Hensel Phelps Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hensel Phelps Construction Bundle

What is included in the product

Strategic recommendations for Hensel Phelps' construction projects using the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, enabling easy sharing and review.

Preview = Final Product

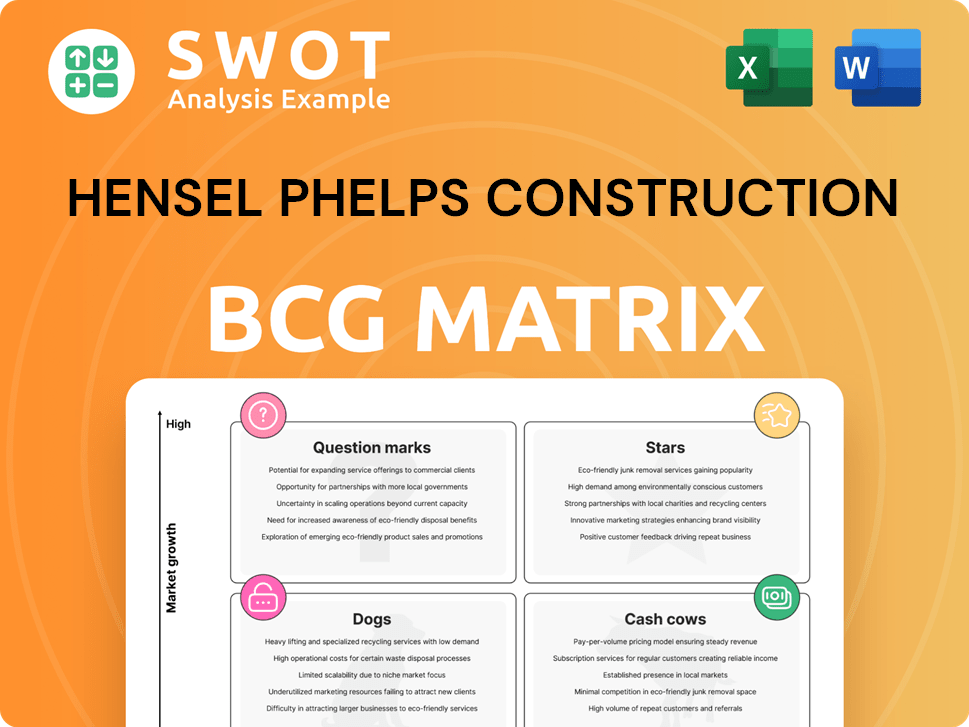

Hensel Phelps Construction BCG Matrix

The BCG Matrix report previewed here is the final product you'll get. It's a complete, ready-to-use strategic analysis tool, optimized for Hensel Phelps Construction's specific needs.

BCG Matrix Template

Hensel Phelps Construction's BCG Matrix offers a snapshot of its diverse portfolio. Analyzing projects, we see potential "Stars" in high-growth areas and "Cash Cows" providing steady revenue. Some initiatives may fall into "Dogs," needing strategic pivots. Others are "Question Marks," ripe for investment decisions.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hensel Phelps excels in aviation, a high-growth area. They're a top U.S. aviation contractor. Their expertise secures complex projects. In 2024, aviation construction grew, boosting their market share.

The surge in AI is fueling data center construction, a market Hensel Phelps is poised to dominate. Their expertise positions them as a leader in this growing sector. In 2024, the data center market is projected to reach $52 billion. Hensel Phelps excels at managing complex, large-scale projects.

Hensel Phelps excels in government and justice projects, with contracts like border station expansions. These projects benefit from government funding, such as the Infrastructure Investment and Jobs Act. Their work encompasses constructing main buildings and inspection lanes. In 2024, the government construction market is projected to grow, offering opportunities. The company's expertise ensures steady growth in this sector.

Healthcare Construction Leadership

Hensel Phelps leads in healthcare construction, exemplified by projects like UCI Health-Irvine, the nation's first all-electric hospital. Their innovative approach and sustainable practices make them a key player. They provide cutting-edge solutions for complex, high-stakes projects. This positions them as a "Star" in their BCG Matrix.

- Hensel Phelps' revenue in 2024 was approximately $7.5 billion.

- The healthcare construction market grew by 8% in 2024.

- UCI Health-Irvine project cost: $1.2 billion.

- Sustainable building projects increased by 15% in 2024.

Technological Innovation

Hensel Phelps Construction excels in technological innovation, integrating cutting-edge tools like BIM and drones into projects. A partnership with Autonomous Control Systems Laboratory Ltd. boosts their drone tech capabilities. They are also using AI and robotics to enhance project execution. This forward-thinking approach is key in today's construction market.

- BIM adoption: Significantly improves project efficiency.

- Drone usage: Reduces site assessment time by up to 60%.

- AI integration: Increases project accuracy and safety.

Hensel Phelps' healthcare projects, like the UCI Health-Irvine hospital ($1.2B), drive their "Star" status. The healthcare market grew by 8% in 2024. Sustainable practices and cutting-edge solutions position them for continued success. Their revenue was approximately $7.5 billion in 2024.

| Market Segment | Growth Rate (2024) | Hensel Phelps' Position |

|---|---|---|

| Healthcare Construction | 8% | Star |

| Aviation Construction | Growing | Star |

| Data Center Construction | Projected to reach $52B | Star |

Cash Cows

Hensel Phelps, established in 1937, has a solid market presence. Consistently ranked among the top contractors by Engineering News-Record, their reputation is strong. Their operational method, 'Plan the Work, then Work the Plan,' shows their approach. In 2023, they had approximately $6.5 billion in revenue, reflecting their market stability.

Hensel Phelps thrives on repeat business, showcasing high client satisfaction. Their "Hensel Phelps Way" approach emphasizes collaboration. This drives enduring partnerships, encouraging clients to return for key projects. A recent study indicated that repeat clients constitute over 60% of their project volume. This loyalty significantly boosts their financial stability.

Hensel Phelps, an employee-owned firm, fosters a motivated workforce. Their average tenure is 13 years, enhancing project consistency. This structure ensures shared success among employees. In 2024, employee-owned firms saw a 7% increase in productivity.

Diverse Market Sectors

Hensel Phelps' strength lies in its diverse market presence, spanning aviation, commercial, healthcare, and government projects. This diversification acts as a financial buffer, spreading risk across multiple sectors. The company’s ability to operate in various areas helps ensure consistent revenue. Hensel Phelps' expansion from a residential builder to a national player demonstrates its adaptability and market understanding. In 2024, the company's revenue exceeded $6.5 billion.

- Diverse portfolio includes aviation, commercial, healthcare, and government sectors.

- Mitigation of risk through sector diversification.

- From Colorado beginnings to 12 regional offices across the U.S.

- 2024 revenue surpassed $6.5 billion.

Focus on Sustainable Building

Hensel Phelps Construction's sustainable building focus positions it well. Their use of low-carbon materials and LEED-Gold standards meets growing demand for eco-friendly construction. The GSA's "Buy Clean" initiative mandates such materials. This reduces project embodied carbon significantly.

- GSA projects using low-carbon materials can reduce embodied carbon by hundreds of metric tons.

- LEED-Gold certification is a recognized standard for sustainable building.

- Market demand for sustainable construction is increasing.

- The "Buy Clean" initiative is part of the Biden administration's sustainability goals.

Hensel Phelps, a Cash Cow in the BCG Matrix, boasts strong market presence. Their diverse portfolio and repeat business drive financial stability. Employee ownership and sustainable practices enhance their solid position.

| Characteristic | Details |

|---|---|

| Market Share | Consistent top contractor rankings. |

| Revenue 2024 | Exceeded $6.5 billion |

| Client Loyalty | Over 60% repeat business. |

Dogs

Hensel Phelps faces challenges in distressed commercial real estate. Sluggish development affects core markets. Office markets, especially in Northern California, struggle. Elevated interest rates hurt multifamily construction. Office vacancy rates hit 19.6% in Q4 2023, impacting projects.

Outdated technologies or processes at Hensel Phelps Construction could diminish competitiveness, given the industry's need for on-time, budget-friendly projects. The construction market valued at $1.5 trillion in 2024, demands efficiency. Hensel Phelps leverages a cloud-based platform for speedier, data-driven decisions, addressing these pressures. Its focus on innovation aims to avoid becoming a "dog" in the BCG matrix, helping stay competitive in the market.

Some Hensel Phelps projects, especially those in competitive bidding scenarios, face low profit margins. These projects might consume significant resources without generating high returns. For example, in 2024, the construction industry saw average profit margins between 2-5% on fixed-price contracts. Careful pre-project profitability analysis is essential.

Geographic Regions with Limited Growth

Operating in areas with slow economic growth limits project opportunities for Hensel Phelps. Strategic resource allocation is key for expansion. The company is growing, entering new regions. They are expanding in the Pacific Northwest, Nashville, and water/wastewater markets. Hensel Phelps reported $6.3 billion in revenue in 2023.

- Limited Growth: Restricts new project potential.

- Strategic Allocation: Focus on high-growth areas.

- Expansion: New regions, such as Pacific Northwest and Nashville.

- Market Growth: Water and wastewater projects.

Projects Dependent on Declining Industries

Projects tied to waning industries like certain aspects of the automotive sector, which saw a 10% decline in sales in 2023, are risky. Hensel Phelps should diversify its projects, as the rubber-making line at Michelin's plant is still running. This helps offset losses, especially with the rise of electric vehicle projects. New EV plants represent a significant, growing market, unlike declining sectors.

- Automotive sales decreased by 10% in 2023, indicating a potential risk for related construction projects.

- Michelin's rubber-making line continues operations, offering some stability.

- The EV sector's expansion presents a significant opportunity for construction projects.

- Diversification is key to mitigating risks associated with industry-specific downturns.

Hensel Phelps's "Dogs" include projects with low margins and slow growth potential. Office and automotive projects face risks due to market conditions and declining sectors. Mitigating these, diversification is key to stability.

| Category | Characteristic | Impact |

|---|---|---|

| Market Risk | Low profit margins on fixed-price contracts (2-5% in 2024) | Resource-intensive, low returns |

| Industry Decline | Automotive sector decline (10% sales drop in 2023) | Project risk |

| Strategic Response | Diversification into EV and water/wastewater projects | Mitigate losses, seek growth |

Question Marks

Hensel Phelps' ventures into new areas like the Pacific Northwest and Nashville, Tennessee, are question marks in their BCG Matrix. These expansions require substantial investment, increasing financial risk for the company. The firm's new Northern Colorado headquarters development shows a continued commitment to growth. Their success hinges on how they navigate these new markets.

Hensel Phelps's foray into the water and wastewater market is a question mark, representing a growing sector but requiring strategic market share gains. The company's expansion into regions like the Pacific Northwest and Nashville, Tennessee, signals their commitment to this market. In 2024, the global water and wastewater treatment market was valued at approximately $800 billion, with projected annual growth of 4-5%. Their success hinges on capturing a significant portion of this expanding market.

Hensel Phelps' adoption of new construction technologies, such as AI and robotics, is currently a question mark, as the return on investment (ROI) is still under evaluation. The company is carefully assessing the costs and benefits before wider implementation. In 2024, the construction industry saw a 10-15% increase in tech adoption. The integration of cmBuilder signifies a notable step forward, enhancing digital project planning and execution. cmBuilder's web-based technology and collaboration tools offer enterprise-scale solutions for site logistics and 4D simulations.

Public-Private Partnerships

Public-private partnerships (PPPs) can be a "question mark" for Hensel Phelps, given the complex negotiations and shared risks involved. These projects require meticulous evaluation and robust risk management strategies. Hensel Phelps secured a $274.7 million design-build contract for a border station expansion in Arizona. This project is funded by the Infrastructure Investment and Jobs Act and the Inflation Reduction Act.

- PPPs often involve intricate legal and financial structures.

- Success hinges on effective collaboration between public and private entities.

- Risk management is crucial to mitigate potential challenges.

- The Arizona project demonstrates the scale of PPP opportunities.

Innovative Project Delivery Methods

Hensel Phelps employs innovative project delivery methods, such as design-build, which can be risky on complex projects but offer potential benefits. The General Services Administration selected Hensel Phelps for the Calexico West Land Port of Entry project, a design-build endeavor. Managing these risks is crucial for the company to ensure project success and profitability. A key aspect involves careful resource allocation and project management.

- Design-build projects can lead to faster project completion.

- They also offer potential cost savings due to streamlined processes.

- However, they can have higher upfront costs.

- Risks include design changes and delays.

New ventures and markets pose financial risks. These require investment and strategic market share gains. Hensel Phelps assesses ROI on tech. Public-private partnerships (PPPs) are complex.

| Aspect | Details | Impact |

|---|---|---|

| Market Expansion | PNW, Nashville, water/wastewater | High investment, risk. |

| Tech Adoption | AI, robotics, cmBuilder | ROI under review, digital efficiency. |

| PPPs | Border station project | Complex, requires risk management. |

BCG Matrix Data Sources

The Hensel Phelps BCG Matrix is sourced from construction industry reports, financial data, and expert analyses for robust insights. These are supplemented with project data and market trend research.