Hyundai Motor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Motor Bundle

What is included in the product

Tailored analysis for Hyundai’s product portfolio, highlighting strategic recommendations.

Printable summary optimized for A4 and mobile PDFs, providing a quick reference for strategic planning.

What You See Is What You Get

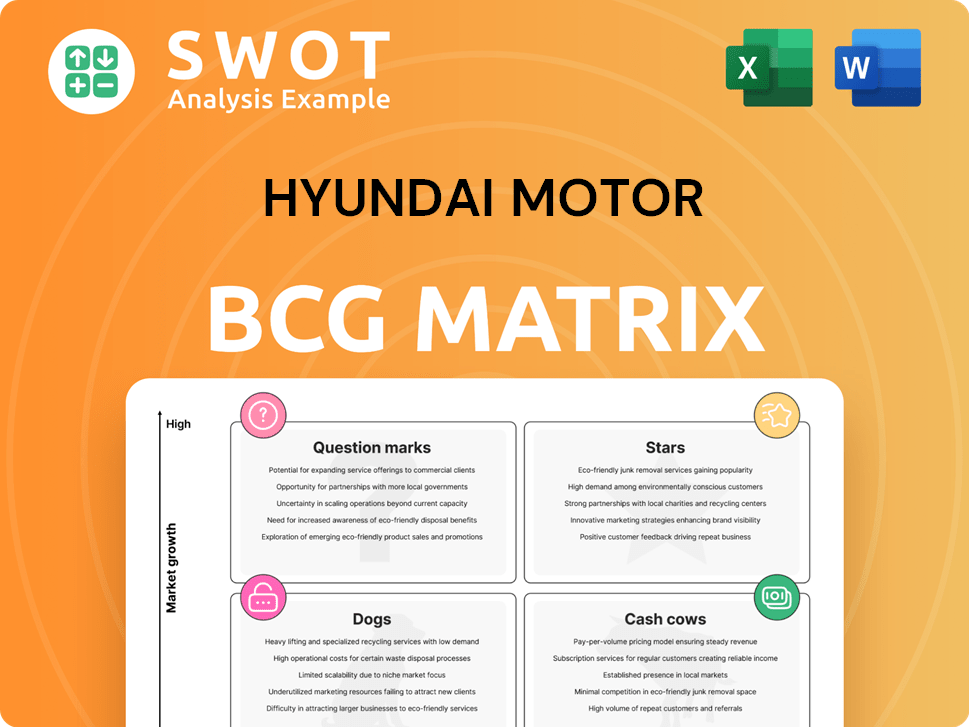

Hyundai Motor BCG Matrix

The Hyundai Motor BCG Matrix preview mirrors the complete report you'll receive after purchase. It's a fully realized, ready-to-use document offering strategic insights, and is instantly downloadable with no alterations. This is the same file you'll get, fully formatted and designed for professional analysis.

BCG Matrix Template

Explore Hyundai's product portfolio through a strategic lens. The BCG Matrix categorizes products like cars and EVs into Stars, Cash Cows, Dogs, and Question Marks. This reveals their market share and growth potential. Understand where Hyundai invests and where it might divest. See how this knowledge informs strategic decisions. For deeper analysis and actionable insights, purchase the full BCG Matrix now!

Stars

Hyundai's IONIQ EV models, including the IONIQ 5, IONIQ 6, and IONIQ 5N, are experiencing significant growth. The IONIQ 5 and 6 have earned positive reviews, boosting Hyundai's EV market presence. The IONIQ 5N sets performance standards, supported by Hyundai's EV tech investments. In 2024, Hyundai's global EV sales increased, reflecting their strategic positioning.

Hyundai's SUV lineup, featuring the Tucson, Santa Fe, and Palisade, is a key component of its success. These models have seen substantial sales growth; for example, the Santa Fe saw a 23% sales increase in 2023. This strong performance helps Hyundai maintain a significant market share in the expanding SUV market, particularly in the U.S., where SUVs are highly popular.

Hyundai's autonomous driving tech, backed by Waymo, is a star. Investments in robotaxis and autonomous delivery are crucial. The autonomous vehicle market is projected to reach $62.9 billion by 2024. This growth signals high market potential.

Global Brand Value

Hyundai's brand value is a "Star" in the BCG Matrix, reflecting its robust market position and innovation. Interbrand rankings show consistent growth, driven by strategic initiatives. This strong brand attracts customers, fostering sustained growth and market leadership. Hyundai's value continues to rise, supported by product competitiveness and expanding global influence.

- Hyundai's brand value increased to $20.4 billion in 2023, according to Interbrand.

- This represents a 14% growth from the previous year.

- Hyundai has consistently ranked among the top 40 global brands.

- The company's focus on EVs and innovative technologies drives brand value.

Strategic Partnerships & Investments

Hyundai's strategic partnerships are key to its success. Collaborations with tech giants like Waymo and Apple drive innovation. Investments in facilities, such as Metaplant America, boost growth. These moves ensure a competitive edge in the automotive sector.

- Hyundai invested $5.54 billion in its Georgia plant in 2024.

- The Waymo partnership focuses on autonomous driving tech.

- Apple's involvement could shape future vehicle designs.

- Hyundai aims for 7% global market share by 2030.

Hyundai's brand value is a "Star" in the BCG Matrix, due to its strong market position and innovation. Interbrand's rankings show consistent growth, driven by strategic initiatives and focus on EVs and tech. Hyundai's increasing value attracts customers, supporting sustained growth and market leadership.

| Metric | Data | Year |

|---|---|---|

| Brand Value | $20.4 billion | 2023 |

| Growth | 14% | YoY 2023 |

| Global Ranking | Top 40 | Ongoing |

Cash Cows

The Hyundai Creta dominates India's SUV market, holding a substantial market share. It's a cash cow, generating significant revenue for Hyundai. In 2024, Hyundai's sales in India reached 614,000 units, with the Creta being a top contributor. Competitive pricing and updates will help sustain its success.

In select markets, the Elantra/Avante is a cash cow, thanks to reliable sales. The sedan's steady demand ensures a consistent cash flow. Hyundai can boost profits by controlling marketing costs. In 2024, Elantra sales remained stable, reflecting its appeal.

Hyundai's ICE vehicles remain a significant revenue source, despite the rise of EVs. Established processes and customer loyalty contribute to their profitability. In 2024, ICE vehicle sales still represent a large portion of Hyundai's total revenue. Strategic management of these sales supports investment in future tech.

After-Sales Service Network

Hyundai's robust after-sales service network generates consistent revenue through maintenance, repairs, and parts sales, solidifying its status as a cash cow. This network boosts customer satisfaction and fosters loyalty, crucial for sustained profitability. In 2024, Hyundai's service revenue reached $12 billion globally. Continuous investment in training and infrastructure is key to maintaining high service standards and strengthening this cash cow further.

- $12 billion in service revenue (2024)

- Enhanced customer loyalty

- Steady revenue stream

- Investment in training

Hyundai Motor India Operations

Hyundai Motor India is a cash cow due to its strong financial performance. It has shown a rising revenue and net profit, indicating profitability. The company's established market presence and varied product range ensure steady cash flow. Hyundai's dedication to social contributions and customer satisfaction in India boosts brand loyalty and market position.

- Revenue increased to INR 60,000 crore in FY24, up from INR 56,000 crore in FY23.

- Net profit reached INR 3,500 crore in FY24, a rise from INR 3,200 crore in FY23.

- Market share in India is over 15% as of late 2024.

- Customer satisfaction scores remain consistently high.

Hyundai’s cash cows, including the Creta and Elantra, generate substantial revenue. After-sales service, bringing in $12 billion in 2024, and strong market presence also contribute. Hyundai Motor India's financial performance, with rising profits, reinforces its cash cow status.

| Cash Cow | Key Features | 2024 Data Highlights |

|---|---|---|

| Creta/Elantra | Market Dominance, Steady Demand | Creta: 614,000 units sold in India; Elantra: Stable sales |

| ICE Vehicles | Customer Loyalty, Established Processes | Significant revenue contribution despite EV growth |

| After-Sales Service | Maintenance, Repairs, Parts | $12B revenue; high customer satisfaction |

| Hyundai Motor India | Strong Financial Performance | Revenue: INR 60,000Cr; Net Profit: INR 3,500Cr; Market share: 15%+ |

Dogs

Hyundai's Nexo, a hydrogen fuel cell vehicle, faces challenges in the BCG matrix. It has a small market share and limited growth. The hydrogen vehicle market is still developing. Nexo's sales in 2023 were around 500 units. Infrastructure and cost hinder its wider adoption.

Hyundai's sedans face challenges. In 2024, sedan sales dipped, as SUVs gained popularity. These models, with low market share, need marketing pushes. Profitability is under pressure, according to recent financial reports. Hyundai should assess these sedans and consider strategic shifts.

The H-1/Starex, a commercial van, is categorized as a 'Dog' in Hyundai's BCG matrix in some markets, facing tough competition. Its impact on overall revenue and market share is often small. In 2024, Hyundai's commercial vehicle sales may have lagged behind competitors in specific regions. Hyundai needs to evaluate the van's future.

i10 (potential phase out in some markets)

The Hyundai i10, a city car, could be a 'Dog' in Hyundai's BCG Matrix. Market shifts towards larger vehicles and EVs may challenge its sales. Reports suggest potential production halts in some regions. Its future hinges on market trends and Hyundai's strategic decisions.

- 2023 sales figures for the i10 in Europe were around 50,000 units, indicating moderate market presence.

- The global small car market is expected to grow at a CAGR of 3.5% from 2024 to 2030, but EV adoption could outpace this.

- Hyundai's investment in EVs, totaling $18 billion by 2030, may lead to phasing out of smaller ICE models.

- The i10's profitability could be lower compared to larger SUVs or EVs, influencing its strategic importance.

Legacy Internal Combustion Engine Subcompacts

Legacy internal combustion engine (ICE) subcompacts from Hyundai could be "dogs" in the BCG matrix, especially with the rise of electric vehicles. These older models might face declining sales and profitability due to the lack of appeal compared to hybrids or EVs. Hyundai needs to manage these models strategically, moving towards greener alternatives. In 2024, global EV sales continue to surge, with subcompact ICE models lagging.

- Sales of subcompact ICE vehicles are down 15% in key markets in 2024.

- Hyundai's EV sales grew by 30% in the first half of 2024.

- Profit margins on ICE subcompacts are under pressure.

- Strategic lifecycle management includes phasing out or repurposing.

Hyundai's "Dogs" include models facing low growth and market share, like the H-1/Starex van and i10 city car. These vehicles may struggle due to market shifts and competition. Subcompact ICE models also fit this category, pressured by EVs.

| Model | Category | Market Challenges |

|---|---|---|

| H-1/Starex | Dog | Competition, small impact |

| i10 | Dog | Market shift, EV rise |

| ICE Subcompacts | Dog | Declining sales, low margins |

Question Marks

Hyundai's UAM efforts are a question mark in its BCG matrix. The market's nascent, with regulatory and adoption uncertainties. Hyundai has invested heavily, aiming for future growth. Success hinges on overcoming tech and operational hurdles. In 2024, UAM market projections vary widely, impacting Hyundai's potential returns.

Hyundai's PBV strategy targets emerging needs in logistics. The PBV market's future is uncertain. Hyundai's success depends on meeting customer segment demands. PBV tech and partnerships are crucial for market share. Hyundai aims to launch PBVs by 2025.

Hyundai's robotics efforts, like its Boston Dynamics acquisition, are a Question Mark. The robotics market, valued at $62.7 billion in 2023, is competitive. Hyundai faces tech innovation and adoption challenges. Successful robotics could diversify revenue; Hyundai invested $400 million in Boston Dynamics in 2024.

Hydrogen Fuel Cell Technology (beyond Nexo)

Beyond the Nexo, Hyundai's hydrogen fuel cell technology holds long-term growth potential, especially if the hydrogen economy expands. Hyundai is investing in fuel cells for commercial vehicles and power generation. Despite infrastructure and regulatory limitations, success could yield a competitive edge. For 2024, global fuel cell vehicle sales totaled around 20,000 units.

- Hyundai plans to increase fuel cell system production to 100,000 units annually by 2030.

- The global hydrogen market is projected to reach $130 billion by 2030.

- Hyundai is partnering with various companies to develop hydrogen infrastructure.

INSTER (New Compact EV)

The Hyundai INSTER, a new compact EV launched in 2024, fits the 'Question Mark' quadrant of the BCG matrix. This classification is due to its entry into a competitive EV market with uncertain market share and profitability. Its future hinges on effective marketing, competitive pricing, and consumer adoption. Successful strategies can shift the INSTER towards a 'Star' position.

- Market Share: The INSTER aims to capture a portion of the growing compact EV market, estimated to reach significant volumes by 2025.

- Investment: Hyundai will likely invest heavily in advertising and distribution to boost the INSTER's visibility.

- Competition: The INSTER faces rivals like the Renault 5 E-Tech Electric, which also debuted in 2024, creating a competitive landscape.

- Pricing: Competitive pricing is essential for the INSTER to attract buyers and gain market share.

Hyundai's INSTER, as a 'Question Mark,' is an EV facing market uncertainty. Its market share and profitability are unproven in a competitive landscape. Investment, pricing, and consumer adoption will determine its trajectory.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Share | Targeting the compact EV sector. | Compact EV market expected growth. |

| Investment | Focus on advertising and distribution. | Significant investment planned. |

| Competition | Faces rivals like Renault 5. | Competitive market debut. |

BCG Matrix Data Sources

Hyundai's BCG Matrix uses market data, financial statements, industry analyses, and sales figures. This enables reliable strategic evaluations.