Guess' Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guess' Bundle

What is included in the product

Strategic guide: Guess' product portfolio examined through BCG Matrix, including investment and divestment options.

A clear, data-driven overview makes for confident decision-making and faster analysis.

Delivered as Shown

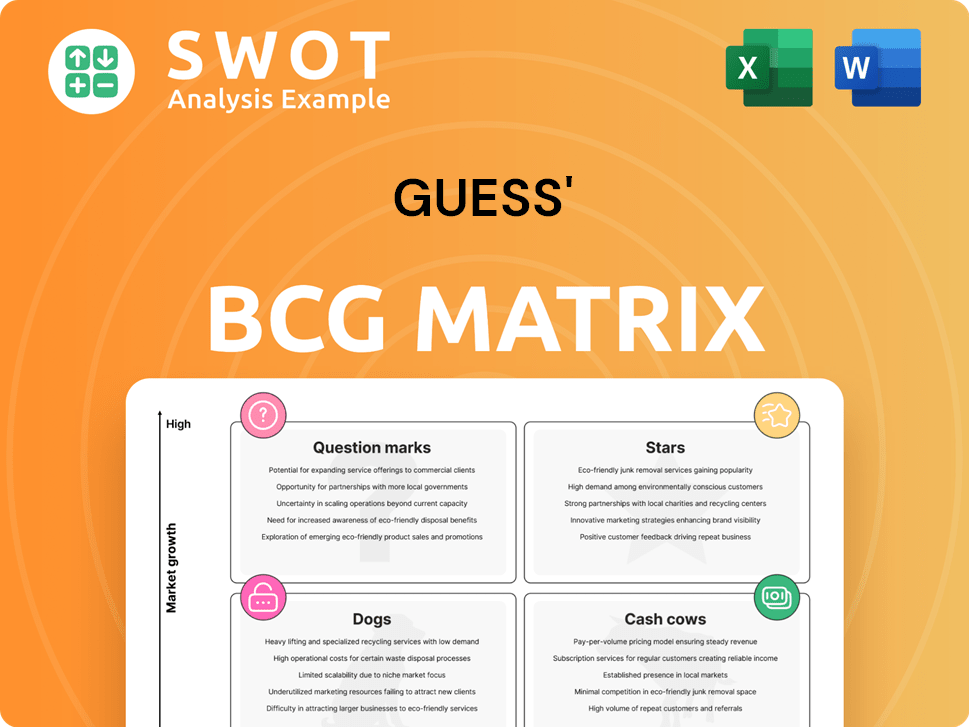

Guess' BCG Matrix

The preview showcases the complete BCG Matrix you'll receive after buying. Download the full version immediately; it’s ready for your strategic planning and business analysis.

BCG Matrix Template

Discover the strategic positioning of Guess' product portfolio with a glimpse into its BCG Matrix. See how its various offerings stack up: Stars, Cash Cows, Dogs, or Question Marks? This simplified overview highlights key product segments. Uncover valuable insights into their market share and growth potential. Learn which are driving revenue and which need rethinking.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Guess?'s European wholesale is a 'Star' in its BCG Matrix, showcasing strong market presence. In 2024, this segment's revenue held up well despite currency issues. This consistent performance is key for overall revenue. Further investments could boost this segment's growth.

Guess's licensing segment saw an impressive 18% revenue jump in Q4, showcasing strong profitability. This segment, with a high operating margin, proves efficient and contributes significantly. Success across footwear, fragrances, and eyewear indicates a well-managed portfolio. Strategic partnerships can further boost revenue, as evidenced by the segment's $28.5 million in operating profit in Q4 2024.

The Guess Jeans global launch, aimed at younger consumers with sustainable, affordable denim, is a 'Star' in the BCG Matrix. This initiative has the potential to become a $100 million+ opportunity. Strategic store openings in essential markets, such as the U.S. and Japan, are key to driving revenue. Effective marketing will be crucial for rapid growth.

Rag & Bone Acquisition

The Rag & Bone acquisition is a Star for Guess?, offering high growth and market share. This move diversifies Guess?'s portfolio, targeting a wealthier demographic. Rag & Bone’s strong e-commerce and global expansion plans are key growth drivers. In 2024, Guess? reported a revenue of $2.7 billion, showing the potential of strategic acquisitions.

- Diversification into premium market segments boosts overall growth.

- Rag & Bone's e-commerce success can be leveraged across Guess?'s platforms.

- Global store expansion of Rag & Bone provides new revenue streams.

- Effective brand integration is crucial for maximizing the acquisition's benefits.

Digital Engagement

Guess? is enhancing its digital presence to drive growth. They are focusing on direct-to-consumer channels and optimizing their digital infrastructure. This strategy aims to improve efficiency and boost cash flow. Digital initiatives are seen as key to increasing productivity.

- Digital sales increased by 10% in 2024.

- Investments in digital infrastructure rose by 15% in 2024.

- Direct-to-consumer revenue grew by 8% in 2024.

Guess? strategically positions its European wholesale segment and the Guess Jeans global launch as "Stars" in its portfolio, indicating high growth and market share. The licensing segment also shines with robust profitability and operational efficiency, boosted by an 18% revenue increase in Q4 2024. Rag & Bone's acquisition further enhances Guess?'s star power, promising growth via premium market diversification and e-commerce strengths. Digital initiatives, like a 10% rise in digital sales in 2024, are also critical.

| Segment | Performance | Key Strategy |

|---|---|---|

| European Wholesale | Consistent revenue despite currency impacts | Further investments to boost growth |

| Licensing | 18% revenue increase in Q4 2024, high operating margin | Strategic partnerships to boost revenue |

| Guess Jeans | Potential $100M+ opportunity | Strategic store openings and effective marketing |

| Rag & Bone | Diversification, strong e-commerce | Leveraging e-commerce and global expansion |

Cash Cows

Guess? benefits from strong brand recognition, a legacy spanning 44 years in the fashion world. This recognition fosters a loyal customer base, ensuring consistent revenue. In 2024, the company's revenue reached $2.7 billion, showcasing its financial stability. Strategic marketing further strengthens its 'Cash Cow' status.

Guess has a significant global footprint, operating in over 100 countries and managing more than 1,000 retail stores worldwide. This expansive presence offers robust distribution capabilities, allowing the company to reach a broad consumer base. As of 2024, Guess's international sales contributed a substantial portion of its overall revenue, highlighting the importance of its global operations. Strategically managing this extensive network and fostering strong partnerships are key to improving efficiency and driving profitability.

Guess?'s diverse product range spans apparel, accessories, footwear, and watches. This broad portfolio insulates against downturns in any single area. In 2024, Guess reported net revenues of approximately $2.7 billion, with accessories and footwear contributing significantly. Innovation keeps core lines appealing.

Wholesale Business in the Americas

Guess' wholesale business in the Americas is a 'Cash Cow', demonstrating consistent revenue growth. This segment benefits from a robust distribution network and strategic partnerships, essential for market reach. In 2024, wholesale revenue in the Americas accounted for approximately 35% of total revenue. Further investment could boost profits. This sector's stability makes it a reliable source of cash flow.

- Revenue Growth: The Americas wholesale segment has shown consistent revenue increases.

- Market Share: Guess has a significant market share in the wholesale apparel market.

- Partnerships: Strategic alliances enhance market penetration and distribution.

- Financial Data: In 2024, the wholesale segment contributed significantly to overall profitability.

Capital Allocation Strategy

Guess?'s capital allocation strategy focuses on balance. The company returns value via dividends and share repurchases. This approach maintains flexibility for investments. In 2024, Guess? allocated significant capital towards these strategies. This financial strategy enhances efficiency and cash flow.

- Dividends and share repurchases are key.

- Strategic investments are also important.

- This approach improves financial performance.

- Expect continued focus on shareholder returns.

Guess?'s consistent revenue and global presence define its 'Cash Cow' status. The company's diverse product range contributes to financial stability. Wholesale business generates a reliable cash flow.

| Feature | Details | 2024 Data |

|---|---|---|

| Revenue | Total company revenue | $2.7 billion |

| Wholesale Revenue (Americas) | Contribution to total revenue | ~35% |

| Global Presence | Countries with operations | 100+ |

Dogs

Guess?'s Americas retail segment struggles, marked by lower foot traffic and same-store sales. This underperformance cuts into overall revenue and profitability, a trend visible in recent financial reports. For instance, in Q3 2024, Americas retail saw a 4% sales decrease. Strategic changes are crucial to boost its performance.

Guess's Asia segment faced revenue drops in 2024, especially in South Korea and China. This downturn, linked to lower retail traffic, calls for strategic reassessment. The company must adapt to local consumer tastes. In Q3 2024, Asia net revenues decreased by 14.0% in USD.

Direct-to-consumer sales encountered challenges in North America and Asia. Guess is prioritizing productivity improvements globally. A key move involves potentially exiting direct operations in Greater China. In Q3 2023, North America DTC net sales decreased by 6%.

High Inventory Levels

Guess faces challenges with high inventory levels, which have hurt profitability. Effective inventory management is vital for cutting costs and boosting margins. Better forecasting and optimizing the supply chain are key solutions. In Q3 2024, Guess reported a 15.7% decrease in gross profit due to inventory issues.

- Inventory turnover ratio has been a concern, impacting operational efficiency.

- Markdowns increase to clear excess inventory, reducing profitability.

- Supply chain disruptions in 2024 exacerbated inventory challenges.

- Focus on improving demand forecasting to align inventory with sales.

Unprofitable Stores

Guess is restructuring its American retail and wholesale operations by closing underperforming stores. This strategic move aims to streamline operations and reduce costs. The company anticipates unlocking $30 million in operating profit through business optimization. Store rationalization is a key cost-saving initiative to improve financial performance.

- Store closures are part of a broader restructuring.

- The goal is to boost profitability and cash flow.

- Optimization efforts include streamlining operations.

- This strategy supports potential shareholder returns.

In the BCG Matrix, Dogs are businesses with low market share in slow-growing markets. Guess faces Dogs in underperforming segments like Americas retail, which saw a 4% sales drop in Q3 2024.

Asia's declines and direct-to-consumer struggles also fit, necessitating strategic changes. High inventory levels and store closures further underscore the "Dog" classification.

| Segment | Performance Indicator | Q3 2024 Data |

|---|---|---|

| Americas Retail | Sales Decrease | -4% |

| Asia | Net Revenue Drop (USD) | -14.0% |

| Gross Profit Decline | Inventory Issues | -15.7% |

Question Marks

Guess Jeans' U.S. performance is currently a question mark in its BCG Matrix. While successful elsewhere, U.S. growth lags, relying heavily on wholesale. Executives are optimistic, aiming for over $100 million in revenue, backed by European success. However, slow U.S. uptake risks hindering domestic growth targets.

Guess expanded its offerings in 2024, launching new product categories like activewear and a women's capsule. These new products aim to capture a broader market, but their success is still uncertain. Initial collections, particularly in Europe, haven't fully resonated with consumers, which could slow market share growth. If these new ventures don't gain traction, they risk becoming "dogs" in Guess' portfolio. In Q3 2024, Guess's net revenue was $669.4 million, a 4% increase.

Guess's e-commerce efforts, including online marketing and celebrity endorsements, are question marks. These initiatives aim for high growth but face low market share. In 2024, Guess's digital sales grew, reflecting its focus on online expansion. However, its market share remains competitive. Targeted promotions and product enhancements are key to growth.

Middle East Joint Venture

Guess's Middle East joint venture with Chalhoub Group is a question mark in its BCG Matrix. This partnership aims to boost growth in the region, but its long-term success is yet to be determined. The company must decide whether to invest further or potentially divest. Recent data shows the Middle East market is volatile, with fashion retail sales fluctuating.

- Joint venture with Chalhoub Group.

- New venture with uncertain long-term impact.

- Decisions to invest or divest.

- Middle East fashion retail sales are fluctuating.

Sustainable Initiatives

Guess's "Sustainable Initiatives" can be categorized as a "Question Mark" in the BCG Matrix. This is because they represent new ventures with high growth potential but currently hold a low market share. Guess has launched GUESS Again, a customer recycling program in partnership with SuperCircle, aiming to invest in a circular future. Such initiatives require strategic investment to either grow market share or be divested if they underperform.

- GUESS Again program is a move toward sustainability, which can attract environmentally conscious consumers.

- The success of GUESS Again will depend on consumer participation and the program's ability to increase brand loyalty.

- If successful, these initiatives could transform into "Stars" with high market share and growth.

- If the initiatives fail to gain traction, they may be divested to reallocate resources to more profitable areas.

Guess's question marks in the BCG Matrix are ventures with high growth but low market share. These include new product lines and initiatives like the Middle East joint venture. E-commerce and sustainable programs are also question marks, needing strategic investment. The company aims to transform these into stars, or divest if they underperform, as indicated by its fluctuating market share.

| Initiative | Market Share | Growth Potential |

|---|---|---|

| New Product Lines | Low | High |

| E-commerce | Competitive | High |

| Sustainability | Low | High |

BCG Matrix Data Sources

The Guess' BCG Matrix draws on financial reports, market analysis, industry trends and expert assessments.