Huons PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Huons Bundle

What is included in the product

Assesses the impact of external macro-factors on Huons. Focuses on six key dimensions for a comprehensive analysis.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview Before You Purchase

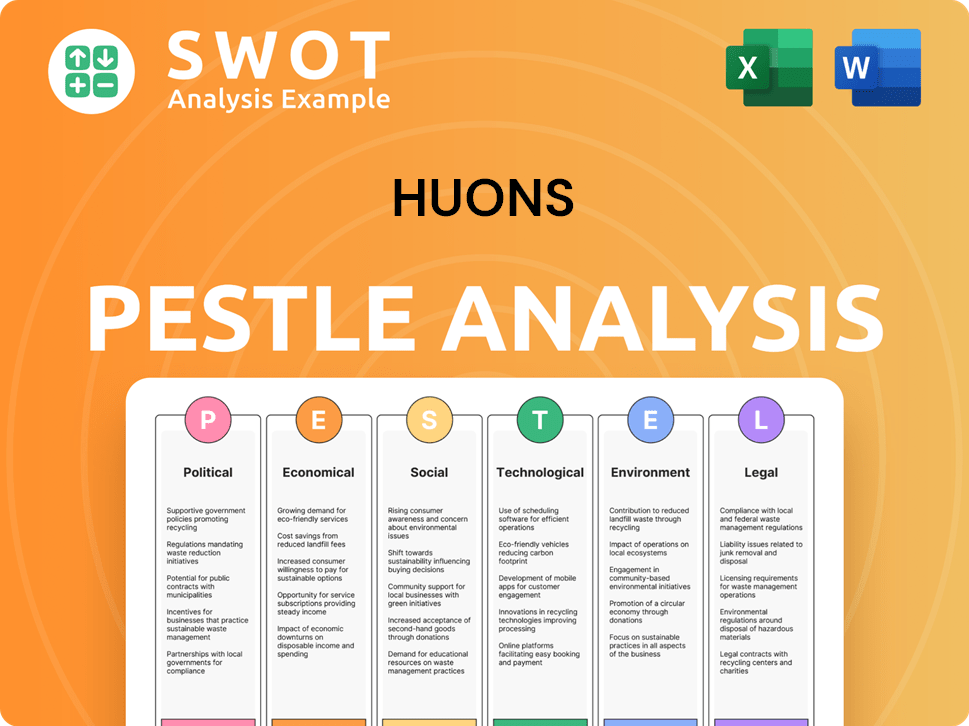

Huons PESTLE Analysis

Here’s a preview of the Huons PESTLE analysis, examining political, economic, social, technological, legal, and environmental factors. The insights displayed within this preview reflect the actual document.

This detailed analysis showcases the strategic considerations for Huons' business.

The layout, content, and structure are all the same as what you will receive immediately.

You'll gain the completed, in-depth Huons PESTLE analysis instantly upon purchase.

Enjoy!

PESTLE Analysis Template

Explore the external factors shaping Huons with our concise PESTLE analysis. We delve into political, economic, social, technological, legal, and environmental influences impacting its strategy. Understand key market drivers and potential challenges.

Identify opportunities and navigate risks using our expert insights. Optimize your business planning and make informed decisions, whether for investment or market analysis. Download the full report now to gain a competitive edge.

Political factors

Government healthcare policies are crucial for Huons. In South Korea, policies on pricing, reimbursement, and access to treatments are key. The South Korean government plans to increase medical school admissions, which may alter the healthcare landscape. These changes can affect Huons' operations and market access. For example, in 2024, the Korean government allocated $1.5 billion to support healthcare infrastructure.

South Korea's political stability and regional geopolitical risks are crucial. Policy shifts and conflicts can disrupt supply chains and market access. The Korean Peninsula's tensions impact the economic outlook. In 2024, South Korea's GDP growth forecast is around 2.2%, reflecting these factors.

Government support significantly impacts Huons' R&D. South Korea's health ministry boosts R&D, including AI-driven drug development. Such initiatives provide financial incentives. These supports enhance innovation, potentially increasing Huons' competitiveness. These measures are projected to increase R&D spending by 15% in 2024.

International Relations and Trade Agreements

International relations and trade agreements significantly influence Huons' operations, particularly its export and import activities. The company's growth is tied to its ability to expand its global reach and forge strategic partnerships. Securing partnerships, especially in regions like the Middle East, is crucial for Huons' strategic expansion. For example, in 2024, Huons' exports to the Middle East accounted for 15% of its total exports.

- Trade agreements: Influence costs and market access.

- Geopolitical stability: Impacts supply chains and investment.

- Foreign policy: Affects partnerships and market entry.

- Export regulations: Determine market entry barriers.

Regulatory Environment and Enforcement

The regulatory environment significantly impacts Huons. Political will and capability to enforce pharmaceutical regulations concerning quality, safety, and fair competition are vital. Changes in regulatory bodies and new system implementations, such as the Pharmaceutical Data Protection System, are influenced by political decisions. These factors can affect Huons' operational costs and market access.

- South Korea's pharmaceutical market was valued at approximately $20 billion in 2024.

- The Ministry of Food and Drug Safety (MFDS) is the primary regulatory body.

- Regulatory changes can impact drug approval timelines and market entry.

- Fair competition is ensured by the Korea Fair Trade Commission (KFTC).

Government healthcare policies, especially pricing and reimbursement rules, critically impact Huons, with the South Korean government allocating $1.5 billion for healthcare infrastructure in 2024.

South Korea's political stability and geopolitical risks influence supply chains and market access; the nation's 2024 GDP growth forecast is around 2.2%, reflecting these factors.

Government support for R&D is crucial, with initiatives aimed at AI-driven drug development; these initiatives are projected to increase R&D spending by 15% in 2024, bolstering Huons' competitiveness.

| Political Factor | Impact on Huons | 2024 Data |

|---|---|---|

| Healthcare Policies | Pricing, access | $1.5B for infrastructure |

| Geopolitical Risks | Supply chains, market access | 2.2% GDP growth |

| R&D Support | Innovation, competitiveness | 15% increase in R&D spending |

Economic factors

South Korea's economic growth impacts Huons' performance. Moderate GDP growth is expected in 2024 and 2025. Recent forecasts suggest a growth of around 2.2% in 2024 and 2.3% in 2025. This influences healthcare spending and investment. Economic health of its partners matters too.

Healthcare expenditure significantly influences Huons' market. South Korea's healthcare spending reached $180 billion in 2023, with continued growth expected. Public funding and National Health Insurance sustainability are pivotal economic factors. These dynamics impact demand for Huons' pharmaceuticals.

Inflation rates and interest rate policies significantly impact Huons' operational costs and investment strategies. South Korea's inflation is expected to stabilize. In 2024, the Bank of Korea maintained its base rate at 3.50%. Potential interest rate cuts could boost consumer spending and equipment investments.

Exchange Rates

Exchange rate volatility is a key concern for Huons, impacting both export revenues and import costs. A stronger Korean won can make exports more expensive, potentially reducing sales in international markets. Conversely, a weaker won can increase the cost of imported materials, affecting profit margins. Effective currency risk management strategies are crucial for Huons.

- In 2024, the Korean won's fluctuations against the USD and other major currencies could have impacted Huons' financial performance.

- Companies often use hedging tools like forward contracts to mitigate currency risk.

- Monitoring global economic trends and central bank policies is essential.

Market Competition and Pricing Pressures

Market competition significantly impacts Huons' revenue and profitability, particularly with pricing pressures from generic drugs and biosimilars. The pharmaceutical industry faces constant competition, necessitating strategic pricing to maintain market share. In 2024, the global generics market was valued at approximately $400 billion. The revised evaluation criteria for drug pricing are also a key economic factor.

- Competition from generics and biosimilars.

- Global generics market valued at $400 billion in 2024.

- Impact of revised drug pricing evaluations.

South Korea's GDP growth, projected at 2.2% in 2024 and 2.3% in 2025, affects Huons. Healthcare expenditure, reaching $180B in 2023, shapes its market. Inflation and interest rates, with the base rate at 3.50% in 2024, also matter.

| Economic Factor | Impact on Huons | Data/Details |

|---|---|---|

| GDP Growth | Influences healthcare spending & investment | 2.2% in 2024, 2.3% in 2025 (forecasts) |

| Healthcare Spending | Drives market demand | $180B in 2023 |

| Inflation/Interest Rates | Affect operational costs/investment | BOK base rate 3.50% in 2024 |

Sociological factors

South Korea's rapidly aging population is a key sociological factor. This demographic shift boosts demand for healthcare services. In 2024, over 19% of South Korea's population is aged 65 and older, driving increased needs for chronic disease management and age-related treatments. This creates opportunities and challenges for Huons.

Growing health and wellness awareness is boosting demand for health products. Huons' dermatology and aesthetics focus fits this trend. In 2024, the global health and wellness market was valued at $7 trillion. The aesthetic medicine market is projected to reach $24.6 billion by 2025.

Societal expectations and government policies significantly shape healthcare access and drug affordability. In 2024, the U.S. healthcare spending reached nearly $4.8 trillion, reflecting these dynamics. Ongoing crises spotlight disparities in medical professional distribution. Efforts to improve healthcare access and equity are crucial.

Public Perception and Trust in Healthcare

Public trust in healthcare, including pharmaceutical companies like Huons, significantly influences patient acceptance of treatments and brand reputation. Major events, such as the COVID-19 pandemic, have tested this trust. According to a 2024 survey, trust in pharmaceutical companies has fluctuated, with some periods showing declines. The public's perception of ethical practices and transparency plays a crucial role.

- Trust levels can impact the success of new drug launches and market penetration.

- Transparency in clinical trials and pricing strategies is essential for maintaining public trust.

- Negative media coverage or controversies can severely damage a company's reputation.

- Building and maintaining trust requires proactive communication and ethical business practices.

Work-Life Balance and Employee Well-being

Societal shifts prioritizing work-life balance affect healthcare workforce dynamics. Huons, operating in this sector, may face challenges or opportunities related to employee well-being. Employee satisfaction and productivity are directly impacted, influencing operational efficiency. Huons' recognition for its efforts in this area could be a competitive advantage, boosting talent attraction and retention.

- In 2024, studies showed a 15% increase in healthcare workers seeking better work-life balance.

- Huons' employee satisfaction scores (2024) reflect this trend.

- Companies with strong employee well-being programs see up to 20% higher productivity.

South Korea's aging population boosts demand for healthcare, with over 19% aged 65+ in 2024. Increased health & wellness awareness drives demand for health products, aesthetics included. Public trust impacts drug acceptance; transparency is essential for reputation. Societal shifts in work-life balance affect workforce dynamics; strong well-being programs increase productivity.

| Sociological Factor | Impact on Huons | 2024/2025 Data Point |

|---|---|---|

| Aging Population | Increased demand for healthcare products | Over 19% of population aged 65+ in 2024. |

| Health & Wellness Trends | Opportunities in aesthetics and health products | Aesthetic medicine market projected to reach $24.6B by 2025. |

| Public Trust & Healthcare Access | Reputation risk, impact on drug launch. | U.S. healthcare spending nearly $4.8T in 2024. |

Technological factors

Technological advancements in drug discovery are vital for Huons. The company invests in R&D, focusing on synthetic peptides and biologics. Globally, the biotech market is projected to reach $752.88 billion by 2028. AI and biotechnology are crucial in drug development and manufacturing.

Digital healthcare, including telemedicine and AI diagnostics, is rapidly changing healthcare. South Korea's digital health market is expanding significantly. The market is projected to reach $2.5 billion by 2025, with a CAGR of 20% from 2020. This growth creates new opportunities.

Huons must leverage advancements in manufacturing technologies and automation for optimal production. This includes adhering to GMP and HACCP standards, vital for product quality. In 2024, the global pharmaceutical automation market was valued at $6.8 billion, expected to reach $10.5 billion by 2029. Automation enhances efficiency and reduces errors.

Medical Device Innovation

Technological factors significantly influence Huons's operations, particularly in medical device innovation. Advancements in aesthetic devices and drug delivery systems are key for expanding its product portfolio and maintaining market competitiveness. Huons Meditech's development of devices, such as Dermashine Pro, exemplifies this focus. This strategic direction is supported by the growing global medical devices market, which was valued at $455.69 billion in 2023 and is projected to reach $634.36 billion by 2030.

- Market size in 2023: $455.69 billion.

- Projected market size by 2030: $634.36 billion.

- Huons Meditech focuses on aesthetic devices.

- Technological advancements drive product portfolio expansion.

Data Security and Privacy Technologies

Data security and privacy are increasingly vital for Huons, especially with digital health records and connected devices. Blockchain technology is emerging to secure patient data in healthcare. The global healthcare cybersecurity market is projected to reach $28.9 billion by 2025. This growth highlights the need for robust data protection measures.

- Global healthcare cybersecurity market forecast: $28.9 billion by 2025.

- Blockchain adoption in healthcare is growing for data security.

Huons thrives on tech, from drug discovery with AI, which is experiencing significant growth, to medical device innovations. Digital healthcare and data security are also crucial. South Korea’s digital health market, for example, is anticipated to hit $2.5B by 2025.

| Technology Area | Market Size (2023) | Projected Market Size (2030) |

|---|---|---|

| Global Medical Devices | $455.69B | $634.36B |

| Global Pharma Automation (2024) | $6.8B | $10.5B (by 2029) |

| Global Healthcare Cybersecurity (2025) | - | $28.9B (by 2025) |

Legal factors

Regulations in South Korea dictate Huons' pharmaceutical activities. The new Pharmaceutical Data Protection System affects data exclusivity. Changes in drug approval processes influence product launches. For 2024, the Korean pharmaceutical market is valued at approximately $25 billion. Regulatory compliance is crucial for Huons' market access and operations.

Huons must navigate intellectual property laws, including patents and trademarks, to protect its pharmaceutical innovations. South Korea's Pharmaceutical Data Protection System, updated in 2024, offers enhanced protection for pharmaceutical intellectual property, which could affect Huons' market competitiveness.

Huons faces legal scrutiny due to healthcare fraud and abuse laws. Regulations, like those on illegal rebates, affect marketing and sales. For instance, in 2024, the DOJ recovered over $5 billion from healthcare fraud cases. Compliance with CSO reporting is crucial. Failure to adhere can result in significant penalties, potentially impacting its financial performance.

Product Liability and Patient Safety Regulations

Huons, like all pharmaceutical companies, faces strict product liability laws and patient safety regulations, demanding rigorous quality control. These regulations also necessitate comprehensive post-market surveillance to monitor drug performance and identify adverse effects. The company must integrate the drug re-examination system's functions into its Risk Management Plan. In 2024, the global pharmaceutical market reached approximately $1.5 trillion, highlighting the financial stakes involved.

- Product recalls cost the pharmaceutical industry billions annually, with an average cost per recall ranging from $10 million to $100 million.

- Post-market surveillance programs can reduce adverse drug events by up to 30%.

- In 2024, the FDA conducted over 4,000 inspections of pharmaceutical manufacturing facilities.

Labor Laws and Employment Regulations

Labor laws and employment regulations significantly influence Huons' operational strategies, particularly in workforce management and cost structures. South Korea's labor laws, including those concerning minimum wage, overtime, and employee benefits, directly impact Huons' financial planning and budgeting. The ongoing medical crisis in South Korea underscores the importance of robust labor relations within the healthcare sector. Recent data indicates that labor disputes can disrupt operations, affecting supply chains and production schedules.

- Minimum wage in South Korea: ₩9,860 per hour in 2024, impacting labor costs.

- Overtime regulations: Strict limits on working hours to ensure compliance.

- Employee benefits: Mandated contributions to social insurance and healthcare.

- Labor disputes: Potential disruptions in the pharmaceutical sector.

Huons operates under strict South Korean pharmaceutical regulations. Intellectual property laws are key for innovation protection. Compliance with labor and employment laws also shapes operations.

| Regulation Area | Impact on Huons | 2024/2025 Data Points |

|---|---|---|

| Pharmaceutical Data Protection | Affects market competitiveness. | Market value: ~$25B (KR), average recall costs: $10M-$100M. |

| Healthcare Fraud and Abuse Laws | Influences marketing and sales practices. | DOJ recovered $5B+ from fraud in 2024, FDA conducted >4,000 inspections. |

| Labor Laws | Impacts financial planning. | Minimum wage: ₩9,860/hr (2024), overtime & benefits regulations. |

Environmental factors

Huons faces environmental regulations impacting its manufacturing. These rules cover waste, emissions, and water use at production sites. Compliance with standards like ISO 14001 is essential. Stricter rules could raise operational costs. As of 2024, environmental fines in South Korea for violations averaged $5,000-$50,000 per incident.

Huons' supply chain's environmental impact, spanning raw material sourcing to distribution, is under scrutiny. Sustainable practices are gaining importance. In 2024, companies faced rising pressure to reduce carbon emissions within their supply chains. Data shows a 15% increase in consumer demand for eco-friendly products, influencing Huons' strategies.

Climate change and extreme weather events pose indirect risks to healthcare. Changes in temperature and weather patterns can influence public health and strain infrastructure. For instance, the World Health Organization (WHO) estimates that climate change could cause approximately 250,000 additional deaths per year between 2030 and 2050. These environmental shifts indirectly impact societal health, which can affect pharmaceutical demand.

Resource Availability and Sustainability

Huons, as a pharmaceutical manufacturer, must assess resource availability, especially water and energy, critical for its operations. The pharmaceutical industry faces increasing scrutiny regarding water usage, mirroring trends in aquaculture, where sustainable practices are evolving. For example, the global pharmaceutical market is projected to reach $1.7 trillion by 2025, underscoring the need for resource-efficient manufacturing. Companies are increasingly adopting strategies to minimize environmental impact and ensure long-term operational viability.

- Water scarcity and efficiency are becoming key performance indicators.

- Sustainable energy sources are gaining importance in manufacturing processes.

- Compliance with environmental regulations impacts operational costs.

- Investment in green technologies is growing within the sector.

Packaging and Waste Management Regulations

Huons faces environmental pressures from packaging and waste regulations. These rules, crucial for pharmaceutical companies, impact packaging choices and disposal methods. Compliance requires investment in eco-friendly materials and waste management. As of late 2024, the global market for sustainable packaging in pharmaceuticals is estimated to reach $5 billion.

- Regulations vary globally, with stricter rules in the EU and North America.

- Huons must adapt to evolving standards to avoid penalties and maintain a positive brand image.

- The company must optimize its waste disposal methods to reduce environmental impact.

Environmental factors significantly affect Huons. Stricter regulations increase operational expenses and drive the need for sustainable practices in the supply chain. Climate change and resource availability, like water and energy, also present indirect risks, potentially influencing pharmaceutical demand. Investments in eco-friendly solutions are key as sustainable packaging market reaches $5B by 2025.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Regulations | Compliance costs, potential fines | Avg. fines: $5K-$50K/incident in South Korea; Global sustainable packaging market: $5B by 2025 |

| Supply Chain | Emissions scrutiny, eco-friendly demand | 15% increase in consumer demand for eco-friendly products. |

| Climate Change | Public health risks, infrastructure strain | WHO estimate: 250K deaths/year (2030-2050). |

PESTLE Analysis Data Sources

The Huons PESTLE Analysis leverages economic indicators, policy updates, and market research reports.