Hangzhou Hikvision Digital Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hangzhou Hikvision Digital Technology Bundle

What is included in the product

Detailed analysis of each competitive force, supported by industry data and strategic commentary.

Swap in your own data, labels, and notes to reflect current business conditions.

Full Version Awaits

Hangzhou Hikvision Digital Technology Porter's Five Forces Analysis

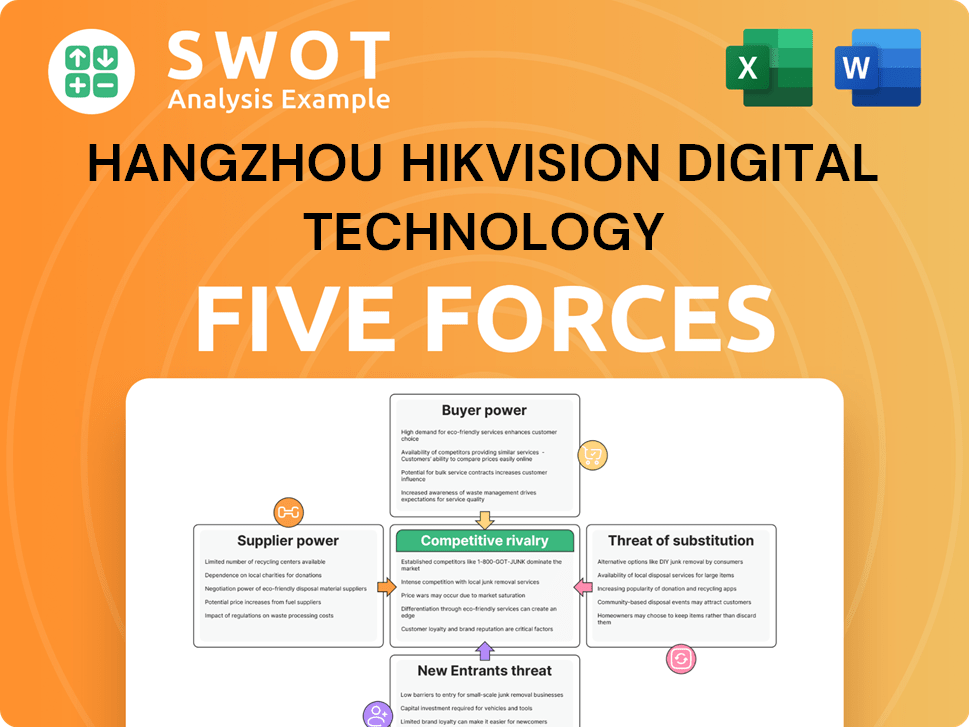

This preview reflects the complete Porter's Five Forces analysis for Hangzhou Hikvision. It explores industry competition, supplier power, buyer power, threats of new entrants, and substitute products. The same detailed analysis is what you’ll download after purchasing. It offers a ready-to-use assessment of Hikvision's strategic position.

Porter's Five Forces Analysis Template

Hikvision faces moderate supplier power, mainly due to reliance on component vendors. Buyer power is also moderate, influenced by price competition and product alternatives. The threat of new entrants is low, given high barriers. Substitute products pose a moderate threat. Competitive rivalry is intense due to market saturation.

The full analysis reveals the strength and intensity of each market force affecting Hangzhou Hikvision Digital Technology, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Hikvision's supplier power is moderate, benefiting from a wide supplier base. Yet, reliance on specific tech component suppliers elevates their influence. Supplier concentration directly impacts power dynamics; a few dominate. In 2024, Hikvision sourced from 1,200+ suppliers.

Switching costs for Hikvision to change suppliers could be substantial, potentially impacting its profitability. This is particularly relevant if components are highly specialized, like advanced imaging sensors. Significant re-engineering of products to accommodate new suppliers also raises costs. Consequently, higher switching costs amplify supplier power, influencing Hikvision's operational flexibility.

Hikvision's reliance on differentiated suppliers impacts its operations. Suppliers with unique components, like specialized chipsets, hold more power. In 2024, the global video surveillance market, where Hikvision is a leader, saw a shift towards higher-resolution cameras, increasing demand for advanced, proprietary components. This boosts supplier influence.

Impact of Inputs on Quality/Cost

Hikvision's bargaining power with suppliers hinges on how much input quality and cost affect its products. If supplier inputs greatly influence product performance or reliability, suppliers gain leverage. For example, in 2024, a shortage of specific chips could increase costs and reduce Hikvision's profit margins. Suppliers of essential components hold more power.

- Component costs can fluctuate significantly, impacting profitability.

- Supplier concentration, e.g., reliance on a few key chipmakers, strengthens supplier power.

- Hikvision's ability to switch suppliers is a key factor.

- Long-term contracts can mitigate, but not eliminate, supplier influence.

Forward Integration Threat

The bargaining power of suppliers increases if they can move into Hikvision's market. This forward integration threat allows suppliers to become direct competitors, which strengthens their ability to negotiate better terms. For example, if a key component manufacturer could start selling directly to Hikvision's customers. This could significantly pressure Hikvision's margins.

- Forward integration can be a significant threat, especially for suppliers with unique or critical components.

- The threat level depends on the supplier's capabilities, resources, and the ease of entering Hikvision's market.

- Hikvision's strategies to mitigate this include diversification of suppliers and strong partnerships.

- In 2024, Hikvision's revenue reached approximately CNY 95 billion, highlighting the impact of supplier negotiations.

Hikvision's supplier power is moderate due to a wide base, yet specific tech suppliers hold influence. Switching costs impact its profitability, especially with specialized components like imaging sensors. The shift toward high-res cameras boosts supplier influence.

Supplier bargaining power hinges on input quality and cost impact. Forward integration by suppliers presents a threat, pressuring margins. In 2024, Hikvision's revenue was around CNY 95 billion, reflecting supplier negotiation impacts.

| Factor | Impact | Mitigation |

|---|---|---|

| Supplier Concentration | Increases Supplier Power | Diversify suppliers |

| Switching Costs | High costs amplify power | Develop multiple supply channels |

| Component Uniqueness | More power to specialized suppliers | Strategic partnerships, innovation |

Customers Bargaining Power

Hikvision's enterprise clients wield considerable bargaining power due to their substantial order volumes. These large customers can negotiate favorable pricing and terms, impacting Hikvision's profit margins. For instance, in 2024, Hikvision's revenue from government and enterprise clients accounted for a significant portion of its total sales. The concentrated nature of these key accounts further amplifies their influence in price negotiations.

Switching costs for Hikvision's customers are low, increasing customer power. Customers can switch surveillance solutions easily. In 2024, Hikvision's revenue was $12.6 billion, highlighting its market presence. However, competitors offer similar products, simplifying the switch for clients. Lower switching costs mean customers have more power.

In the surveillance market, products are largely standardized, enhancing customer influence. This enables customers to readily compare prices and switch vendors. Hikvision's revenue in 2024 was approximately $13.4 billion, reflecting competitive pricing pressures. The standardization of products amplifies customer power significantly. This makes it easier for buyers to negotiate lower prices.

Price Sensitivity

Price sensitivity among Hangzhou Hikvision's customers significantly impacts their bargaining power, especially in competitive markets. Customers, especially those in price-sensitive segments, can easily switch to competitors based on price differences. This capability gives them considerable power to negotiate better terms or demand discounts. In 2024, Hikvision's global market share in video surveillance equipment was approximately 30%, indicating that many competitors exist. This competition increases price sensitivity.

- Market competition drives price sensitivity.

- Customers can switch providers easily.

- Hikvision's market share is around 30% in 2024.

- Price negotiations are common.

Backward Integration Threat

The threat from customers integrating backward to develop their own surveillance solutions is low but exists. Large organizations with significant resources could potentially insource their security needs, thereby increasing their bargaining power. This could lead to reduced demand for Hikvision's products, impacting sales. For instance, in 2024, the global video surveillance market was valued at approximately $49.2 billion. Therefore, any shift towards self-built systems could affect market dynamics.

- Market Competition: Hikvision competes with numerous other companies.

- Technological Advancements: Rapid innovation is reshaping surveillance.

- Economic Factors: Global economic trends affect purchasing.

- Regulatory Changes: Data privacy laws influence business.

Hikvision's customers possess strong bargaining power due to factors like large order volumes and low switching costs. Standardized products and price sensitivity further amplify this power, as customers can easily compare prices and switch vendors. In 2024, Hikvision's market share was around 30%, increasing competition and customer influence.

| Factor | Impact | 2024 Data |

|---|---|---|

| Order Volume | Negotiating Power | Significant orders |

| Switching Costs | High Customer Power | Low switching costs |

| Product Standardization | Price Sensitivity | Market share approx. 30% |

Rivalry Among Competitors

The video surveillance market shows moderate concentration, featuring major firms and many smaller competitors, intensifying competition. This dynamic is evident in 2024 market shares: Hikvision holds about 20%, Dahua 10%, and others like Axis and Uniview compete for the rest. Lower market concentration amplifies rivalry.

The video surveillance market shows steady growth, though it's decelerating. This slowdown, reported by various market analyses, amplifies competitive pressures. For example, in 2024, the global video surveillance market was valued at around $60 billion. Slower expansion intensifies the battle for market share among companies like Hikvision.

Hikvision's product differentiation relies on technology and solutions. Many products are easily copied, which intensifies rivalry. This lower differentiation leads to higher competitive rivalry. In 2024, Hikvision's global market share in video surveillance was around 24%, reflecting the intense competition. The company's revenue in 2023 was approximately $12.4 billion, facing pressure from competitors offering similar features.

Switching Costs

Low switching costs in the video surveillance market, where Hikvision operates, significantly amplify competitive rivalry. Customers can readily change vendors due to the standardization of technology and readily available alternatives, fueling price wars. This dynamic is evident in the industry's pricing trends, where competitive pressures often lead to margin compression. The ease of switching intensifies the need for Hikvision to continually innovate and offer competitive pricing to retain market share.

- Competitive pricing is crucial.

- Standardization of technology.

- Margin compression.

- Continuous innovation.

Exit Barriers

High exit barriers intensify competition in video surveillance. Firms struggle to leave, even when underperforming, causing overcapacity. This sustained presence keeps rivalry high, pressuring profitability. These barriers significantly impact Hikvision. Higher exit barriers exacerbate competition.

- High capital investments create exit obstacles.

- Specialized assets are difficult to redeploy.

- Strong relationships with integrators are difficult to unwind.

- Government regulations and compliance create exit barriers.

Hikvision faces intense rivalry due to moderate market concentration, with about 20% market share in 2024. Slow market growth and product similarity amplify competition, pushing for constant innovation. The ease of switching vendors also heightens price wars.

| Factor | Impact | Data (2024 est.) |

|---|---|---|

| Market Concentration | Moderate | Hikvision ~20% market share |

| Market Growth | Slowing | Global market ~$60B |

| Product Differentiation | Low | Many products are easily copied |

SSubstitutes Threaten

The threat of substitutes for Hangzhou Hikvision Digital Technology is moderate. Alternative security systems, such as drone-based surveillance and strengthened cybersecurity, offer viable options. The market for these substitutes is growing; for instance, the global drone market is projected to reach $41.4 billion by 2024. This availability increases the potential for customers to switch, affecting Hikvision's market share.

The price performance of substitutes significantly impacts the threat level. If alternatives provide comparable functionality at a reduced price, the threat to Hangzhou Hikvision Digital Technology escalates. For instance, cheaper surveillance solutions like those from Dahua Technology, with a market share of around 10-15% in 2024, could pose a threat. A strong price-performance ratio of substitutes, like open-source or cloud-based systems, intensifies the competitive pressure. This could lead to a price war, impacting Hikvision's profitability.

Switching costs for Hikvision's customers to adopt substitute security solutions are relatively low, heightening the threat of substitution. Customers can readily integrate alternative security measures from competitors. Low switching costs mean customers can easily change vendors. This increases the likelihood they'll switch.

Technological Advancements

Technological advancements pose a significant threat to Hikvision. AI-driven analytics and other tech innovations can create substitute products with superior capabilities. These advancements can offer better performance and features. The rapid pace of technological change heightens this risk. The global video surveillance market is expected to reach $75.6 billion by 2024, reflecting the dynamic nature of the industry.

- AI-driven analytics: Offers enhanced capabilities.

- Rapid technological change: Increases substitution risk.

- Market size: Global video surveillance market is projected to be $75.6 billion in 2024.

Customer Acceptance

Customer acceptance of substitute security solutions significantly influences the threat of substitution for Hangzhou Hikvision. If customers are willing to switch from traditional security products, the threat from alternatives like cloud-based systems or AI-driven surveillance rises. Higher acceptance rates make Hikvision more vulnerable to losing market share. For example, the global video surveillance market, valued at $48.6 billion in 2023, is projected to reach $86.4 billion by 2030, indicating strong customer interest in advanced solutions.

- Market growth indicates more customer acceptance of new technologies.

- Hikvision faces competition from cloud and AI security providers.

- Customer openness to change elevates the substitution threat.

- The industry's expansion shows a shift in customer preferences.

The threat of substitutes for Hikvision is moderate, intensified by technological advancements and customer acceptance of new solutions. The drone market is forecasted to reach $41.4 billion by 2024, presenting viable alternatives. Low switching costs and competitive pricing, such as from Dahua Technology (10-15% market share in 2024), further elevate the substitution risk.

| Factor | Impact | Data (2024) |

|---|---|---|

| Drone Market | Alternative security option | $41.4 billion projected market |

| Dahua's Market Share | Competitive pressure | 10-15% |

| Video Surveillance Market | Customer interest in innovation | $75.6 billion |

Entrants Threaten

High capital requirements and technological expertise are significant hurdles. New competitors need substantial investment to compete effectively. For instance, Hikvision's R&D spending in 2024 was roughly $1.5 billion, reflecting the need for ongoing innovation. Higher barriers to entry, like these, decrease the threat of new players disrupting the market. This protects Hikvision's market position.

Hikvision's substantial size provides strong economies of scale in both production and distribution. New competitors face significant hurdles in matching Hikvision's cost efficiency. These established economies of scale substantially lessen the threat posed by potential new entrants. In 2024, Hikvision's revenue reached approximately $13.1 billion, reflecting its vast operational scale. This scale allows for lower per-unit costs, making it difficult for smaller firms to compete on price.

Hikvision benefits from solid brand loyalty, making it tough for new competitors. This customer loyalty significantly reduces the threat of new entrants. In 2024, Hikvision's strong brand recognition helped maintain its market dominance. New companies struggle to overcome the established trust and preference for Hikvision's products.

Government Regulations

Stringent government regulations, especially concerning data security and privacy, significantly raise barriers for new companies. These regulations mandate complex compliance measures that can be costly and time-consuming for new entrants, potentially deterring them. Stricter regulations, such as those seen in the EU's GDPR or China's Cybersecurity Law, make it harder for new companies to compete. This reduces the threat of new entrants, as they face higher hurdles to enter the market. In 2024, the global cybersecurity market is estimated at $217 billion, highlighting the financial implications of these regulations.

- Compliance Costs: New entrants face significant costs to meet regulatory requirements, potentially including legal fees, technology upgrades, and staffing.

- Market Entry Delays: The process of obtaining necessary approvals and demonstrating compliance can delay market entry, giving incumbents a competitive advantage.

- Data Security Standards: Regulations like GDPR and CCPA require robust data protection measures, which can be expensive and technically challenging for new entrants.

- Cybersecurity Market: The global cybersecurity market is expected to reach $250 billion by the end of 2024.

Access to Distribution Channels

Hikvision, as a major player, benefits from established distribution networks, a significant advantage in the video surveillance market. New companies often struggle to replicate this reach, making it hard to get products to customers. Limited distribution access significantly reduces the threat of new competitors. This barrier is crucial in a market projected to reach USD 74.6 billion by 2027.

- Hikvision has extensive distribution networks.

- New entrants face difficulties accessing these channels.

- Restricted distribution lowers the competitive threat.

- The video surveillance market is growing steadily.

High barriers like significant R&D spending, about $1.5 billion in 2024, deter new entrants. Hikvision’s size offers economies of scale, making it hard for smaller firms to compete on cost. Brand loyalty and regulatory compliance, especially in cybersecurity, also protect Hikvision.

| Factor | Impact on Threat | 2024 Data/Example |

|---|---|---|

| Capital Needs | High Barrier | R&D: ~$1.5B |

| Economies of Scale | High Barrier | Revenue: ~$13.1B |

| Brand Loyalty | Reduced Threat | Strong Market Position |

Porter's Five Forces Analysis Data Sources

This analysis leverages data from Hikvision's annual reports, industry studies, and market analysis, ensuring thorough insights.