ACS Actividades de Construccion y Servicios Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ACS Actividades de Construccion y Servicios Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

Printable summary optimized for A4 and mobile PDFs, allowing clear analysis of ACS's business units.

Delivered as Shown

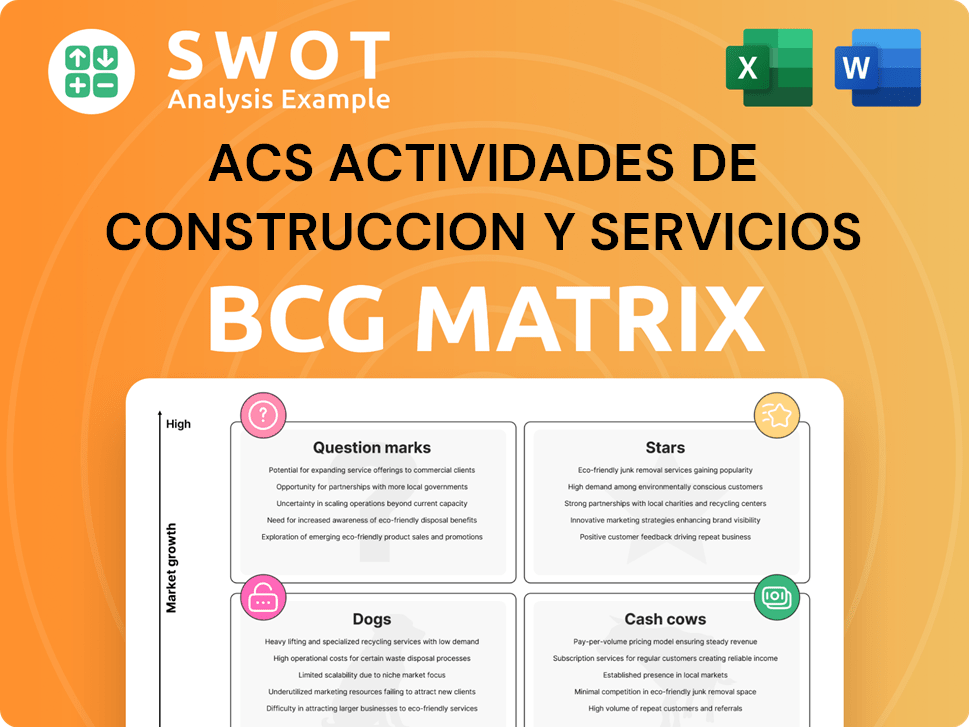

ACS Actividades de Construccion y Servicios BCG Matrix

The ACS Actividades de Construccion y Servicios BCG Matrix displayed here is the complete document you'll receive after purchase. It’s fully formatted and ready for your strategic analysis, business planning or presentation.

BCG Matrix Template

ACS Actividades de Construccion y Servicios's BCG Matrix reveals its diversified portfolio. Some divisions likely shine as Stars, generating high revenue in growing markets. Others may be Cash Cows, providing steady income. Question Marks need careful evaluation. Dogs may require strategic decisions. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ACS is heavily investing in digital infrastructure, particularly data centers, due to their rapid growth. These projects, like those in the US and Europe, are expected to generate substantial cash flow. The global data center market was valued at $280 billion in 2023 and is projected to reach $600 billion by 2030, showing huge potential for market share. ACS aims to capitalize on this expansion.

ACS actively participates in renewable energy, including solar and wind farms, supporting global sustainability goals. These projects capitalize on government incentives and rising green energy investments. In 2024, the global renewable energy market is forecasted to reach over $1 trillion, indicating significant growth potential. ACS's strategic positioning in this sector suggests a strong market share and high-growth prospects.

ACS Actividades de Construcción y Servicios (ACS) has a significant footprint in North America, especially in the U.S., participating in major infrastructure ventures like roads and airports. These projects, boosted by government funding such as the Infrastructure Investment and Jobs Act, present substantial growth opportunities. ACS's North American revenue in 2023 was around €12.5 billion, showcasing its strong position. The U.S. infrastructure market is projected to grow, offering ACS potential for increased market share.

Strategic Positioning in High-Growth Markets

ACS strategically positions itself as a global leader in infrastructure, targeting high-growth markets. This approach, focusing on digital infrastructure, energy, sustainable mobility, and defense, helps secure new orders and maintain a robust backlog. In 2024, ACS reported a significant increase in its order book, reflecting its strong market position. The company's focus on these sectors is paying off handsomely.

- Digital Infrastructure: ACS is investing heavily in data centers and telecommunications networks.

- Energy: The company is involved in renewable energy projects and grid modernization.

- Sustainable Mobility: ACS is expanding its presence in electric vehicle charging infrastructure.

- Defense: ACS is involved in the development of advanced infrastructure for defense.

Turner's Low-Risk Construction Business Model

Turner, an ACS subsidiary, shines as a "Star" in the BCG Matrix due to its low-risk construction model in the high-end technology sector. This strategic focus has fueled substantial growth, with Turner's projects contributing significantly to ACS's revenue and backlog. The company's strong performance is reflected in its awards, which have seen a robust rebound, solidifying its position within the group.

- Turner's revenue contribution to ACS is substantial, with recent figures showing consistent growth.

- Backlog growth indicates future revenue potential and project pipeline strength.

- Focus on the high-end technology market provides a competitive advantage.

- The low-risk model ensures financial stability and predictability.

Turner, a Star in ACS's portfolio, excels with its low-risk strategy in high-tech construction, driving significant revenue. Its strong backlog growth showcases future earnings, aided by a competitive edge in the high-end tech market. Turner's awards have also rebounded, enhancing its position.

| Metric | Value | Year |

|---|---|---|

| Turner Revenue Contribution | Consistent Growth | 2024 |

| Backlog Growth | Increased | 2024 |

| High-End Tech Market Focus | Competitive Advantage | Ongoing |

| Risk Model | Low | Ongoing |

Cash Cows

ACS's civil construction arm, encompassing highways and airports, is a cash cow. It generates steady revenue with high market share. In 2024, ACS secured several civil construction contracts, boosting its backlog. Revenue from this segment is expected to be stable.

ACS Actividades de Construccion y Servicios' facility management services, like building maintenance, form a cash cow. These services provide a stable income stream, essential for consistent cash flow. They boast a strong market position, needing minimal new investments. For example, in 2024, this segment generated a substantial portion of ACS's revenue, showcasing its financial stability.

ACS Actividades de Construcción y Servicios' Industrial Services, encompassing engineering and maintenance, are cash cows. These services thrive on long-term contracts and a stable customer base, guaranteeing steady cash flow. In 2024, the industrial services segment generated a significant portion of ACS's revenue, reflecting its consistent performance. This segment's growth is more moderate compared to other areas.

Mining Services

ACS, through CIMIC and Thiess, is a key player in mining services, a cash cow within the BCG matrix. This segment offers stable revenue with high market share, especially in Asia Pacific. In 2024, Thiess secured a $1.6 billion contract extension in Australia. This sector's consistent performance supports ACS's overall financial stability.

- Steady revenue streams.

- High market share in Asia Pacific.

- Thiess's $1.6B contract extension.

- Supports ACS's financial stability.

Concessions (Toll Roads)

ACS's toll road concessions, managed by Abertis, are prime examples of cash cows. These concessions provide steady revenue streams, thanks to their essential services and long-term contracts. They boast high profit margins and require minimal reinvestment, ensuring consistent cash generation. For instance, in 2024, Abertis reported a revenue of approximately €5.5 billion from its toll road operations, demonstrating their financial stability.

- Steady revenue from essential services.

- High profit margins with low reinvestment needs.

- Abertis's 2024 revenue approximately €5.5 billion.

- Long-term contracts ensure financial stability.

ACS's cash cows include civil construction, facility management, industrial services, mining services, and toll road concessions. These segments generate consistent revenue with strong market positions. In 2024, these areas contributed significantly to ACS's financial stability. The revenue from toll road operations was approximately €5.5 billion.

| Segment | Description | 2024 Performance Highlights |

|---|---|---|

| Civil Construction | Highways, airports | Secured contracts, stable revenue |

| Facility Management | Building maintenance | Generated substantial revenue |

| Industrial Services | Engineering and maintenance | Significant revenue, long-term contracts |

| Mining Services | CIMIC, Thiess | Thiess secured a $1.6B contract extension |

| Toll Road Concessions | Abertis | €5.5B revenue |

Dogs

In some areas, traditional residential construction aligns with the "dog" quadrant of the BCG Matrix. Growth is often slow, and competition is fierce, particularly in established markets. These projects might offer limited returns, potentially around a 2-4% profit margin. Such investments can tie up capital without significant financial benefits.

Small-scale local projects in markets with limited growth potential often end up in the dogs category. These projects typically have low market share, which means they don't significantly boost overall revenue. For example, in 2024, ACS Actividades de Construccion y Servicios saw a 2% revenue contribution from these types of projects, indicating their limited impact. These projects might struggle to compete effectively.

Non-strategic services in the Dogs quadrant, like those at ACS Actividades de Construccion y Servicios, often show low profitability and slow growth. These services might consume resources without significant returns, potentially dragging down overall performance. In 2023, companies in this situation saw around a 5% decrease in operating profit margins. Divestiture is a common strategy to reallocate resources more effectively.

Underperforming Geographic Regions

In the BCG Matrix for ACS Actividades de Construccion y Servicios, underperforming geographic regions are classified as "Dogs." These areas, where ACS has a weak market presence, often struggle to generate substantial revenue. Turning around these regions demands considerable investment, with no guarantee of success. For example, in 2024, ACS's revenue in the Asia-Pacific region remained relatively low compared to its European operations.

- Limited Market Share: ACS faces challenges in specific areas.

- Investment Needs: Significant funds are required for improvements.

- Uncertain Outcomes: Success is not guaranteed in these regions.

- Revenue Disparity: Lower revenue in some areas compared to others.

Legacy Telecommunications

In the BCG Matrix, ACS's legacy telecommunications services are likely "dogs." These services, including older infrastructure, may experience declining demand due to the rise of advanced technologies. Limited growth opportunities and potential for negative cash flow are typical for "dogs." ACS might need to consider divesting or restructuring these services to allocate resources more efficiently. For instance, in 2024, legacy telecom infrastructure spending decreased by about 5% globally, highlighting the shift towards new technologies.

- Decreasing demand for older infrastructure.

- Limited growth potential compared to newer segments.

- Potential for negative cash flow.

- Need for strategic resource allocation.

Dogs represent low market share and growth for ACS Actividades de Construccion y Servicios. These projects or services often yield limited profits, such as a 2-4% margin. Legacy services, like older telecom, face declining demand and potential negative cash flow.

| Characteristic | Impact | Example (2024) |

|---|---|---|

| Market Share | Low, struggles to generate revenue. | 2% revenue from small-scale projects. |

| Growth | Slow, limited opportunities. | 5% decrease in legacy telecom spending. |

| Profitability | Low, can drag down overall performance. | 5% decrease in operating profit margins (2023). |

Question Marks

ACS's data center ventures fit the question mark quadrant of the BCG matrix. These are high-growth, low-share opportunities. ACS is making big investments in data centers, with a global data center market size of $66.89 billion in 2024. They aim for significant market share gains here. This requires substantial capital and strategic execution.

ACS is venturing into sustainable mobility, focusing on electric vehicle infrastructure. This area is experiencing high growth, yet ACS's market share is currently low. Investments are crucial for ACS to compete effectively. For example, the global EV charging market is projected to reach $45.6 billion by 2028.

ACS actively builds advanced tech facilities, including biopharma and healthcare projects. These areas offer high growth, yet demand substantial investments. Securing market share and expertise is crucial. In 2024, the global biopharma market is estimated at $1.7 trillion. ACS needs to invest to compete.

Emerging Markets Expansion

For ACS Actividades de Construcción y Servicios, venturing into new emerging markets is a strategic move. It's a high-growth opportunity, yet packed with significant risks. Such expansions require substantial upfront investment to build a market presence. ACS must carefully weigh the potential rewards against the uncertainties.

- In 2024, ACS's international revenue accounted for 60% of its total revenue.

- Emerging markets often present currency risks, which can impact profitability.

- Competition in these markets may be fierce, requiring aggressive strategies.

- Political and economic instability poses further challenges.

Innovative Construction Technologies

ACS Actividades de Construcción y Servicios (ACS) is exploring innovative construction technologies. These technologies, including AI-driven project management and 3D printing, represent a high-growth potential, but currently hold a low market share. Significant investment in research and development (R&D) and adoption strategies are essential to unlock their full potential.

- The construction industry is expected to see growth in 2025.

- AI-powered tools and 3D printing are key.

- R&D spending is crucial.

- Market share is currently low.

ACS's data center, sustainable mobility, advanced tech facilities, new markets, and construction tech ventures all fit the question mark category of the BCG matrix. These ventures promise high growth but currently have low market shares. Successful strategies require substantial investment and strategic execution.

| Venture | Market Growth | ACS Market Share |

|---|---|---|

| Data Centers | High | Low |

| Sustainable Mobility | High | Low |

| Tech Facilities | High | Low |

| Emerging Markets | High | Low |

BCG Matrix Data Sources

ACS's BCG Matrix relies on financial statements, industry reports, competitor analysis, and market data for accurate, data-driven insights.