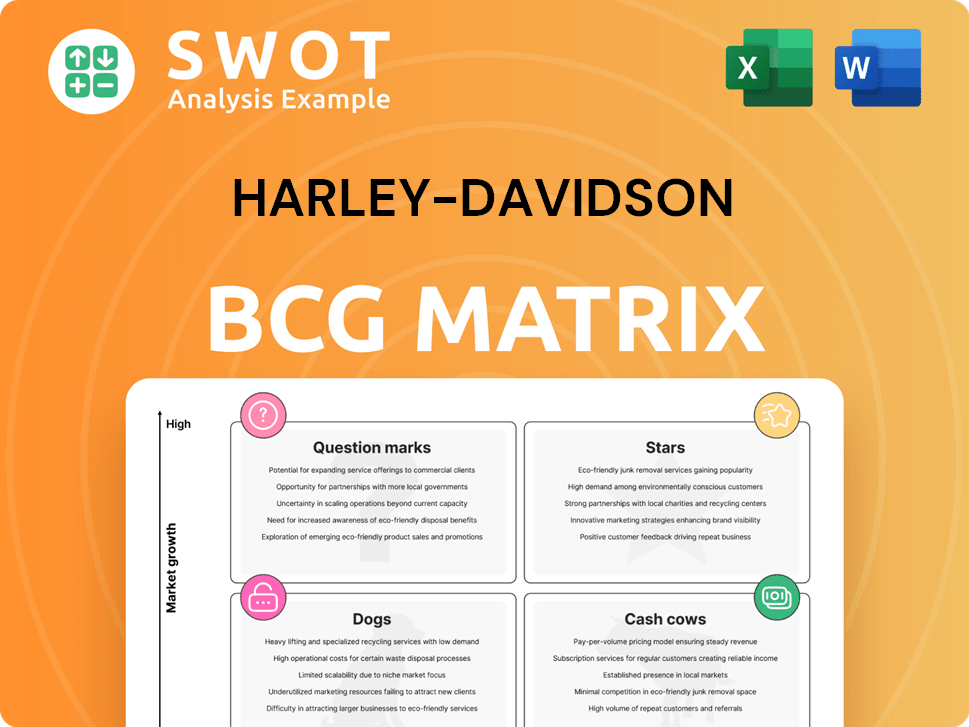

Harley-Davidson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harley-Davidson Bundle

What is included in the product

Tailored analysis for Harley-Davidson’s product portfolio across the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, to easily share Harley-Davidson's business strategy.

Delivered as Shown

Harley-Davidson BCG Matrix

The Harley-Davidson BCG Matrix you're previewing is the final, downloadable document. This is the exact, ready-to-use analysis you'll receive after purchase; prepared for strategic decision-making and planning.

BCG Matrix Template

Harley-Davidson's BCG Matrix offers a snapshot of its product portfolio's health. Motorcycles likely dominate as Cash Cows, generating steady revenue. New electric models might be Question Marks, with uncertain future growth. Apparel & accessories could be Dogs, facing slow growth. Understanding these positions guides strategic decisions.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Harley-Davidson's touring motorcycles, such as the Street Glide and Road Glide, are stars. They command a substantial market share within the high-profit touring segment. These models benefit from strong brand recognition and a loyal customer base. The U.S. touring segment saw growth, boosted by updated 2024 models.

Harley-Davidson's CVO models are its premium offerings, targeting high-end customers. These limited-edition bikes boost profitability with their high margins. The 2025 CVO lineup, including the Street Glide and Road Glide ST, features unique designs. In Q4 2023, Harley-Davidson's motorcycles revenue was $1.03 billion.

Harley-Davidson Financial Services (HDFS) is a star, offering financing for dealers and customers. In 2024, HDFS saw increased operating income, showcasing its stability. Despite this, a 10-15% decrease is projected for 2025. This is due to reduced finance receivables and elevated borrowing expenses.

International Growth (India, Europe, Latin America)

Harley-Davidson is expanding internationally, with a focus on India, Europe, and Latin America. Partnerships, like the one with Hero MotoCorp in India, are boosting sales. These regions offer growth potential to offset U.S. market challenges.

- India sales grew significantly in 2023, driven by the Hero MotoCorp partnership.

- European sales showed positive trends, though exact figures vary.

- Latin American markets present growth opportunities, though data is still emerging.

Strong Brand Identity

Harley-Davidson's strong brand identity, symbolizing freedom and individualism, is deeply ingrained in American culture. This recognition fosters a loyal customer base, allowing premium pricing. The iconic logo represents a century of motorcycle culture, transforming it into a lifestyle. In 2024, Harley-Davidson's brand value was estimated at $6.5 billion, reflecting its strong market presence.

- Brand Value: $6.5 billion (2024)

- Loyal Customer Base

- Premium Pricing Strategy

- Iconic Brand Representation

Harley-Davidson's Stars, including touring and CVO models, hold strong market positions with high profitability. These segments benefit from brand recognition and premium pricing. HDFS also shines, but faces a projected downturn in 2025 due to reduced finance receivables and elevated borrowing costs.

| Category | Details | 2024 Data |

|---|---|---|

| Touring Motorcycles | Models like Street Glide, Road Glide | U.S. touring segment growth |

| CVO Models | Premium offerings, limited editions | Q4 2023 Revenue: $1.03B |

| HDFS | Financing arm | Increased operating income |

Cash Cows

Harley-Davidson's heavyweight cruisers are cash cows, providing consistent revenue due to a loyal customer base. Models like the Fat Boy are key contributors. While the cruiser segment faces declines, it still generated $1.2 billion in revenue in 2023. Strategic focus is crucial to sustain profitability.

Harley-Davidson's aftermarket parts and accessories are a cash cow, generating substantial revenue. This segment thrives on customization, enhancing bikes. In 2024, this area continued to boost profits. New accessories are expected to further grow this profitable business.

Harley-Davidson's established dealer network is a cornerstone of its success, acting as a robust distribution channel. The company's dealerships offer sales, service, and support, driving repeat business. In 2024, Harley-Davidson's dealer network included around 450 dealerships in the United States. Improving dealer performance is key to maintaining a competitive edge.

Core Touring and Softail Motorcycle Lines

Harley-Davidson's core touring and Softail lines are cash cows, providing consistent revenue due to strong brand loyalty. These models, like the Road King and Street Bob, cater to many riders and boost profitability. However, the Softail segment faces sales declines, necessitating strategic changes.

- In Q1 2024, Harley-Davidson's motorcycle revenue was $1.47 billion.

- Softail sales saw a decrease, highlighting the need for market adaptation.

- Touring models remain popular, supporting the company's financial stability.

- Harley-Davidson focuses on product optimization and market strategy.

Grand American Touring

Harley-Davidson's Grand American Touring models are a cash cow within its BCG matrix, generating substantial revenue with established market share. These models, known for comfort and technology, contribute significantly to the company's financial stability. In 2024, Harley-Davidson aimed to grow its leadership in touring, focusing on its potential for growth. This category is key to maintaining Harley-Davidson's market position.

- Focus on reinventing, reimagining, and reinvigorating the Touring category.

- These models are designed for long-distance riding with comfort, performance, and technology.

- The Touring category provides financial stability.

- Harley-Davidson aimed to grow leadership in touring in 2024.

The Pan America adventure touring motorcycle is categorized as a cash cow. It generated revenue with substantial market presence. Harley-Davidson aimed to grow this category.

| Aspect | Details |

|---|---|

| Revenue | Contributes to substantial revenue |

| Market Share | Established market presence |

| Strategic Focus | Harley-Davidson aimed to grow this category in 2024 |

Dogs

Harley-Davidson has axed slow-selling models and withdrawn from markets that weren't profitable, a key move in its strategic overhaul. These decisions free up resources, as these areas had little growth potential. Focusing on core segments and profitable regions is vital; in 2024, Harley-Davidson saw a 7.8% increase in Q3 revenue.

Some international markets for Harley-Davidson have shown poor performance. These areas may need large investments for improvement or could be sold off. In 2023, Harley-Davidson's international sales represented about 40% of total motorcycle revenue. Focusing on stronger markets, like India and Europe, is more beneficial. In Q3 2023, Europe saw a revenue decrease of 10.8% for Harley-Davidson.

Harley-Davidson's non-core motorcycle segment, classified as "Dogs" in its BCG matrix, faces challenges. Retail sales for these models have decreased, signaling weak demand and profitability. Harley-Davidson has reduced its workforce and global dealer network. In 2024, the company exited 39 markets with poor sales, reflecting strategic shifts.

LiveWire (Electric Motorcycles)

LiveWire, Harley-Davidson's electric motorcycle venture, faces challenges despite being a market leader. It's forecasted to sell 1,000-1,500 bikes in 2025, with projected operating losses of $70-$80 million. The electric motorcycle market's growth is hindered by limited charging infrastructure and high upfront costs. These issues impact LiveWire's financial performance and market positioning.

- Projected sales for 2025: 1,000-1,500 units.

- Expected operating loss in 2025: $70-$80 million.

- Market challenges: Limited charging infrastructure.

- Market challenges: High initial costs.

Declining Sales in the United States

Harley-Davidson's U.S. sales are struggling. Retail sales in North America dropped by 13% in 2024. High-interest rates and economic uncertainty are key factors. The company aims to boost profits with updated 2025 Touring bikes.

- 2024 retail sales decline in North America: 13%

- Factors: High-interest rates, economic uncertainty

- Strategy: Focus on higher-margin Touring bikes

- Target: Affluent customers through custom operations

Harley-Davidson's "Dogs" represent underperforming segments within its portfolio.

These models experience declining sales and weak demand, leading to strategic workforce reductions and market exits.

In 2024, the company withdrew from 39 markets due to poor sales, underscoring their strategic challenges.

| Category | Details | 2024 Data |

|---|---|---|

| Sales Performance | Retail Sales Decline | North America -13% |

| Strategic Action | Market Exits | 39 markets |

| Market Segment | Classification | "Dogs" |

Question Marks

Harley-Davidson's Pan America, an adventure touring motorcycle, is a question mark in the BCG Matrix. This segment offers high growth potential for Harley-Davidson. It competes with established adventure touring brands. In 2024, the Pan America's sales figures were closely monitored, and the segment's market share grew to 8%.

Harley-Davidson's Sportster S, a Question Mark, targets the sport motorcycle market. This model features enhanced suspension and tech, aiming to attract new riders. The segment's growth potential needs marketing and development investments. In 2024, Harley-Davidson's sales were approximately $5.79 billion, showcasing the need for strategic focus on models like the Sportster S to capture market share.

Harley-Davidson's LiveWire, its electric motorcycle segment, is a question mark due to high growth potential. The electric motorcycle market is projected to reach $3.9 billion by 2029. Innovation in battery tech and fast charging is key. In 2024, Harley-Davidson's revenue was $5.79 billion.

Partnerships and Collaborations

Harley-Davidson's partnerships are key strategies for growth. Collaborations, like the one with Hero MotoCorp in India, open doors to new markets. These alliances boost reach and tap into new customer segments. In 2024, the Indian market shows strong growth, particularly thanks to the Hero MotoCorp partnership, with nearly 12,000 sales.

- Partnerships drive Harley-Davidson's expansion.

- Hero MotoCorp collaboration boosts Indian sales.

- New markets and customer bases are targeted.

- Nearly 12,000 sales in India in 2024.

Factory Custom Paint & Graphics Program

Harley-Davidson's Factory Custom Paint & Graphics program, launched for select models, fits the question mark quadrant of the BCG matrix. This program, featuring mother-of-pearl backgrounds and unique medallions, is a strategic move. It aims to capture new market segments with offerings like Midnight Firestorm, Whiskey Firestorm, and Mystic Shift. This initiative is an attempt to increase market share.

- New paint options attract customers.

- Expands into new market segments.

- Increase market share.

- Offers exclusive paint sets.

The BCG matrix categorizes Harley-Davidson's new ventures as question marks, due to high growth potential. The company strategically invests in these areas, such as the Pan America adventure touring, and electric motorcycles. Success depends on market penetration and innovation. In 2024, Harley-Davidson's revenue was approximately $5.79 billion.

| Model | Category | Focus |

|---|---|---|

| Pan America | Adventure Touring | Market Share Growth |

| Sportster S | Sport Motorcycles | New Rider Attraction |

| LiveWire | Electric Motorcycles | Innovation |

BCG Matrix Data Sources

This BCG Matrix leverages diverse sources, from Harley-Davidson's financial filings to competitor analysis, for insightful market positions.