HP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HP Bundle

What is included in the product

Analysis of HP's business units across BCG Matrix quadrants.

Printable summary optimized for A4 and mobile PDFs. Generate actionable insights from anywhere.

Full Transparency, Always

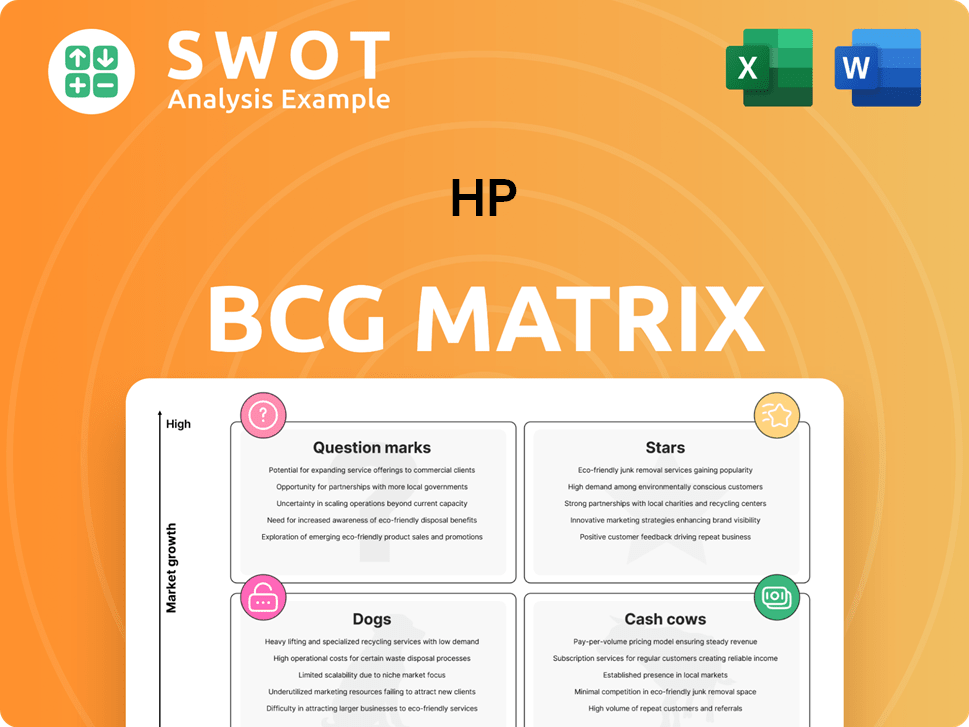

HP BCG Matrix

The displayed BCG Matrix preview is identical to the document you'll obtain upon purchase. Experience the full strategic analysis and market insights, immediately ready for use and without any alterations. Your fully editable and customizable report awaits instant download and implementation in your work.

BCG Matrix Template

This snapshot reveals the power of the BCG Matrix, offering a glimpse into product portfolio dynamics. See how this company's offerings are categorized: Stars, Cash Cows, Dogs, or Question Marks. Understand the core concepts behind this crucial strategic tool. The preview scratches the surface, giving you a taste of the analysis. Purchase the full BCG Matrix for a comprehensive view, detailed recommendations, and actionable strategies!

Stars

HP's AI-powered PCs are emerging Stars in its portfolio, showing substantial growth. These PCs, designed for enhanced collaboration and productivity, are gaining traction. Sales in the AI PC category are surging, with HP well-placed to benefit. In Q1 2024, HP's Personal Systems revenue was $7.0 billion, a 3% increase year-over-year, driven by strong demand for commercial PCs, including AI-enhanced models.

HP's commercial personal systems are shining as Stars in its portfolio. In fiscal year 2024, HP saw substantial growth in this segment, fueled by strong refresh cycles and public sector demand. Specifically, the commercial PC business grew significantly year-over-year. This reflects HP's success in capturing market share and its strategic focus on this high-growth area.

The gaming PC and peripherals segment is a star for HP, reflecting robust demand. This segment saw double-digit growth in FY2024, highlighting its strong market presence. HP capitalizes on the rising consumer PC market fueled by gaming. The introduction of new laptops, like the Omen Max 16, supports this focus.

Workplace Peripherals

HP's focus on workplace peripherals addresses hybrid work needs. Their Workforce Experience Platform boosts employee satisfaction and tackles IT issues proactively. This unified approach enhances customer and partner experiences across HP's portfolio. For example, in 2024, HP's PC revenue was $12.9 billion.

- Workplace peripherals are key for hybrid work.

- Workforce Experience Platform improves satisfaction.

- Unified approach benefits customers and partners.

- 2024 PC revenue: $12.9 billion.

High-End Commercial AI Laptops

HP's EliteBook series, such as the EliteBook X and Ultra, are prime examples of high-end commercial AI laptops, designed for today's professionals. These laptops utilize Intel Core Ultra processors and HP AI Companion for improved collaboration and productivity. HP is aiming for leadership in the premium laptop market by focusing on accessible AI features and cutting-edge designs. In Q4 2023, HP's PC revenue was $13.9 billion.

- HP's EliteBook series includes AI-enhanced features.

- They use the latest Intel Core Ultra processors.

- Focus on accessible AI features and innovative designs.

- HP's Q4 2023 PC revenue was $13.9 billion.

HP's Stars, like AI-powered and commercial PCs, show strong growth and market presence. These segments saw substantial revenue increases in 2024, reflecting strategic focus. The gaming PC segment continues to shine with double-digit growth in fiscal year 2024, as consumer demand rises.

| Segment | FY2024 Performance | Key Drivers |

|---|---|---|

| AI PCs | Strong growth, Q1 Personal Systems revenue: $7.0B | Enhanced collaboration & productivity, rising sales |

| Commercial PCs | Significant growth, strong refresh cycles | Public sector demand, market share gains |

| Gaming PCs | Double-digit growth | Rising consumer PC market, new product launches |

Cash Cows

HP's traditional printing market is a cash cow, leveraging a strong brand reputation. The company is recognized for quality and reliability, maintaining a significant market share. In 2024, HP's printing revenue was approximately $18.9 billion. It continues to generate substantial cash flow, fueling investments in growth areas.

HP's printing supplies are a cash cow, generating consistent revenue. In 2024, supplies accounted for a significant portion of HP's net revenue. This segment benefits from a large printer base and ongoing demand. HP's strategies help maintain healthy margins.

HP's managed print services are a cash cow, offering recurring revenue. These services enhance customer relationships and provide partners with a competitive edge. HP invests in subscription models like Instant Ink and the All-In Plan. In 2024, HP's printing revenue was approximately $4.6 billion, with managed services contributing significantly.

Consumer Hardware

HP's consumer hardware segment is a cash cow, showcasing robust performance and expanding market share. This success is fueled by HP's strong brand recognition and extensive distribution. In 2024, HP's PC revenue reached $12.9 billion, a testament to its market dominance. This segment offers stability and reinforces HP's position as a leader.

- Market share growth in key product categories.

- Consistent revenue streams from consumer hardware sales.

- Strong brand equity driving consumer loyalty.

- Efficient supply chain and distribution networks.

Consumer Subscriptions

HP's consumer subscriptions, including Instant Ink, are a cash cow, generating double-digit revenue growth. These subscriptions offer recurring revenue, bolstering customer loyalty and predictability. This strategy aligns with the market's shift towards subscription models, giving HP an edge.

- Instant Ink subscriptions have grown significantly, with millions of subscribers.

- Subscription services contribute substantially to HP's overall revenue.

- Customer retention rates for subscribers are notably high.

HP's cash cows, like printing and hardware, generate steady profits. Printing revenue in 2024 was about $18.9B, a key source. Consumer hardware added $12.9B, showcasing strong market presence.

| Cash Cow | 2024 Revenue (approx.) | Key Feature |

|---|---|---|

| Printing | $18.9B | Strong Brand, Market Share |

| Supplies | Significant Portion | Consistent, Large Base |

| Consumer Hardware | $12.9B | Market Dominance |

Dogs

The desktop PC market is shrinking, and HP's market share is suffering. Global traditional PC shipments fell, signaling a tough market. HP's low-cost laptop sales are also down, with rivals gaining ground. In Q3 2023, PC shipments dropped, affecting HP's position.

HP's low-cost laptop presence is shrinking, with rivals Acer and Lenovo gaining ground. The average selling price of HP's budget laptops is less competitive. In 2024, HP's market share in this segment is around 18%, facing challenges. Strategic changes are vital for HP to recover market share in this competitive space.

In China, the commercial printing sector is struggling, which affects HP's earnings. The competitive pricing environment in these areas makes things even harder for HP. For instance, HP's printing revenue in Asia-Pacific fell by 9% in the fourth quarter of fiscal year 2024. HP must use specific plans to overcome these regional market issues.

Hardware Manufacturing (Legacy Products)

HP's legacy hardware manufacturing, a "Dog" in the BCG matrix, struggles. Total hardware revenue is declining, signaling shrinking market share. Manufacturing inefficiencies further squeeze profitability, impacting the bottom line. HP must strategically address these issues to revitalize financial performance.

- Total hardware revenue decline reflects challenges.

- Manufacturing inefficiencies hurt profitability.

- Strategic adjustments are necessary.

Outdated or Unsupported Software

Outdated or unsupported software represents a "Dog" in HP's BCG matrix. These software offerings often struggle to attract new customers. They generate little revenue, and require significant maintenance. HP should either sell or shut down these products.

- Limited market appeal.

- Minimal revenue generation.

- High maintenance costs.

- Strategic misalignment.

HP's "Dogs" in the BCG matrix include declining hardware and outdated software. These areas suffer from shrinking market share, low revenue, and high maintenance expenses. In Q4 2024, hardware revenue dropped by 6%. HP must consider divestiture to improve financial performance.

| Category | Description | Financial Impact (2024) |

|---|---|---|

| Hardware Revenue Decline | Shrinking market share in hardware. | -6% in Q4 2024 |

| Outdated Software | Limited market appeal, high maintenance. | Minimal revenue |

| Strategic Action | Divestiture or shut down. | Improve profitability |

Question Marks

HP's 3D printing segment is a Question Mark in its BCG matrix. This segment is in a high-growth market, yet HP's market share is low. To succeed, HP must increase its market penetration. In 2024, 3D printing contributed a small portion of HP's overall printing revenue, signaling a need for more investment.

HP's IoT involvement presents risks and opportunities, needing strategic investments. A clear strategy for IoT initiatives is crucial. Success depends on innovation and delivering customer value. In 2024, the IoT market is projected to reach $1.1 trillion, with significant growth potential for HP. HP's revenue from IoT solutions could increase by 15% annually.

HP's AI-driven services, like the Workforce Experience Platform, are a "Question Mark" in its BCG Matrix. These services, while promising growth, need significant investment to capture market share. For example, the global AI market is projected to reach $1.81 trillion by 2030. HP must prove their value effectively.

Sustainable Printing Technologies

HP's focus on sustainable printing, including recyclable ink cartridges and energy-efficient printers, is a strategic move. It allows HP to tap into the growing market of environmentally conscious consumers. Effective promotion of these technologies is key to capturing this segment.

- In 2023, HP reported that over 80% of its ink cartridges are now made with recycled content.

- The company’s energy-efficient printers can reduce energy consumption by up to 50% compared to older models.

- HP's sustainability efforts have led to a 15% increase in sales of its eco-friendly products in 2024.

- HP aims to have 100% of its packaging sourced from sustainable forests by 2025.

Expansion in Emerging Markets

HP's foray into emerging markets, like India, is a strategic move for growth, but faces hurdles. Competition and market penetration pose significant challenges. Adapting strategies to local conditions is crucial for success. Understanding and catering to local customer needs is key for HP in these markets.

- India's PC market grew by 15% in 2024, a key target for HP.

- HP's revenue in Asia-Pacific grew by 8% in 2024, reflecting expansion efforts.

- Adapting products for affordability and local languages is a key strategy.

- Competition includes local and international brands like Lenovo and Dell.

HP's sustainability initiatives are crucial; they focus on eco-friendly products. These efforts tap into the growing market of environmentally conscious consumers. In 2024, sales of eco-friendly products rose by 15%.

| Sustainability Aspect | Details | 2024 Impact |

|---|---|---|

| Recycled Content | Over 80% of ink cartridges | Reduced waste & environmental footprint. |

| Energy Efficiency | Printers reduce energy up to 50% | Lowered operational costs for users. |

| Sales of Eco-Friendly | Increased demand | 15% sales growth in 2024 |

BCG Matrix Data Sources

This HP BCG Matrix utilizes market research, competitor financials, and product sales data to position each business unit.