Henderson Land Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

What is included in the product

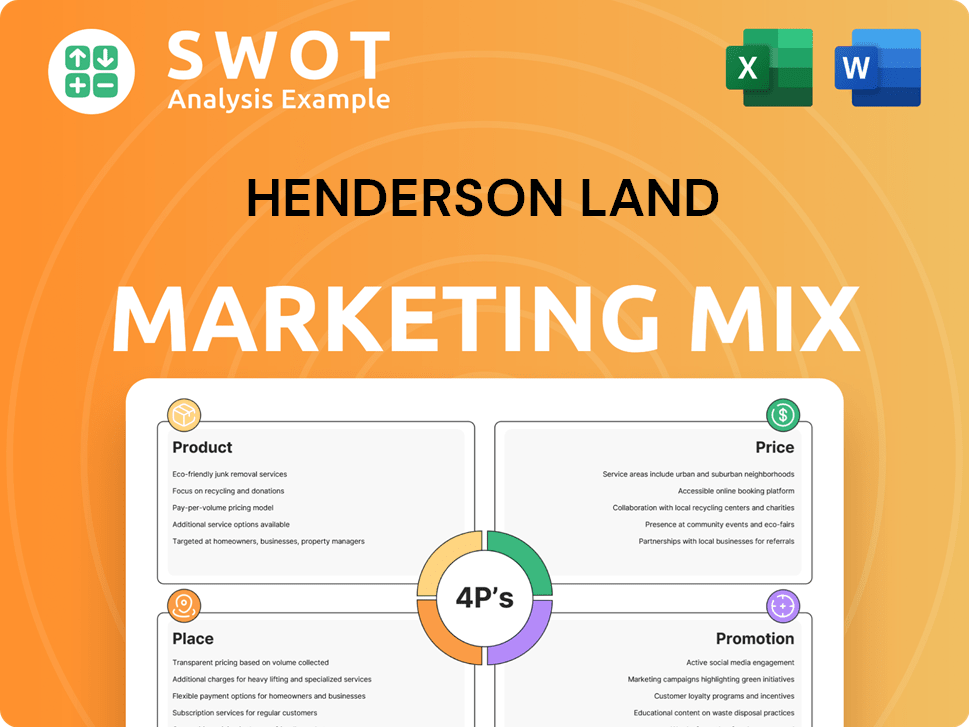

Offers a thorough 4Ps analysis of Henderson Land's marketing strategies, examining Product, Price, Place, and Promotion.

Simplifies Henderson Land's marketing strategy with a structured overview, saving time on lengthy document reviews.

Same Document Delivered

Henderson Land 4P's Marketing Mix Analysis

This is the same detailed Henderson Land 4P's Marketing Mix analysis you'll receive instantly upon purchase. It’s a fully comprehensive study, ready for your strategic decisions.

4P's Marketing Mix Analysis Template

Henderson Land thrives in real estate with innovative offerings. Their pricing strategy balances value and market demands. They select prime locations, ensuring accessibility. Promotion includes diverse, engaging campaigns. Uncover every detail in the 4P's analysis. Get instant access for strategic insights.

Product

Henderson Land's residential properties are a key part of their marketing mix, focusing on both Hong Kong and Mainland China markets. They offer diverse housing options, from mass-market estates to high-end luxury units, targeting various customer groups. For example, in 2024, projects like THE HENLEY and Eden Manor contributed significantly to their revenue. The company's strategic approach is evident in its project portfolio, which includes developments such as Double Cove and Arbour.

Henderson Land's commercial properties are a cornerstone of its strategy. The company focuses on developing and investing in office spaces, retail units, and shopping arcades. These properties generate substantial rental income, contributing significantly to overall financial performance. Key assets include the International Finance Centre (ifc) and The Henderson. In 2024, rental income from investment properties reached HK$10.85 billion, showcasing the segment's importance.

Henderson Land's hotel operations, integral to its 4Ps, include hotel management and ownership. This diversification complements its property investments. A key asset is the Four Seasons Hotel in the ifc complex. In 2024, the hospitality sector saw a revenue increase of 15% in Hong Kong. Henderson Land's hotel segment contributes significantly to its overall revenue.

Infrastructure and Energy

Henderson Land's infrastructure and energy investments, notably its stake in The Hong Kong and China Gas Company, form a crucial part of its product portfolio. This strategic move diversifies the company's revenue streams, reducing reliance on property development alone. As of 2024, The Hong Kong and China Gas Company contributed significantly to Henderson Land's overall profit. This diversification enhances the company's resilience to market fluctuations.

- The Hong Kong and China Gas Company: a key asset.

- Diversification beyond property development.

- Revenue stream stability.

- Enhanced market resilience.

Other Businesses

Henderson Land diversifies beyond property development. They manage properties and engage in construction, finance, and department store operations. These ventures bolster their core business, adding to their revenue streams. For example, in 2024, property management contributed significantly to the company's overall income.

- Property management provides a stable income.

- Construction projects support property development.

- Financial services aid in property financing.

- Department stores enhance brand presence.

Henderson Land's diverse products include residential, commercial, and hotel properties. Investments in infrastructure and energy also contribute. Non-property ventures include property management, construction, and financial services.

| Segment | Key Assets | 2024 Revenue Contribution |

|---|---|---|

| Residential | THE HENLEY, Eden Manor | Significant |

| Commercial | ifc, The Henderson | Rental income HK$10.85B |

| Hotels | Four Seasons (ifc) | 15% revenue increase in HK |

Place

Henderson Land strategically develops properties in Hong Kong's prime locations, like Central, Kowloon, and New Territories. These areas offer high visibility and accessibility, especially near mass transit. In 2024, Central’s office space commanded some of the highest rental rates globally, reflecting its desirability.

Henderson Land has a significant presence in Mainland China, holding a considerable land bank and numerous development projects. This strategic expansion broadens its market reach. In 2024, the company's Mainland China property portfolio contributed substantially to its overall revenue. The company continues to invest in projects across major cities like Shanghai and Beijing. This presence is crucial for long-term growth.

Henderson Land's urban redevelopment strategy focuses on acquiring older buildings for new projects, especially in prime locations. This approach is crucial for land bank replenishment, vital for future developments. In 2024, they invested HK$15 billion in urban renewal projects. Their urban redevelopment pipeline includes over 100 projects, with a total gross floor area exceeding 20 million sq ft.

Agricultural Land Conversion

Henderson Land's agricultural land conversion strategy significantly impacts its marketing mix. The company strategically converts its vast holdings in the New Territories for development purposes. This approach establishes a beneficial cost basis for land acquisition, enhancing project profitability. In 2024, land conversion contributed substantially to Henderson Land's project pipeline.

- Land conversion reduces acquisition costs.

- It supports higher profit margins.

- This strategy streamlines project development.

- It ensures a steady supply of land.

Diverse Property Portfolio Distribution

Henderson Land's marketing mix benefits from a diverse property portfolio. This includes offices and shopping arcades, strategically distributed across various sectors and locations. This diversification helps mitigate risks. For example, in 2024, office space contributed significantly to rental income.

- Office properties generated HK$6.8 billion in rental income in 2024.

- Retail properties contributed HK$4.2 billion to the rental income in the same year.

- The portfolio spans different regions, including Hong Kong and Mainland China.

Henderson Land focuses on strategic property placement, primarily in Hong Kong and Mainland China. These areas provide high visibility and accessibility. As of 2024, properties like Central office spaces command significant rental rates. Their land conversion efforts and urban redevelopment strategies ensure steady land supply.

| Strategic Area | 2024 Key Data | Impact |

|---|---|---|

| Hong Kong (Central) | High Rental Rates | Premium Market Position |

| Mainland China | Substantial Revenue | Growth and Diversification |

| Urban Redevelopment Investment | HK$15 Billion (2024) | Land Bank & Project Pipeline |

Promotion

Henderson Land actively runs marketing campaigns to showcase its properties and services. These campaigns effectively emphasize the distinctive features and amenities of their developments, attracting potential buyers and tenants. In 2024, Henderson Land allocated approximately HK$500 million towards marketing initiatives, reflecting a 10% increase from the previous year. This investment supports diverse promotional activities, including digital marketing, print advertisements, and event sponsorships, all aimed at enhancing brand visibility and driving sales.

Henderson Land leverages digital marketing and social media to expand its reach. They utilize platforms like Facebook, Instagram, and LinkedIn for brand consistency. In 2024, social media ad spend is projected to reach $238 billion globally, indicating digital marketing's importance. The company's digital efforts are critical to engage with its target demographics and promote its real estate projects.

Henderson Land actively engages in public relations and events. They regularly host festive campaigns at their shopping malls. This strategy aims to draw in shoppers. In 2024, these efforts contributed significantly to foot traffic. The company's marketing budget allocated approximately 15% to promotional events.

Showcasing Property Features

Henderson Land's promotional strategy heavily emphasizes visual content to highlight property features. They utilize high-quality photos and videos to showcase design elements, amenities, and the overall lifestyle. This approach aims to attract potential buyers by providing a compelling view of the properties. This strategy is crucial, as 70% of consumers prefer video content when learning about a product.

- High-quality visuals increase engagement by up to 80%.

- Video marketing can boost conversions by 30%.

- Properties with virtual tours see a 40% increase in inquiries.

Collaboration with Professionals

Henderson Land's promotional strategies showcase collaborations with architects and design professionals, highlighting the quality and design of their projects. This approach can enhance brand perception and attract discerning customers. Emphasizing these partnerships builds trust and showcases attention to detail. For instance, in 2024, the company allocated approximately HK$500 million to marketing, with a significant portion dedicated to design and promotional activities.

- Marketing spend in 2024: HK$500 million.

- Focus on design collaboration.

- Enhancement of brand perception.

Henderson Land uses extensive marketing to promote its properties and services, with a HK$500 million marketing budget in 2024. Digital marketing and social media, crucial in a projected $238 billion global ad spend, help boost its visibility and engage customers. They enhance properties through visuals. They have collaborations for brand building.

| Strategy | Description | 2024 Data |

|---|---|---|

| Digital Marketing | Use of platforms like Facebook, Instagram, LinkedIn. | Social media ad spend projected to reach $238 billion globally |

| Public Relations | Festive campaigns at shopping malls. | 15% of marketing budget for events |

| Visual Content | High-quality photos, videos. | 70% of consumers prefer video for products |

Price

Henderson Land employs varied pricing strategies for its properties. These strategies consider market dynamics, location, and property features. In 2024, Hong Kong's property prices saw a slight decrease of 0.8% according to the Rating and Valuation Department. Pricing decisions reflect these trends to stay competitive.

Rental income is a key revenue driver for Henderson Land. Rental rates for their office buildings and shopping arcades are influenced by market demand and property quality. In 2024, Henderson Land's investment properties generated a substantial portion of its revenue. The company's rental income is closely tied to occupancy rates and prevailing market conditions.

Henderson Land's hotel room pricing, seen at the Four Seasons, hinges on factors such as location and luxury. In 2024, luxury hotel average daily rates (ADR) in Hong Kong were around HK$2,500-$4,000. This pricing strategy reflects the premium positioning of their properties. Room rates are also affected by demand and seasonality, with fluctuations throughout the year.

Discounts and Incentives

Henderson Land strategically employs discounts and incentives to boost sales, especially in residential projects. These can include early bird discounts, stamp duty waivers, or flexible payment plans. In 2024, such tactics were crucial, with the Hong Kong property market showing signs of recovery. These strategies are designed to make properties more attractive to potential buyers.

- Early bird discounts can range from 2% to 5% off the initial price.

- Stamp duty waivers can save buyers up to 4.25% of the property value.

- Flexible payment plans allow buyers to spread payments over a longer period.

Financial Performance and Profitability

Henderson Land's financial health, directly tied to its pricing across sectors, impacts overall performance. Recent reports indicate a dip in net profit, even with a rise in underlying profit. This highlights the critical role of pricing in maintaining profitability. Understanding these dynamics is crucial for assessing the company's value.

- 2024 Interim Results: Underlying profit increased by 14% to HK$5.74 billion.

- 2024 Interim Results: Net profit decreased by 28% to HK$3.58 billion.

Henderson Land uses dynamic pricing across its property portfolio, adapting to market changes, especially in Hong Kong. In 2024, property price changes drove the company's strategies. Discounts and incentives aim to stimulate sales.

| Pricing Strategy | Description | 2024 Data/Example |

|---|---|---|

| Residential | Offers discounts and incentives. | Early bird discounts: 2%-5% off; Stamp duty waivers: up to 4.25%. |

| Commercial Rentals | Rental income adjusted based on market demand and occupancy rates. | Impacts total revenue. |

| Luxury Hotel Rates | Reflects premium positioning and seasonality. | ADR (average daily rate) in Hong Kong: HK$2,500 - HK$4,000. |

4P's Marketing Mix Analysis Data Sources

Our Henderson Land 4P analysis leverages financial reports, property listings, investor presentations, and promotional materials.