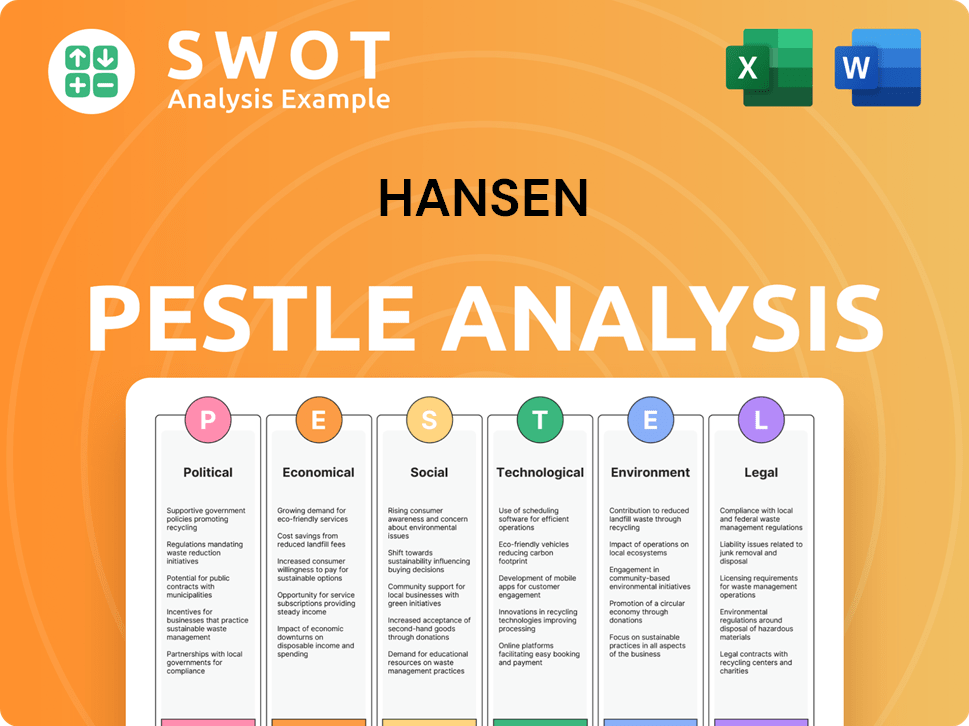

Hansen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hansen Bundle

What is included in the product

It assesses external macro factors across six areas to reveal Hansen's threats and chances.

A readily adaptable document for teams that offers comprehensive external factor insights. Enables focused strategy adjustments or risk mitigation responses.

What You See Is What You Get

Hansen PESTLE Analysis

What you’re previewing is the complete Hansen PESTLE Analysis.

Every element you see, from headings to the in-depth analysis, will be present.

This detailed view mirrors the document you'll instantly download.

It's fully formatted and ready for your use upon purchase.

No changes—what you see is what you get!

PESTLE Analysis Template

See how external factors shape Hansen's path with our PESTLE analysis. Uncover crucial trends in politics, economy, society, technology, law, & environment. Spot opportunities, forecast risks, and boost your strategic planning. Download the full report for actionable insights!

Political factors

Hansen Technologies faces government regulations in energy, water, pay-TV, and telecoms. Policy shifts, deregulation, and licensing changes affect operations. For example, in 2024, new energy regulations in Australia impacted Hansen. The company's profitability can fluctuate due to these political factors. In the UK, telecom licensing updates in early 2025 could reshape market access.

Political stability is vital for Hansen Technologies. Geopolitical events, shifts in government, or unrest can disrupt operations. For example, political instability in regions like Eastern Europe, where 15% of Hansen's clients are located, could affect service delivery. Economic uncertainties tied to these events may also impact investment decisions and customer confidence, as seen during the 2022 Russia-Ukraine conflict that caused a 7% decrease in IT spending in affected areas.

Government initiatives are key. For instance, smart grid projects and renewable energy incentives could boost Hansen's tech solutions. In 2024, the U.S. government allocated $3.46 billion for smart grid investments. Changes in funding, however, could impact Hansen's growth.

International Trade Policies

Hansen Technologies, operating globally, must navigate international trade policies. These policies, including tariffs and sanctions, directly affect operational costs. For instance, the average tariff rate in the U.S. was 3.1% in 2024. Changes significantly influence market strategies and international partnerships. The impact can be seen in fluctuations in import costs and supply chain disruptions.

- 2024 saw significant shifts in trade policies globally.

- Tariffs can increase operational costs.

- Sanctions can limit market access.

- Trade agreements impact market entry.

Data Privacy and Security Regulations

Data privacy and security regulations are tightening globally. Hansen Technologies must comply with laws like GDPR. This necessitates significant investments in data protection. Failure to comply can lead to hefty fines. New regulations could also require further costly adjustments.

- GDPR fines can reach up to 4% of annual global turnover.

- Data breaches cost companies an average of $4.45 million in 2023.

- Compliance spending is projected to keep rising in 2024/2025.

Hansen faces political hurdles from regulations across sectors like energy and telecom, with changes in policy directly affecting operations. For example, In 2024, energy regulations caused a fluctuation in profits, especially in regions such as Australia, and the company adapts to new market access rules due to updates in the UK, like telecom licensing. Political instability and initiatives such as smart grid investments also affect Hansen's business operations.

| Political Factor | Impact on Hansen | Relevant Data (2024/2025) |

|---|---|---|

| Regulations | Operational Cost | EU GDPR fines up to 4% annual global turnover |

| Trade Policies | Market access, Operational costs | Avg US tariff rate of 3.1% (2024), Data breach cost $4.45M (2023) |

| Government Initiatives | Growth Potential | U.S. allocated $3.46B for smart grid investments (2024) |

Economic factors

Global economic conditions significantly impact Hansen Technologies. A strong global economy supports higher IT spending by clients in energy, utilities, and communications. Conversely, downturns can lead to budget cuts. For example, in 2023, global IT spending grew by only 3.8%, a slowdown from previous years, according to Gartner. This impacted project timelines.

Hansen Technologies feels the economic pulse of its key sectors. Energy price volatility, like the 2024-2025 fluctuations, impacts utility spending. Consumer spending shifts, seen in pay-TV and telecom, influence demand for Hansen's offerings. Infrastructure investment levels, such as the projected $80 billion in US water infrastructure spending by 2025, drive Hansen's growth.

Hansen Technologies, operating internationally, faces foreign exchange rate fluctuations. Volatile rates affect revenue conversion and operational costs abroad. For example, a stronger Australian dollar could increase the cost of their international operations. Currency impacts pricing competitiveness; a 10% AUD appreciation could reduce margins.

Inflation and Interest Rates

Inflation poses a challenge for Hansen Technologies, potentially elevating operating costs such as labor and technology investments. Recent data shows the U.S. inflation rate was 3.5% in March 2024, impacting business expenses. Interest rate fluctuations affect borrowing costs for Hansen and its clients, influencing investments in new software projects. For instance, the Federal Reserve held its benchmark interest rate steady in May 2024, but future changes could impact project financing.

- U.S. inflation rate was 3.5% in March 2024.

- Federal Reserve held benchmark interest rate steady in May 2024.

Customer Investment Cycles

Hansen Technologies' revenue is significantly influenced by the investment cycles of its utility and telecommunications clients. These clients typically face long sales cycles and substantial capital expenditures when making purchasing decisions. Economic downturns or industry-specific financial challenges can extend these cycles, impacting Hansen's sales pipeline and revenue forecasts. For example, in 2024, the global IT spending is projected to reach $5.06 trillion, representing a 6.8% increase from 2023, which may affect Hansen's clients' IT investments. The predictability of Hansen's revenue stream is directly tied to these cycles, making economic monitoring crucial.

- IT spending globally is expected to rise by 6.8% in 2024.

- Long sales cycles are common in Hansen's client base.

- Economic conditions directly affect client investment decisions.

- Revenue predictability is linked to client investment cycles.

Economic factors are pivotal for Hansen Technologies' success, with global IT spending and energy prices significantly affecting client investments and operational costs. Currency fluctuations and inflation rates, such as the 3.5% U.S. inflation rate in March 2024, impact revenues and expenses. Fluctuations in interest rates can influence client investment decisions.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| IT Spending | Client investment, revenue | Expected +6.8% in 2024. |

| Inflation | Costs, margins | U.S. at 3.5% (March 2024) |

| Interest Rates | Borrowing costs, project financing | Fed held rates steady (May 2024) |

Sociological factors

Customer demographics are shifting, impacting service expectations in energy, water, pay-TV, and telecom. This includes a rise in digital natives and aging populations, demanding tailored experiences. The demand for AI-powered agents and self-service portals is growing, with the global AI market expected to reach $267 billion by 2025. This trend drives Hansen's software solutions.

Public perception significantly shapes utility and telecom operations. High public trust often correlates with less regulatory scrutiny and smoother project approvals. Conversely, negative perceptions, fueled by poor service or high prices, can lead to increased regulatory pressure. For example, in 2024, customer satisfaction with telecom providers hit a low of 72%, influencing investment decisions.

Hansen Technologies' success is significantly tied to the availability of skilled tech workers. A scarcity of talent in software development, AI, and data management can hinder innovation. Currently, the tech industry faces a talent shortage, with over 1 million unfilled jobs in the US alone as of early 2024. This could affect project timelines and competitiveness.

Digital Inclusion and Literacy

Digital inclusion and literacy rates significantly impact Hansen's digital customer service adoption. Higher digital literacy fuels demand for self-service tools and online account management. Globally, internet penetration reached 66% in early 2024, indicating growing digital access. This trend supports increased use of Hansen's digital offerings.

- 66% global internet penetration in early 2024.

- Rising digital literacy enhances self-service adoption.

- Increased online account management demands.

Societal Expectations for Corporate Responsibility

Societal expectations for corporate responsibility are rising, impacting Hansen Technologies. Data privacy, environmental impact, and fair labor practices are key concerns. Companies face pressure to meet these expectations to maintain a positive reputation. Failure can lead to boycotts or regulatory penalties.

- In 2024, 86% of consumers expect companies to take a stand on social issues.

- The global ESG investment market reached $40.5 trillion in 2023.

- Data breaches cost companies an average of $4.45 million in 2023.

Customer expectations for personalized services drive Hansen's AI and self-service solutions. Public trust significantly impacts utility and telecom operations, influencing regulations and project approvals. A shortage of skilled tech workers, like the over 1 million unfilled tech jobs in the US as of early 2024, affects project timelines.

Digital literacy and societal expectations regarding data privacy are also key factors. With internet penetration at 66% globally in early 2024, digital adoption rises. Consumers increasingly expect companies to address social issues.

| Sociological Factor | Impact on Hansen | Data/Statistics (2024/2025) |

|---|---|---|

| Customer Expectations | Demand for AI, self-service | AI market to $267B by 2025 |

| Public Perception | Influences regulation | Customer satisfaction with telecom 72% in 2024 |

| Talent Availability | Affects project timelines | 1M+ unfilled tech jobs in the US early 2024 |

| Digital Inclusion | Adoption of digital services | 66% global internet penetration in early 2024 |

| Corporate Responsibility | Data privacy, ESG demands | ESG investment market $40.5T in 2023 |

Technological factors

Advancements in AI and Machine Learning are crucial. Hansen Technologies uses AI for virtual agents, improving customer service. The company's R&D spending in 2024 was $45 million, a 10% increase from 2023, to stay ahead. AI's rapid growth means constant investment is vital for Hansen's competitiveness.

Cloud computing's growth reshapes software delivery. Businesses increasingly use cloud services, impacting Hansen. In 2024, cloud spending hit $670 billion globally, a 20% rise. Hansen must offer cloud-based solutions. This meets demand for scalability and lowers costs.

The rollout of 5G and the rise of IoT are reshaping industries. 5G's faster speeds and lower latency are crucial for IoT device connectivity. By 2024, there were over 17 billion IoT devices globally. Hansen must adapt its solutions to manage the surge in data and new service offerings. This includes evolving billing systems to support diverse usage models.

Development of Smart Grids and Renewable Energy Technologies

The energy sector's evolution towards smart grids, virtual power plants, and renewables demands sophisticated meter data management and billing systems. Hansen's capabilities in these areas are underscored by its inclusion in the Gartner Market Guide for Meter Data Management. This positions Hansen to leverage the increasing demand for advanced grid technologies, with the smart grid market projected to reach $61.3 billion by 2025. This growth reflects the sector's technological shift.

Cybersecurity Threats and Solutions

Cybersecurity threats represent a major technological challenge for Hansen Technologies. The escalating risk of cyberattacks necessitates continuous investment in robust security measures. These measures are essential to safeguard software, infrastructure, and sensitive customer data. In 2024, global cybercrime costs are projected to reach $9.5 trillion, highlighting the urgency. Hansen must also provide solutions to help clients improve their own security.

- Global cybercrime costs are estimated to hit $10.5 trillion annually by 2025.

- Cybersecurity spending is expected to exceed $210 billion in 2024.

- The average cost of a data breach in 2024 is around $4.5 million.

Technological advancements drive Hansen Technologies. AI and Machine Learning are pivotal, with cybersecurity spending soaring above $210 billion in 2024. Cloud computing's global spending reached $670 billion in 2024. The company must navigate fast-paced tech changes.

| Technological Factor | Impact on Hansen Technologies | Relevant Data (2024) |

|---|---|---|

| AI & Machine Learning | Enhances customer service and operational efficiency. | R&D Spending: $45 million |

| Cloud Computing | Offers scalable, cost-effective solutions. | Global Spending: $670 billion |

| Cybersecurity | Protects data & infrastructure from threats. | Cybercrime Costs: $9.5 trillion |

Legal factors

Hansen Technologies faces stringent industry-specific regulations. These regulations are critical in energy, water, telecommunications, and media. For instance, in 2024, the global energy market was valued at $2.6 trillion. Regulatory shifts can affect Hansen's product development and service offerings. The company must adapt to stay compliant and competitive.

Hansen Technologies must navigate stringent data protection and privacy laws globally, including GDPR. Compliance necessitates continuous adjustments to software solutions and data handling practices. The global data privacy market is expected to reach $13.3 billion by 2025, reflecting the importance of adherence. Failure to comply can result in significant fines, potentially impacting Hansen's financial performance. Data breaches, like the 2023 MGM Resorts one, highlight the need for robust security measures.

Hansen Technologies must navigate complex software licensing and intellectual property laws. They need to protect their software and respect licenses for third-party tools. In 2024, software piracy caused $46.8 billion in losses globally. Adhering to these laws is vital for avoiding legal issues and maintaining business integrity.

Consumer Protection Laws

Hansen Technologies must adhere to consumer protection laws, which directly influence its customer care and billing software. These laws cover crucial areas such as billing practices, customer service quality, and fair contract terms. Compliance ensures clients operate legally and ethically, avoiding penalties and reputational damage. In 2024, the Federal Trade Commission (FTC) reported over $3.5 billion in refunds to consumers due to violations of consumer protection laws, highlighting the importance of compliance.

- Billing Practices: Accurate and transparent billing processes are essential to avoid consumer disputes.

- Customer Service Standards: Meeting specific response times and issue resolution rates as mandated by law.

- Fair Contract Terms: Ensuring contracts are understandable and do not contain unfair clauses.

Contract Law and Litigation

Hansen Technologies' business model is heavily reliant on contracts with clients. Any shifts in contract law or the company's involvement in legal proceedings can introduce significant legal risks. The legal regulations surrounding technology procurement and contractual remedies are directly pertinent to Hansen's daily operations. In 2024, the tech sector saw a 15% increase in contract disputes, highlighting the importance of robust legal frameworks. Furthermore, litigation costs for tech companies have risen by an average of 10% annually over the past three years.

- Contractual disputes increased by 15% in the tech sector in 2024.

- Litigation costs for tech firms have risen by 10% annually.

- Hansen's operations are directly affected by technology sourcing laws.

Legal factors significantly influence Hansen Technologies through strict regulations, data protection, and contract laws. Compliance is vital; otherwise, Hansen faces potential financial repercussions. Specifically, consumer protection laws affect Hansen's billing and customer service. Furthermore, litigation costs and contract disputes pose additional legal risks.

| Legal Area | Impact | Data |

|---|---|---|

| Data Privacy | Compliance, penalties | Global data privacy market: $13.3B by 2025 |

| Consumer Protection | Billing, service, contracts | FTC refunded $3.5B (2024) |

| Contract Law | Disputes, costs | Tech contract disputes +15% in 2024 |

Environmental factors

Climate change concerns and sustainability initiatives greatly influence the energy and utilities sectors. This leads to increased investment in renewables, smart grids, and energy efficiency. For example, in 2024, global investment in renewable energy reached $350 billion. This creates demand for Hansen's solutions.

Environmental regulations, focusing on emissions, water use, and resource management, are critical for utilities. These regulations directly affect how Hansen's clients operate. Hansen's software assists utilities in managing data and ensuring compliance with these evolving environmental standards. Utilities face increasing pressure, with potential fines reaching millions for non-compliance. For example, the EPA proposed in 2024 to strengthen regulations on coal ash disposal, impacting many utility operations.

Investors and the public increasingly prioritize Environmental, Social, and Governance (ESG) factors. Hansen Technologies' commitment to sustainability, including carbon neutrality, is becoming more crucial. In 2024, sustainable investments reached $51.4 trillion globally. Companies with strong ESG profiles often see better financial performance.

Extreme Weather Events

Extreme weather events, which are potentially linked to climate change, are becoming more frequent and intense. This can cause significant disruptions to utility infrastructure and operations. Although Hansen's software doesn't directly face these impacts, their clients' needs for resilient systems and data management could be influenced.

- In 2024, the U.S. experienced 28 separate billion-dollar weather disasters.

- The financial impact of these disasters exceeded $92.9 billion.

- These events can lead to increased demand for Hansen's data analytics solutions.

Resource Scarcity (Water and Energy)

Resource scarcity, especially water and energy, poses significant environmental concerns. This scarcity drives innovation and investment in efficiency and conservation technologies within the utility sector. Consequently, there's a growing need for advanced metering and data analytics solutions, like those offered by Hansen. The global smart meter market is projected to reach $34.3 billion by 2025.

- Water scarcity affects over 2 billion people worldwide.

- Global energy demand is expected to increase by nearly 50% by 2050.

- Investments in smart grid technologies are rising to address these challenges.

- Hansen's solutions can help utilities optimize resource use.

Environmental factors like climate change and resource scarcity deeply affect utilities. This fuels demand for sustainability initiatives, with $350B in renewable energy investment in 2024. Regulations and ESG concerns also drive changes. Extreme weather and resource limits create operational challenges, affecting companies like Hansen Technologies.

| Factor | Impact | 2024 Data |

|---|---|---|

| Climate Change | Disruptions, Increased Demand | 28 Billion-dollar disasters, $92.9B impact in U.S. |

| Regulations | Compliance Costs | EPA coal ash regulations proposed |

| Resource Scarcity | Innovation and Efficiency | Smart meter market projected to $34.3B by 2025 |

PESTLE Analysis Data Sources

The Hansen PESTLE leverages international databases, government reports, and sector-specific publications. Insights derive from diverse, current, and reliable data.