Hörmann Holding GmbH & Co. KG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hörmann Holding GmbH & Co. KG Bundle

What is included in the product

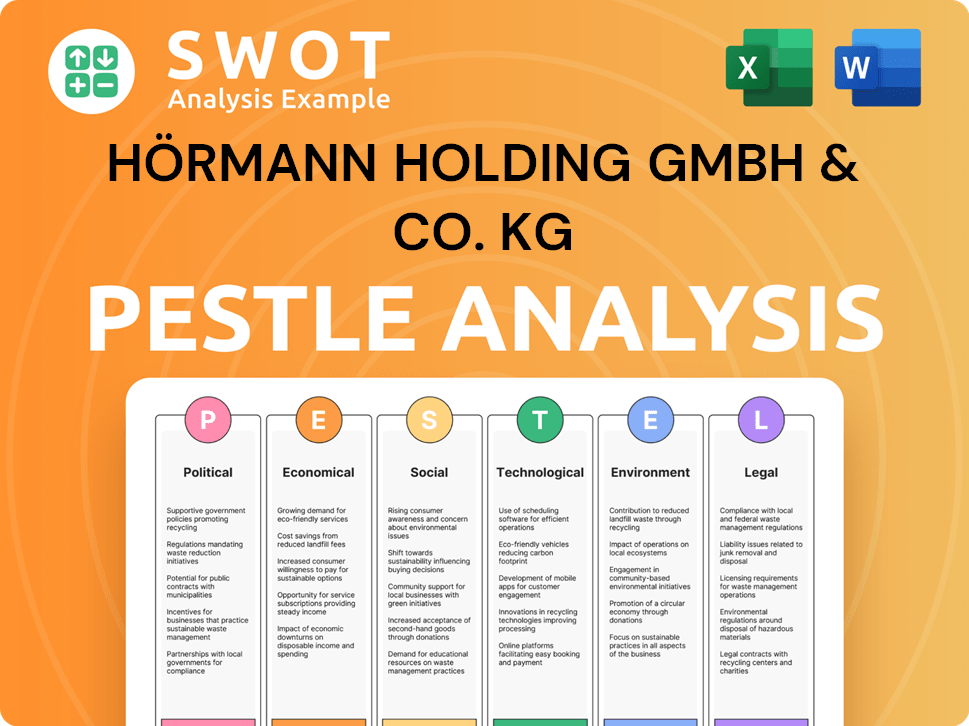

Evaluates Hörmann Holding's macro environment using PESTLE factors: Political, Economic, Social, Technological, Environmental, and Legal.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

Hörmann Holding GmbH & Co. KG PESTLE Analysis

This preview showcases the Hörmann Holding GmbH & Co. KG PESTLE Analysis—fully formatted. The political, economic, social, technological, legal, and environmental factors are all comprehensively assessed. The layout is precisely how the document appears after purchase. Download this exact, ready-to-use file after checkout.

PESTLE Analysis Template

Delve into the external forces shaping Hörmann Holding GmbH & Co. KG with our insightful PESTLE Analysis. Explore the impact of political stability, economic trends, and social shifts. Understand the legal landscape and technological advancements influencing their operations. Uncover how environmental concerns shape their strategies. Need deeper strategic insights? Get actionable intelligence to strengthen your market strategy! Purchase the full version now.

Political factors

Government regulations significantly affect Hörmann. Building codes, safety standards, and environmental rules shape product design. Compliance is crucial across all operational countries. For instance, the EU's Construction Products Regulation (CPR) impacts door manufacturing. Stricter regulations may raise costs, impacting profitability.

Hörmann Holding GmbH & Co. KG must navigate evolving trade policies. Fluctuations in tariffs impact material costs and product pricing. The EU's trade deals and potential tariffs changes (2024-2025) are key. Trade disputes, like those affecting steel, can raise costs. These issues affect Hörmann's market competitiveness.

Political instability, such as shifts in government or civil unrest, poses risks to Hörmann's operations. For example, the war in Ukraine has significantly impacted supply chains. In 2024, geopolitical tensions continue to affect international trade and investment. These factors can disrupt production and sales, impacting financial performance.

Government Investment in Infrastructure

Government investment in infrastructure significantly influences Hörmann's business. Increased spending on projects like roads and buildings directly boosts demand for Hörmann's doors, gates, and related products. In 2024, infrastructure spending in Germany reached €148 billion, a 5% increase from 2023, indicating a robust market for Hörmann. This trend is expected to continue through 2025, supported by EU funding initiatives.

- 2024 German infrastructure spending: €148 billion.

- Year-over-year growth in spending: 5%.

- EU funding impact: Supports ongoing project development.

International Relations and Geopolitical Events

Hörmann, with its global presence, faces significant impacts from international relations and geopolitical events. Tensions and conflicts can disrupt supply chains, as seen with the Russia-Ukraine war, causing material shortages and price hikes. For instance, the Baltic Dry Index, a measure of shipping costs, surged to over 5,000 points in late 2024 due to these disruptions.

Energy prices, crucial for manufacturing, are also sensitive to geopolitical instability. The price of Brent crude oil fluctuated significantly, reaching over $90 per barrel in early 2025 amidst Middle East conflicts. These fluctuations directly affect Hörmann’s production costs and profitability. Economic confidence, vital for investment decisions, is undermined by uncertainty.

This can lead to decreased demand in key markets. Hörmann must actively monitor these global dynamics. The company needs to adapt its strategies to mitigate risks and seize opportunities arising from evolving international landscapes.

- Supply Chain Disruptions: Russia-Ukraine war and Baltic Dry Index surge.

- Energy Price Volatility: Brent crude oil prices and Middle East conflicts.

- Economic Confidence: Impact on investment and demand.

- Strategic Adaptation: Monitoring and response to global changes.

Political factors, including regulations and trade policies, significantly shape Hörmann’s operations. Changes in trade deals and potential tariffs impacts material costs. In 2024, Germany's infrastructure spending increased by 5%, hitting €148 billion. Geopolitical events also influence supply chains.

| Factor | Impact | Example/Data (2024-2025) |

|---|---|---|

| Regulations | Affects product design & costs | EU CPR compliance. |

| Trade Policies | Influences material costs & pricing | Tariff fluctuations; Baltic Dry Index surge. |

| Infrastructure | Boosts demand for products | €148B spending in Germany. |

Economic factors

Global economic growth forecasts for 2024-2025 are moderate, with potential regional variations. The Eurozone, a key market for Hörmann, faced a slowdown in 2023, with growth around 0.5%. A recession can significantly impact construction, as seen during the 2008 financial crisis when construction output dropped sharply. Hörmann's sales are directly affected by fluctuations in construction activity, making economic outlooks crucial for strategic planning.

Inflation and material costs pose significant challenges. Recent data shows inflation at 3.2% in March 2024, impacting manufacturing. Steel prices, crucial for Hörmann, fluctuated, with aluminum up 5% in Q1 2024. These rises directly affect production expenses and profit margins.

As an international firm, Hörmann faces currency exchange rate risks. The Euro's value impacts import costs and export revenues. Fluctuations can alter profitability; for example, a stronger Euro makes exports more expensive. In 2024, the EUR/USD rate has varied significantly, impacting international sales.

Interest Rates and Access to Financing

Interest rates significantly affect construction projects and financing options, directly influencing the demand for Hörmann's products. Higher interest rates can increase borrowing costs, potentially slowing down construction activities and reducing investment in new projects. Conversely, lower rates can stimulate demand by making financing more affordable. As of early 2024, the European Central Bank (ECB) maintained a key interest rate of 4.5%, impacting construction financing.

- ECB's key interest rate at 4.5% in early 2024.

- Changes in rates affect borrowing costs for construction.

- Impacts demand for Hörmann's products.

Supply Chain Disruptions

Disruptions in global supply chains, intensified by the war in Ukraine and the pandemic, pose significant challenges to Hörmann Holding GmbH & Co. KG. These disruptions can lead to increased costs and delays in obtaining essential components and materials, impacting production efficiency. For example, in 2024, the Baltic Dry Index, reflecting the cost of shipping raw materials, saw fluctuations, indicating ongoing volatility. The company must navigate these complexities to maintain profitability and meet customer demands.

- Increased raw material costs due to supply chain bottlenecks.

- Potential delays in project timelines due to component shortages.

- Increased need for inventory management to mitigate risks.

- Pressure on profit margins due to higher operational expenses.

Moderate global growth forecasts and Eurozone slowdown could impact Hörmann. Inflation in March 2024 stood at 3.2%, with steel prices fluctuating. Currency risks like EUR/USD rates affect import costs.

| Economic Factor | Impact on Hörmann | 2024/2025 Data |

|---|---|---|

| Economic Growth | Construction demand, Sales | Eurozone growth ~0.5% (2023), Moderate outlook |

| Inflation | Production costs, Profit margins | 3.2% in March 2024, Steel & Aluminum price changes |

| Currency Exchange | Import/export costs | EUR/USD varied in 2024 impacting international sales. |

Sociological factors

Consumer preferences are evolving, significantly impacting Hörmann's product demand. There's a rise in demand for aesthetically pleasing, secure, and convenient home solutions. Energy efficiency and smart home integration are key drivers. The global smart home market is projected to reach $625.6 billion by 2027.

Population growth and urbanization influence building demand, directly impacting Hörmann. The global population is projected to reach 8 billion by 2024, increasing construction needs. Urbanization rates, especially in Asia, drive commercial and residential construction. Changing age demographics, like an aging population in Europe, shift building preferences towards accessibility, affecting Hörmann's product design and market strategy.

Lifestyle shifts towards convenience boost demand for smart home tech, including automated doors. Research indicates a 15% annual growth in the smart home market. Hörmann adapts by integrating user-friendly features into its products. This approach aligns with consumer preferences for ease of use, influencing product development and sales strategies.

Safety and Security Concerns

Growing societal unease over safety and security significantly influences market dynamics for Hörmann Holding GmbH & Co. KG. Heightened concerns drive demand for secure doors and gates. This is particularly evident in urban areas. The global security market is projected to reach $300 billion by 2025.

- Increased home security spending is expected to grow 7% annually through 2025.

- Commercial security solutions are also seeing a rise, with a 6% growth rate.

Awareness of Sustainability and Ethical Practices

Growing consumer and societal focus on environmental and social issues shapes buying choices, supporting firms with solid sustainability and ethical standards. Consumers increasingly consider a company's environmental impact and social responsibility. This leads to a shift in market dynamics. For instance, in 2024, sustainable product sales grew, reflecting this trend.

- 2024: Sustainable product sales increased by 15% globally.

- Consumers prioritize ethical sourcing and eco-friendly practices.

- Hörmann can leverage this trend by highlighting its green initiatives.

Societal shifts greatly impact Hörmann Holding. Safety concerns drive demand for security products, with the global market projected to hit $300B by 2025. Increased interest in sustainable products is evident, with sales rising in 2024. These trends affect consumer choices, and company strategies must adapt.

| Factor | Impact on Hörmann | Data |

|---|---|---|

| Security Concerns | Increased Demand | Home security spending expected to grow 7% annually through 2025 |

| Sustainability | Green products demand | Sustainable product sales increased by 15% in 2024 |

| Lifestyle | Smart Home Integration | Smart home market is projected to reach $625.6B by 2027. |

Technological factors

Hörmann can leverage automation, smart home tech, and IoT to enhance doors and operators. This opens doors for innovation and new product lines. The global smart home market is projected to reach $536.8 billion by 2027. Hörmann could integrate smart features, increasing product value and market share.

Hörmann can leverage innovations in materials and manufacturing. This includes using lighter, stronger materials for doors and gates. Advanced techniques like 3D printing can enable customized designs. In 2024, the global smart materials market was valued at $55.8 billion, expected to reach $99.9 billion by 2029. These innovations improve product quality and efficiency.

The digitalization of business processes is crucial, encompassing design, production, and logistics. Hörmann Holding can boost efficiency and stay competitive by embracing digital tools. In 2024, companies saw a 15% increase in digital transformation spending. This shift supports better customer service and streamlined operations.

Development of Sustainable Technologies

Hörmann Holding GmbH & Co. KG must embrace sustainable technologies. These include advancements in energy efficiency and renewable energy integration. Waste reduction in manufacturing is also vital. This aligns with environmental standards and consumer demand. The global green technology and sustainability market is projected to reach $74.6 billion by 2025.

- Energy-efficient doors and automation systems can reduce energy consumption by up to 30%.

- Investment in solar panel installations for its factories, potentially lowering energy costs by 20%.

- Implementing closed-loop recycling systems to minimize waste and improve resource efficiency.

Data Security and Cybersecurity

Hörmann Holding GmbH & Co. KG must prioritize data security and cybersecurity due to increased connectivity. This is crucial for protecting both the company and its customers from cyber threats. The global cybersecurity market is projected to reach $345.7 billion in 2024. Investments in cybersecurity are vital to safeguard sensitive information and maintain operational integrity. Cybersecurity incidents have increased by 38% globally in 2024.

- Cybersecurity market expected to reach $345.7 billion in 2024.

- Cybersecurity incidents increased by 38% globally in 2024.

Hörmann should adopt smart tech for innovative products. Embrace advanced materials and 3D printing to enhance quality and customization. Prioritize digital transformation to streamline processes.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| Smart Home Market | Product Innovation | $536.8B by 2027 (Projected) |

| Smart Materials Market | Product Enhancement | $55.8B in 2024, $99.9B by 2029 (Projected) |

| Digital Transformation Spend | Operational Efficiency | 15% increase in 2024 |

Legal factors

Hörmann Holding GmbH & Co. KG must comply with national and regional building codes. This includes safety regulations and accessibility standards. These regulations impact product design and installation processes. Non-compliance can lead to project delays and financial penalties. In 2024, the construction sector faced over €1.2 billion in fines due to regulatory breaches, highlighting the importance of adherence.

Hörmann Holding GmbH & Co. KG is legally bound by product liability laws in every market it operates within. These laws mandate that products meet specific safety standards, and manufacturers are responsible for any harm caused by defective products. In 2024, product recalls in the construction and manufacturing sectors cost companies an average of $12 million per incident, highlighting the financial risks. Compliance includes rigorous testing and quality control, reflecting a global trend toward stricter product safety regulations.

Hörmann must adhere to labor laws globally. This includes working conditions, wages, and employee rights. In Germany, labor costs are high, with social security contributions adding to the expense. In 2024, the average monthly gross salary in Germany was around €4,100. Compliance is vital to avoid legal issues.

Environmental Laws and Regulations

Hörmann Holding GmbH & Co. KG must comply with environmental regulations concerning emissions, waste, and hazardous substances. These regulations significantly influence manufacturing processes and product design, impacting cost and operational efficiency. Non-compliance risks hefty fines and reputational damage. The company must invest in sustainable practices to meet evolving standards. For example, in 2024, EU environmental compliance costs for manufacturing rose by 7%, reflecting stricter enforcement.

- Emission control technologies can increase production costs by up to 10%.

- Waste disposal regulations can add 5-15% to operational expenses.

- Hazardous substance restrictions influence material choices and product development.

- Failure to comply can result in fines exceeding €100,000 per violation.

Data Protection and Privacy Laws (e.g., GDPR)

Hörmann must comply with data protection laws like GDPR, especially in Europe, to manage customer and employee data securely. Non-compliance can lead to significant fines; for example, GDPR fines can reach up to 4% of annual global turnover. The European data protection market was valued at $10.5 billion in 2023 and is forecast to reach $20.5 billion by 2029. This necessitates robust data security measures and transparent data handling practices to maintain customer trust and legal compliance.

- GDPR fines can be up to 4% of global turnover.

- The European data protection market was $10.5 billion in 2023.

- Forecasted to reach $20.5 billion by 2029.

Hörmann must adhere to building codes, including safety and accessibility regulations; in 2024, construction faced €1.2B in fines for breaches. Product liability laws globally require adherence to safety standards, with recalls costing ~$12M/incident. Labor laws dictate working conditions and wages.

Environmental regulations on emissions, waste, and hazardous substances, impact operations. Non-compliance leads to fines, requiring sustainable practices; EU compliance costs rose 7% in 2024. Data protection laws such as GDPR with fines up to 4% global turnover necessitate robust security, as the European data market will reach $20.5B by 2029.

| Regulation Type | Compliance Impact | Financial Consequence |

|---|---|---|

| Building Codes | Product Design, Installation | Fines exceeding €1.2 Billion in 2024 |

| Product Liability | Safety Standards, Testing | Avg. $12M per Recall Incident |

| Labor Laws | Working Conditions, Wages | Compliance costs vary. In Germany, ~€4,100 monthly gross salary (2024). |

Environmental factors

Climate change is increasing extreme weather events. This affects Hörmann's external products. For instance, in 2024, extreme weather caused $30 billion in US damages. Supply chains may be disrupted.

Resource scarcity and material sustainability are critical. The construction sector faces pressure to adopt eco-friendly practices. For 2024, the demand for sustainable building materials increased by 15%. Hörmann Holding GmbH & Co. KG must prioritize responsible sourcing and sustainable materials to meet evolving environmental standards and consumer preferences. This approach helps mitigate risks and enhances long-term viability.

Hörmann Holding GmbH & Co. KG faces scrutiny regarding energy consumption in its manufacturing. The company actively works to decrease energy use and improve the efficiency of its products. In 2024, the focus is on offering energy-efficient doors and automation systems. This aligns with the growing demand for sustainable building solutions. Expect further investments in eco-friendly practices.

Waste Management and Recycling

Hörmann Holding GmbH & Co. KG must prioritize waste management and recycling to reduce its environmental footprint. This includes efficient waste handling during manufacturing and considering end-of-life product management. Effective recycling programs can lower disposal costs and enhance the company's sustainability profile. By reducing waste, Hörmann can improve its resource efficiency and meet growing environmental regulations.

- In 2023, the global recycling rate for construction and demolition waste was around 50%.

- European Union targets for recycling of construction and demolition waste are set at 70% by 2020.

- Companies adopting circular economy models often report cost savings of 10-20% due to waste reduction.

Carbon Emissions and Climate Protection Strategies

Hörmann Holding GmbH & Co. KG faces growing pressure to curb carbon emissions across its operations. Climate change concerns and stricter regulations necessitate the adoption of climate protection strategies. The company must focus on reducing emissions from production and logistics. Offering carbon-neutral products can enhance its market position.

- EU's Emission Trading System (ETS) covers energy-intensive industries, potentially impacting production costs.

- The global carbon market was valued at $846 billion in 2023, demonstrating the financial implications of carbon reduction.

- Companies are increasingly setting science-based targets to reduce emissions, following the Science Based Targets initiative.

Environmental factors significantly shape Hörmann Holding GmbH & Co. KG's operations, from extreme weather's impact on external products to resource scarcity influencing material sourcing.

Sustainability and carbon reduction efforts are increasingly critical, driven by evolving regulations and consumer demand. In 2024, the sustainable building materials market grew, reflecting these shifts.

Hörmann must adapt to climate change, prioritizing eco-friendly practices, waste management, and reducing its carbon footprint. Effective waste management programs and carbon reduction strategies are crucial.

| Environmental Aspect | Impact | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change | Increased extreme weather; supply chain disruptions | US extreme weather damage ~$30B (2024); focus on weather-resistant products. |

| Resource Scarcity | Pressure for sustainable materials | 15% demand increase for sustainable materials (2024); prioritize responsible sourcing. |

| Energy Consumption | Need for energy-efficient manufacturing | Investment in energy-efficient doors and automation (2024); growing sustainable demand. |

PESTLE Analysis Data Sources

The PESTLE Analysis relies on data from government agencies, economic databases, industry reports, and international organizations. This ensures accuracy and reliability in assessing external factors.