I-Net PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

I-Net Bundle

What is included in the product

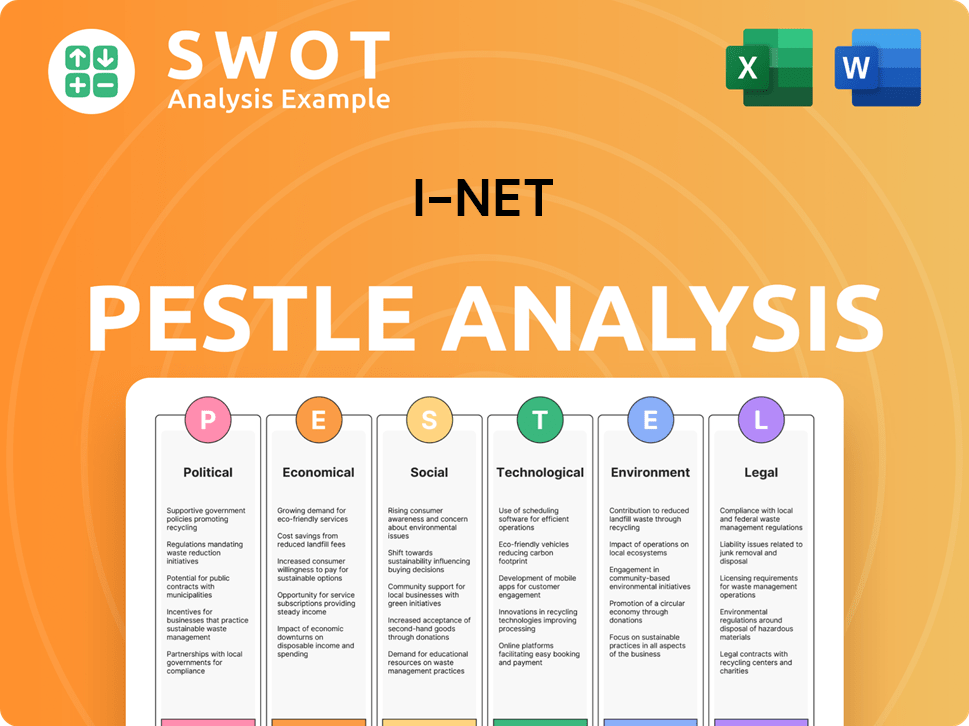

Assesses macro-environmental factors across six areas: Political, Economic, Social, Technological, Environmental, and Legal, tailored for I-Net.

Enables focused decision-making through its distilled content and easy-to-understand formatting.

Preview Before You Purchase

I-Net PESTLE Analysis

What you see is what you get! The preview for this I-Net PESTLE Analysis is the complete, fully formed document.

It’s ready for you to download and utilize immediately after your purchase. No hidden sections or surprises.

This detailed and ready-to-use file will be in your hands instantly. You’ll have everything displayed here.

Everything is ready for immediate use. Access to all the provided details! It is already formatted!

PESTLE Analysis Template

See how external factors shape I-Net's business. This concise PESTLE Analysis explores political, economic, and social impacts. Gain crucial insights to inform your investment strategies. Download the full, detailed PESTLE analysis and get ahead today!

Political factors

The Japanese government's push for digital transformation, spanning public services and healthcare, is significant. This digitalization creates opportunities for companies like IIJ. Key initiatives for 2024-2025, outlined in the 'Digital Society Plan', include My Number card services and 5G expansion. The focus on digital infrastructure directly boosts demand for internet and network services; in 2024, the government allocated ¥5.6 trillion for digital transformation projects.

Japan prioritizes cybersecurity due to digital dependence. Active cyber defence strategies are evolving to combat rising threats. The National Cyber Security Office is planned for 2025. Enhanced public-private collaboration will affect IIJ, creating opportunities and compliance needs. In 2024, Japan's cybersecurity market was valued at $10.5 billion, expected to reach $15 billion by 2028, as per Statista.

Japan's telecom sector faces strict regulations impacting competition, pricing, and network growth. Recent changes in spectrum rules and pricing controls affect IIJ's strategies. The government aims to boost wireless networks and undersea cables. In 2024, Japan's telecom market was worth over $100 billion.

International Relations and Trade Policies

Geopolitical risks and trade tensions significantly influence the IT industry, potentially disrupting supply chains and international collaborations. Although tariffs' impact on Japanese corporate earnings may seem minimal, global economic conditions and trade policies continue to affect IT business investments and growth. For instance, the US-China trade war in 2018-2019 saw a decrease in IT hardware exports. In 2024, the industry closely monitors evolving trade regulations.

- 2024 projections show a 4.5% growth in global IT spending, yet geopolitical uncertainties could temper this.

- Trade disputes can lead to increased costs and reduced access to critical components.

- Companies are diversifying supply chains to mitigate these risks.

- International collaborations face increased scrutiny and potential restrictions.

Government Procurement and IT Spending

Government procurement heavily influences IT markets, setting specific guidelines for IT products and services, including cloud and telecom. These guidelines emphasize security and supply chain risk assessments, crucial for companies like IIJ. The government's IT spending offers a major market for IIJ, especially in secure network infrastructure and cloud solutions. In 2024, the U.S. federal government's IT spending reached $118 billion, reflecting the scale of this opportunity.

- Government IT spending is a significant market.

- Security and supply chain are key factors.

- IIJ can capitalize on these opportunities.

- U.S. federal IT spending in 2024 reached $118B.

Government digital initiatives, like the "Digital Society Plan" with ¥5.6 trillion allocated in 2024, drive infrastructure demand. Cybersecurity is prioritized; Japan's market, $10.5B in 2024, aims for $15B by 2028. Telecom regulations and geopolitical risks significantly impact IT markets.

| Political Factor | Impact on IIJ | Data/Stats (2024-2025) |

|---|---|---|

| Digital Transformation | Increased demand for services. | ¥5.6T for digital projects, Digital Society Plan. |

| Cybersecurity | Creates opportunities, compliance. | $10.5B (2024) cybersecurity market. |

| Telecom Regulations | Affects strategy, competition. | Japan's telecom market over $100B in 2024. |

Economic factors

Japan's economy anticipates a moderate recovery. Real GDP growth is projected for 2025, potentially around 1.0%. Corporate profits are trending up, supporting increased business investment.

This growth, alongside improving profitability, fosters a favorable environment. Business fixed investment is rising, indicating confidence in the future.

Such conditions usually boost IT spending. Companies like IIJ, focusing on corporate clients, stand to gain from this trend.

Increased IT budgets often translate to higher demand. This benefits IIJ's services, potentially improving revenue streams.

The interplay between economic growth and investment is crucial. It directly influences IIJ's business prospects.

Inflation remains a key economic concern, though recent data hints at wage growth exceeding price rises. This trend could drive up private consumption, a positive sign for economic expansion. The Bank of Japan is closely monitoring the interplay between wages and inflation. Businesses might respond to rising labor costs by investing more in automation and digital solutions.

The Bank of Japan's shift from unconventional policies, with expected gradual rate hikes, is underway. Although financial conditions are still favorable, rising interest rates may increase borrowing costs for companies. This could affect IT infrastructure investments by IIJ's clients. The Bank of Japan's current policy rate stands at 0.1%.

Digital Economy Expansion

Japan's digital economy is booming, fueled by cloud, IoT, and AI. This boosts demand for IT services like security and data privacy. The Japanese IT services market is expected to see substantial growth. Recent data indicates a 10% yearly rise in cloud adoption across various sectors. This expansion presents significant opportunities for businesses.

- Cloud computing adoption is up by 10% annually.

- IT services market growth is strong.

Consumer Spending and E-commerce Growth

Consumer spending in Japan has seen moderate growth, yet consumer sentiment remains cautious. E-commerce continues to expand, with mobile commerce driving online retail. This growth boosts the need for strong internet infrastructure and services.

- E-commerce in Japan grew by 6.8% in 2024, reaching ¥22.7 trillion.

- Mobile commerce accounts for over 50% of all e-commerce transactions.

Japan's economy is seeing a modest recovery, with 1.0% GDP growth projected for 2025. Corporate profits are up, fostering business investment, which should help IT spending. The Bank of Japan's policy changes, along with inflation and wage trends, impact financial conditions.

| Economic Factor | Details | Impact |

|---|---|---|

| GDP Growth | ~1.0% (2025 projected) | Positive for IT spending |

| Inflation | Wage growth exceeds price rises | Boosts private consumption, potentially |

| Interest Rates | BOJ policy rate 0.1%, with gradual hikes | Could increase borrowing costs |

Sociological factors

Japan grapples with a shrinking, aging population, and labor shortages. The median age in Japan is about 49 years old, one of the highest globally. These demographic shifts are pushing for automation to boost efficiency. This creates demand for IT to enhance productivity, especially in sectors like healthcare and logistics. In 2024, Japan's labor force is projected to decrease, intensifying these challenges.

Japan boasts high internet penetration, with approximately 93.3% of the population online as of early 2024. Digital adoption is rising across all ages; older consumers are increasingly using online shopping, which drives demand for internet services.

The shift to remote work, accelerated by the pandemic and labor reforms, significantly impacts work styles. This trend encourages investments in digital infrastructure to support remote operations. According to a 2024 study, 60% of companies plan to increase their remote work options. IIJ's core offerings, like secure networks, are crucial for this distributed work environment.

Consumer Demand for Digital Services

Consumer behavior is shifting towards digital platforms globally, with significant implications for internet demand. In 2024, e-commerce sales are projected to reach $6.3 trillion worldwide, highlighting the importance of robust digital infrastructure. While brand research on social media may vary by region, the overall trend shows increasing engagement with digital services. This drives the need for reliable internet and network capabilities to support various online activities.

- Global e-commerce sales in 2024 are projected to reach $6.3 trillion.

- Internet penetration rates continue to increase worldwide, driving demand for digital services.

Focus on Digital Inclusivity

Japan's digital society vision prioritizes inclusivity. The goal is for everyone to access digital services, regardless of their background. This push might mean service providers need to make their offerings accessible to all. In 2024, 98% of Japanese households had internet access, but digital literacy varies.

- Government initiatives aim to reduce the digital divide.

- Focus on accessibility features for diverse users.

- Potential for increased investment in digital infrastructure.

Japan's aging population and declining birth rate will likely require more automation and IT solutions in areas like healthcare, potentially increasing demand. Increased remote work, projected by 60% of companies as of 2024, stimulates further investment in digital infrastructure and services. Worldwide, e-commerce growth to $6.3 trillion in 2024 signals the necessity for strong digital support, in line with Japan's 98% household internet access as of 2024.

| Factor | Impact | Data Point (2024) |

|---|---|---|

| Aging Population | Increased demand for automation/IT in healthcare | Median age ~49 years |

| Remote Work Trends | More investment in digital infrastructure. | 60% companies increase remote options. |

| E-commerce Growth | Need for strong digital infrastructure | $6.3T global sales. |

Technological factors

Japan is experiencing substantial growth in cloud computing and data center infrastructure, fueled by rising cloud service adoption and AI. Tech giants are heavily investing in expanding data centers across Japan. This benefits IIJ, a provider of cloud and data center solutions. The Japanese data center market is projected to reach $14.6 billion by 2025, with a CAGR of 8.4% from 2020 to 2025.

The Japanese IT market is significantly influenced by the rapid adoption of AI, IoT, and other advanced technologies. These technologies demand strong network infrastructure, substantial data processing, and elevated security protocols. In 2024, the IoT market in Japan is projected to reach $28.7 billion. IIJ's offerings in network, cloud, and security are crucial for the implementation of these technologies. The Japanese AI market is predicted to reach $18.4 billion by the end of 2025.

The escalating cyber threats and emphasis on digital resilience drive demand for application security, cloud security, and data privacy solutions. Investments in secure software development and robust security protocols are growing. The global cybersecurity market is projected to reach \$345.4 billion in 2024. This creates opportunities for companies like IIJ to expand their security offerings, as spending on cybersecurity is expected to increase by 12% in 2025.

Evolution of Network Infrastructure (e.g., 5G, Undersea Cables)

The ongoing evolution of network infrastructure, including 5G and undersea cables, is vital. These advancements underpin the increasing need for data and connectivity. IIJ's services benefit from this, broadening its market reach. For example, 5G is projected to cover 85% of North America by 2025.

- 5G is projected to cover 85% of North America by 2025.

- Undersea cables are expanding globally, increasing data transfer capacity.

- These improvements enhance IIJ's service delivery.

- Increased connectivity drives market growth.

Technological Innovation and R&D

Japan is heavily investing in its digital infrastructure, focusing on AI, cloud computing, and data platforms. This includes significant funding for cutting-edge areas like semiconductors and quantum technology. The government's push for technological advancement is evident in initiatives such as the "Strategic Program for Advancing AI" and the "Moonshot R&D Program," with the aim of global leadership. These investments are critical for companies like IIJ, which develops its own network equipment and software.

- Japan's R&D expenditure in 2024 is projected to be around ¥20 trillion.

- The global AI market is expected to reach $200 billion by the end of 2024.

- IIJ's R&D spending for the fiscal year 2024 is estimated at approximately ¥10 billion.

Technological advancements in Japan are rapidly evolving, with strong growth in cloud computing and data centers, particularly driven by AI adoption.

The government is investing heavily in digital infrastructure, including semiconductors and quantum tech; Japan's R&D expenditure is around ¥20 trillion in 2024.

This fosters an environment where companies such as IIJ expand offerings in networks, cloud, and security, aligned with market needs.

| Technology Trend | Market Size (2024) | Growth Rate |

|---|---|---|

| Japanese AI Market | $18.4 billion (projected) | Significant expansion |

| Global Cybersecurity Market | $345.4 billion | 12% increase in 2025 |

| Japanese Data Center Market | $14.6 billion (2025 proj.) | 8.4% CAGR (2020-2025) |

Legal factors

Japan's Act on the Protection of Personal Information (APPI) is key. Recent APPI amendments demand tighter security and risk checks. IIJ and similar firms must follow these rules. Non-compliance can bring hefty fines, impacting finances and operations. In 2024, data breach penalties saw increases.

Japan has cybersecurity laws and guidelines, especially for key infrastructure and network operators. These mandate proactive cybersecurity enhancements and government cooperation. The new 'active cyber defence' strategy could introduce additional legal frameworks for cyber threat responses. In 2024, Japan's cybersecurity market was valued at $12.5 billion, projected to reach $15 billion by 2025, reflecting growing legal and compliance pressures.

Telecommunications laws significantly shape IIJ's operations. These laws dictate licensing, service quality, and consumer rights. For instance, regulations on data privacy, like those in effect in 2024, have been updated. Compliance costs can impact profitability. Changes in these laws can directly affect IIJ's service offerings and require strategic adjustments.

Regulations on Digital Platforms and E-commerce

The digital landscape is heavily influenced by legal factors. The DPF Act safeguards online shoppers. Advertising and payment service regulations are crucial for e-commerce. These rules indirectly impact IIJ's corporate clients. Compliance is vital for all digital operations.

- DPF Act strengthens consumer rights.

- Advertising standards are strictly enforced.

- Payment regulations ensure secure transactions.

- Compliance impacts the broader digital market.

Contract Law and Technology Sourcing Regulations

IIJ must navigate legal frameworks for technology sourcing, focusing on contracts like work and time-and-material agreements. While no specific private sector tech procurement regulations exist, responsible supply chain and human rights guidelines are increasingly important. For example, the EU's Digital Services Act (DSA) and Digital Markets Act (DMA) set precedents. These regulations impact IIJ's service provision. Moreover, the global IT services market is projected to reach $1.4 trillion in 2024, highlighting the scale of related contracts.

- Contract law governs agreements for IIJ's services.

- Human rights guidelines are relevant for supply chains.

- The IT services market is worth over a trillion dollars.

- EU regulations influence digital service providers.

Legal factors like Japan's APPI and cybersecurity laws mandate robust data protection and proactive cybersecurity. Telecommunications laws influence licensing and service quality. The DPF Act and advertising standards impact e-commerce, affecting IIJ's clients. Compliance is key for IIJ, with the IT services market at $1.4T in 2024.

| Aspect | Details | Impact for IIJ |

|---|---|---|

| APPI Compliance | Stronger data security, risk assessments, and non-compliance fines. | Financial and operational risks |

| Cybersecurity Laws | Enhancements in proactive cybersecurity. | New cyber threat responses, government partnership |

| Telecom Regulations | Licensing, service quality and customer rights, impact service offers | Adjustments in service offerings |

Environmental factors

Data centers are major electricity users. Their energy demand is rising due to AI and cloud computing growth. This impacts firms like IIJ. Data centers globally consumed about 2% of total electricity in 2022. Sustainable power sources and energy efficiency are crucial.

The global push for renewable energy is intensifying, driven by climate goals. Japan actively promotes renewable energy adoption for data centers and semiconductor factories. Corporate PPAs for green energy are on the rise, affecting IIJ's energy strategies. In 2024, Japan's renewable energy capacity grew by 12%, influenced by government incentives.

Japan aims for carbon neutrality by 2050, pushing for decarbonization across sectors. Regulations and incentives are evolving to promote energy efficiency and reduce emissions, affecting IT infrastructure. The Ministry of Economy, Trade and Industry (METI) supports green initiatives. In 2024, Japan's renewable energy share was about 20%. The government is also backing low-carbon hydrogen and ammonia, investing ¥3.5 trillion by 2030.

Sustainable Construction Practices

Environmental factors significantly impact the construction of data centers. This includes the sourcing of materials, where sustainable options are gaining traction. In Japan, firms are increasingly using low-carbon concrete and other eco-friendly building materials. This shift is driven by growing environmental awareness and potential regulatory changes.

- Data center construction in Japan is evolving to embrace sustainable practices.

- Low-carbon concrete and other sustainable materials are being adopted.

- This aligns with global trends toward reducing carbon footprints.

- Expectations and regulations may further drive these sustainable construction practices.

E-waste Management and Circular Economy

The IT sector significantly contributes to electronic waste, necessitating robust management strategies. The circular economy model, focusing on reuse and recycling, is gaining traction in the industry. Globally, e-waste generation is projected to reach 74.7 million metric tons by 2030, up from 53.6 million tons in 2019, highlighting the urgency. Companies must adhere to environmental regulations and integrate sustainable practices.

- E-waste generation is growing rapidly.

- Circular economy principles offer solutions.

- Companies must embrace sustainability.

- Regulatory compliance is essential.

Environmental factors like energy consumption and waste management critically influence IIJ and its data centers. Data centers' growing energy demands, accelerated by AI, spur a push for renewable sources and efficiency. In Japan, embracing carbon neutrality and circular economy principles, along with adhering to rising environmental standards, are essential.

| Aspect | Details | Data |

|---|---|---|

| Energy Demand | Data center power needs due to AI, Cloud computing | Global data center electricity use reached about 2% in 2022. |

| Renewable Energy | Japan's focus on green power in data centers | Japan saw a 12% increase in renewable energy capacity in 2024. |

| E-Waste | IT sector's role and waste management needs | Global e-waste forecast is 74.7 million metric tons by 2030. |

PESTLE Analysis Data Sources

The analysis uses global economic indicators, legal documents, and technology forecasts, drawing from research firms and official government sources.