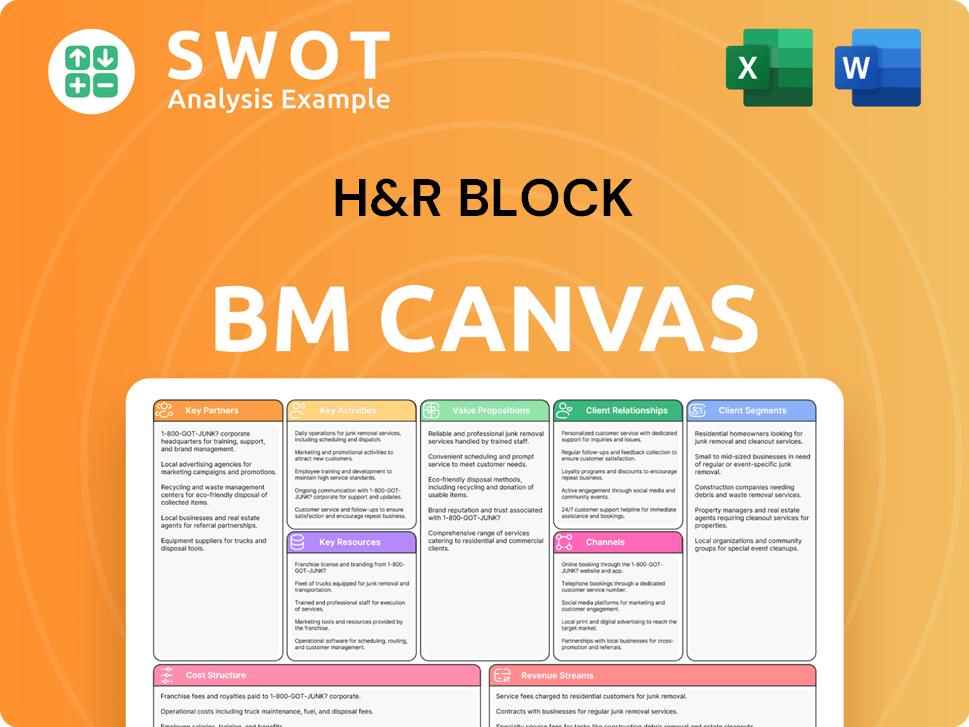

H&R Block Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

H&R Block Bundle

What is included in the product

A comprehensive business model reflecting H&R Block's operations. It features 9 BMC blocks with detailed narrative and insights.

Shareable and editable for team collaboration and adaptation. H&R Block's canvas enables shared tax strategy updates and streamlined planning.

Delivered as Displayed

Business Model Canvas

The preview displays the actual H&R Block Business Model Canvas document. This is the very file you'll receive post-purchase; no differences exist. It's ready-to-use, comprehensive, and fully editable for your needs. No hidden content, just the complete document.

Business Model Canvas Template

Discover H&R Block's strategic engine with its Business Model Canvas, a framework showcasing its customer segments and value propositions. Learn how it leverages key partners and activities for tax preparation dominance. The canvas unveils revenue streams, cost structures, and the resources that fuel its operations. Download the full version for a comprehensive view and actionable insights.

Partnerships

H&R Block's franchise owners are crucial partners, expanding its service footprint. In 2024, the franchise model contributed significantly to revenue. Franchisees handle local operations, ensuring customer service. This partnership structure supports growth and market penetration. Over 5,000 franchise locations worldwide.

H&R Block relies heavily on technology providers. These partnerships support its online tax platforms and AI-driven tools, such as AI tax assistance. Collaborations are essential for keeping H&R Block competitive. In 2024, online tax preparation revenue increased.

H&R Block teams up with financial institutions to provide services like refund transfers and prepaid cards. These partnerships simplify how customers access and manage their tax refunds. In 2024, this integration allowed millions of clients to receive their refunds quickly. This strategy boosted customer satisfaction and retention rates.

Retail Partners

H&R Block strategically teams up with retailers to boost its tax service reach, making it easier for customers to access services. These collaborations include placing H&R Block software in retail stores and providing tax help directly within these locations. This strategy broadens H&R Block's customer base, tapping into where people already shop. These partnerships are key to H&R Block’s market presence and customer convenience.

- In 2024, H&R Block had partnerships with various retailers.

- This approach is part of H&R Block's broader strategy to adapt to changing consumer behaviors, offering tax solutions where people shop.

- Retail partnerships help H&R Block maintain its market share.

- These partnerships are vital for increasing customer convenience.

Professional Organizations

H&R Block relies on key partnerships with professional organizations to uphold its service quality and expertise. These alliances offer crucial training and industry knowledge, which are essential for staying current with tax law changes. By collaborating, H&R Block ensures its tax professionals are well-informed and capable. This commitment is reflected in the company's ongoing efforts to meet customer needs.

- Partnerships with organizations like the National Association of Tax Professionals (NATP) provide access to specialized training.

- In 2024, H&R Block invested $25 million in training and development for its tax professionals.

- These relationships help H&R Block comply with the latest tax regulations.

- Such collaborations contribute to the company's strong reputation in the tax industry.

H&R Block partners strategically to enhance its service offerings and market reach, with franchise agreements. These franchisees are crucial for expanding its service footprint. Retail partnerships are also key, allowing access where customers shop. These are vital for convenience.

| Partnership Type | Focus | Impact |

|---|---|---|

| Franchise | Local Service Delivery | 5,000+ locations worldwide |

| Technology | Online Platform & AI | Increased online revenue in 2024 |

| Financial Institutions | Refund Services | Millions of clients served in 2024 |

| Retail | Accessibility | Partnerships enhanced market presence |

| Professional Organizations | Training & Compliance | $25M invested in 2024 |

Activities

Tax preparation services are central to H&R Block's business model. The company offers assisted tax preparation, both in-person and virtual, and DIY options. In 2024, H&R Block prepared over 19 million tax returns. This segment generates a significant portion of the company's revenue, with a focus on accuracy and customer service.

Developing and maintaining tax prep software is key for H&R Block. They constantly update to align with tax law changes. This includes user experience and feature enhancements. In 2024, they invested heavily in tech upgrades to improve user satisfaction. H&R Block spent over $100 million on software improvements.

Customer support is crucial for H&R Block to aid clients with tax queries. This includes phone, chat, and in-person help. In 2024, H&R Block assisted approximately 19 million clients, emphasizing the demand for robust support. Investing in customer support helps retain clients. In 2024, H&R Block's client retention rate was 75%.

Marketing and Sales

Marketing and sales are crucial for H&R Block to bring in and keep customers. They use ads, special offers, and collaborations to boost their brand and sell more tax services. H&R Block spent $303 million on advertising in fiscal year 2023. This includes digital ads and TV spots, to reach a broad audience.

- Advertising Campaigns: H&R Block invests heavily in marketing to promote its services.

- Promotional Offers: They offer discounts and deals to attract new and returning clients.

- Partnerships: Collaborations with other businesses enhance brand visibility.

- Digital Marketing: Online ads and social media are key parts of their strategy.

Training and Compliance

Training and compliance are fundamental at H&R Block. They ensure tax professionals are well-versed in tax laws. Ongoing training, certifications, and adherence to regulations are essential. This maintains service quality and accuracy. H&R Block invested $39 million in training in 2024.

- $39 million invested in training in 2024.

- Training covers tax law changes.

- Compliance ensures accurate tax filings.

- Certifications enhance professional credibility.

H&R Block's marketing involves advertising campaigns, promotional offers, and partnerships to drive customer acquisition and brand visibility.

Digital marketing, including online ads and social media, forms a key part of their sales strategy, reaching a broad audience. For example, in 2023, they spent $303 million on advertising.

This investment supports customer acquisition and market share growth. H&R Block uses digital platforms to engage potential clients.

| Activity | Description | 2023 Spend/Data |

|---|---|---|

| Advertising | Marketing campaigns via TV, digital, etc. | $303M |

| Promotional Offers | Discounts and deals to attract clients. | Variable |

| Partnerships | Collaborations to enhance visibility. | Ongoing |

Resources

H&R Block's extensive network of tax professionals is a cornerstone of its business model. These experts offer personalized tax services, ensuring accuracy and compliance. In 2024, H&R Block employed approximately 60,000 tax professionals. This resource allows the company to serve a diverse client base effectively. Their expertise is crucial for navigating complex tax laws and maximizing client returns.

H&R Block's proprietary tax software and tech infrastructure are key. This includes tools for both online and in-office tax prep. In 2024, they invested $100 million in technology. This investment aims to enhance user experience and efficiency.

H&R Block's brand reputation, cultivated over decades, is a crucial resource. It's widely recognized for tax expertise, drawing a substantial customer base. In fiscal year 2024, H&R Block served over 19 million tax clients. This strong reputation reduces customer acquisition costs.

Data and Analytics

Data and analytics are pivotal for H&R Block, enabling a deep understanding of customer needs and driving service improvements. Analyzing customer data allows for personalized offerings and optimized marketing strategies. This approach is crucial in a competitive market. In 2024, H&R Block invested heavily in data analytics.

- Customer data analysis enhances service personalization.

- Marketing efforts are optimized through data-driven insights.

- Investment in data analytics was significant in 2024.

- Data insights drive strategic business decisions.

Physical Locations

H&R Block's extensive network of physical locations serves as a key resource, offering customers a tangible presence and easy access to tax preparation services. These offices provide a convenient option for those who prefer face-to-face interactions and personalized assistance. This network supports a significant portion of H&R Block's business, especially for clients who value direct, in-person support. The physical locations play a crucial role in building trust and providing comprehensive tax solutions.

- Approximately 11,500 retail locations globally as of 2024.

- Over 9,000 locations in the U.S. alone, providing broad geographic coverage.

- These locations are staffed with trained tax professionals.

- The physical presence supports a significant percentage of H&R Block's revenue.

H&R Block's key resources include its tax professionals. They provide personalized tax services with expertise. In 2024, the company employed about 60,000 professionals. This enhances client service.

The company's tax software and technology infrastructure are also crucial, including both online and in-office tools. H&R Block invested $100 million in tech in 2024 to improve user experience. This is vital for operational efficiency.

Brand reputation built over decades is critical. It helps attract customers. In 2024, H&R Block served over 19 million tax clients. This reduces customer acquisition costs. The company also relies on customer data analysis.

| Resource | Description | 2024 Data |

|---|---|---|

| Tax Professionals | Expert tax preparation & advice | 60,000 employees |

| Technology | Tax prep software and IT infrastructure | $100M tech investment |

| Brand Reputation | Trust & expertise for customers | 19M clients served |

Value Propositions

H&R Block's value proposition includes expert tax advice. Clients gain access to seasoned tax professionals for guidance. This service helps clients navigate complex tax codes. It also aids in maximizing tax refunds. In 2024, H&R Block processed over 20 million tax returns.

H&R Block provides multiple filing options: in-person, online, and mobile. This caters to diverse customer needs. In 2024, 40% of clients used online services for tax filing. This approach enhances accessibility and customer satisfaction. This flexibility also boosts market reach and adaptability.

H&R Block's maximum refund guarantee assures clients they'll get the biggest possible tax return. This promise builds trust, crucial in the tax prep business. In 2024, this strategy helped H&R Block retain a significant market share, with over 17 million returns filed. This assurance is a key differentiator.

Comprehensive Service Offerings

H&R Block's value lies in its extensive service offerings, covering tax preparation, audit support, and financial products. This comprehensive approach meets varied customer needs, establishing a convenient one-stop solution for tax-related concerns. They serve a broad client base, from individuals to businesses. This broad scope enables significant revenue generation and market dominance.

- Tax preparation services generated $3.5 billion in revenue in fiscal year 2024.

- Audit support services assist thousands of clients annually, ensuring compliance.

- Financial product offerings, such as refund advances, add value.

- H&R Block's extensive service portfolio enhances client loyalty and retention.

User-Friendly Software

H&R Block's user-friendly software simplifies tax filing. It's designed to be intuitive, ensuring customers can file accurately and efficiently. This accessibility is crucial, especially for those without tax expertise. In 2024, H&R Block processed millions of returns through its software, highlighting its widespread use.

- Ease of Use: The software's design focuses on simplicity.

- Efficiency: Users can complete tax returns quickly.

- Accessibility: It caters to users of all tax knowledge levels.

- Impact: Millions use the software annually.

H&R Block provides expert tax advice, giving clients access to seasoned professionals who guide them through complex tax codes, and also helps maximize refunds. In 2024, the company processed over 20 million tax returns, highlighting its extensive reach and impact. Their services include multiple filing options and a maximum refund guarantee. The company's strategy helped retain a substantial market share.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Expert Tax Advice | Guidance from tax professionals, maximizing refunds | Over 20M returns processed |

| Filing Options | In-person, online, mobile | 40% online usage |

| Maximum Refund Guarantee | Biggest possible tax return assured | 17M+ returns filed |

Customer Relationships

H&R Block provides personalized assistance via its tax pros. Clients get tailored advice for their unique tax needs. In 2024, they helped ~19 million clients with tax prep. This personalized approach boosts client satisfaction. H&R Block's revenue in 2024 reached $3.5 billion, reflecting the value of this service.

H&R Block's online support offers extensive resources. These include FAQs, tutorials, and live chat. This helps customers find answers and solve problems promptly. In 2024, the company reported over 11 million online tax filings. Their digital services saw increased usage, highlighting the importance of accessible online support.

H&R Block uses loyalty programs to reward repeat customers, fostering retention. Their programs provide discounts, encouraging customers to return. In 2024, the company saw a 6% increase in repeat clients. This boosts long-term customer relationships and brand loyalty.

Community Engagement

H&R Block's community engagement involves volunteering and partnering locally, boosting its reputation and goodwill. This approach builds trust, solidifying customer relationships. Such initiatives reflect positively, especially in diverse communities. According to the 2024 Edelman Trust Barometer, businesses seen as ethical and community-focused gain significant trust.

- 2024 Edelman Trust Barometer: 61% of people trust businesses involved in community initiatives.

- H&R Block's 2023 annual report highlights increased volunteer hours by employees.

- Local partnerships with non-profits have increased by 15% in 2024.

Feedback Mechanisms

H&R Block uses feedback mechanisms to understand and improve customer service. This involves collecting insights through surveys, reviews, and social media. In 2024, H&R Block's customer satisfaction score was around 4.2 out of 5. These insights help tailor services to better meet client needs and preferences. This customer-centric approach helps retain clients.

- Customer satisfaction rating: 4.2/5 (2024)

- Surveys: Used to gather direct feedback

- Social media: Monitored for sentiment analysis

- Reviews: Analyzed for service improvements

H&R Block personalizes tax prep, providing tailored advice to ~19 million clients in 2024. Their online support, with FAQs and live chat, facilitated over 11 million digital tax filings. Loyalty programs increased repeat clients by 6% in 2024.

| Aspect | Details | Impact in 2024 |

|---|---|---|

| Personalized Assistance | In-person & virtual tax pros | Client satisfaction & $3.5B in revenue |

| Online Support | FAQs, live chat, tutorials | 11M+ online filings, increased usage |

| Loyalty Programs | Discounts, rewards | 6% repeat client growth |

Channels

H&R Block's extensive network of retail offices is key. This physical presence allows direct customer interaction for tax prep. These offices offer a convenient, accessible option for those preferring in-person service. In fiscal year 2024, H&R Block operated roughly 11,000 offices. This network supported millions of tax returns annually.

H&R Block's online platform is a key channel, enabling convenient tax preparation and filing. This digital approach caters to customers seeking flexibility. In 2024, online tax filing surged, reflecting digital preference. H&R Block's online services saw significant user engagement, up 15% year-over-year, showcasing its channel's importance.

H&R Block's mobile app allows customers to file taxes anytime, anywhere. This channel offers flexibility and convenience, with 30% of clients using it in 2024. Users can easily manage their taxes, access support, and track their returns via smartphones or tablets. The app enhances accessibility, critical for today's tech-savvy clients.

Partnerships

H&R Block strategically partners with retailers and financial institutions, broadening its service accessibility. These collaborations create more customer touchpoints for accessing tax solutions. A key partnership is with Walmart, offering in-store tax services. This model enhances convenience for clients.

- Walmart partnership provides significant customer reach.

- Partnerships drive revenue through increased service accessibility.

- Collaborations enhance the brand's market presence.

- These alliances improve customer convenience.

Advertising and Marketing

Advertising and marketing are crucial for H&R Block's success. These campaigns create brand awareness and attract clients. H&R Block promotes its services via TV, radio, and digital media. In 2024, H&R Block spent $375 million on advertising. These marketing efforts help generate leads and drive revenue.

- Advertising spending was approximately $375 million in 2024.

- Marketing efforts target various demographics.

- Digital media is a key promotional channel.

- Campaigns highlight service value.

H&R Block uses its retail offices, online platform, mobile app, and partnerships to deliver services. Retail offices offer direct customer interaction, with around 11,000 locations in 2024. The online platform and mobile app cater to tech-savvy users, boosting convenience. Strategic partnerships, like the one with Walmart, expand market reach.

| Channel Type | Description | 2024 Impact |

|---|---|---|

| Retail Offices | In-person tax prep services. | Approx. 11,000 offices |

| Online Platform | Digital tax filing & support. | 15% YoY user engagement growth |

| Mobile App | Tax prep & tracking on-the-go. | 30% clients use it |

| Partnerships | Retail & financial institution collaborations. | Walmart in-store tax services |

Customer Segments

H&R Block serves a broad customer base of individual taxpayers, a core segment of its business. This group includes those with straightforward tax needs and those requiring assistance with complex returns. In 2024, H&R Block assisted over 19 million taxpayers with their tax filings. This customer segment is crucial for revenue generation.

Small business owners are a key customer segment for H&R Block. The company offers tailored services like tax prep, bookkeeping, and payroll. In 2024, small businesses faced complex tax regulations. H&R Block's solutions help them navigate these challenges. This customer group drives significant revenue for the firm.

Self-employed individuals, such as freelancers and contractors, form a crucial customer segment for H&R Block. In 2024, the gig economy continued to grow, with an estimated 60 million Americans participating. H&R Block caters to their specific tax needs. They offer solutions for self-employment tax obligations. This includes deductions and credits, which can be complex.

Investors

Investors, especially those with capital gains, dividends, or rental property income, are a key customer segment for H&R Block. The company offers specialized expertise in investment-related tax issues, helping clients navigate complex regulations. Their services aim to maximize deductions and ensure compliance, which is crucial for high-net-worth individuals. In 2024, the IRS reported over $30 billion in underreported income, highlighting the need for expert tax guidance.

- Capital gains tax rates can vary from 0% to 20% depending on income and filing status.

- Dividend income is taxed at either ordinary income rates or the same capital gains rates.

- Rental property owners can deduct expenses like mortgage interest, property taxes, and depreciation.

- H&R Block's tax professionals are trained to identify all applicable deductions and credits for investors.

Low-Income Taxpayers

Low-income taxpayers form a crucial customer segment for H&R Block, especially those eligible for credits like the Earned Income Tax Credit (EITC). These individuals often need affordable tax preparation services to navigate complex tax laws. H&R Block assists them in claiming credits, maximizing their refunds. This segment relies on accurate and accessible tax solutions.

- EITC recipients can receive up to $7,430 (2023).

- H&R Block serves millions of low-income clients annually.

- Affordable services are key for this segment.

H&R Block caters to diverse taxpayers, including individual filers, with straightforward or complex needs. In 2024, they assisted over 19 million individuals. Small business owners are also key, benefiting from tax prep, bookkeeping, and payroll services. The firm serves self-employed individuals, investors, and low-income taxpayers, offering specialized and affordable services.

| Customer Segment | Service Offered | 2024 Data/Facts |

|---|---|---|

| Individual Taxpayers | Tax filing and advisory | 19M+ assisted in 2024 |

| Small Business Owners | Tax, bookkeeping, payroll | Complex regs addressed |

| Self-Employed | Tax prep and advice | 60M+ in gig economy |

| Investors | Specialized tax help | >$30B underreported |

| Low-Income | EITC and affordable help | EITC up to $7,430 (2023) |

Cost Structure

Salaries and wages form a substantial part of H&R Block's cost structure. This covers compensation for tax professionals, customer service, and software developers. In 2024, labor expenses significantly impacted operational costs. Specifically, employee-related expenses were a key factor.

Marketing and advertising represent a significant portion of H&R Block's cost structure. These expenses are crucial for customer acquisition and retention. For instance, in fiscal year 2024, H&R Block spent $416 million on advertising.

H&R Block's cost structure heavily features technology and software development. Investments include maintaining and updating tax preparation software, which is essential for their service. In 2024, H&R Block allocated a significant portion of its budget, approximately $200 million, to technology and digital initiatives. This investment is critical for remaining competitive.

Rent and Occupancy

Rent and occupancy expenses represent a substantial portion of H&R Block's cost structure, particularly due to its extensive network of physical retail offices. These costs encompass lease agreements, utility bills, and ongoing maintenance for the company's numerous locations across the United States and other countries. For instance, in 2024, H&R Block's occupancy costs amounted to a significant sum, impacting overall profitability. The company continually evaluates its real estate footprint to optimize these expenses.

- In 2024, H&R Block's occupancy costs were a significant expense.

- Occupancy includes rent, utilities, and maintenance.

- H&R Block has a large network of retail offices.

- The company actively manages its real estate footprint.

Franchise Support

H&R Block's cost structure includes expenses related to franchise support. This involves costs for training programs, marketing materials, and technological tools. These resources help maintain service consistency across all franchise locations. Franchise support is crucial for upholding brand standards and client satisfaction.

- In 2024, H&R Block invested significantly in its digital platform to aid franchise support.

- Marketing assistance costs include advertising campaigns and local promotional activities.

- Technology infrastructure expenses cover software and hardware upkeep for franchisees.

- Training programs ensure franchisees meet professional standards.

H&R Block's cost structure encompasses franchise support expenses, including training and tech resources. These costs help maintain service standards across all franchise locations, critical for brand consistency. H&R Block's support initiatives aim to enhance client satisfaction and uphold brand value.

| Cost Category | Description | 2024 Data |

|---|---|---|

| Franchise Support | Training, tech, marketing assistance | Digital platform investment increased by 10% |

| Marketing Assistance | Advertising and local promotion | Local promotional activities increased by 8% |

| Technology Infrastructure | Software and hardware for franchisees | Tech upkeep costs rose by 5% |

Revenue Streams

H&R Block's main income comes from tax preparation fees. These fees cover both in-person and virtual assisted tax services. They also include revenue from DIY tax software users. In 2024, the company's tax prep services generated a significant portion of its $3.6 billion revenue.

Software sales form a key revenue stream for H&R Block, encompassing both online and desktop tax preparation software. In 2024, H&R Block's digital tax preparation revenue grew. This indicates a strong demand for their software solutions. H&R Block's digital revenue was $507 million in 2024.

H&R Block's revenue streams include financial products like refund transfers and prepaid cards. These products allow customers to receive and manage tax refunds conveniently. In 2024, the company processed approximately 19 million tax returns, generating significant revenue from these financial offerings. This segment provides a seamless experience for clients, boosting customer satisfaction and financial inclusion. The company's focus on digital and financial products yielded $3.5B in revenue in fiscal year 2024.

Audit Support Services

Audit support services generate revenue through fees for assisting clients with IRS issues. This includes managing IRS notice correspondence and providing in-person audit representation. H&R Block's expertise in tax law helps them secure this additional income stream. These services are crucial for clients facing complex tax situations. For example, in 2024, H&R Block assisted over 1.5 million clients with tax notices.

- IRS Notice Support: Fees for managing IRS notices.

- Audit Representation: Charges for in-person audit assistance.

- Revenue Source: Adds to overall service income.

- Client Benefit: Provides expert tax issue support.

Small Business Services

H&R Block's small business services, including bookkeeping and payroll solutions, are a key revenue stream. These services address the specific needs of small business owners, offering year-round support. This segment helps diversify H&R Block's income beyond tax preparation, providing a more stable financial base. It capitalizes on the ongoing demand for financial management assistance among entrepreneurs.

- Bookkeeping and payroll services are essential for small businesses.

- H&R Block aims to provide year-round support, not just during tax season.

- This expands H&R Block's revenue sources.

- Small business services tap into a consistent market demand.

H&R Block's revenue streams are diversified. Tax preparation fees generated a large part of the $3.6B revenue in 2024. Digital tax preparation revenue reached $507M in 2024. The company's financial products and small business services also contribute significantly.

| Revenue Stream | Description | 2024 Revenue (Approx.) |

|---|---|---|

| Tax Preparation Services | Fees from in-person, virtual, and DIY tax prep. | $3.6 Billion |

| Digital Tax Preparation | Revenue from online and desktop software sales. | $507 Million |

| Financial Products | Refund transfers and prepaid cards. | Included in Tax Prep Services |

Business Model Canvas Data Sources

H&R Block's BMC uses company filings, market research, and tax industry analysis for accurate strategy mapping.