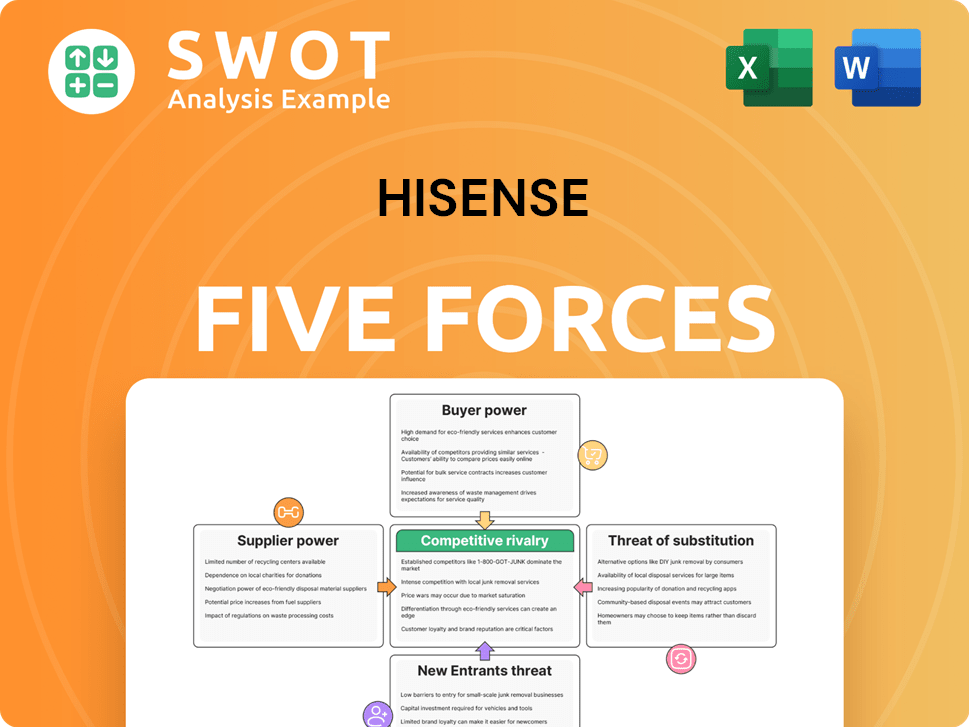

Hisense Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hisense Bundle

What is included in the product

Examines competition, buyer power, supplier influence, new entrants, and substitutes impacting Hisense.

Quickly identify competitive threats with intuitive visual data and analysis.

What You See Is What You Get

Hisense Porter's Five Forces Analysis

You're previewing the actual Hisense Porter's Five Forces Analysis document. This comprehensive analysis, outlining the competitive landscape, is fully accessible upon purchase.

Porter's Five Forces Analysis Template

Hisense faces a dynamic market landscape shaped by Porter's Five Forces. Rivalry among competitors is intense, driven by product innovation and pricing strategies. Bargaining power of suppliers and buyers influences profitability. The threat of new entrants and substitutes continually reshape the industry. Understanding these forces is crucial.

This preview is just the starting point. Dive into a complete, consultant-grade breakdown of Hisense’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Hisense sources components, especially LCD TV panels, from a concentrated supplier base. The top panel suppliers like BOE and CSOT significantly impact Hisense's costs. In 2024, BOE and CSOT controlled a substantial share of the global LCD panel market. This concentration gives these suppliers leverage in pricing negotiations. Hisense must manage these relationships carefully to mitigate cost pressures.

Raw material price volatility significantly influences supplier power for Hisense. For example, copper prices saw fluctuations, impacting production costs. In 2024, copper prices varied, affecting manufacturing expenses. High demand or supply issues due to conflicts further empower suppliers. These factors can squeeze Hisense's profit margins.

The electronics industry is experiencing supplier consolidation. Acquisitions are increasing the barriers to entry for suppliers. This reduction in supplier numbers enhances their bargaining power. For instance, in 2024, the top 5 display panel makers controlled over 70% of the market.

Geopolitical and trade tensions

Geopolitical and trade tensions significantly influence Hisense's supplier relationships. Ongoing tensions between China and Western nations introduce volatility into the supply chain, potentially increasing the bargaining power of suppliers. Tariffs and trade restrictions on Chinese-made components can inflate costs, thereby strengthening suppliers' leverage. For instance, in 2024, the average tariff on Chinese electronics imported into the U.S. was around 7.5%, impacting Hisense's profitability and supplier dynamics.

- Increased Costs: Tariffs and restrictions raise expenses for Hisense.

- Reduced Availability: Certain components might become harder to source.

- Supplier Leverage: Suppliers gain power due to limited alternatives.

- Geopolitical Risk: Tensions add uncertainty to supply chain.

Dependence on overseas suppliers

Hisense, like other electronics firms, faces supplier bargaining power challenges due to its dependence on overseas materials. The industry's reliance on global supply chains makes it susceptible to disruptions. These disruptions, whether from pandemics or political tensions, can severely impact material availability.

- In 2024, global supply chain issues increased the cost of electronic components by an average of 15%.

- The electronics industry imports over 70% of its raw materials from Asia.

- Political instability caused a 20% increase in shipping costs in the first half of 2024.

- Pandemic-related shutdowns led to a 30% reduction in component supply in Q2 2024.

Hisense's suppliers, like BOE and CSOT, hold significant bargaining power due to market concentration. Raw material price fluctuations, seen in copper, impact costs. Supplier consolidation enhances their leverage. In 2024, display panel makers controlled over 70% of the market. Geopolitical issues, with average tariffs around 7.5% on Chinese electronics, further empower suppliers, affecting Hisense's profitability.

| Factor | Impact on Hisense | 2024 Data |

|---|---|---|

| Supplier Concentration | Higher Costs, Dependence | Top 5 panel makers control over 70% of market |

| Raw Material Volatility | Margin Pressure | Copper price fluctuations |

| Geopolitical Tensions | Increased Costs, Supply Risk | Average 7.5% tariff on Chinese electronics to U.S. |

Customers Bargaining Power

Consumers' price sensitivity heavily shapes Hisense's market position. Value is key, with many seeking budget-friendly options without sacrificing quality. In 2024, approximately 60% of consumers actively look for deals. Smaller, impulse buys are rising, with a 15% increase in such purchases compared to 2023, showcasing the impact of promotions.

Hisense faces customer bargaining power influenced by brand loyalty, though price competition remains significant. In 2024, Hisense's market share in some regions ranked first, showcasing brand appeal. However, this position is challenged by rivals offering similar connectivity features and competitive pricing. Therefore, Hisense must balance brand strength with value to retain customer interest.

Online sales have dramatically increased, providing consumers with unprecedented access to information and a wide array of choices. This enhanced transparency enables consumers to easily compare prices and product features, thereby strengthening their bargaining power. For example, in 2024, online electronics sales accounted for approximately 45% of total sales, reflecting this shift. This empowers consumers to negotiate better deals.

Dominance of major retailers

Major retailers such as Amazon and Walmart wield considerable influence in the consumer electronics market. They command substantial market share, attracting value-conscious consumers. This dominance enables them to dictate terms with manufacturers like Hisense. Retailers can negotiate lower prices, favorable payment terms, and other concessions. These pressures can squeeze Hisense's profit margins and limit its strategic flexibility.

- Walmart's revenue in 2024 was over $648 billion, highlighting its immense purchasing power.

- Amazon's net sales in 2024 exceeded $575 billion, further demonstrating its market dominance.

- These retailers' combined market share significantly impacts pricing and product placement.

Demand for product innovation

Consumers' demand for product innovation, such as AI-powered features and enhanced performance, significantly influences the bargaining power of customers. Manufacturers must lead with value to attract today's purpose-driven consumers. This shift requires companies like Hisense to invest heavily in R&D to meet consumer expectations. Failure to innovate can lead to a loss of market share and reduced pricing power.

- In 2024, global spending on AI in consumer electronics reached $20 billion.

- Hisense's R&D spending increased by 15% in 2023 to focus on innovation.

- Smart TV sales with advanced features grew by 12% in Q1 2024.

- Consumers are willing to pay 10-15% more for innovative products.

Hisense contends with strong customer bargaining power, especially from price-sensitive consumers and major retailers. Online sales growth, accounting for roughly 45% of electronics sales in 2024, increases price comparison and selection, enhancing consumer power. High retailer dominance further enables negotiation, squeezing margins, and affecting strategy.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | 60% consumers seek deals |

| Online Sales | Increased comparison | 45% of total sales |

| Retailer Influence | Negotiated terms | Walmart $648B revenue |

Rivalry Among Competitors

The consumer electronics market is fiercely competitive, with many brands competing. This rivalry results in price wars and squeezing profit margins. Innovation is crucial to stay ahead. For example, in 2024, Samsung and Apple heavily invested in advanced display technologies and AI integration to maintain their market positions, which is a good example of the competitive rivalry.

The consumer electronics market is highly competitive. Apple, Samsung, and Sony are major players, commanding substantial market shares. Their robust brand presence and varied product lines fuel fierce competition. For instance, in 2024, Samsung's revenue reached $250 billion, indicating its market dominance.

Hisense faces intense rivalry, particularly in AI and innovation. Competitors are investing heavily in AI-driven features to stand out. This tech race increases competitive pressures. For example, in 2024, global spending on AI systems reached $154 billion, fueling this rivalry.

Hisense's global ranking

Hisense holds a strong position in the TV market. The company is currently ranked No. 2 globally in TV shipments. Hisense's plans to increase LCD TV shipments are expected to heighten competition with other brands. This intensifies the rivalry in the global TV market.

- Hisense's global TV shipment ranking: No. 2

- Focus: Increasing LCD TV shipments

- Impact: Heightened market competition

Competitor strategies and advancements

Samsung and LG, key rivals, continuously innovate in the TV market. Their strategies include larger screens and boosted brightness, meeting consumer desires for immersive viewing. For instance, in 2024, Samsung unveiled its 98-inch QLED TV, intensifying competition. LG's focus remains on OLED technology, aiming for superior picture quality. These moves heighten rivalry, driving continuous improvements.

- Samsung's 2024 revenue reached $240 billion, a 4% increase year-over-year, fueled by innovative TV models.

- LG's OLED TV sales grew by 15% in 2024, showcasing strong consumer interest in premium displays.

- The global TV market is projected to reach $250 billion by the end of 2024.

The consumer electronics sector is defined by its intense competition, particularly impacting profitability. Hisense battles against formidable rivals such as Samsung and LG, who continuously innovate. In 2024, Samsung's TV segment revenue reached $40 billion. The race for technological advancements, especially in AI and display tech, intensifies this rivalry.

| Metric | Details |

|---|---|

| Samsung TV Revenue (2024) | $40 Billion |

| Global AI System Spending (2024) | $154 Billion |

| Projected Global TV Market (End of 2024) | $250 Billion |

SSubstitutes Threaten

Consumers now have diverse entertainment choices, like streaming services, gaming consoles, and other gadgets. These alternatives compete with traditional TVs and home appliances, which can impact Hisense's market share. For instance, in 2024, streaming services saw a 25% rise in viewership. This shift means that consumers may choose streaming over buying new TVs.

Technological convergence poses a threat to Hisense. Smartphones and tablets now rival traditional consumer electronics. In 2024, global smartphone sales hit $580 billion, showing the shift. This trend allows consumers to substitute Hisense products with multi-functional devices.

Long product lifecycles for appliances mean consumers delay upgrades, opting for repairs instead. This increases the risk from substitutes. For example, in 2024, appliance repair services saw a 10% rise, indicating consumers' preference to maintain older models. Reduced demand impacts revenue; Hisense's 2024 sales figures showed a slight dip in certain markets. This shift highlights the importance of competitive pricing.

Availability of refurbished products

The availability of refurbished products poses a threat to Hisense. Marketplaces such as Refurbed and Back Market offer cheaper alternatives to new electronics. This can directly impact sales of new Hisense devices. The rising popularity of these platforms increases the threat of substitution.

- Refurbished electronics sales are projected to reach $65 billion globally by 2024.

- Back Market raised $510 million in funding to expand its refurbished product offerings in 2021.

- The consumer electronics market saw a 6% increase in refurbished product sales in 2023.

Open-source alternatives

The threat of substitutes in Hisense's market is amplified by open-source software and AI-driven automation. These alternatives can replace proprietary technologies, lessening the dependence on specific brands like Hisense. For instance, the open-source market is projected to reach $32.9 billion by 2024. This allows consumers to explore cheaper or free alternatives.

- Open-source software growth continues.

- AI automation is becoming more prevalent.

- Consumer choice is expanding.

- Hisense faces increased competition.

Hisense confronts significant substitution threats from diverse entertainment options and multi-functional devices. Consumers are shifting toward streaming, with a projected 25% rise in 2024 viewership, impacting TV sales. Refurbished electronics, like those on Back Market, also offer cheaper alternatives, projected to hit $65 billion by 2024.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Streaming Services | Reduced TV Sales | 25% rise in viewership |

| Smartphones/Tablets | Functional substitution | $580B global sales |

| Refurbished Electronics | Price competition | $65B market projection |

Entrants Threaten

The consumer electronics sector faces a growing threat from budget-friendly brands. These competitors, often with lower overheads, put downward pressure on prices. Hisense, as a major player, must innovate to maintain its market share. In 2024, the global consumer electronics market was valued at approximately $800 billion, with increasing competition from low-cost brands. This makes it tougher for new entrants to gain ground.

The consumer electronics sector demands substantial capital for R&D, production, and advertising. High initial costs act as a barrier, limiting new competitors. For example, Hisense's R&D expenditure in 2024 was approximately $1.5 billion, showcasing the financial commitment. This makes it difficult for smaller firms to enter.

Established brands in the smartphone market, such as Apple and Samsung, benefit from strong brand loyalty. This loyalty makes it hard for new companies to attract customers. Building brand recognition and consumer trust requires significant investment and time. For example, Apple's brand value in 2024 was estimated at over $355 billion, highlighting the strength of its market position.

Dominance of Asian manufacturers

The Asia-Pacific region's dominance in consumer electronics, particularly in manufacturing, poses a significant threat to new entrants. Countries like China, South Korea, and Japan control a large portion of the market. This existing infrastructure and established supply chains create high entry barriers for competitors. Newcomers struggle to compete with the established scale and efficiency of Asian manufacturers.

- China's consumer electronics exports reached $770 billion in 2024.

- South Korea's electronics industry accounted for 30% of its total exports in 2024.

- Japan's electronics sector maintained a strong global presence, with about 10% of market share in 2024.

Ecosystem integration

Ecosystem integration poses a significant barrier to entry. Companies like Apple create tightly integrated ecosystems, making it tough for new entrants to compete effectively. Replicating this level of seamless integration demands considerable resources and expertise. This difficulty discourages potential competitors.

- Apple's ecosystem, including hardware, software, and services, generated over $70 billion in revenue in Q4 2023.

- The cost to develop a comparable ecosystem could run into billions of dollars.

- Hisense's focus on value and affordability provides a different, but potentially competitive, market approach.

- The success of any new entrant hinges on offering unique value or a differentiated ecosystem strategy.

New entrants face hurdles in the consumer electronics market. High costs and established brands limit easy entry. Asian dominance in manufacturing also creates barriers. Hisense's focus on value offers a competitive edge.

| Factor | Description | Impact on Entry |

|---|---|---|

| Capital Needs | R&D, Production, Marketing | High investment, limiting new entrants |

| Brand Loyalty | Established brands have loyal customers | Makes it hard to attract new customers |

| Asia's Dominance | Manufacturing and Supply Chains | High barriers, competition |

Porter's Five Forces Analysis Data Sources

The Hisense analysis draws on annual reports, market research, financial filings, and industry-specific databases for a data-driven competitive assessment.