Haworth PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Haworth Bundle

What is included in the product

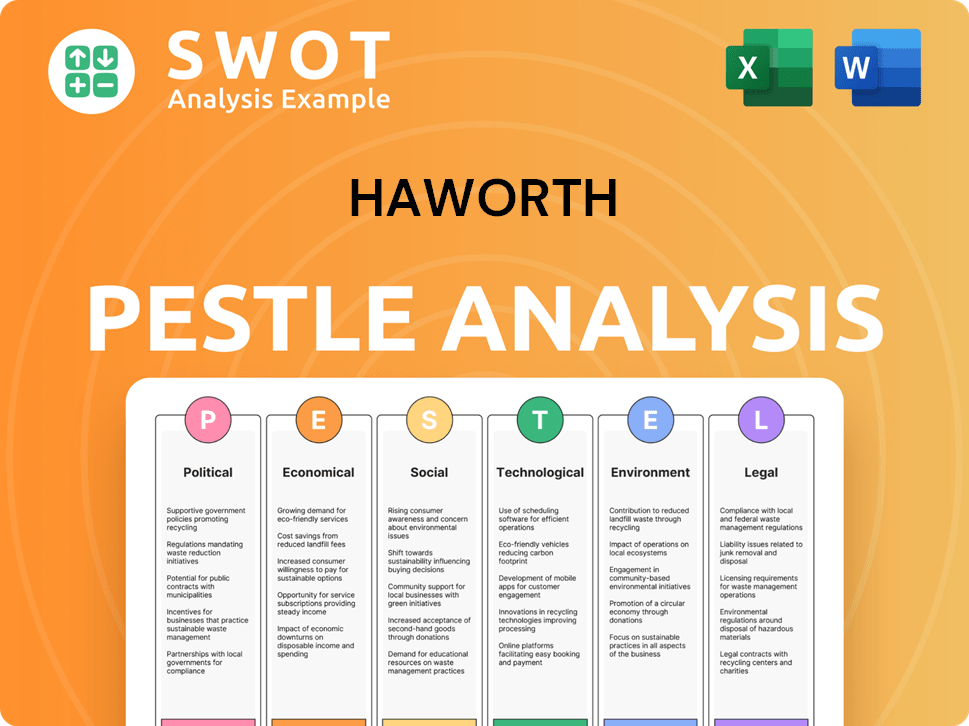

This PESTLE analysis assesses external influences impacting Haworth: Political, Economic, Social, Tech, Environmental, Legal.

A succinct Haworth PESTLE helps stakeholders analyze factors affecting the organization's goals.

Preview Before You Purchase

Haworth PESTLE Analysis

Everything displayed here is part of the final product. This Haworth PESTLE Analysis preview showcases the complete document. You'll receive this exact, professionally structured file instantly. There are no differences between the preview and the purchased download. What you see is what you'll be working with.

PESTLE Analysis Template

Navigate Haworth's future with a comprehensive PESTLE Analysis. This essential tool unpacks key external forces affecting the company. Discover crucial political, economic, social, technological, legal, and environmental factors. Identify opportunities, mitigate risks, and refine your strategies. Get the complete, ready-to-use analysis and gain a competitive edge!

Political factors

Government regulations and trade policies significantly influence Haworth's operational costs. For instance, tariffs on raw materials like steel and aluminum directly affect manufacturing expenses. In 2024, the U.S. imposed tariffs averaging 15% on various imported goods, potentially increasing Haworth's production costs. Geopolitical instability and protectionist measures, as seen with the EU's proposed carbon border tax, introduce further complexities for international business. Adapting to such policy shifts is vital for cost management and ensuring market access.

Haworth's operational success hinges on the political stability of its operating regions. Instability, such as elections or conflicts, can disrupt sales and investment. Stable environments foster predictable markets, crucial for growth. For example, in 2024, political instability in regions like Eastern Europe affected supply chains, impacting Haworth's operations.

Government investments significantly impact Haworth. Spending on education and public buildings boosts demand for their furniture. The US government's infrastructure bill, with billions allocated to schools and public spaces, offers opportunities. For example, the US government's investment in educational facilities is projected to reach $80 billion by 2025, increasing the demand for Haworth's products in library furniture. This creates potential for growth.

Policies on Workplace Design and Accessibility

Government policies significantly shape workplace design, with accessibility standards like the ADA directly impacting furniture demand. Haworth can capitalize on its design capabilities to meet these requirements, focusing on accessible and ergonomic office furniture. This approach aligns with the rising need for inclusive workplaces. Accessibility is crucial, with the U.S. Census Bureau reporting that nearly 27% of adults have a disability.

- ADA compliance drives demand.

- Haworth can innovate accessible designs.

- Ergonomics are increasingly important.

- Focus on inclusive workplace solutions.

International Relations and Global Cooperation

International relations and global cooperation significantly influence trade and market access. Positive relationships ease market expansion, while strained ties create barriers. Geopolitical uncertainty poses a major challenge for businesses. For instance, in 2024, trade tensions between major economies affected global supply chains.

- The World Bank projected global trade growth at 2.4% in 2024.

- Geopolitical risks were cited by 60% of businesses as a top concern.

- Trade agreements like the USMCA and CPTPP continue to shape market access.

Political factors profoundly affect Haworth’s business operations. Regulations and tariffs influence manufacturing costs; in 2024, tariffs impacted imported goods significantly. Governmental spending on infrastructure boosts demand, as seen with projected educational facility investments. International relations impact trade and market access.

| Aspect | Impact | Data |

|---|---|---|

| Tariffs | Increase in costs | US tariffs averaging 15% on various imports in 2024 |

| Infrastructure Spending | Demand boost | US educational facilities investment projected to reach $80 billion by 2025 |

| Trade Growth | Market influence | World Bank projected global trade growth at 2.4% in 2024 |

Economic factors

Haworth's success is tied to worldwide economic health. FY24 saw slower global growth, impacting demand. Strategies must adapt to regional GDP variations. Securing new clients and using dealer networks are key during slowdowns. The IMF projects global growth at 3.2% in 2024, influencing Haworth's outlook.

Inflation and interest rates significantly influence Haworth's operations. Rising inflation, which hit 3.5% in March 2024, erodes purchasing power, potentially impacting demand for Haworth's products. High interest rates, currently around 5.25%-5.50% in the US, can increase borrowing costs, affecting investment decisions and order volumes. Haworth must adapt pricing and financial strategies to navigate these economic fluctuations and maintain profitability in 2024/2025.

Currency exchange rate fluctuations significantly influence Haworth's international business. These fluctuations directly impact the cost of goods sold and revenue generated in foreign markets, as seen in the 2024 financial reports. Companies often use hedging strategies to mitigate these risks, aiming to stabilize financial outcomes. For example, in 2024, a 5% adverse currency movement could have reduced Haworth's profit margins.

Real Estate Market Trends

The real estate market's health significantly influences Haworth's furniture demand. In 2024, U.S. construction spending reached $2.06 trillion, a 10.7% increase from 2023, indicating potential growth for Haworth. New commercial and residential projects boost furniture sales. Expansion in real estate offers Haworth opportunities.

- U.S. construction spending in 2024: $2.06 trillion.

- Increase in construction spending from 2023: 10.7%.

Consumer Spending and Business Investment

Consumer spending and business investment are crucial for Haworth's office furnishings market. Reduced consumer spending or cautious business investment in office upgrades can significantly affect sales cycles. For example, the U.S. Bureau of Economic Analysis reported a 2.7% increase in consumer spending in the first quarter of 2024. However, business investment saw a slight decrease, indicating a potential slowdown in office space investments. These trends directly influence Haworth's revenue streams and strategic planning.

- Consumer spending in the U.S. rose 2.7% in Q1 2024.

- Business investment showed a slight decrease in the same period.

- Haworth's sales cycles are sensitive to these economic shifts.

- Cautious investment impacts demand for office furnishings.

Economic conditions greatly impact Haworth. Global growth, projected at 3.2% in 2024, shapes demand. Inflation (3.5% in March 2024) and interest rates (5.25-5.50% in US) affect costs. The real estate sector, with $2.06T in 2024 construction spending, and consumer spending trends influence Haworth's success.

| Economic Factor | Impact on Haworth | Data (2024) |

|---|---|---|

| Global Growth | Affects demand | 3.2% (IMF Projection) |

| Inflation | Erodes purchasing power | 3.5% (March) |

| Interest Rates (US) | Influences borrowing, investment | 5.25%-5.50% |

Sociological factors

Aging populations in developed nations are creating skilled labor shortages, a significant challenge for Haworth. The U.S. Bureau of Labor Statistics projects a 5.9% increase in employment in "Architecture and Engineering Occupations" from 2022 to 2032. Haworth must focus on talent acquisition and retention. Investing in training programs is crucial to navigate these shifts and secure its future.

The shift to hybrid work impacts furniture demand. Flexible and well-being-focused designs are crucial. Companies are redesigning spaces for collaboration and employee needs. Haworth's research highlights these trends. In 2024, 60% of companies adopted hybrid models, influencing office furniture choices.

There's a rising focus on workplace health. This boosts demand for ergonomic furniture. Companies are investing in better air quality systems, with the global market expected to reach $14.7 billion by 2025. This also includes soundproofing and natural light solutions, all enhancing employee well-being.

Social Responsibility Expectations

Societal pressure on companies to be socially responsible is growing, impacting how consumers and stakeholders view businesses. Haworth needs to showcase its CSR efforts transparently to meet these expectations. In 2024, 77% of consumers prefer brands that are socially conscious. This includes clear communication about environmental sustainability and ethical labor practices, essential for building trust and brand loyalty.

- 77% of consumers favor socially responsible brands.

- Transparency in CSR efforts builds trust.

- Ethical practices are increasingly important.

- Haworth's CSR initiatives are crucial.

Diversity, Equity, and Inclusion (DEI) in the Workplace

DEI is increasingly important in the workplace, impacting design. Haworth embraces inclusive design and DEI within its networks. This reflects changing social values and the need for equitable spaces. Haworth's commitment is aligned with broader societal shifts.

- In 2024, 74% of companies reported focusing on DEI.

- Haworth's DEI initiatives include supplier diversity programs.

- Inclusive design aims for spaces that accommodate all.

Consumers increasingly favor socially responsible brands; 77% prioritized such brands in 2024. This drives the demand for transparency in corporate social responsibility (CSR) efforts. Ethical practices are essential for maintaining consumer trust.

| Factor | Impact | Data Point (2024-2025) |

|---|---|---|

| Socially Responsible Brands | Enhanced Brand Reputation | 77% consumer preference |

| CSR Transparency | Trust and Loyalty | Growing consumer demand |

| DEI Focus | Inclusive Design | 74% companies focused on DEI |

Technological factors

Advancements in manufacturing, like automation and robotics, influence production efficiency and costs. Despite a 2024 dip in warehouse automation orders, long-term growth is expected. The global industrial automation market is forecast to reach $326.1 billion by 2025. This growth highlights technology's increasing importance in manufacturing for companies like Haworth.

E-commerce, mobile, and social commerce reshape furniture retail. Haworth must invest in digital platforms to boost customer reach and online experience. E-commerce significantly increases furniture sales; in 2024, the online furniture market reached $36.8 billion. Mobile commerce grew by 25% in 2024, signaling a shift.

Technology shapes Haworth's workspace designs. Smart offices and sensors are key, with a focus on environmental monitoring and space use. This opens doors for Haworth to create tech-integrated furniture. The smart office market is expected to reach $61.9 billion by 2025.

Innovation in Product Design and Materials

Haworth's ability to compete hinges on continuous innovation in product design, materials, and manufacturing. The company is investing heavily in introducing new, sustainable products and exploring circular design principles. This approach is driven by technological advancements and evolving market demands, particularly in eco-friendly solutions. Haworth's focus on tech-driven design is critical.

- Haworth's 2024 sustainability report highlights their commitment to reducing environmental impact through material innovation.

- The global market for sustainable furniture is projected to reach $48.9 billion by 2025, indicating significant growth opportunities.

- Haworth is incorporating smart technology into its products, with a 15% increase in sales for tech-integrated furniture in 2024.

Use of Data Analytics and AI

Haworth can gain a competitive edge by using data analytics and AI. These technologies offer deeper insights into customer behavior, market shifts, and operational improvements. For instance, the global AI in manufacturing market is projected to reach $17.2 billion by 2025. This helps in making data-driven decisions for product development and marketing.

- AI-driven insights can boost Haworth's operational efficiency.

- Data analytics can improve supply chain management.

- The use of AI is growing in the furniture industry.

Technological advancements significantly impact Haworth through automation, reshaping manufacturing processes and reducing costs; for instance, the industrial automation market is forecasted to reach $326.1 billion by 2025. E-commerce and digital platforms are crucial, impacting customer reach and sales in furniture retail, with online furniture sales hitting $36.8 billion in 2024. Smart office technologies and data analytics, with the AI in manufacturing market predicted to hit $17.2 billion by 2025, drive Haworth's design innovations and market strategies.

| Technology Area | Impact on Haworth | 2024/2025 Data |

|---|---|---|

| Automation | Enhances manufacturing, reduces costs | Warehouse automation orders dipped, but long-term growth expected; industrial automation market $326.1B by 2025. |

| E-commerce | Boosts customer reach & sales | Online furniture market reached $36.8B in 2024; mobile commerce increased by 25%. |

| Smart Tech/AI | Drives design innovation, efficiency | Smart office market $61.9B by 2025; AI in manufacturing $17.2B by 2025; 15% sales increase in tech-integrated furniture. |

Legal factors

Workplace health and safety regulations, encompassing air quality, ergonomics, and building codes, significantly influence office furniture design and production. Haworth must ensure its products meet these standards to offer safe and healthy workspaces, impacting manufacturing costs and product features. For instance, the global market for ergonomic furniture was valued at USD 135.2 billion in 2024 and is projected to reach USD 178.3 billion by 2029. Compliance is crucial.

Data privacy regulations are becoming stricter worldwide. The California Consumer Privacy Act (CCPA) and similar laws demand significant investment in data security. E-commerce platforms must prioritize compliance to safeguard customer data. Failing to comply can lead to hefty fines and loss of customer trust. Data breaches cost companies an average of $4.45 million in 2023.

Haworth must navigate trade agreements and tariffs, which directly influence costs and market access. For instance, the US-China trade war impacted furniture imports, potentially raising Haworth's expenses. In 2024, tariffs on imported furniture from China averaged around 25%. Effective legal strategies are crucial for supply chain management and global operations.

Employment Laws and Labor Regulations

Haworth, operating globally, must navigate diverse employment laws, significantly affecting its HR strategies. These regulations dictate hiring, compensation, and workplace standards. Non-compliance risks legal penalties and reputational damage, vital for operational integrity. For instance, the EU's GDPR impacts data handling in HR, while varying minimum wage laws across countries, like the recent increases in Germany and France, affect Haworth's payroll.

- GDPR compliance is essential for handling employee data in the EU.

- Minimum wage increases in countries like Germany (2024: €12.41/hour) and France impact labor costs.

- Compliance with labor laws is crucial for maintaining a positive employer brand.

Intellectual Property Laws

Haworth must navigate intellectual property laws to protect its designs and brand. This involves securing patents, trademarks, and copyrights globally. The legal landscape varies, requiring a strategic approach. In 2024, global patent filings reached approximately 3.4 million. Effective IP protection is critical for maintaining competitive advantage.

- Global patent filings in 2024 were around 3.4 million.

- Trademark applications worldwide in 2024 totaled about 18 million.

- Copyright registrations globally in 2024 exceeded 7 million.

Legal factors profoundly influence Haworth's operations through compliance, intellectual property, and trade. Workplace safety standards, like ergonomic furniture regulations, impact product design and manufacturing costs. Strict data privacy laws necessitate investment in data security to avoid penalties. Navigating tariffs and international trade agreements remains crucial for managing supply chains and market access.

| Aspect | Details |

|---|---|

| Ergonomic Furniture Market (2024) | USD 135.2 billion |

| Data Breach Cost (2023) | $4.45 million (average) |

| China Furniture Tariffs (2024) | Around 25% |

| Global Patent Filings (2024) | Approx. 3.4 million |

Environmental factors

Growing environmental awareness boosts demand for eco-friendly products and circular practices. Haworth's circular design and sustainable sourcing align with these trends. For instance, in 2024, Haworth reported a 20% increase in sales from its sustainable product lines. Their carbon footprint reduction efforts are key.

Haworth faces scrutiny regarding responsible sourcing of materials. The focus is on reducing environmental impact, especially with wood and raw materials. Haworth's sustainable wood sourcing and efforts to cut hazardous chemicals are key. In 2024, the demand for sustainably sourced wood increased by 15% in the furniture industry.

Climate change concerns drive businesses to cut carbon emissions. Haworth aims to reduce emissions across its operations and supply chain. The company invests in second-life programs, aiming for a 40% reduction in carbon emissions by 2030. Haworth's commitment is reflected in its 2024 sustainability report, showing a 15% decrease in carbon footprint compared to 2023.

Waste Management and Recycling Regulations

Waste management and recycling regulations significantly shape Haworth's product design and how it handles products at the end of their life. The company's circular services, like programs for used furniture, are vital to keep waste out of landfills. Haworth's efforts align with growing global emphasis on sustainability and reduce environmental impact. These initiatives are increasingly important for businesses.

- In 2024, the global waste management market was valued at approximately $2.1 trillion.

- The recycling rate in the United States was around 32% in 2023, showing room for improvement.

- EU targets aim for 65% recycling of municipal waste by 2035, pushing companies to adopt circular models.

Environmental Certifications and Standards

Haworth's dedication to environmental sustainability is evident through its adherence to certifications like Ecovadis Gold and Greenguard. These certifications showcase a commitment to reducing environmental impact. In 2024, the global green building materials market was valued at approximately $300 billion, reflecting the growing importance of sustainability. Achieving these standards can positively influence customer choices, as evidenced by surveys indicating that over 60% of consumers are willing to pay more for sustainable products.

- Ecovadis Gold certification demonstrates a commitment to environmental, social, and ethical performance.

- Greenguard certification ensures products meet strict chemical emission limits, improving indoor air quality.

- The green building materials market is projected to reach $450 billion by 2027.

- Consumer preference for sustainable products continues to rise, driving demand for certified offerings.

Environmental awareness drives eco-friendly product demand. Haworth's sustainable practices, like sourcing wood and cutting emissions, address these concerns, reflected in certifications. In 2024, the global green building materials market was approximately $300 billion.

Waste management and recycling regulations are key. Haworth's circular services minimize landfill waste, aligned with rising sustainability. The EU aims for 65% recycling by 2035. Businesses that adopt this are increasing their profitability and social responsibility.

| Key Environmental Aspect | Haworth's Response | 2024/2025 Data Point |

|---|---|---|

| Eco-Friendly Products | Sustainable product lines and circular design. | 20% sales increase from sustainable lines (2024). |

| Material Sourcing | Sustainable wood sourcing and cutting hazardous chemicals. | 15% increase in sustainable wood demand (furniture, 2024). |

| Carbon Emissions | Emission reduction across operations and second-life programs. | 15% carbon footprint decrease (Haworth, 2024). |

PESTLE Analysis Data Sources

Haworth's PESTLE utilizes reputable sources: industry reports, governmental data, and market analyses.