Helvetia Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helvetia Holding Bundle

What is included in the product

Helvetia Holding's BCG Matrix: strategic insights for portfolio optimization, investment strategies, and business unit analysis.

Printable summary optimized for A4 and mobile PDFs, enabling on-the-go access to strategic insights.

Delivered as Shown

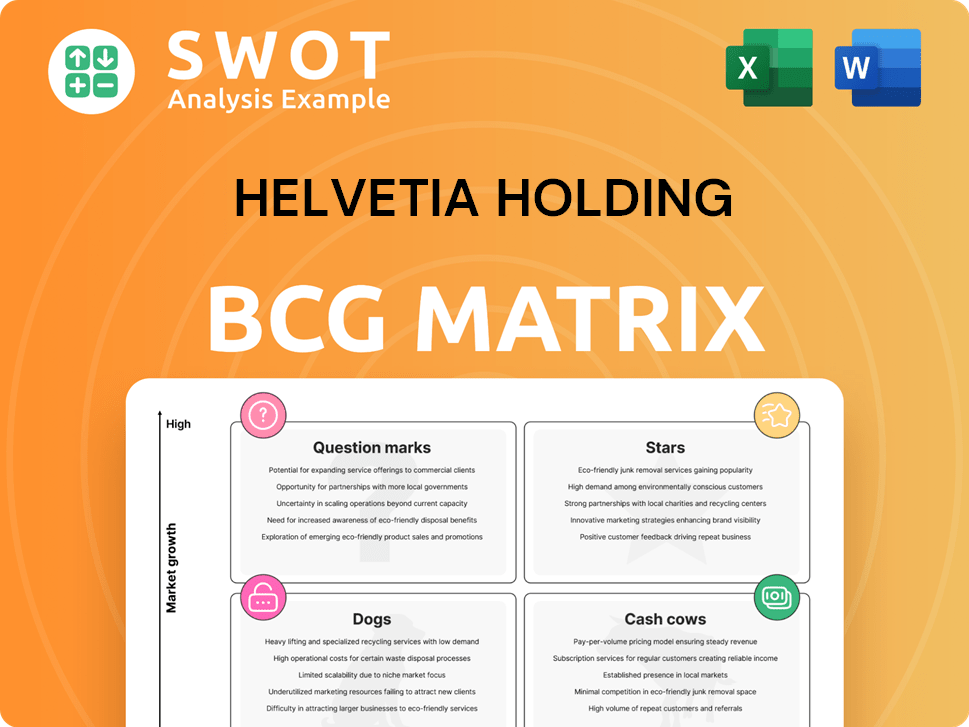

Helvetia Holding BCG Matrix

The Helvetia Holding BCG Matrix preview shows the complete document you’ll receive. It's the fully formatted strategic analysis, ready for immediate use post-purchase, with no alterations needed.

BCG Matrix Template

Helvetia Holding’s BCG Matrix offers a glimpse into its portfolio's performance. See how products fare across Stars, Cash Cows, Dogs, and Question Marks. This analysis helps pinpoint growth drivers and resource drains. Understanding these dynamics is crucial for strategic planning. This snapshot hints at investment priorities and market positioning. Discover the full picture and gain actionable insights.

Stars

Helvetia's strong non-life business is a "Star" in its BCG Matrix. It showed strong growth and profitability in 2024, with a combined ratio of 95.0%. This segment leads in its market, generating substantial cash. Its high growth potential makes it a key driver.

Helvetia's specialty lines business shows robust growth, especially in Europe. The company is expanding this segment strategically. This focus is crucial for international growth and profitability. In 2024, this segment contributed significantly to Helvetia's overall revenue, with a reported increase of 8% year-over-year.

Helvetia's digital transformation includes the Helvetia Venture Fund, fostering innovation and revenue. These initiatives target InsurTech and digital solutions to improve customer interaction. In 2024, Helvetia invested CHF 115 million in digital projects. This strategic move positions Helvetia as a digital leader.

Merger Synergies with Baloise (Potential)

The proposed merger with Baloise presents a strategic opportunity for Helvetia, potentially transforming it into a Star within the BCG Matrix. This combination could establish a dominant presence in the Swiss and European insurance markets. The merger aims to unlock cost efficiencies, potentially boosting profitability. Successful integration could significantly enhance cash flow generation, driving value.

- Market Position: Creates a leading composite insurance group.

- Synergy: Expected to generate cost synergies.

- Cash Flow: Aims to enhance cash generation.

- Execution: Success depends on effective merger execution.

Strong Capitalization

Helvetia Holding's "Stars" benefit from exceptional capitalization. The Swiss Solvency Test (SST) ratio was approximately 290% as of January 1, 2024, showcasing financial strength. This robust financial health fuels Helvetia's growth initiatives and investments in lucrative business areas. It ensures stability and supports future expansion.

- SST ratio of about 290% as of January 1, 2024.

- Strong financial foundation for expansion.

- Supports investments in profitable sectors.

- Ensures long-term stability.

Helvetia's "Stars" are key for growth, with the non-life segment leading. They boast strong market positions and high profitability, like the non-life business with a 95.0% combined ratio in 2024. The merger with Baloise could boost these "Stars" further, enhancing cash flow. Capitalization remains robust, underscored by a 290% SST ratio as of early 2024.

| Segment | Key Feature | 2024 Data |

|---|---|---|

| Non-Life | Combined Ratio | 95.0% |

| Specialty Lines | Revenue Growth (YoY) | 8% |

| Digital Investments | CHF Invested | 115M |

Cash Cows

Swiss Life Insurance, a key part of Helvetia's portfolio, is a cash cow. It generates steady revenue and cash flow in the Swiss market. Despite a slight dip in 2024, this segment remains robust. With strong customer ties, it maintains a solid market position. Helvetia's life business contributed significantly to its overall financial stability in 2024.

Helvetia's GIAM (German, Italian, Austrian Markets) are cash cows, generating stable income. These markets, with established positions, diversify Helvetia's portfolio. GIAM's focus on profitable business supports consistent performance. In 2024, the GIAM segment showed solid premium growth, providing stable returns.

Helvetia's fee business, encompassing fund and asset management, is a dependable income source. This segment saw a 7.2% rise in income, adjusted for currency, in 2024, highlighting its stability. It offers diversification and boosts Helvetia's financial results. The fee business remains a strong contributor.

Local Customer Champion Positioning

Helvetia's 'Local Customer Champion' strategy boosts loyalty and retention, especially in Switzerland. This customer-centric approach provides stability for revenue streams. It strengthens Helvetia's market position, supporting sustained profitability. Focusing on tailored services and strong relationships is key.

- In 2023, Helvetia's Swiss business showed strong growth.

- Customer retention rates were high due to the local focus.

- Helvetia's net profit increased by 13.7% to CHF 672.7 million in 2023.

- The company's strategy contributed to these positive results.

Reinsurance Business

Helvetia's reinsurance business, part of the 'Other Activities' segment, diversifies revenue and offers a steady income stream. This area leverages the company's expertise, leading to consistent returns. Reinsurance is critical to Helvetia's overall business model. In 2023, Helvetia's premiums written in the non-life segment were CHF 6.3 billion, showing its importance.

- Revenue Diversification: Reinsurance contributes to a diversified revenue base.

- Consistent Returns: Expertise drives steady income generation.

- Strategic Importance: Crucial to Helvetia's business model.

- Financial Data: 2023 non-life premiums written were CHF 6.3 billion.

Cash cows for Helvetia provide consistent revenue with a solid market position. Swiss Life Insurance and the GIAM markets are notable examples. The fee business and reinsurance also contribute stable income streams. These segments consistently deliver financial stability for the company.

| Segment | 2024 Performance | Contribution |

|---|---|---|

| Swiss Life Insurance | Steady, despite dip | Solid market position |

| GIAM | Stable premium growth | Diversification |

| Fee Business | 7.2% rise (currency-adjusted) | Income diversification |

Dogs

Helvetia's French operations could be a 'Dog' in its BCG matrix if they show low growth and market share. To confirm, we'd need to see how France compares to other regions, like Germany, where Helvetia had a strong presence in 2024. If France underperforms, strategic changes or divestiture might be considered. In 2024, Helvetia's total premiums were CHF 12.4 billion.

In Helvetia Holding's BCG matrix, certain insurance product lines could be "Dogs," showing low growth and market share. These underperformers might include specific life or non-life insurance offerings. For example, older, less competitive products might generate low returns. Addressing these, like in 2024, when Helvetia focused on optimizing its portfolio, is vital for profitability.

If Helvetia has operations in less crucial geographic areas, they are likely classified as "Dogs" in the BCG matrix, such as regions with minimal revenue or growth. These markets need strategic evaluation, potentially leading to reduced investment. For example, Helvetia's 2024 reports might show stagnant sales in certain regions, indicating a need for market exit.

Legacy IT Systems

Legacy IT systems at Helvetia Holding can be classified as "Dogs" due to their inefficiency. These outdated systems impede innovation and consume resources without generating sufficient returns. Modernizing the IT infrastructure is crucial for enhancing operational efficiency and staying competitive. In 2024, many firms faced similar challenges, with 35% of IT budgets still allocated to maintaining legacy systems.

- Inefficiency: Outdated systems slow down processes.

- Resource Drain: They consume funds without yielding high returns.

- Modernization: Investment is needed to improve operations.

- Competitiveness: Upgrading IT boosts market position.

Inefficient Distribution Channels

Inefficient distribution channels in Helvetia Holding's portfolio might be classified as Dogs. These channels underperform in reaching customers or generating sales and need restructuring. Optimizing these channels is crucial for boosting market reach and sales effectiveness. For instance, in 2024, companies with optimized distribution saw a 15% increase in revenue.

- Ineffective channels: Underperforming distribution networks.

- Restructuring: Requires significant operational changes.

- Optimization: Key for sales and market growth.

- Revenue: Optimized channels can boost income.

Certain Helvetia Holding's business areas could be "Dogs," characterized by low growth and market share, necessitating strategic review. Examples include underperforming product lines or geographical segments that drag down overall performance. In 2024, Helvetia focused on strategic portfolio optimization to improve profitability.

| Criteria | Description |

|---|---|

| Market Share | Low relative market share compared to competitors. |

| Growth Rate | Low or negative growth in revenue and market presence. |

| Financial Impact | May require continuous investment with minimal returns. |

Question Marks

Helvetia's sustainable insurance products are likely "Question Marks" in its BCG matrix. They target a growing, but initially small, market segment. Launching these products requires investment to build market share. In 2024, sustainable insurance premiums are rising, suggesting growth potential. Success hinges on customer acceptance and brand alignment with sustainability.

New digital insurance offerings, especially for younger people and using new tech, are question marks. These offerings have strong growth potential but need investment to gain market share. Helvetia's digital shift could boost these offerings. In 2024, digital insurance is expected to reach $155.6 billion worldwide, growing annually by 12.55%.

If Helvetia explores emerging markets outside Europe, these ventures would be Question Marks. These markets promise high growth but have risks and need investment. Strategic partnerships and thorough market analysis are crucial. For instance, emerging markets' insurance premiums grew by 9.8% in 2023.

AI-Driven Insurance Solutions

AI-driven insurance is a Question Mark for Helvetia. These solutions, like personalized risk assessments, have high potential but uncertain outcomes. They require investment in technology and data analysis. Successful implementation could provide a competitive edge, driving future growth. For example, the global Insurtech market was valued at $6.94 billion in 2024, projected to reach $13.98 billion by 2029.

- Investment in AI and data analytics is crucial for success.

- Uncertainty exists regarding the return on investment.

- Competitive advantage depends on effective implementation.

- Market growth in Insurtech indicates potential.

Partnerships with InsurTech Startups

Helvetia's partnerships with InsurTech startups, while promising, are question marks within the BCG Matrix, demanding careful management and investment. These collaborations offer access to cutting-edge technologies and innovative business models, potentially reshaping the insurance landscape. The success of these ventures hinges on effective collaboration, strategic alignment, and the ability to adapt to evolving market dynamics. However, the inherent uncertainty and risk associated with these partnerships place them firmly in the "question mark" quadrant.

- Helvetia has been actively pursuing partnerships with InsurTechs to enhance its digital capabilities and explore new business opportunities.

- These partnerships involve investments in areas such as data analytics, AI-driven underwriting, and customer experience improvements.

- The InsurTech market continues to grow, with global investments reaching billions of dollars annually, highlighting the potential for significant returns.

- Effective risk management and strategic integration are crucial for converting these question marks into stars or cash cows.

Helvetia's initiatives, such as sustainable insurance and digital offerings, are categorized as Question Marks. They face high growth potential coupled with significant investment needs. Success depends on strategic execution and adaptation, with global Insurtech investments reaching billions annually.

| Initiative | BCG Status | Key Factor |

|---|---|---|

| Sustainable Insurance | Question Mark | Market acceptance |

| Digital Insurance | Question Mark | Market share gain |

| Emerging Markets | Question Mark | Strategic partnerships |

BCG Matrix Data Sources

Our Helvetia BCG Matrix uses annual reports, market research, and industry analysis for data, guaranteeing actionable insights.