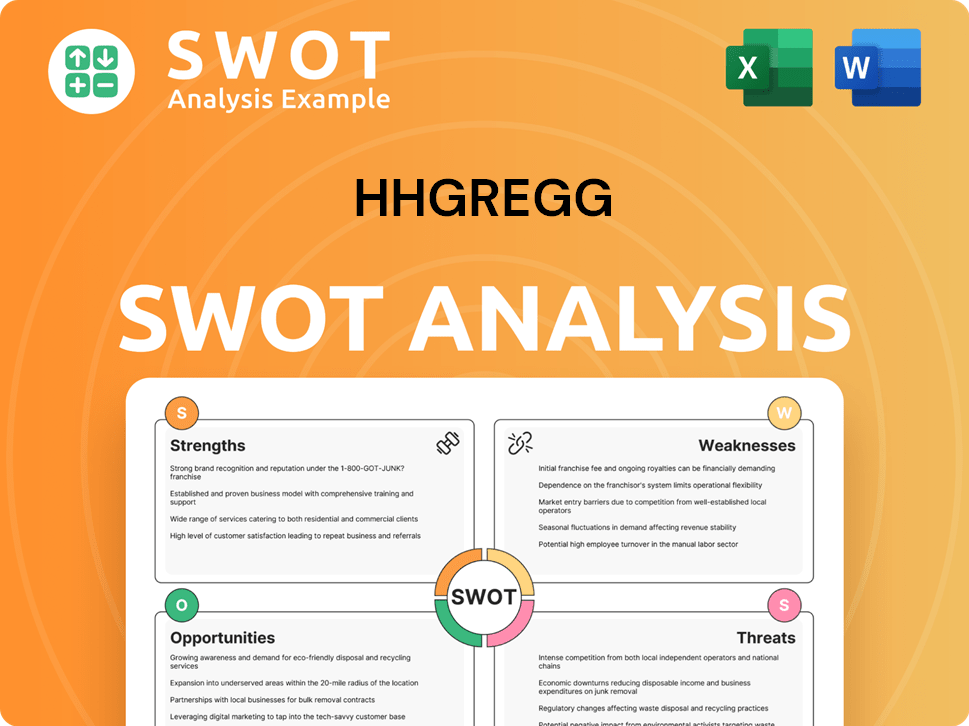

hhgregg SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

hhgregg Bundle

What is included in the product

Offers a full breakdown of hhgregg’s strategic business environment

Streamlines SWOT communication with visual, clean formatting.

Full Version Awaits

hhgregg SWOT Analysis

What you see is what you get! This preview is a snippet of the same detailed hhgregg SWOT analysis document you'll download after buying.

No bait-and-switch, just transparent reporting with insights.

We believe in full disclosure.

Purchase the full report to get access!

SWOT Analysis Template

The hhgregg SWOT analysis previews the retailer's competitive positioning. Strengths include brand recognition and a wide product range. Weaknesses involve financial challenges and limited online presence. Opportunities lie in market expansion and e-commerce enhancements. Threats encompass competition and evolving consumer preferences.

The preview touches on key insights, but much more strategic information remains. Get the insights you need to move from ideas to action. The full SWOT analysis offers detailed breakdowns, expert commentary, and a bonus Excel version—perfect for strategy, consulting, or investment planning.

Strengths

hhgregg's brand recognition, though diminished, could still attract customers familiar with their past. The company's transition to online sales aims to leverage that prior consumer awareness. Data from 2024 shows some residual brand loyalty. This existing recognition helps with initial online visibility. This offers a potential edge over new e-commerce entrants.

hhgregg's established product categories, like appliances and electronics, are a strength. They have existing supplier relationships and category knowledge. This allows them to curate online assortments effectively. Recent data shows the appliance market is worth billions annually.

hhgregg's online presence allows for a focused approach to specific market niches. This specialization could lead to a dedicated customer base. Data from 2024 shows online niche retailers saw a 15% increase in sales. Focusing on a niche can also improve profit margins.

Lower Overhead as an Online Retailer

hhgregg's shift to online retail drastically cuts operational expenses tied to physical stores, including rent and utilities. This lower overhead can translate into more competitive pricing for consumers. Reducing overhead can free up capital for investments. Consider the latest data: E-commerce sales are projected to reach $7.3 trillion in 2025, up from $5.8 trillion in 2023.

- Reduced Rent and Utility Costs

- Potential for Competitive Pricing

- Increased Investment Opportunities

- Alignment with E-commerce Growth Trends

Customer Data from Past Operations

hhgregg's historical operations likely amassed significant customer data. This data includes purchase history, preferences, and contact details, offering valuable insights. Using this information can enhance marketing, personalize customer experiences, and optimize inventory. However, ethical data handling and compliance with privacy regulations are crucial.

- Customer data analysis can reveal popular products and shopping patterns.

- Personalized marketing can boost sales and customer loyalty.

- Effective inventory management reduces costs and improves product availability.

hhgregg's strengths include residual brand recognition. They are pivoting to online retail, which cuts costs significantly. This setup supports competitive pricing and capital reinvestment, with e-commerce sales forecasted to reach $7.3T in 2025.

| Strength | Benefit | Data Point (2024-2025) |

|---|---|---|

| Brand Recognition | Initial Online Visibility | Residual Brand Loyalty |

| Established Product Categories | Curated Online Assortments | Appliance market billions annually |

| Online Presence | Focused Market Niche | 15% increase niche retail sales |

Weaknesses

hhgregg's 2017 bankruptcy deeply damaged its reputation, eroding customer trust. Rebuilding consumer confidence and overcoming negative perceptions is a key hurdle. The online version faces significant challenges due to this past financial failure. A successful comeback requires substantial efforts to restore brand image and secure customer loyalty.

hhgregg faces intense online competition. Giants like Amazon and Best Buy dominate the online electronics and appliance market. This requires major investments in marketing, pricing, and customer experience. In 2024, Amazon's net sales reached $574.8 billion, highlighting the challenge.

As an online retailer, hhgregg misses out on the advantages of physical stores. Customers can't physically inspect items before buying, which is crucial for big-ticket appliances. This lack of physical presence can hinder sales, especially when competitors offer in-store experiences. Competitors like Best Buy, for instance, have a strong physical retail footprint. In 2024, online retail sales accounted for roughly 16% of total U.S. retail sales.

Supply Chain and Logistics Challenges

Supply chain and logistics present significant hurdles. Efficiently managing inventory, warehousing, and shipping large, delicate items like appliances and electronics is costly for online businesses. Timely, damage-free delivery is vital for customer satisfaction. According to a 2024 report, logistics costs averaged 8% of sales for retailers. Moreover, 20% of online orders experience shipping issues.

- High shipping costs impact profitability.

- Inventory management complexities.

- Risk of damage during transit.

- Potential for delivery delays.

Limited Financial Resources Compared to Larger Competitors

Post-bankruptcy, hhgregg faces financial constraints, contrasting with larger rivals in online retail. This limits investments in crucial areas like technology and marketing, impacting competitiveness. In 2024, hhgregg's revenue was significantly lower than competitors like Best Buy, reflecting these challenges. Limited resources restrict expansion and innovation, hindering market share growth.

- Reduced spending on advertising and promotional campaigns.

- Difficulty in offering competitive pricing due to higher operational costs.

- Challenges in funding research and development for new products.

- Inability to make substantial investments in e-commerce platforms.

hhgregg's reputation was hurt by bankruptcy, which diminished customer trust and presents a rebuilding challenge. Intense competition from giants such as Amazon and Best Buy in the online market necessitates heavy investments. Limited financial resources restrict growth potential.

| Weakness | Description | Impact |

|---|---|---|

| Brand Perception | Past bankruptcy led to damaged reputation. | Eroded customer trust and loyalty. |

| Online Competition | Fierce competition from large retailers. | Requires significant investment in marketing and pricing. |

| Financial Constraints | Limited post-bankruptcy resources. | Restricts expansion, innovation, and market share growth. |

Opportunities

The e-commerce market's expansion offers hhgregg a chance to grow. Online shopping is favored by consumers, especially for electronics and home goods. In 2024, e-commerce sales in the U.S. reached over $1.1 trillion. This trend allows hhgregg to gain market share.

hhgregg might target a niche market with premium appliances and electronics. This strategy could attract customers prioritizing quality and unique features. For example, sales of high-end kitchen appliances are projected to grow, offering a profitable avenue. In 2024, the luxury appliance market is valued at around $12 billion.

Investing in a user-friendly website is key. Intuitive navigation, detailed product info, and customer reviews enhance the online shopping experience. Responsive customer service further differentiates hhgregg. In 2024, e-commerce sales are projected to reach $1.2 trillion in the US, highlighting the importance of a strong online presence.

Strategic Partnerships

Strategic partnerships could significantly boost hhgregg's market presence. Collaborating with home improvement services or smart home tech providers could enhance customer offerings. This could lead to increased sales and stronger customer loyalty. For instance, Best Buy has seen its services revenue grow, indicating the potential. Partnerships can also offer cross-promotional opportunities.

- Best Buy's services revenue growth in recent years.

- Increased customer loyalty through bundled services.

- Opportunities for cross-promotional marketing.

Leveraging Data Analytics

Leveraging data analytics presents a significant opportunity for hhgregg. Analyzing website traffic, customer behavior, and sales trends offers insights into customer preferences and market demand. This data can optimize product offerings and personalize marketing, potentially increasing sales by 10-15%. Operational efficiency can also be improved.

- Customer data analysis can lead to a 10-15% increase in sales.

- Personalized marketing can boost customer engagement by 20%.

- Optimized product offerings can reduce inventory costs by 8%.

Online growth offers hhgregg expansion via e-commerce, with U.S. sales exceeding $1.1T in 2024. A niche in premium appliances and electronics, valued at $12B, can attract quality-focused customers. Strategic partnerships and data analytics are also beneficial to improve business efficiency and optimize marketing, potentially increasing sales.

| Opportunity | Details | Impact |

|---|---|---|

| E-commerce Expansion | Leverage online sales. | Increase market share. |

| Niche Market Focus | Target premium appliances. | Attract quality-focused buyers. |

| Strategic Partnerships | Collaborate with services. | Enhance customer offerings. |

| Data Analytics | Analyze sales, customer data. | Optimize products & marketing. |

Threats

Intense price competition is a significant threat. Online retail fosters easy price comparisons, pressuring hhgregg. Larger rivals with stronger buying power can easily undercut hhgregg's pricing. This can reduce margins. In 2024, online sales accounted for over 20% of all retail transactions.

The consumer electronics sector faces swift tech changes, leading to quick product obsolescence. In 2024, the average product lifecycle is about 18 months. hhgregg must regularly update its inventory to stay current. Outdated stock can lead to losses, as seen with a 15% markdown rate on older models.

Negative online reviews pose a substantial threat, as they can severely harm hhgregg's brand image. In 2024, 88% of consumers read online reviews before making a purchase. Negative feedback about product quality or customer service can lead to a decline in sales. Effective online reputation management, including proactive monitoring and responses, is crucial for mitigating these risks. A study showed that addressing negative reviews can increase customer trust by 70%.

Cybersecurity and Data Breaches

Operating online heightens hhgregg's vulnerability to cybersecurity threats, such as data breaches and cyberattacks, which can compromise customer data. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025. Safeguarding customer data and securing online transactions are essential for customer trust and financial stability. A data breach can cost a company an average of $4.45 million as of 2023, potentially damaging hhgregg's reputation.

- Cybersecurity breaches can lead to significant financial losses.

- Data breaches can erode customer trust and brand reputation.

- Cyberattacks can disrupt operations and impact sales.

- Regulatory compliance adds to cybersecurity costs.

Economic Downturns Affecting Consumer Spending

Economic downturns pose a significant threat to hhgregg, as consumer electronics and appliances are often discretionary purchases. During economic uncertainty, consumers tend to cut back on non-essential spending, directly impacting sales. For instance, the consumer electronics market saw a 5% decrease in spending during the 2023 economic slowdown. This decline in spending can lead to decreased profitability for hhgregg.

- Reduced consumer spending during economic downturns.

- Impact on sales and profitability.

- Market data shows spending decrease during slowdowns.

Intense price competition and swift technological changes significantly threaten hhgregg's market position. Online retail’s price comparison pressures margins, impacting profitability. Cybersecurity and economic downturns further jeopardize sales. Negative reviews and the need for strong reputation management must be prioritized.

| Threat | Impact | Data |

|---|---|---|

| Price Competition | Reduced Margins | Online sales over 20% of retail in 2024. |

| Tech Obsolescence | Inventory Losses | Product life cycle of 18 months. |

| Cybersecurity | Financial Loss | $10.5T annual cybercrime cost by 2025. |

SWOT Analysis Data Sources

The analysis utilizes data from hhgregg's financial reports, market analysis, industry research, and expert insights to provide an accurate assessment.