Hydro One Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hydro One Bundle

What is included in the product

Tailored analysis for Hydro One's electricity delivery services across the BCG Matrix.

Optimized for C-level presentation, offering a clean, distraction-free view of Hydro One's BCG matrix.

Delivered as Shown

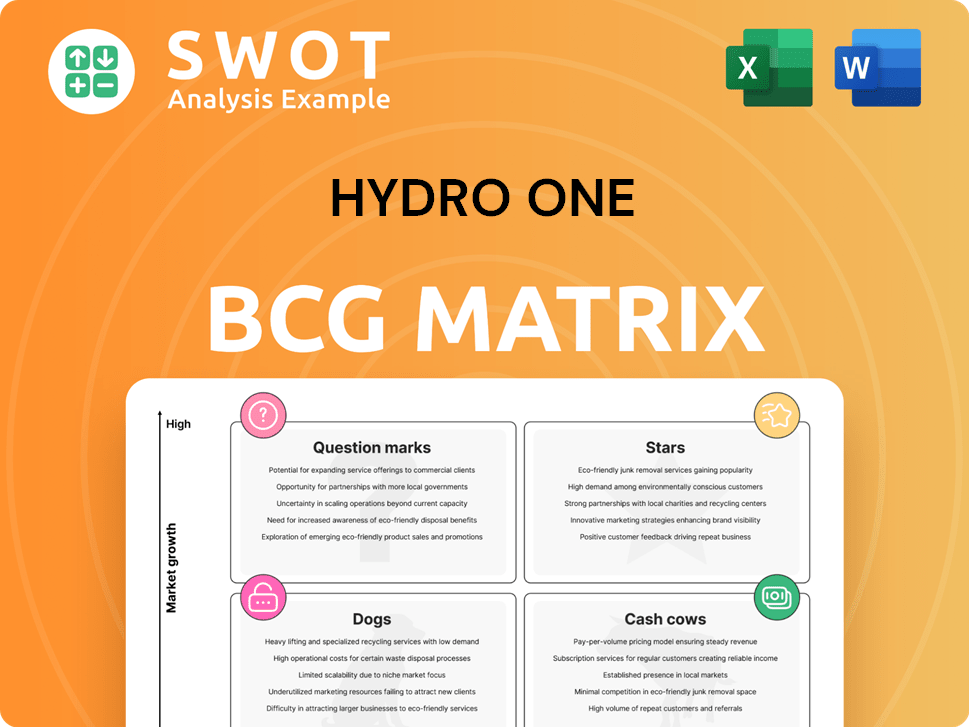

Hydro One BCG Matrix

The Hydro One BCG Matrix preview is the complete document you'll receive. This is the final, ready-to-use report with all analysis included – no hidden content or alterations needed.

BCG Matrix Template

Hydro One's BCG Matrix offers a strategic snapshot. It categorizes its services within market growth and relative market share. Identify which offerings are stars, cash cows, question marks, or dogs. This preliminary view only scratches the surface. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Hydro One's strategic infrastructure projects, like the Wawa to Porcupine Transmission Line, are "Stars" in its BCG Matrix. These projects, including the Chatham to Lakeshore Transmission Line, are vital for meeting Ontario's rising electricity needs. These initiatives demand considerable initial capital but deliver high returns. Hydro One invested $2.1 billion in capital expenditures in 2024, supporting these projects and market leadership.

Hydro One's 50-50 First Nations Equity Partnership model is a growth opportunity. This approach builds relationships and shares economic benefits, ensuring responsible project development. It's innovative and positions Hydro One as a leader. In 2024, this model supported projects worth over $1 billion.

Hydro One's sustainable financing includes Medium-Term Notes supporting green projects. These funds target emission reduction, energy efficiency, and Ontario's low-carbon transition. In 2024, ESG-focused investments grew, attracting investors. Hydro One's framework aligns with these trends, boosting its appeal.

Grid Modernization Programs

Hydro One's grid modernization programs are a shining star in its BCG matrix, representing high growth and market share. These investments, including smart meters and advanced analytics, are vital for boosting reliability and customer service. They facilitate better electricity management, reducing outages, and offering customers more consumption insight. Modernizing the grid is crucial for a competitive edge.

- Hydro One invested $1.8 billion in grid modernization in 2024.

- Smart meter deployment has reached nearly 1.4 million customers.

- These efforts have reduced outage duration by 15% in 2024.

- Advanced analytics have improved outage response times by 20%.

Enhanced Customer Service

Hydro One's dedication to enhanced customer service positions it as a "Star" within the BCG Matrix. This is due to its innovative solutions, including AI and virtual reality training, driving customer satisfaction. In 2024, Hydro One reported 88% satisfaction among residential and small business clients, and 85% for commercial and industrial customers. This high level of customer experience fosters loyalty and supports sustainable growth.

- AI-powered tools for improved customer interactions.

- VR training for customer service representatives.

- High customer satisfaction rates across different segments.

- Focus on customer experience as a key differentiator.

Hydro One's "Stars" are high-growth, high-share areas. Grid modernization and infrastructure projects drive revenue. Customer satisfaction is a key "Star" component.

| Feature | Details | 2024 Data |

|---|---|---|

| Grid Modernization Investment | Smart meters, analytics, reliability | $1.8 billion invested |

| Customer Satisfaction | Residential, business satisfaction | 88%, 85% satisfaction rates |

| Infrastructure Projects | Transmission lines, equity partnerships | $2.1B in capital expenditures |

Cash Cows

Hydro One's regulated transmission business is a cash cow. It represents about 60% of its rate base, ensuring steady revenue. The Ontario Energy Board (OEB) approves its stable rate structure, providing predictable earnings. This segment needs continuous upkeep but offers consistent, low-risk returns. In 2024, Hydro One's transmission revenue was approximately $1.8 billion.

Hydro One's distribution business, serving ~1.5 million Ontario customers, is a cash cow. This segment, like transmission, benefits from a regulated environment, guaranteeing predictable revenues. In 2024, Hydro One invested significantly in distribution infrastructure. It offers a steady income stream, requiring constant investment in infrastructure and customer service.

Hydro One focuses on boosting cash flow through productivity savings. In 2024, they achieved $150 million in savings via efficiency initiatives. These savings boost profits and fund future investments.

Acronym Solutions

Acronym Solutions, Hydro One's telecom arm, functions as a cash cow, even though it contributes less than 1% to overall results. This segment generates steady revenue with minimal upkeep, providing vital communication services. Acronym Solutions benefits from enduring contracts, ensuring a consistent income flow. In 2024, Hydro One's telecom revenue was stable, reflecting the cash cow status.

- Steady revenue stream.

- Low maintenance needs.

- Essential communication services.

- Long-term contracts.

OEB-Approved Rate Adjustments

Hydro One's "Cash Cows" status in the BCG matrix is underpinned by OEB-approved rate adjustments. These adjustments enable Hydro One to recover costs and earn a regulated return on equity (ROE), ensuring financial stability. The OEB periodically revises these rates based on operational costs and capital investments, providing a predictable revenue stream. In 2024, Hydro One's ROE was approximately 9%, reflecting the impact of OEB's regulatory framework.

- OEB-approved rates ensure cost recovery and ROE for Hydro One.

- Rates are adjusted to reflect operational and capital changes.

- The regulatory framework supports Hydro One's financial stability.

- In 2024, ROE was about 9% due to regulatory influence.

Hydro One's cash cows, including transmission and distribution, generate consistent revenue. These segments operate under regulatory frameworks, ensuring stable earnings and cash flow. Productivity savings and telecom operations also boost financial performance.

| Segment | 2024 Revenue | Key Features |

|---|---|---|

| Transmission | $1.8B | Regulated, steady income, ~60% of rate base |

| Distribution | Significant investment | Regulated, predictable revenue, serves ~1.5M customers |

| Telecom | Stable | Steady revenue, minimal upkeep, essential services |

Dogs

Legacy IT systems at Hydro One, like outdated infrastructure, can significantly increase operating costs. These systems are often hard to integrate with modern tech. Maintaining these systems offers limited value and may create security vulnerabilities. Hydro One's 2023 annual report showed IT expenses of $287 million, highlighting the financial impact.

Underperforming rural infrastructure in Hydro One's portfolio can be a challenge. These areas, with low population density and aging assets, may struggle to generate sufficient revenue. In 2024, Hydro One invested $1.9 billion in grid modernization, which includes rural infrastructure upgrades. If maintenance costs outweigh revenue, divestiture or focused upgrades become essential for better performance.

Infrastructure projects that face substantial cost overruns and delays can be a drag on Hydro One's financial performance. These projects consume capital and resources without yielding anticipated returns. According to the Q4 2024 earnings call, project delays or cost overruns are a key concern. Rigorous project management and risk assessment are crucial to mitigate these risks, as highlighted in the company's 2024 annual report.

Areas with High Electricity Theft

Areas with high electricity theft significantly affect revenue and profitability. Hydro One faces challenges in regions with rampant theft, impacting its financial performance. Combating theft necessitates investments in security and enforcement, which may not always yield positive returns. These areas could be classified as "Dogs" if the financial losses from theft surpass the advantages of serving those customers. In 2024, Hydro One reported millions in losses due to theft, prompting increased security measures.

- High theft rates reduce revenue.

- Increased security measures are costly.

- Theft can lead to financial losses.

- Serving these areas might be unprofitable.

Customer Service Processes with Low Satisfaction

Customer service processes with low satisfaction at Hydro One, categorized as Dogs in the BCG matrix, consistently face challenges. These areas, generating complaints, demand immediate attention and improvements to boost customer experience. The 2024 report highlights that, while complaints dropped by 17 percent to 729, significant issues still persist. This requires strategic redesigns for efficiency.

- Complaint Reduction: 17% decrease in 2024.

- Total Complaints: 729 received in 2024.

- Focus: Improve customer experience.

- Strategy: Redesign inefficient processes.

Areas with high theft rates and low customer satisfaction at Hydro One are classified as Dogs. These segments face revenue reduction, high costs, and financial losses, impacting overall profitability. Security measures and customer service redesigns are costly solutions, but essential. For 2024, the firm noted millions in losses due to theft and 729 customer complaints.

| Metric | Data |

|---|---|

| Theft Losses (2024) | Millions |

| Customer Complaints (2024) | 729 |

| Complaint Reduction (2024) | 17% |

Question Marks

Hydro One's investments in new energy storage technologies, like battery systems, show high growth potential but also uncertainty. These technologies can boost grid reliability and integrate renewables. The economic viability and long-term performance are still being tested. In 2024, the global energy storage market was valued at $20.1 billion, projected to reach $48.5 billion by 2029.

Hydro One's move into EV charging is a growth bet, given rising EV use in Ontario. Competition is tough, and the market is evolving. Building a strong charging network needs significant investments. In 2024, EV sales in Ontario rose, showing potential. Hydro One's move is a strategic gamble.

Hydro One is actively exploring smart grid innovations. These include advanced sensors and data analytics to enhance grid management. The company's investments in smart grid tech totaled approximately $600 million in 2024. Widespread adoption needs significant investment and regulatory backing. These technologies aim to boost efficiency, reducing operational costs.

New Partnerships with Renewable Energy Providers

Hydro One's partnerships with renewable energy providers are a strategic move for growth. Collaborating on wind and solar projects is a key opportunity. Success hinges on financing, approvals, and grid integration. The company takes a regional approach to understand energy needs.

- In 2024, Hydro One invested significantly in renewable energy projects, with a focus on solar and wind.

- Regulatory approvals remain a key challenge, with project timelines often impacted by permitting processes.

- Grid integration costs for renewables are a major consideration, with upgrades required to handle intermittent energy sources.

- Hydro One's regional portfolio approach involves assessing the specific energy demands of different areas.

Investments in AI and Machine Learning

Hydro One's investments in AI and ML show potential, especially for grid improvements and predictive maintenance. These technologies aim to boost reliability and cut costs. The success hinges on data quality and algorithm precision.

- Hydro One is investing in AI-powered tools to improve customer service.

- Strategic projects like the Chatham to Lakeshore and St. Clair Transmission Lines are key for future growth.

- In 2024, Hydro One is likely allocating a portion of its $6.7 billion capital expenditure plan towards AI and ML initiatives.

Hydro One's question marks include energy storage and EV charging, representing high growth but uncertain outcomes. These areas demand substantial investment and face competitive challenges. Smart grid tech and AI initiatives also fall into this category. The company aims for growth in these uncertain markets.

| Category | Examples | Challenges |

|---|---|---|

| Question Marks | Energy storage, EV charging, Smart Grid Tech, AI/ML | High investment, market competition, regulatory hurdles |

| Key Investments (2024) | Smart grid ($600M), AI/ML (part of $6.7B CapEx) | Data quality, financing, integration |

| Market Context (2024) | Energy Storage: $20.1B (Global), EV sales rise in Ontario | Project timelines, grid upgrades |

BCG Matrix Data Sources

Hydro One's BCG Matrix relies on financial statements, market analysis, and expert insights. Data includes company filings, industry reports, and growth projections.