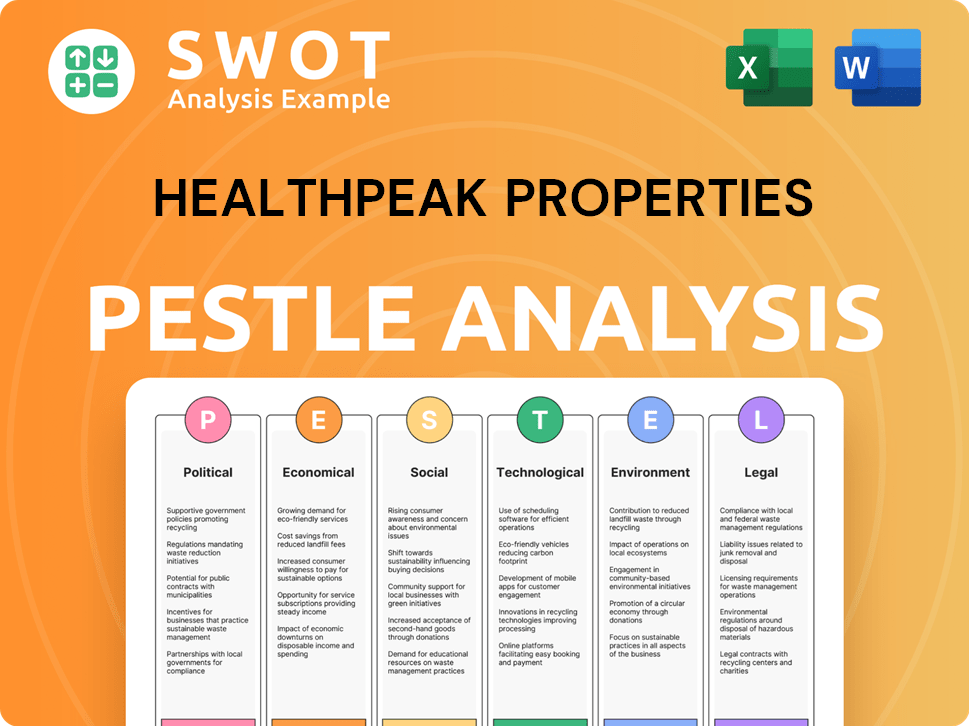

Healthpeak Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Healthpeak Properties Bundle

What is included in the product

Assesses external influences on Healthpeak Properties via PESTLE. Aids in identifying threats, opportunities, and future strategies.

Provides a concise version to inform business decisions by outlining factors impacting Healthpeak Properties.

Preview the Actual Deliverable

Healthpeak Properties PESTLE Analysis

This Healthpeak Properties PESTLE Analysis preview is the final product. You’ll receive this fully formatted document upon purchase. It's professionally structured and ready to download. No alterations will be necessary. Everything you see now is part of your purchase.

PESTLE Analysis Template

Analyze Healthpeak Properties with our expert PESTLE analysis. Discover key external forces shaping its path. Understand political & economic impacts on the company's strategy. Explore social trends & technological shifts affecting its performance. Get detailed insights into legal & environmental factors. Boost your market understanding – purchase the full PESTLE now!

Political factors

Government healthcare spending and reimbursement policies are critical. In 2024, Medicare spending is projected at $988 billion. Changes to these programs impact providers and real estate demand. Cuts or fluctuations can reduce demand, affecting rental rates. Healthpeak's performance is tied to these policies.

Healthpeak Properties faces political and regulatory risks. Healthcare policy changes, like those impacting Medicare/Medicaid, can alter property demand. Land use rules and building codes also affect development and operations. These factors introduce uncertainty, potentially influencing investment choices and property values. For example, in 2024, policy shifts could impact occupancy rates, which were at ~90% in senior housing.

Government programs expanding healthcare access, especially in areas with limited resources, may boost healthcare facility development. Healthpeak could capitalize on this by investing in new properties. For instance, the U.S. government allocated $2.5 billion in 2024 to improve healthcare access in rural areas. This could increase Healthpeak's opportunities.

Political Stability and Policy Changes

Political stability and shifts in government priorities greatly affect the economic landscape and investor trust in real estate. Policy changes, such as alterations to healthcare regulations, directly impact Healthpeak Properties. Uncertainty can lead to decreased investment or cautious development. For example, in 2024, the healthcare REIT sector faced scrutiny due to evolving reimbursement models.

- Changes in healthcare policy directly affect Healthpeak's operations.

- Political instability can lead to investment hesitancy.

- Government priorities influence economic conditions relevant to real estate.

Influence of Lobbying and Advocacy Groups

Lobbying and advocacy significantly impact Healthpeak's operations. Healthcare providers, real estate groups, and other stakeholders actively shape policy. These efforts directly influence regulations affecting Healthpeak's properties and demand. For instance, in 2024, healthcare lobbying spending reached billions, influencing healthcare real estate.

- Healthcare lobbying spending exceeded $600 million in the first half of 2024.

- Real estate associations spent over $100 million on lobbying in 2024.

Healthcare policy changes directly affect Healthpeak Properties, with Medicare spending projected at $988 billion in 2024.

Political instability and evolving regulations can create uncertainty. Healthcare lobbying reached billions, and real estate associations spent over $100 million in 2024.

Government priorities and advocacy significantly shape Healthpeak's operational landscape. Policy shifts can impact occupancy rates, affecting the company’s performance.

| Political Factor | Impact on Healthpeak | 2024/2025 Data |

|---|---|---|

| Healthcare Policy Changes | Affect property demand and rental rates | Medicare spending ~$988B in 2024, impacting providers. |

| Political Instability | Can lead to investment hesitancy | Healthcare lobbying reached billions, influencing real estate. |

| Government Priorities | Influence economic conditions | Healthcare lobbying spending exceeds $600M in the first half of 2024. |

Economic factors

Interest rates are pivotal in healthcare real estate. Healthpeak's borrowing costs are directly affected by interest rate fluctuations, influencing development and acquisitions. In Q1 2024, the 10-year Treasury yield, a benchmark, varied, impacting Healthpeak's financing costs. Rising rates can increase costs, potentially reducing investment activity; the Federal Reserve's decisions are crucial.

Economic growth and employment levels significantly impact Healthpeak Properties. A robust economy, marked by rising GDP and low unemployment, typically boosts healthcare spending. In Q4 2024, the U.S. GDP grew by 3.4%, influencing demand for healthcare real estate. Conversely, economic slowdowns can curb spending and affect facility needs.

Inflation significantly influences construction costs, encompassing materials and labor, thereby impacting Healthpeak's development expenses. Although inflation moderated to 3.1% in the US in November 2024, the construction sector still faced higher costs. Securing advantageous financing will be pivotal for project viability in 2025, considering these economic pressures.

Capital Market Conditions and Investment Activity

Capital market conditions are crucial for Healthpeak's investment activities. Access to debt and equity financing directly affects the company's ability to acquire and develop healthcare properties. In 2024, rising interest rates and economic uncertainty may have impacted the availability of capital. However, any improvement in market conditions could boost Healthpeak's transaction volume.

- Interest rate hikes could increase borrowing costs.

- Economic uncertainty might slow down investment.

- Improved markets could lead to more acquisitions.

- Healthpeak needs to monitor market trends.

Healthcare Spending and Affordability

Healthcare spending and affordability significantly impact demand for healthcare facilities. The U.S. healthcare spending reached $4.5 trillion in 2022, and is projected to hit $7.2 trillion by 2024, according to CMS. Increased spending can boost real estate demand. Affordability issues, however, may limit access and constrain this demand.

- 2022 U.S. healthcare spending: $4.5 trillion.

- Projected 2024 U.S. healthcare spending: $7.2 trillion.

Interest rates are vital, with potential borrowing cost hikes impacting Healthpeak. Economic growth, including the Q4 2024 US GDP of 3.4%, drives healthcare spending and real estate needs. Inflation and construction costs influence development expenses.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Interest Rates | Influence borrowing costs | 10-year Treasury yield fluctuations |

| Economic Growth | Boosts healthcare spending | Q4 2024 GDP: 3.4% |

| Inflation | Affects construction costs | November 2024 US inflation: 3.1% |

Sociological factors

The aging population significantly fuels healthcare real estate demand, a key factor for Healthpeak Properties. In the U.S., the 65+ population is projected to reach 73 million by 2030. This demographic shift increases the need for senior housing and medical facilities. Healthpeak's portfolio strategically aligns with these needs.

Evolving consumer preferences are driving healthcare toward convenient outpatient settings. This shift boosts demand for medical office buildings (MOBs), Healthpeak's focus. In 2024, outpatient visits increased by 5%, reflecting this trend. Healthpeak's MOB portfolio occupancy remained high at 95% in Q4 2024, capitalizing on this shift.

Consumer preferences significantly shape healthcare facility demands. Accessibility and location preferences drive demand for specific facility types. Community-based care near residences supports outpatient medical building growth. In 2024, outpatient visits rose, reflecting this trend. Healthpeak's portfolio aligns with these preferences.

Health and Wellness Trends

Growing health and wellness awareness boosts demand for healthcare facilities. This includes properties for preventative care and specialized treatments. The wellness market is expanding; in 2024, it reached $7 trillion globally. Healthpeak Properties could benefit from this trend.

- The global wellness market was valued at $7 trillion in 2024.

- Preventative care is becoming more important.

- Demand is rising for specialized treatment centers.

Labor Availability in Healthcare

Labor availability in healthcare significantly affects Healthpeak Properties' tenants. Shortages of healthcare professionals can limit facility capacity and influence demand for space. The U.S. Bureau of Labor Statistics projects a 13% growth for healthcare occupations from 2022 to 2032. This growth rate is faster than the average for all occupations. This could impact Healthpeak's occupancy rates and rental income.

- Projected 13% growth for healthcare occupations from 2022-2032.

- Shortages may affect facility capacity.

Sociological factors greatly influence Healthpeak's performance. An aging population drives healthcare real estate demand, with the 65+ group projected to reach 73 million by 2030 in the U.S. Consumer preferences, like convenient outpatient care, boost demand for medical office buildings. Wellness market expansion, valued at $7 trillion globally in 2024, is also significant.

| Factor | Impact | Data |

|---|---|---|

| Aging Population | Increased demand | 73M aged 65+ by 2030 |

| Consumer Preferences | Demand shifts | Outpatient visits +5% in 2024 |

| Wellness Trends | Market Growth | $7T global value (2024) |

Technological factors

Technological advancements in medical equipment and procedures directly influence healthcare facility designs. Properties must adapt to accommodate innovations, impacting development and renovation choices. For example, in 2024, the healthcare technology market is projected to reach $280 billion, highlighting the need for flexible spaces. Adaptability is key; in 2025, the demand for technologically advanced medical facilities is expected to increase by 15%.

Telemedicine and remote patient monitoring are revolutionizing healthcare. This shift could decrease in-person visits. However, it demands facilities with robust communication systems. For example, the global telemedicine market is projected to reach $175.5 billion by 2026. This could lead to redesigning or repurposing existing spaces.

The integration of AI in healthcare is surging, particularly in diagnostics and therapeutics. This trend is fueling higher R&D spending, benefiting Healthpeak's life science properties. In 2024, global healthcare AI market was valued at $29.7 billion, expected to reach $194.4 billion by 2030. This growth could increase demand for Healthpeak's lab spaces.

Building Technology and Smart Buildings

Healthpeak Properties can leverage building technology and smart buildings to boost efficiency and tenant satisfaction. These technologies can lower energy use and streamline operations across their healthcare properties. Investing in such tech helps attract and keep tenants, enhancing property value. For instance, smart HVAC systems can cut energy costs by up to 30%.

- Smart building tech can reduce energy consumption by 20-30%.

- Implementing smart systems can increase tenant satisfaction by 15%.

- Healthpeak might allocate 5-10% of its capital expenditure on these technologies.

- The smart building market is projected to grow by 12% annually through 2025.

Data Security and Privacy in Healthcare Facilities

Data security and patient privacy are paramount in healthcare, especially with tech integration. Healthpeak Properties must invest in robust IT infrastructure and cybersecurity. The healthcare cybersecurity market is projected to reach $25.8 billion by 2025. This impacts property management and development strategies.

- Cybersecurity spending in healthcare is rising significantly.

- Data breaches can lead to substantial financial and reputational damage.

- Compliance with regulations like HIPAA is essential.

- Secure IT infrastructure is a key differentiator for healthcare properties.

Healthcare tech impacts Healthpeak's properties by influencing designs, with a $280 billion market size in 2024. Telemedicine shifts need robust communication systems, and the market is set to hit $175.5B by 2026. AI is boosting demand for lab spaces, growing to $194.4B by 2030. Smart buildings can cut costs.

| Aspect | Details | Impact |

|---|---|---|

| Market Growth | Healthcare technology in 2024, $280B | Affects facility designs and renovation. |

| Telemedicine | $175.5B by 2026 | Could lead to repurposing spaces. |

| AI in Healthcare | Expected to hit $194.4B by 2030 | Increased demand for lab space. |

Legal factors

Healthpeak and its tenants face intricate healthcare regulations. These rules govern patient care, facility licensing, and operations, directly affecting property use. Compliance costs are significant, potentially impacting Healthpeak's profitability. In 2024, healthcare spending reached $4.8 trillion, highlighting regulatory importance. Non-compliance can lead to hefty fines and operational restrictions.

Zoning and land use laws are crucial for Healthpeak, determining where they can develop healthcare facilities. These laws impact Healthpeak's expansion strategies, potentially limiting new construction in certain areas. For instance, in 2024, changes in zoning regulations in key markets like California and Florida influenced property development plans. Healthpeak must navigate these regulations to ensure compliance and successful project launches. Failure to comply can lead to project delays or cancellations, impacting financial performance.

Healthcare properties, like those owned by Healthpeak Properties, face strict building codes and safety regulations, crucial for patient and staff safety. These regulations cover areas like fire safety, accessibility, and sanitation, impacting construction and operations. Non-compliance can lead to hefty fines and operational shutdowns, affecting revenue. For example, in 2024, healthcare facility violations resulted in over $10 million in penalties.

Americans with Disabilities Act (ADA) Compliance

Healthpeak Properties must adhere to the Americans with Disabilities Act (ADA) to ensure its healthcare facilities are accessible. ADA compliance involves modifications to buildings and services. Non-compliance can lead to lawsuits and financial penalties. In 2023, the Department of Justice received over 10,000 ADA complaints.

- ADA compliance is crucial for avoiding legal issues.

- Healthpeak's properties must meet specific accessibility standards.

- Non-compliance can result in fines and reputational damage.

Laws Prohibiting Eviction

Laws against evicting tenants, especially in healthcare, affect Healthpeak's property management and rent collection. For instance, during the COVID-19 pandemic, many jurisdictions implemented eviction moratoriums. These laws can delay or prevent evictions, impacting cash flow and property turnover. Healthpeak must navigate varying state and local regulations to ensure compliance. This requires constant legal monitoring and strategic adaptation.

- Eviction moratoriums during COVID-19 led to significant rent collection challenges.

- Healthcare-specific eviction laws may protect vulnerable populations.

- Compliance costs include legal fees and property management adjustments.

Healthpeak's profitability hinges on navigating complex healthcare laws and zoning. Stricter building codes and safety regulations add to operational costs and compliance challenges. Laws protecting tenants influence cash flow, necessitating constant legal adjustments. Regulatory compliance costs could reach $25 million in 2025.

| Legal Aspect | Impact | Financial Implication (2024/2025) |

|---|---|---|

| Healthcare Regulations | Patient care, facility licensing, and operations. | Compliance costs; Potential fines of up to $15M |

| Zoning and Land Use | Development strategies & project delays | Influence on expansion plans, revenue loss |

| Building Codes | Safety for staff and patients | Facility shutdowns; Potential penalties of up to $10M |

Environmental factors

Sustainability is increasingly vital in real estate. Healthpeak focuses on green building strategies to lower its environmental impact. Incorporating these practices can boost property appeal. For 2024, the green building market is valued at $366.8 billion.

Healthpeak Properties prioritizes reducing energy and water consumption across its portfolio. Energy efficiency improvements and water conservation efforts are key initiatives. These actions aim to cut operational costs and support sustainability. In 2024, Healthpeak reported a 5% decrease in water usage and a 3% reduction in energy consumption across its properties.

Climate change is increasing natural disasters, posing risks to healthcare properties. These events can damage facilities and disrupt services. For example, in 2024, the US experienced over $100 billion in damage from weather-related disasters. This impacts property location, design, and insurance costs.

Environmental Regulations

Healthpeak Properties must adhere to environmental regulations. These rules cover building operations, waste, and emissions. Changes in these regulations can affect costs and require investments. For example, in 2024, stricter EPA rules on refrigerants could raise expenses.

- Healthpeak's 2024 Sustainability Report highlights these compliance efforts.

- Failure to comply can lead to fines and reputational damage.

- The company's focus is on energy efficiency and green building practices.

Stakeholder Expectations regarding Environmental Performance

Stakeholders, including investors and tenants, are now highly focused on a company's environmental performance. Healthpeak's dedication to sustainability and open environmental reporting can significantly boost its standing. This commitment can attract investment and improve tenant relations. For example, in 2024, sustainable investments hit a record high, showing this growing trend. A strong environmental record is crucial for maintaining positive stakeholder relationships.

- Investors are increasingly prioritizing ESG factors.

- Tenants are seeking sustainable building options.

- Transparent environmental disclosure builds trust.

Healthpeak integrates green building methods to meet environmental needs, reducing impacts, like a reported 3% energy cut in 2024. This strategic approach reduces energy and water use, boosting appeal. Healthpeak's dedication is key. In 2024, sustainable investments boomed, showcasing its significance.

| Environmental Aspect | Healthpeak's Action | 2024 Impact |

|---|---|---|

| Sustainability | Green building strategies | Market: $366.8B |

| Resource Use | Energy, water conservation | Water use: -5%, Energy: -3% |

| Compliance | Adherence to regulations | EPA rules changes, 2024. |

PESTLE Analysis Data Sources

Healthpeak's PESTLE analysis uses SEC filings, real estate market reports, economic indicators, and government data for accuracy. Data from trusted industry and financial sources is included.