces pressure to minimize its environmental impact. This could involve strategies to decrease carbon emissions. The EU's Emissions Trading System (ETS) and carbon taxes are examples of regulations.

- The global restaurant industry’s carbon footprint is substantial, with estimates suggesting it contributes significantly to greenhouse gas emissions, around 2%-3% of global emissions.

- Carbon taxes and emissions trading schemes are implemented in various regions, potentially increasing operational costs. For example, the EU ETS has seen fluctuating carbon prices, impacting businesses.

- Consumers are increasingly eco-conscious, which influences their dining choices and can affect Groupe Flo's brand image.

Groupe Flo faces intense environmental pressures. Sustainable practices are vital as 68% of consumers prefer eco-friendly options. EU regulations and waste directives demand action in 2024/2025.

Water scarcity, especially impacting operations, increases costs; the industry averages 3,000-5,000 gallons/day usage. Climate change awareness also demands cutting emissions.

Carbon taxes and emission trading, like the EU ETS, add costs; restaurant's emissions account for 2-3% globally. Prioritize compliance and eco-friendly changes.

| Environmental Factor | Impact on Groupe Flo | Data Point (2024/2025) |

|---|---|---|

| Sustainability | Compliance, brand value | 68% consumer preference for eco-friendly |

| Waste Management | Higher costs | EU Waste Framework Directive targets |

| Water Usage | Cost, operations | Average restaurant uses 3,000-5,000 gallons daily |

| Climate Change | Regulations, costs | Restaurant industry emits 2-3% global GHG |

PESTLE Analysis Data Sources

This Groupe Flo PESTLE leverages global economic data, French government reports, and market research publications.