Hitachi High-Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hitachi High-Technologies Bundle

What is included in the product

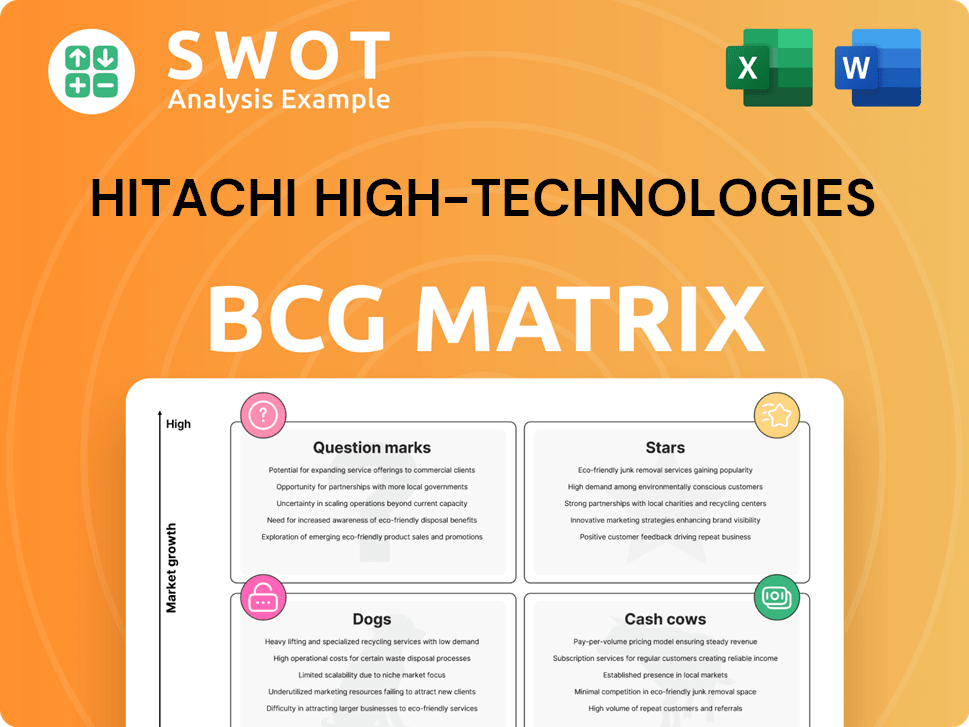

Hitachi High-Tech's BCG matrix analysis reveals investment strategies for its diverse portfolio.

Clean, distraction-free view optimized for C-level presentation, highlighting key strategies.

Full Transparency, Always

Hitachi High-Technologies BCG Matrix

The Hitachi High-Technologies BCG Matrix preview is the final, complete document. It's the same professional-grade report you'll receive instantly after purchase, ready for immediate application. No hidden content or modifications—just strategic insights in a ready-to-use format.

BCG Matrix Template

Hitachi High-Technologies' BCG Matrix offers a glimpse into its diverse portfolio. See how its products are categorized—Stars, Cash Cows, Dogs, or Question Marks? This preview is just a snapshot of its market strategy. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment.

Stars

Hitachi High-Tech's semiconductor manufacturing equipment, especially CD-SEM systems, is a Star. They hold a top global market share, essential for advanced chip production. In 2023, the semiconductor equipment market reached ~$100 billion. Continued investment is vital to maintain this strong position.

The analytical instruments sector, a star in Hitachi High-Technologies' BCG Matrix, includes X-ray fluorescence and liquid chromatography, vital for R&D and quality control. This sector aligns with growing demands for safety and environmental solutions. Hitachi's focus on core technology integration will enhance its market position. In 2024, the global analytical instruments market was valued at approximately $60 billion, growing steadily.

Hitachi's Advanced Industrial AI, fueled by collaborations like the one with NVIDIA, is positioned as a Star in its BCG Matrix. This strategic focus enhances industrial simulations and asset optimization across sectors. Recent data indicates a 20% increase in efficiency gains through AI-driven solutions. Continued innovation is vital for maintaining this momentum.

High-Resolution Electron Microscopes

Hitachi High-Tech's high-resolution electron microscopes are pivotal, especially in nanotechnology and materials science. These microscopes facilitate detailed nanoscale analysis and manipulation. Continuous investment in R&D is crucial for maintaining a competitive edge. This is important due to the growing demand for nanotechnology applications. In 2024, the nanotechnology market is valued at approximately $80 billion.

- Market growth in nanotechnology applications is projected to increase by 15% annually through 2029.

- Hitachi High-Tech invested approximately $1.2 billion in R&D in 2024.

- Electron microscopes contribute significantly to the company's revenue, with a 10% increase year-over-year.

- The company's goal is to expand their market share by 5% in the next three years.

Battery Production Machines

Hitachi High-Tech is a key player in battery production machines, a sector experiencing high growth. This is fueled by the rising demand for batteries in electric vehicles and renewable energy. Innovation in production processes will keep Hitachi High-Tech at the forefront. The global EV battery market is projected to reach $169.9 billion by 2030.

- Hitachi High-Tech's focus on battery production aligns with market growth.

- The EV market is a major driver, with sales increasing yearly.

- Innovation in production is crucial for staying competitive.

- The battery market is expected to grow significantly by 2030.

Hitachi High-Tech's Star products include high-resolution electron microscopes, essential in nanotechnology. The market for nanotechnology is booming, showing a 15% annual growth rate. They also focus on battery production machines, aiming for the EV market.

| Product | Market Size (2024) | Growth Rate (Annual) |

|---|---|---|

| Electron Microscopes | $80 Billion | 15% (through 2029) |

| Battery Production | $169.9 Billion (by 2030) | Significant, EV-driven |

| CD-SEM Systems | $100 Billion (Semiconductor Eq.) | Steady |

Cash Cows

Clinical chemistry and immunochemistry analyzers are strong cash cows for Hitachi High-Tech. These analyzers are crucial for R&D and quality control in healthcare. Focusing on efficiency and expanding applications in molecular diagnostics can boost cash flow. In 2024, the global clinical chemistry market is valued at $10.5 billion.

Hitachi High-Tech's building services boosted revenue and profits, even with China's slowdown in new installations. They're making money from modernization and maintenance. Digital services and industrial products are key. Lumada business expansion and synergy with DSS and GEM sectors will increase cash flow.

Hitachi High-Technologies' industrial products, a cash cow, benefit from robust R&D and expanding digital services, leveraging its vast installed base. In 2024, this segment generated approximately $2.5 billion in revenue, demonstrating steady profitability. The focus is on enhancing service offerings to boost customer retention. This strategic pivot aims to ensure sustained cash flow and market dominance.

Digital Engineering Business

Hitachi's Digital Engineering business, a cash cow, leverages Hitachi Cloud and DX Solutions to drive digital transformation (DX) for clients. They focus on value creation and productivity improvements through Generative AI, enhancing customer value. Deployment of assets occurs via the Lumada Solution Hub. In 2024, Hitachi's digital solutions saw a revenue increase of 12%, reflecting strong market demand.

- Hitachi Cloud and DX Solutions focus on digital transformation.

- Generative AI drives value creation and productivity.

- Lumada Solution Hub facilitates asset deployment.

- Digital solutions revenue increased by 12% in 2024.

High-Tech Medical Devices

Hitachi High-Technologies' High-Tech Medical Devices segment is a cash cow, driven by the growing need for effective chronic disease management. These devices provide effective monitoring, enhancing patient care significantly. The integration of AI and IoT creates smart devices, delivering targeted information. In 2024, the global market for medical devices is valued at over $600 billion.

- Market Growth: The medical device market is projected to reach $800 billion by 2027.

- AI in Healthcare: AI in medical devices is expected to grow significantly, with a market value of over $20 billion by 2025.

- Hitachi's Revenue: Hitachi High-Technologies' medical business saw a revenue of $2.5 billion in 2023.

Hitachi High-Tech's cash cows include clinical analyzers, building services, and industrial products, each generating stable revenue. These segments benefit from strong market positions and focus on efficiency. Digital solutions and medical devices also contribute, leveraging technology for growth. In 2024, these areas saw significant revenue gains and market expansion.

| Segment | Key Strategy | 2024 Revenue (approx.) |

|---|---|---|

| Clinical Analyzers | R&D, Molecular Diagnostics | $10.5 billion (market) |

| Building Services | Modernization, Maintenance | Increased Profit |

| Industrial Products | Digital Services, Customer Retention | $2.5 billion |

Dogs

Hitachi High-Tech Solutions is divesting its hard disk and FPD-related device businesses. This strategic move likely aims to streamline operations. The segment's revenue in 2024 was approximately ¥15 billion, reflecting its market position. This divestiture may free up resources for higher-growth areas. The BCG matrix categorizes this as a "Dog," requiring strategic decisions.

Hitachi High-Tech is divesting its railroad inspection business. This strategic move, handled by HFS, shifts the focus to HSL. In 2024, Hitachi's net sales were approximately ¥3.5 trillion. Divestiture allows for resource reallocation to core growth areas.

Hitachi High-Technologies' HD/FPD, facing transfer via corporate divestiture, aligns with a "Dog" quadrant in the BCG matrix, indicating low market share in a slow-growth industry. In 2024, this strategic move by Hitachi High-Tech Fine Systems Corporation to Hitachi High-Tech Solutions Corporation aims to minimize and potentially exit this business segment. This action often suggests a focus on more profitable ventures as the HD/FPD market faces challenges.

Laboratory Solutions

Hitachi High-Tech's Laboratory Solutions, now under HSL, underwent a strategic shift via corporate divestiture, streamlining operations. This move aimed to minimize and avoid certain business aspects, focusing resources. In 2024, the laboratory solutions market showed a 5% growth, reflecting ongoing demand. This restructuring aligns with market trends and Hitachi's strategic goals.

- Divestiture streamlined operations.

- Market growth of 5% in 2024.

- Focus on strategic goals.

- Business was transferred to HSL.

Automotive Systems Segment

Hitachi High-Technologies' Automotive Systems segment, now restructured, finds itself in the "Dogs" quadrant of the BCG Matrix. This segment likely faces low market share within a slow-growing or declining automotive market. Recent financial data shows that Hitachi's automotive-related sales have been impacted by global supply chain issues.

- Restructuring efforts aim to improve efficiency.

- The segment's performance is under pressure.

- Market conditions are challenging.

- Focus on cost reduction and strategic partnerships.

Hitachi High-Tech's "Dogs" include divested segments. These face low market share in slow-growth sectors. Strategic moves aim to minimize losses. The 2024 data indicates restructuring.

| Segment | Strategy | 2024 Status |

|---|---|---|

| HD/FPD | Divestiture | Transfer Complete |

| Automotive Systems | Restructuring | Market Pressure |

| Railroad Inspection | Divestiture | Reallocation |

Question Marks

The advanced materials sector is expanding, fueled by automotive, aerospace, and electronics demands. Hitachi High-Tech's presence needs strengthening to benefit from this growth. In 2024, the global advanced materials market was valued at approximately $80 billion. Strategic investments and partnerships could boost its market share, potentially turning it into a star.

Hitachi's Industrial AI Solutions are question marks in its BCG Matrix, representing high growth potential but uncertain market share. Hitachi is actively investing in AI, but the market is nascent, demanding a strategic approach. To succeed, they must deliver impactful solutions and guide AI adoption. Successful pilots and deployments are critical for market share.

Green technologies are a strategic question mark for Hitachi High-Tech, with potential for high growth. The global green technology and sustainability market was valued at $36.6 billion in 2024. Investments in renewable energy and emission reduction technologies could be highly profitable. Strategic focus on sustainability aligns with growing market demand.

Digital Solutions for Green Buildings

Hitachi High-Technologies should focus on digital solutions for green buildings due to high growth potential. Global energy shortages and resource depletion drive this expansion. Concentrate on the digital solutions business within the industrial sector. Consider the following points:

- Green building market expected to reach $1.1 trillion by 2025.

- Digital solutions can improve energy efficiency by up to 30% in buildings.

- Focus on IoT and AI integration for smart building management.

- Demand for sustainable solutions is increasing, especially in Europe and North America.

AI-Driven Transformation for Physical and Industrial Applications

Hitachi High-Tech's collaboration with NVIDIA is a game-changer, especially in Physical AI applications. This partnership has fueled innovation, leading to new products and prototypes. Expert advisory councils are being established, showing a commitment to this area. Significant investment is crucial to capture market share and fully capitalize on these advancements.

- New product launches driven by AI are key.

- Advanced prototype development accelerates innovation cycles.

- Expert advisory councils provide strategic guidance.

- Heavy investment is needed to gain market share.

Question marks in Hitachi High-Tech's BCG Matrix represent high-growth, uncertain market share opportunities. Industrial AI Solutions and green tech are key examples. The global market for green technologies was valued at $36.6 billion in 2024. Strategic investment and focus are essential for converting these into stars.

| Area | Market Size (2024) | Strategic Focus |

|---|---|---|

| Industrial AI Solutions | Nascent, Growing | Impactful Solutions, AI Adoption |

| Green Technologies | $36.6 Billion | Renewable Energy, Emission Reduction |

| Digital Solutions | $1.1 Trillion (by 2025) | IoT, AI for Smart Buildings |

BCG Matrix Data Sources

This BCG Matrix draws from financial statements, market reports, competitor analyses, and expert insights.