Honest Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Honest Bundle

What is included in the product

Strategic guide, analyzing Stars, Cash Cows, Question Marks, and Dogs.

Export-ready design for quick drag-and-drop into PowerPoint, eliminating time-consuming manual chart recreation.

What You’re Viewing Is Included

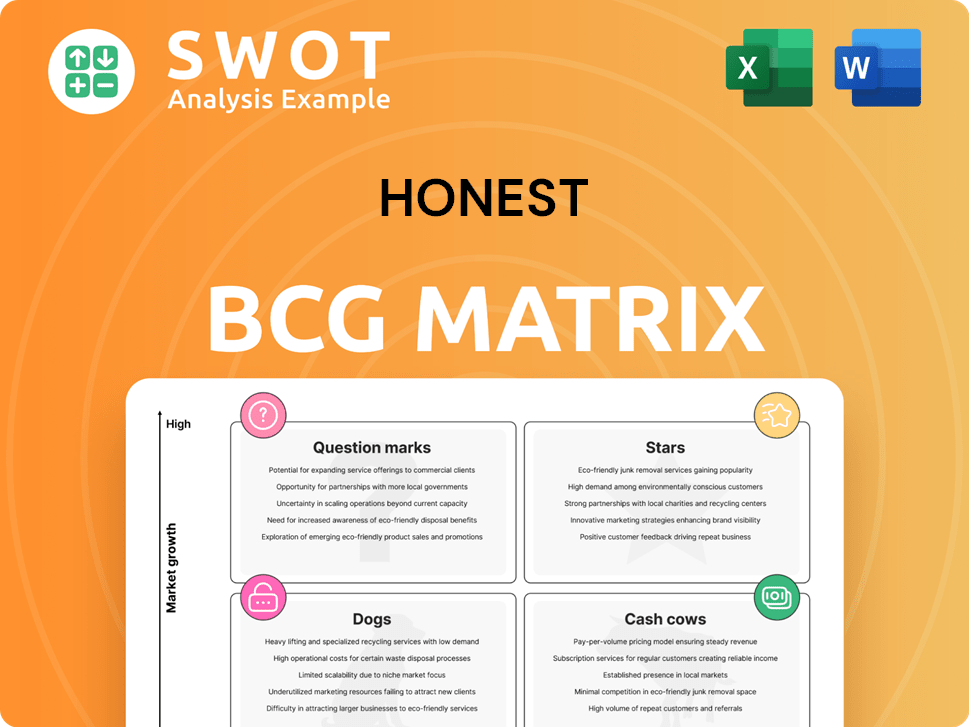

Honest BCG Matrix

This preview showcases the complete BCG Matrix you'll download after purchase. It's a fully functional, ready-to-use report for strategic planning and decision-making, free of hidden content or watermarks.

BCG Matrix Template

See how this company's products fit into the BCG Matrix: Stars, Cash Cows, Dogs, or Question Marks. Understanding this framework is crucial for strategic investment decisions. This is just a glimpse of the overall strategy. Buy the full BCG Matrix to reveal detailed quadrant placements and actionable recommendations.

Stars

The Honest Company's wipes portfolio, led by Clean Conscious wipes, holds the top spot in the natural wipes market. This achievement is supported by strong sales velocities and consumer loyalty. In Q3 2024, wipes sales increased by 15%, driven by larger pack sizes. Repeat purchases are a key factor. The company's success in wipes showcases strong market performance.

Baby apparel is a star for Honest Company, driving revenue. In 2024, this segment's growth was significant, reflecting consumer demand for sustainable products. The focus on clean, eco-friendly baby clothes is key. Consumer preference for sustainable options is increasing. In 2023, the global market size was estimated at $55.7 billion.

The Honest Company excels in digital channels, with a strong online presence. Consumption growth is notable, especially with Amazon, its biggest digital customer. This showcases brand strength and effective e-commerce tactics. In 2024, online sales grew by 15%, driven by digital initiatives. This positions the company well for continued digital expansion.

Sensitive Skin Collection

The Sensitive Skin Collection is a "Star" in The Honest Company's BCG Matrix. Consumption nearly doubled year-over-year, indicating strong demand. This growth is driven by increased awareness of skin sensitivities. The Honest Company's clean ingredients align with consumer preferences. In Q3 2024, the skincare category saw a 35% revenue increase.

- Consumption growth nearly doubled year-over-year.

- Skincare category revenue increased 35% in Q3 2024.

- Driven by consumer demand for gentle products.

- Aligns with the preference for clean ingredients.

Brand Maximization Initiatives

The Honest Company's Brand Maximization efforts are key. They expand availability and refine pricing. Innovation and marketing investments boost the brand. In 2023, revenue grew by 10% due to these strategies. This approach supports continued market leadership.

- Increased revenue growth.

- Higher household penetration rates.

- Enhanced brand awareness.

- Strategic marketing investment.

Stars in the Honest BCG Matrix show high growth. They boast significant revenue increases, such as a 35% rise in skincare in Q3 2024. Key examples include baby apparel and the Sensitive Skin Collection, driven by strong consumer demand.

| Product | Growth Rate (2024) | Key Driver |

|---|---|---|

| Baby Apparel | Significant | Demand for sustainable products |

| Sensitive Skin Collection | Nearly doubled YoY | Increased skin sensitivity awareness |

| Wipes | 15% | Larger pack sizes & Repeat purchases |

Cash Cows

Diapers remain a crucial revenue source for The Honest Company. In 2023, diapers and wipes contributed 63% to the company's total revenue. The existing customer base supports this segment's strength. The company focuses on innovation to boost diaper performance and recapture market share.

The Honest Company's household and wellness products are a consistent revenue source. In 2023, they represented 11% of its total revenue. This segment leverages the company's strong brand image, known for clean and sustainable offerings. Although growth isn't explosive, it offers financial stability.

The Honest Company's retail partnerships, including Target and Walmart, are vital for its consistent revenue stream. These alliances offer broad consumer access, supporting steady sales. In Q3 2023, The Honest Company reported net sales of $76.8 million, with retail accounting for a significant portion. Leveraging these established channels is key to maintaining cash flow and funding future growth strategies.

Sustainability Initiatives

The Honest Company's dedication to sustainability appeals to consumers seeking eco-friendly products. This focus boosts its brand image, drawing in environmentally-aware customers. Ongoing investment in sustainable practices can strengthen brand loyalty. In 2024, the global green products market reached $250 billion, showing growth.

- Increased brand value through eco-friendly practices.

- Attracts customers prioritizing sustainability.

- Strengthens brand loyalty and market position.

- The 2024 green product market is expanding.

Subscription Services

The Honest Company capitalizes on subscription services for items like diapers and household cleaners, creating a dependable revenue flow and boosting customer loyalty. These subscriptions provide convenience and potential cost savings, encouraging consistent purchases. The company can improve customer retention and secure steady cash flow by refining its subscription model. In 2024, subscription-based businesses show strong growth, with a market size expected to reach $1.5 trillion.

- Recurring revenue is a key benefit of subscription services.

- Customer loyalty is fostered through convenience and savings.

- Predictable cash flow is generated via optimized models.

- Subscription market size is substantial, reaching $1.5T in 2024.

Cash Cows are core for The Honest Company's financial stability, contributing significantly to revenue and cash flow.

Diapers, household items, and retail partnerships generate steady income, enhancing their cash flow.

Subscription services fortify their predictable revenue stream, boosting customer loyalty in a market valued at $1.5T in 2024.

| Segment | 2023 Revenue Contribution | Key Strategy |

|---|---|---|

| Diapers & Wipes | 63% | Innovation, customer retention |

| Household & Wellness | 11% | Leverage brand image |

| Retail Partnerships | Significant | Expand distribution |

Dogs

The Honest Company is scaling back its direct-to-consumer (DTC) channel. DTC proved less profitable than partnerships. In 2024, The Honest Company's net revenue decreased by 1.1% year-over-year. This shift aims to boost profitability. Focusing on efficient sales is key for the company's growth.

Some Honest Company product lines might be struggling, not bringing in much money or profit. These could need a lot of investment to improve or might be sold off. In 2024, The Honest Company reported net sales of $299.7 million. Finding and fixing these underperforming lines is key for the company.

If The Honest Company had international ventures that underperformed, these ventures would be "Dogs" in the BCG matrix. These ventures can consume resources without generating significant returns. In 2024, international expansions often require substantial investment. Reassessing and potentially exiting underperforming ventures is crucial for financial health.

Products with Declining Market Share

Dogs are products with declining market share, often due to competition or shifting consumer tastes. These items demand substantial investment to recover or may be phased out. For instance, in 2024, the U.S. pet food market saw some brands lose ground to newer, healthier options. Regular market analysis is crucial for managing these products effectively.

- Decline in market share due to competition or changing consumer preferences.

- Require significant investment or potential discontinuation.

- Regular monitoring of market trends is essential.

- Example: Certain dog food brands lost market share in 2024.

Inefficient Marketing Campaigns

Marketing campaigns that don't meet ROI expectations are often "Dogs". Inefficient campaigns squander resources and fail to draw in customers. Analyzing and refining marketing strategies is key to boosting efficiency and sales. For example, in 2024, many companies saw their digital ad spend yield lower returns due to rising ad costs.

- Ineffective campaigns lead to wasted budgets.

- Poorly targeted ads have low conversion rates.

- Lack of data analysis prevents optimization.

- Inefficient campaigns damage brand reputation.

Dogs in the Honest BCG Matrix represent ventures with low market share and low growth. These underperforming areas, like certain product lines or international ventures, drain resources. In 2024, a decline in digital ad ROI impacted some companies, indicating dogs.

| Characteristic | Implication | 2024 Example |

|---|---|---|

| Low Market Share | Requires significant investment or discontinuation | Some dog food brands faced declining market share. |

| Low Growth | Consumes resources without substantial returns | Ineffective marketing campaigns with low ROI. |

| Strategic Action | Regular market analysis and strategic realignment | Reassessing underperforming international ventures. |

Question Marks

The Honest Company's new beauty and personal care products are question marks. They have high growth potential but uncertain market share. In 2024, The Honest Company invested heavily in marketing. These new launches need significant distribution to succeed. Their future success will determine if they become stars or dogs.

The Honest Company's move into dollar and club stores is a 'Question Mark' in its BCG Matrix, aiming for underserved markets. This strategy requires meticulous planning to align products with new consumer needs. Success hinges on marketing and distribution effectiveness within these channels. In 2024, the company's revenue was $303.9 million, with a gross margin of 35.4% highlighting the need for careful resource allocation in these new ventures.

The Honest Company's eco-friendly product launches are 'Question Marks'. These need R&D investment and clear communication. Success hinges on meeting consumer demand for sustainability. In 2024, the sustainable products market grew, with a 10% increase.

Beauty Category Growth

The beauty category at The Honest Company is a question mark, with growth potential but a smaller revenue share than baby care. To compete effectively, The Honest Company needs to invest more in innovation and marketing, especially given the crowded beauty market. Though the focus on clean and sustainable products aligns with consumer preferences, differentiation is key.

- In 2023, The Honest Company's net revenue was $306.7 million.

- Baby care products make up a larger portion of revenue compared to beauty.

- The beauty market is highly competitive, requiring strong brand positioning.

Partnerships with Influencers

The Honest Company's influencer partnerships fit the 'Question Mark' category in the BCG Matrix, as they aim to boost brand visibility and sales. These collaborations involve carefully choosing influencers who resonate with the company's values and target market. Success hinges on the influencers' ability to effectively promote The Honest Company's products and connect with their audiences. In 2024, influencer marketing spending is projected to reach $24.5 billion, demonstrating the strategy's potential.

- Focus is on enhancing brand visibility and sales

- Requires aligning with brand values and target audiences

- Dependent on influencers' promotional skills

- Influencer marketing is expected to reach $24.5 billion in 2024

Honest Company's 'Question Marks' are new ventures needing significant investment. Success depends on strategic execution in competitive markets. Effective marketing and distribution are critical for these products to grow. The company's overall 2024 focus is on boosting revenue and profitability.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Total company sales | $303.9M |

| Gross Margin | Profit after cost of goods | 35.4% |

| Market Growth | Sustainable Product | +10% |

BCG Matrix Data Sources

This BCG Matrix leverages financial statements, market research, and competitor analysis for accurate quadrant placement.