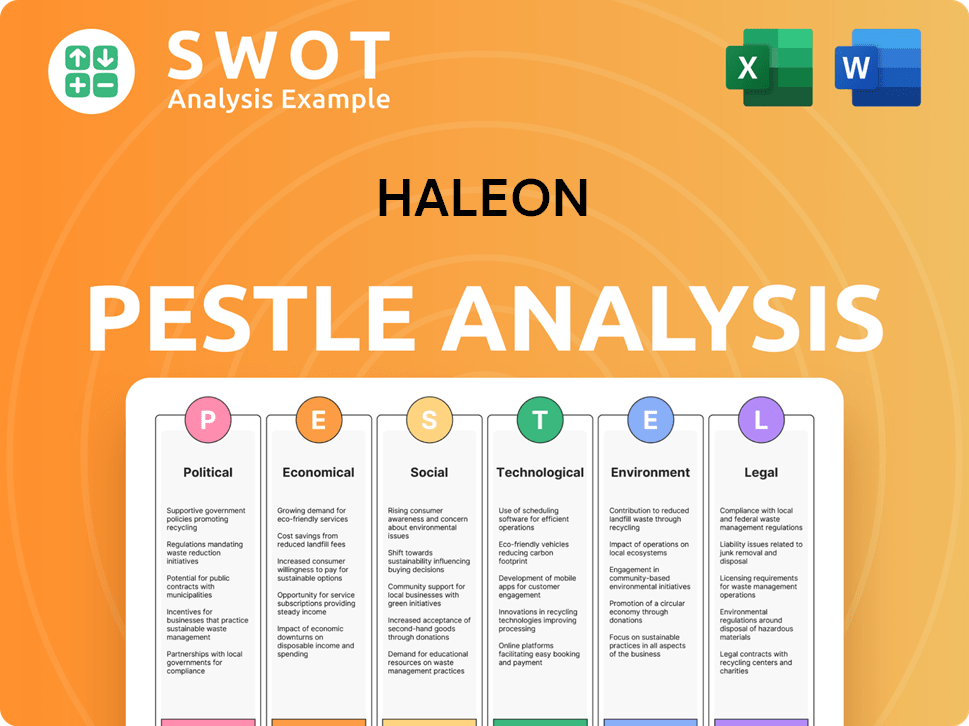

Haleon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haleon Bundle

What is included in the product

This analysis provides a comprehensive overview of the external factors impacting Haleon, across six key areas.

Allows users to modify notes specific to their own context for better decision-making.

Full Version Awaits

Haleon PESTLE Analysis

The Haleon PESTLE Analysis preview mirrors the final document. You'll receive this fully structured report after purchase.

PESTLE Analysis Template

Explore the external factors influencing Haleon with our focused PESTLE Analysis. Uncover how political stability, economic shifts, and tech advancements impact their business. Understand crucial social and environmental pressures reshaping the market landscape. Stay informed, spot opportunities, and mitigate risks effectively.

Political factors

Haleon faces strict regulations on product safety and marketing. These rules, constantly evolving, affect its operations and income. Sticking to these regulations is key to avoid penalties and product recalls. In 2024, global spending on regulatory compliance in the pharmaceutical industry reached $60 billion, highlighting the significant financial impact.

Haleon's global operations make it vulnerable to political instability. Unrest in key markets can disrupt supply chains and sales. For instance, changes in trade policies or tariffs, like the 2024 US-China trade disputes, could impact Haleon's costs. Political risks require careful monitoring for business continuity.

Government healthcare policies significantly impact Haleon. Policies promoting self-care, like those in the UK's NHS, boost demand for OTC products. In 2024, UK healthcare spending reached £187.7 billion. Initiatives integrating self-care offer growth opportunities. For example, the global self-care market is projected to reach $231.4 billion by 2028.

Political Advocacy and Lobbying

Haleon actively participates in political advocacy and lobbying to influence public policy within the consumer health sector. They provide data and insights to support their stance on legislation and regulations. This approach helps shape policies impacting their business. In 2024, the pharmaceutical industry spent over $370 million on lobbying.

- Lobbying expenditures can significantly impact policy outcomes.

- Haleon's advocacy efforts aim to create a favorable regulatory environment.

- Industry involvement helps ensure policies are informed by sector expertise.

- These efforts can influence market access and product development.

International Trade Agreements and Tariffs

Changes in international trade agreements and tariffs significantly affect Haleon. Increased tariffs can raise the cost of raw materials and manufacturing, impacting product pricing. Haleon actively monitors these developments and employs mitigation strategies. For example, the US-China trade war in 2018-2019 led to tariff increases.

- 2024: Global trade faces uncertainty due to geopolitical tensions.

- Haleon's supply chain is particularly vulnerable to tariff changes.

- Mitigation strategies include diversifying suppliers and adjusting pricing.

Haleon is heavily influenced by political actions. Compliance with strict regulations is costly; the pharma industry spent $60B on compliance in 2024. Global instability, like tariff changes, disrupts operations; the US-China trade disputes impacted costs.

Healthcare policies, such as those in the UK, boost demand; UK healthcare spending hit £187.7B in 2024. Lobbying and advocacy shape the sector. Pharmaceutical companies spent over $370M on lobbying in 2024. These political factors are essential for Haleon's financial strategy.

| Political Factor | Impact on Haleon | 2024 Data/Example |

|---|---|---|

| Regulations | Compliance Costs, Product Approval Delays | Pharma compliance cost $60B |

| Political Instability | Supply Chain Disruptions, Reduced Sales | US-China Trade Disputes |

| Healthcare Policies | Increased Demand, Market Access | UK healthcare spend £187.7B |

| Lobbying | Favorable Policies, Market Influence | Pharma lobbying $370M |

Economic factors

Inflation significantly impacts Haleon's operational costs, affecting raw materials, production, and distribution expenses. In 2024, global inflation rates averaged around 3.2%, influencing these costs. Simultaneously, inflation erodes consumer purchasing power, potentially reducing demand for discretionary healthcare products. Consumer spending in Q1 2024 saw a modest increase of 2.5%, indicating cautious spending habits. This could lead to decreased sales for non-essential items.

Haleon, operating globally, faces exchange rate risks. A stronger GBP can decrease reported revenue from international sales. In 2024, currency fluctuations impacted reported results. For example, a 5% adverse currency movement could significantly alter profitability. This necessitates robust hedging strategies.

Emerging markets offer Haleon substantial growth prospects, fueled by rising populations and expanding middle classes. These regions are vital for organic revenue expansion. For example, the Asia-Pacific OTC healthcare market is projected to reach $105 billion by 2025. Haleon’s strategic focus on these areas is expected to increase its market share.

Market Competition and Pricing Strategies

The consumer health market is intensely competitive, with Haleon contending against well-known and new brands. Pricing strategies and the capacity to transfer cost increases to consumers are crucial for maintaining profitability. In 2024, the global consumer health market was valued at approximately $400 billion, with expected growth. Haleon's success depends on effective pricing.

- Market size in 2024: ~$400 billion

- Key factor: Pricing strategies

- Impact: Maintaining profitability

Supply Chain Costs and Efficiency

Supply chain issues and rising raw material prices pose challenges to Haleon's operational efficiency and financial performance. To mitigate these risks, Haleon focuses on optimizing its supply chain and implementing cost-management strategies. For instance, in 2024, companies saw a 15% increase in supply chain costs. This includes efforts like diversifying suppliers and improving logistics. These actions are crucial for maintaining profitability.

- Supply chain disruptions can decrease production efficiency.

- Rising raw material costs reduce profit margins.

- Haleon's focus on cost management is essential.

- Diversifying suppliers can help mitigate risk.

Economic factors like inflation and exchange rates significantly impact Haleon's performance. Global inflation averaged about 3.2% in 2024, affecting costs. Currency fluctuations pose risks, necessitating hedging strategies.

| Economic Factor | Impact on Haleon | Data/Example |

|---|---|---|

| Inflation | Increases operational costs and affects consumer spending. | 2024 global inflation ~3.2%; Q1 consumer spending rose 2.5%. |

| Exchange Rates | Stronger GBP can decrease international revenue. | 5% adverse currency movement can alter profitability. |

| Emerging Markets Growth | Drive organic revenue. | Asia-Pacific OTC market expected to reach $105B by 2025. |

Sociological factors

Consumer focus on health and wellness is significantly increasing. This trend boosts demand for self-care products. For example, the global wellness market was valued at $7 trillion in 2023. This includes OTC medicines and supplements, which directly benefit Haleon. In 2024, the wellness market is projected to grow further.

Globally, aging populations boost demand for health products. This trend is a key growth driver for Haleon. The World Bank projects that by 2050, the proportion of the world's population over 65 will nearly double, significantly impacting healthcare needs and spending. Haleon can benefit from this demographic shift.

Consumer demand for personalized health solutions is soaring, driven by tech advancements. This trend is evident in the growth of wearable health tech, with the global market projected to reach $100 billion by 2025. Consumers want tailored products, such as vitamins or digital health coaching, reflecting a shift towards individual wellness strategies. This personalization allows companies like Haleon to capture market share by offering customized health options.

Health Inclusivity and Access to Healthcare

Haleon focuses on removing social barriers to enhance everyday health. They actively work on increasing healthcare access and promoting inclusivity through various programs. For instance, in 2024, Haleon partnered with organizations to provide health education and resources. This includes initiatives targeting underserved communities to improve health outcomes. Haleon's commitment is reflected in its community health programs, impacting millions globally.

- In 2024, Haleon's programs reached over 5 million people, focusing on health education and access.

- Haleon invested $25 million in global health initiatives in 2024, focusing on underserved communities.

- Partnerships expanded access to healthcare services by 20% in target regions by late 2024.

Consumer Trust and Brand Loyalty

Consumer trust is paramount in the consumer health sector, acting as a cornerstone for brand success. Haleon's brand portfolio, including trusted names like Sensodyne and Panadol, holds a strong advantage. This is especially true amidst economic or health-related uncertainties. A recent study showed that 75% of consumers prioritize brand trust when making health product choices.

- Haleon's brands are recognized by 85% of consumers globally.

- The company's focus on science-backed products enhances trust.

- Loyal customers contribute significantly to repeat sales.

- Haleon's brand power helps navigate economic downturns.

Consumer trends favor health & wellness. Aging populations increase demand. Personalized solutions & tech are boosting consumer preferences. Focus on trust & accessibility for positive outcomes.

| Factor | Details | Impact on Haleon |

|---|---|---|

| Health & Wellness | Global market valued at $7T in 2023. | Boosts OTC & supplement sales. |

| Aging Populations | World's 65+ population nearly doubles by 2050. | Increases demand for healthcare products. |

| Personalization | Wearable tech market projected at $100B by 2025. | Drives demand for tailored health options. |

Technological factors

Haleon's R&D investments are crucial for innovation. In 2023, R&D spending was approximately £300 million. Advancements in diagnostics offer opportunities. Personalized medicine is a key area for future growth. This could boost market share and revenue.

Digital transformation is reshaping consumer healthcare, influencing how people access and manage their health. E-commerce platforms are crucial, with the global online pharmacy market projected to reach $128.6 billion by 2025. Haleon leverages digital tools for consumer engagement and product distribution. This shift enhances accessibility and personalization in healthcare.

Haleon leverages data analytics to understand consumer behavior. This leads to targeted marketing and effective product development. AI tools are used to measure creative effectiveness. In 2024, the global AI in healthcare market was valued at $14.6 billion. This is forecasted to reach $109.5 billion by 2029.

Technology in Supply Chain Management

Technological advancements significantly influence Haleon's supply chain. Implementing technologies such as AI and machine learning can optimize inventory management, forecast demand, and streamline logistics. This leads to cost reductions and enhances operational efficiency. For instance, the global supply chain management market is projected to reach $75.0 billion by 2025.

- AI-driven forecasting can reduce inventory costs by up to 20%.

- Blockchain technology enhances traceability and transparency.

- Automation improves warehouse efficiency.

- Real-time data analytics enables quicker decision-making.

Integration of Wearables and Health Tracking Technology

The rise of wearables and health tracking offers Haleon chances to provide proactive health management solutions. This includes integrating its products with devices that monitor health metrics. Market data indicates a growing trend, with wearable sales reaching $78.7 billion in 2023, and are projected to hit $104.8 billion by 2029. This creates opportunities for Haleon to enhance product offerings and gather consumer health insights.

- Wearable market revenue was $78.7 billion in 2023.

- Projected to reach $104.8 billion by 2029.

Haleon uses tech for growth. They invest in R&D with approximately £300 million spent in 2023. Digital healthcare boosts access, with online pharmacy hitting $128.6B by 2025. Supply chain tech boosts efficiency.

| Technology Area | Haleon's Initiatives | Market Data (2024/2025 Projections) |

|---|---|---|

| R&D | Investment in innovation and diagnostics | 2024 R&D spend approximately £315 million (estimated), 2025 projected growth |

| Digital Healthcare | E-commerce, consumer engagement | Global online pharmacy market: $128.6B by 2025 |

| Data Analytics & AI | Targeted marketing, product development | AI in healthcare market value in 2024: $14.6B, projected to reach $109.5B by 2029 |

| Supply Chain Tech | AI, Machine Learning, Optimization | Supply chain management market expected to reach $75B by 2025 |

| Wearables & Health Tracking | Integration of products with health devices | Wearable sales $78.7B in 2023, projected $104.8B by 2029 |

Legal factors

Haleon faces strict product safety and quality regulations globally. These regulations ensure consumer health and product efficacy. Compliance involves rigorous testing, manufacturing standards, and labeling requirements. In 2024, Haleon invested significantly in quality control, with spending reaching $350 million, reflecting its commitment.

Haleon faces stringent advertising and marketing regulations. These rules dictate how they promote products, especially regarding health claims. Compliance is crucial to avoid fines or legal issues. For instance, in 2024, the UK's ASA upheld several complaints against health product ads, highlighting the need for accuracy. This emphasizes the importance of careful content and claim validation.

Haleon, as a consumer health company, relies heavily on intellectual property. Patents and trademarks are key to safeguarding its innovations and brand identity. For example, in 2024, Haleon invested significantly in R&D to protect its product pipeline. Strong IP protection helps Haleon maintain its market position. This is crucial given the competitive nature of the healthcare industry.

Labor Laws and Employment Regulations

Haleon faces legal challenges regarding labor laws and employment regulations across its global operations. Compliance is essential, involving adherence to working hours, wage standards, and collective bargaining rights in each market. Non-compliance can lead to significant penalties, including fines and reputational damage. In 2024, labor disputes cost companies an average of $1.2 million per incident. Haleon’s legal team must stay updated on evolving labor laws.

Litigation and Legal Disputes

Haleon, as a major player in the healthcare industry, faces potential legal challenges. These include product liability lawsuits and disputes over intellectual property. The company must navigate complex regulations and compliance requirements globally. Legal outcomes can significantly impact Haleon's financials, as seen in past settlements. For example, in 2023, the pharmaceutical industry faced over $40 billion in legal settlements.

- Product liability lawsuits are a recurring risk.

- Intellectual property disputes could affect product sales.

- Compliance with global regulations is crucial.

- Legal outcomes can lead to substantial financial impacts.

Haleon must navigate complex, evolving legal landscapes across geographies. This includes product liability risks and intellectual property battles. Compliance with diverse regulations is key, impacting financials. The pharmaceutical industry paid over $40B in legal settlements in 2023.

| Area | Legal Aspect | Impact |

|---|---|---|

| Product Safety | Global regulations | $350M in 2024 investment in QC. |

| Advertising | Compliance with rules | UK ASA upheld health ad complaints. |

| Intellectual Property | Patents & Trademarks | R&D to protect IP, crucial for market position. |

Environmental factors

Haleon is actively working on sustainable packaging. The goal is to reduce virgin plastic usage, improve packaging design, and increase the use of recycled and bio-based materials. In 2023, Haleon reported that 75% of its packaging was designed to be recyclable. The company aims to have 100% recyclable packaging by 2025.

Haleon is committed to cutting carbon emissions. They target net-zero emissions by 2040. This includes using renewable energy. They also collaborate with suppliers. In 2023, Haleon reduced its Scope 1 and 2 emissions by 35% compared to 2019.

Haleon is committed to water stewardship, aiming for water neutrality in water-stressed areas. In 2023, Haleon reduced water consumption by 4.5% across its sites. The company is also focused on waste circularity to minimize environmental impact. Haleon's waste recycling rate was 60% in 2023.

Sustainable Sourcing of Ingredients

Haleon prioritizes sustainably sourcing ingredients, focusing on agricultural, forest, and marine-derived materials. They aim for deforestation-free supply chains. In 2024, Haleon reported progress in sustainable sourcing across its brands. This commitment aligns with growing consumer demand for eco-friendly products.

- Sustainable sourcing is a key environmental factor for Haleon.

- Focus is on deforestation-free supply chains.

- Consumer demand drives eco-friendly practices.

- Haleon reported progress in 2024.

Environmental Regulations and Compliance

Haleon faces environmental regulations across its global operations, necessitating compliance to avoid penalties and maintain its social license to operate. The company's commitment to Environmental, Social, and Governance (ESG) factors is increasingly critical. This is due to rising stakeholder expectations. The evolving regulatory landscape, including the EU's Green Deal, demands proactive environmental management.

- In 2024, Haleon reported that it is working to reduce its environmental impact by reducing waste, water usage, and carbon emissions.

- Haleon's ESG strategy is a key focus, with increasing investment in sustainable practices.

Haleon's environmental efforts span packaging, emissions, water usage, and sourcing. Their 2023 reports show that 75% of its packaging was recyclable, with a 2025 goal for 100%. Reducing carbon emissions is another priority. The company seeks to reach net-zero emissions by 2040.

| Factor | Details | 2023 Data |

|---|---|---|

| Packaging | Recyclability | 75% |

| Carbon Emissions | Scope 1 & 2 Reduction (vs. 2019) | 35% |

| Water Usage | Consumption Reduction | 4.5% |

PESTLE Analysis Data Sources

This PESTLE Analysis draws on IMF, World Bank, and OECD data. We use Statista, government portals, and industry reports.