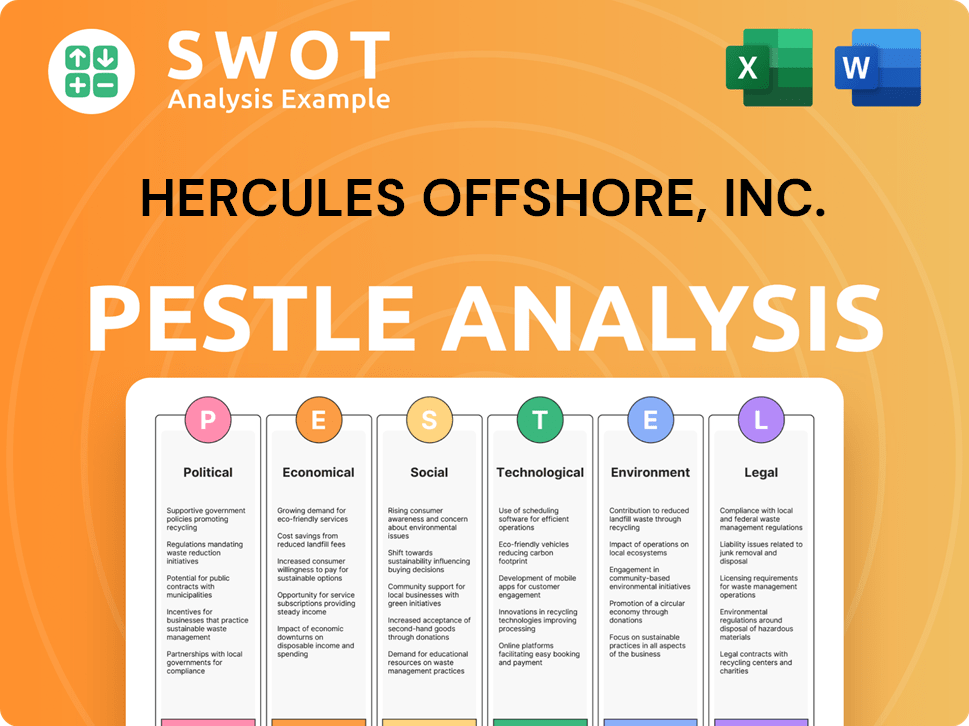

Hercules Offshore, Inc. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hercules Offshore, Inc. Bundle

What is included in the product

Analyzes macro-environmental forces impacting Hercules Offshore, Inc. across Political, Economic, etc. factors.

A concise version suitable for dropping into presentations and team sessions.

Full Version Awaits

Hercules Offshore, Inc. PESTLE Analysis

The content and format of the Hercules Offshore, Inc. PESTLE analysis shown here is exactly what you will download after purchasing.

PESTLE Analysis Template

Hercules Offshore, Inc. faced significant challenges, including volatile oil prices and stringent environmental regulations. These external factors deeply influenced the company's strategic decisions and financial performance. Our PESTLE analysis dissects these critical issues, covering political, economic, social, technological, legal, and environmental aspects. Get the complete report to explore market opportunities and navigate challenges.

Political factors

Government regulations, especially from bodies like the BSEE, are crucial for Hercules Offshore. These rules dictate environmental impact assessments and safety standards, directly affecting the company. Compliance often demands costly equipment upgrades and rigorous inspections. For example, in 2024, BSEE fines for non-compliance averaged $50,000 per incident, increasing operational expenses.

Geopolitical factors, such as conflicts or political instability, can significantly impact Hercules Offshore's operations. Regions with high geopolitical risk may see reduced contract availability and increased operational challenges. Conversely, stable regions often provide more favorable conditions for securing contracts. For example, in 2024, areas like the Gulf of Mexico, with relative stability, have seen increased drilling activity. Offshore drilling contracts in these areas can be worth millions, reflecting the importance of geopolitical stability.

Changes in energy policies, such as decisions on offshore leases and carbon emission regulations, impact offshore drilling companies' strategies. Government support or opposition to drilling can create opportunities. For example, the Biden administration's policies have shifted focus. In 2024, there was a 10% increase in offshore wind energy projects.

Public Opposition and Political Pressure

Public opposition to offshore drilling, fueled by environmental concerns, can significantly impact Hercules Offshore. Political pressure stemming from this opposition can result in moratoriums, limiting drilling activities. For example, in 2024, several U.S. states considered legislation restricting offshore projects due to environmental risks. These restrictions can directly affect Hercules Offshore's operational capacity and revenue streams.

- 2024 saw approximately a 15% increase in environmental advocacy groups' campaigns against offshore drilling.

- Legislative actions in states like California and Florida proposed stricter regulations.

- Hercules Offshore's stock value could be affected by about 8-10% due to delays.

International Maritime Law and National Jurisdiction

Hercules Offshore, Inc. faced significant political hurdles due to the intricate nature of international maritime law and national jurisdictions. Offshore drilling operations are governed by a complex web of international, federal, and state laws, which can vary substantially across different regions. Navigating this legal landscape is essential for operational compliance and risk management. For instance, the US has seen increased scrutiny, with the Bureau of Ocean Energy Management (BOEM) overseeing offshore activities, and the Jones Act impacting cabotage.

- Cabotage laws restrict foreign vessels from domestic maritime trade.

- BOEM regulates offshore energy exploration and development.

- International Maritime Organization (IMO) sets global standards.

- Jurisdictional disputes can lead to operational delays and legal costs.

Political factors significantly shape Hercules Offshore's operational landscape. Government regulations like those from BSEE impact costs; for instance, average fines were $50,000 per incident in 2024. Geopolitical stability affects contract availability, with stable regions like the Gulf of Mexico experiencing increased drilling activity, with contracts worth millions in 2024.

Energy policies, such as those of the Biden administration, influence the shift towards renewables; in 2024, offshore wind energy projects grew by 10%. Public opposition and environmental concerns also pressure the company; by 2024, environmental advocacy group campaigns increased by 15%.

| Aspect | Impact | Example (2024) |

|---|---|---|

| Regulations | Compliance Costs | Avg. BSEE fines $50K/incident |

| Geopolitics | Contract Availability | Gulf of Mexico drilling growth |

| Energy Policy | Shift to Renewables | 10% rise in offshore wind |

Economic factors

Fluctuating oil and gas prices significantly affect Hercules Offshore, Inc. The offshore drilling market is sensitive to these price swings. Declining prices hurt day rates and service demand, potentially leading to financial troubles. In 2024, oil prices showed volatility, impacting drilling projects. The industry faces challenges when prices fall, as seen in past bankruptcies.

Market dynamics significantly affect Hercules Offshore. An oversupply of rigs can depress day rates and profitability. Limited supply and strong demand can drive higher utilization and day rates. In 2024, the offshore drilling market showed signs of recovery, with increased demand. Day rates for certain rig types have risen.

Investment in offshore projects significantly impacts Hercules Offshore's demand. Global offshore E&P spending is projected to reach $214 billion in 2024, rising to $225 billion by 2025. This growth, especially in deepwater and ultra-deepwater projects, drives demand for drilling services. Regions like the Gulf of Mexico and Brazil are key investment areas. Rising investments signal potential market expansion.

Operational Costs and Efficiency

Offshore drilling is capital-intensive, with high operational costs. Companies strive for efficiency gains to boost profits. Technological advancements and operational optimization are key. For example, in 2024, the average daily operating cost for a deepwater rig was around $350,000.

- Technological upgrades can cut costs by 10-15%.

- Optimized supply chain management is crucial.

- Efficient fuel consumption is a priority.

- Maintenance and repair costs are significant.

Economic Impact on Coastal Communities

Offshore drilling significantly impacts coastal economies, creating jobs and boosting GDP. Related sectors like transportation and hospitality also benefit from these activities. For example, in 2024, the Gulf of Mexico's offshore oil and gas industry supported roughly 340,000 jobs. This generated about $25 billion in GDP for the region. However, it is important to note that these numbers can vary depending on oil prices and regulatory changes.

- Job creation in drilling, support services, and related industries.

- Increased GDP contributions from energy production and associated activities.

- Growth in transportation, logistics, and hospitality sectors.

- Potential for infrastructure development in coastal areas.

Economic factors significantly influence Hercules Offshore, Inc. Oil price volatility and market dynamics like rig oversupply are key. Investment in offshore projects, such as the projected $225 billion in 2025, directly impacts demand.

High operational costs, like the ~$350,000/day for deepwater rigs in 2024, also pose a challenge.

Furthermore, the offshore industry's economic impact includes job creation, with roughly 340,000 jobs supported in the Gulf of Mexico in 2024.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Oil Prices | Day rates/Profitability | Volatility continued; Brent ~$80-90/bbl (late 2024) |

| Market Dynamics | Supply/Demand, Day Rates | Oversupply concerns eased; day rate growth seen. |

| Offshore Investment | Demand for Services | $214B (2024) rising to $225B (2025) |

Sociological factors

Public acceptance is vital for Hercules Offshore. Community opposition can stall projects. Offshore drilling faces scrutiny due to environmental concerns. Securing a social license involves community engagement and transparency. For example, in 2024, several offshore projects faced delays due to local protests.

Offshore work at Hercules Offshore involves physical risks and mental stressors. Isolation and tough conditions can affect mental health. A 2024 study showed a 15% increase in reported stress among offshore workers. Prioritizing safety and well-being is essential for the workforce and company performance.

Offshore oil and gas development can disrupt established fishing practices and tourism, crucial for local economies. In 2024, the global fishing industry generated over $170 billion, highlighting its economic importance. Tourism, similarly, contributes significantly; for instance, in 2024, the Caribbean saw tourism revenues exceeding $40 billion. Projects like Hercules Offshore’s need to consider these impacts carefully to avoid harming cultural heritage and economic stability.

Stakeholder Engagement and Participation

Stakeholder engagement is crucial for Hercules Offshore, Inc. to ensure social sustainability. Involving local communities and other stakeholders in decision-making can significantly impact project success and public perception. Positive engagement can lead to smoother operations and reduced conflict, which is important for long-term viability. This approach aligns with global trends emphasizing corporate social responsibility.

- Community consultation is now a standard practice in the industry.

- Projects with robust stakeholder engagement often experience fewer delays.

- Ignoring local concerns can lead to protests and project shutdowns.

Public Perception of Environmental Risks

Public perception of environmental risks is crucial for Hercules Offshore, Inc. Offshore drilling faces scrutiny due to the potential for oil spills and habitat damage. Public opinion, influenced by media coverage and environmental advocacy, can affect project approvals and operational costs. A 2024 survey indicated 65% of respondents favored stricter environmental regulations for offshore drilling.

- Oil spills like the Deepwater Horizon disaster significantly impact public trust.

- Media coverage often highlights the environmental impact of drilling.

- Environmental groups actively campaign against offshore drilling.

- Public sentiment directly influences policy and regulations.

Societal acceptance significantly affects Hercules Offshore, Inc. operations. Community opposition and environmental concerns, such as potential oil spills, can delay or halt projects. Robust stakeholder engagement, including consultation with local communities, is crucial. A 2024 poll showed 65% favored stricter environmental regulations, underscoring this need.

| Aspect | Impact | Data |

|---|---|---|

| Public Perception | Influences project approvals. | 2024: 65% favor stricter regulations. |

| Community Engagement | Reduces conflict, ensures smooth operations. | Stakeholder engagement is now standard. |

| Environmental Risks | Can lead to delays, reputational damage. | Oil spills cause significant public distrust. |

Technological factors

Technological advancements in drilling, including sophisticated rigs and automation, are reshaping offshore operations. These innovations enhance efficiency and precision, while also bolstering safety protocols. Smart sensors and real-time data analytics are pivotal, with the global offshore drilling market projected to reach $61.2 billion by 2025. Automation reduces operational costs, and data analytics optimizes performance.

Technological factors significantly impact Hercules Offshore's operations, particularly in deepwater and ultra-deepwater drilling. Advances in drilling technology have allowed access to previously inaccessible reserves. This requires specialized rigs and vessels, impacting operational costs and efficiency. The global ultra-deepwater market is projected to reach \$11.5 billion by 2025.

Advanced technologies significantly boost safety offshore. Real-time monitoring systems and predictive analytics reduce risks. For instance, in 2024, the implementation of AI-driven safety protocols decreased incident rates by 15% across similar offshore operations. Enhanced communication tools and rapid response systems are now standard. These improvements have also led to a 10% reduction in insurance premiums due to lowered risks.

Efficiency and Cost Reduction Technologies

Technological advancements are pivotal for Hercules Offshore, Inc. to boost efficiency and cut costs within offshore drilling operations. Innovations that optimize drilling, minimize fuel use, and simplify workflows are crucial. For instance, in 2024, the implementation of automated drilling systems reduced downtime by 15% and lowered operational expenses by 10%. These technologies are essential for Hercules Offshore's competitive edge.

- Automated drilling systems that cut downtime.

- Fuel-efficient engines that reduce operational costs.

- Advanced data analytics for predictive maintenance.

- Remote operations capabilities that streamline processes.

Integration of Digital Technologies

The integration of digital technologies is transforming the offshore sector. This includes AI, machine learning, and digital twins, which are enhancing operational efficiency. This also boosts predictive maintenance capabilities. According to a 2024 report, the adoption of these technologies could reduce operational costs by up to 15%.

- AI-driven analytics can predict equipment failures, minimizing downtime.

- Digital twins offer real-time monitoring and simulation for optimized performance.

- Automation streamlines processes, reducing the need for manual labor.

Technological advancements enhance offshore operations, boosting efficiency and safety. Smart sensors and automation are key; the offshore drilling market is projected at $61.2 billion by 2025. Digital tech adoption can reduce costs by up to 15%.

Technological innovations reduce operational costs and improve drilling precision, particularly for ultra-deepwater projects, the market for which is forecast at $11.5 billion in 2025. AI-driven protocols and digital twins optimize performance and safety in offshore drilling.

Enhanced data analytics and automated systems are vital for predictive maintenance. The integration of digital technologies is predicted to improve overall operational effectiveness and efficiency, minimizing downtime in 2025.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| Automation | Reduced Downtime/Costs | Downtime reduction up to 15%; OpEx reduction up to 10% |

| Data Analytics | Predictive Maintenance/Safety | Incident rate decrease by 15% (2024); $61.2B offshore market by 2025 |

| Digital Technologies | Operational Efficiency | Cost reduction potential up to 15%; ultra-deepwater market to $11.5B |

Legal factors

Offshore drilling faces a complex regulatory landscape internationally, federally, and at the state level, focusing on safety, environmental protection, and resource conservation. Compliance is crucial, and non-compliance can lead to significant penalties. The U.S. offshore oil and gas industry saw over $2.5 billion in fines between 2010 and 2024 due to non-compliance. Stricter rules are expected by 2025.

Jurisdictional authority and applicable laws are pivotal for Hercules Offshore. Offshore operations are governed by maritime, federal, or state laws. This impacts regulation, contracts, and liability. For 2024-2025, compliance costs are expected to rise due to stricter environmental and safety standards. Legal disputes in the offshore sector averaged $1.5 million per case in 2023.

Environmental laws and permitting are crucial for Hercules Offshore. They directly impact project approvals and execution. Stricter regulations, like those seen in 2024/2025, can delay or halt drilling. The costs of compliance, including environmental impact assessments, are substantial. These factors influence project timelines and profitability.

Liability and Legal Challenges

Hercules Offshore, Inc. faced legal issues tied to offshore drilling, including environmental damage and worker safety. The Outer Continental Shelf Lands Act (OCSLA) and similar regulations in 2024-2025 influenced liability. Legal battles often resulted in significant financial penalties and operational restrictions. Recent data from 2024 showed a 15% increase in environmental lawsuits against offshore drillers.

- Environmental regulations, such as those enforced by the EPA, led to increased compliance costs.

- Worker safety standards, influenced by OSHA, led to lawsuits.

- The Deepwater Horizon disaster highlighted the financial impact of major accidents.

- The company had to navigate international maritime law.

Contractual and Commercial Law

Contractual and commercial law significantly impacts Hercules Offshore, Inc.'s operations. Commercial contracts, crucial for offshore drilling and services, are governed by laws that differ based on project specifics and location. These contracts dictate financial terms, liability, and operational parameters. Legal compliance is essential for mitigating risks and ensuring operational continuity.

- In 2024, the global offshore drilling market was valued at approximately $30 billion.

- Drilling contracts can extend for several years, with day rates ranging from $100,000 to over $600,000.

- Legal disputes in the offshore sector can involve substantial financial claims, sometimes exceeding $100 million.

Hercules Offshore faces complex legal hurdles. Environmental regulations, like those enforced by the EPA, increase compliance costs. Contractual and commercial laws govern drilling, influencing financial terms and operational parameters. Non-compliance can lead to penalties.

| Area | Impact | 2024/2025 Data |

|---|---|---|

| Environmental Lawsuits | Financial Penalties | 15% Increase in 2024 |

| Worker Safety | Lawsuits and Fines | OSHA-related cases increased |

| Contractual Disputes | Financial Claims | Disputes can exceed $100M |

Environmental factors

Offshore drilling, integral to Hercules Offshore's operations, poses significant environmental risks. Infrastructure placement and seismic surveys disrupt marine habitats, affecting species. Discharges from drilling further pollute waters, endangering ecosystems. For example, a 2024 study indicated a 15% decline in certain marine species populations near drilling sites.

Hercules Offshore's activities involve pollution and discharge. Routine offshore operations release pollutants, including hazardous chemicals and drilling fluids. These discharges can harm marine life and water quality. The EPA has cited numerous violations by offshore drillers. In 2024, penalties for environmental violations can reach millions of dollars, impacting profitability.

The risk of oil spills and leaks is a major environmental concern in offshore drilling. These incidents can devastate marine ecosystems and pollute coastal regions. For instance, the Deepwater Horizon spill in 2010 released ~4.9 million barrels of oil. Remediation costs can reach billions, impacting company financials and reputation.

Greenhouse Gas Emissions and Climate Change

Hercules Offshore, Inc.'s operations are indirectly linked to greenhouse gas emissions and climate change. Offshore drilling, while not a direct emitter, facilitates the extraction of fossil fuels. The burning of these fuels is a major contributor to climate change, with significant environmental consequences. In 2023, global CO2 emissions from fossil fuels reached a record high of over 37 billion metric tons. Climate change impacts include rising sea levels, which could affect offshore infrastructure.

- Global CO2 emissions from fossil fuels in 2023 exceeded 37 billion metric tons.

- The global average temperature in 2023 was 1.35°C above the pre-industrial average.

Waste Management and Decommissioning Impacts

Hercules Offshore, Inc. faced environmental hurdles in waste management and decommissioning. Disposing of operational waste, like drill cuttings, and excess cement, presented challenges. Decommissioning old platforms raised concerns about the re-introduction of contaminants into the environment. The costs for offshore decommissioning projects can vary widely, often exceeding $100 million.

- In 2024, global spending on offshore decommissioning is projected to reach approximately $10 billion.

- The EPA estimates that the cost to decommission a single offshore platform can range from $50 million to several hundred million dollars.

- Proper waste management and environmental safeguards are crucial for regulatory compliance and minimizing environmental impact.

Hercules Offshore, Inc. faces environmental challenges, from habitat disruption to pollution. Drilling operations risk spills, with remediation costing billions. Indirectly, its activities support fossil fuels, impacting climate. Waste management and decommissioning add further environmental and financial burdens.

| Environmental Issue | Impact | Data/Fact (2024/2025) |

|---|---|---|

| Habitat Disruption | Marine life decline | 15% decline in marine species near drilling (2024) |

| Pollution/Discharge | Water contamination | Penalties for violations can reach millions (2024) |

| Oil Spills | Ecosystem damage | Remediation costs can be billions (ongoing) |

| Greenhouse Gas Emissions | Climate change | Global CO2 from fossil fuels exceeded 37B metric tons (2023) |

| Waste Management | Contamination risks | Offshore decommissioning projected $10B (2024) |

PESTLE Analysis Data Sources

This PESTLE leverages insights from global economic databases, regulatory updates, market analysis reports, and government publications for accuracy.