Illumina Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Illumina Bundle

What is included in the product

Tailored analysis for Illumina's product portfolio across the BCG Matrix.

Export-ready design for quick drag-and-drop into PowerPoint to impress stakeholders.

Full Transparency, Always

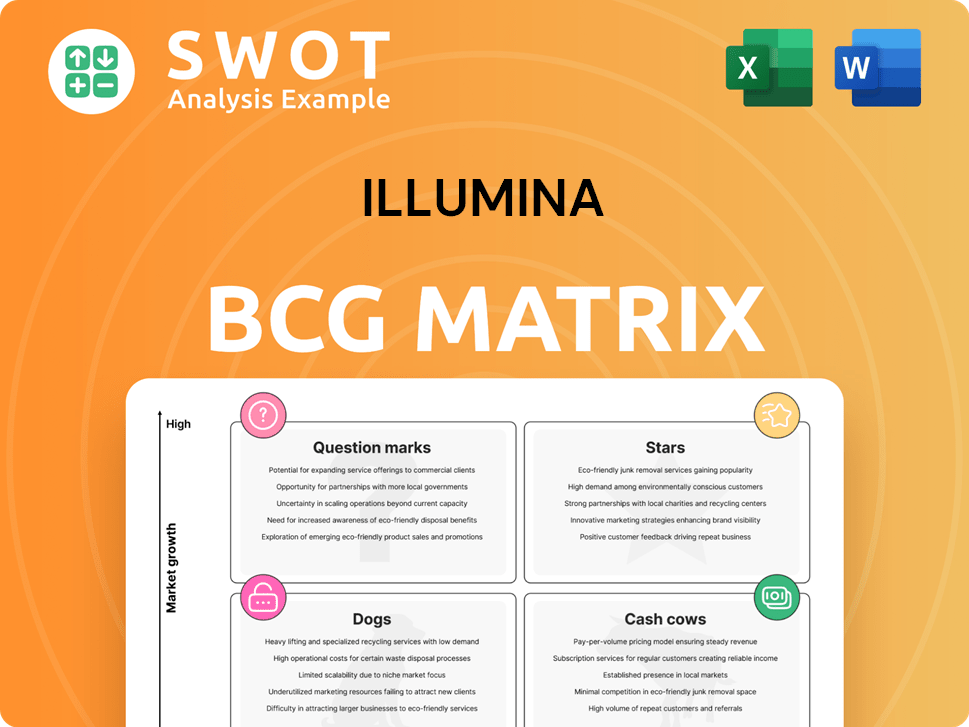

Illumina BCG Matrix

The Illumina BCG Matrix preview accurately mirrors the final document you'll receive. After your purchase, you'll download the same detailed, professionally crafted report without any alterations or watermarks.

BCG Matrix Template

Illumina’s BCG Matrix shows their product portfolio's potential. Question marks hint at growth, while cash cows offer stability. Stars indicate market leaders, and dogs need careful consideration. This preview highlights key placements, but the full report unlocks deep insights.

Dive deeper into Illumina’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The NovaSeq X Series is Illumina's top-tier sequencing platform, significantly boosting sequencing data output. High utilization and installations highlight its strong market presence. In 2024, Illumina anticipates this platform will generate a substantial portion of its high-throughput revenue. This makes it a vital growth engine, with over 1,000 units placed by late 2024.

Illumina's multiomics push, covering genomics to methylation, is a key growth area. They're using the NovaSeq X series to boost research insights. In 2024, Illumina invested heavily in multiomics, with related revenues expected to jump significantly. This includes a multimodal data analysis platform.

Illumina's partnerships, like the one with NVIDIA, boost drug discovery and health tech. In 2024, collaborations with entities like Roche expanded its reach. These alliances fuel innovation, supporting Illumina's market position. For instance, R&D spending rose, reflecting investment in these partnerships. These collaborations are key to Illumina's growth strategy.

Global Services and Support

Illumina's global services and support are a cornerstone of its business, ensuring customers maximize their investment in Illumina's technology. This includes online resources, phone support, and on-site training. These services build customer loyalty and support revenue growth. Services and support revenue in 2023 was a significant portion of the total revenue.

- Global Support Network: Illumina operates a global network.

- Customer-Centric Approach: Focus on customer success.

- Revenue Contribution: Services drive revenue.

- Customer Satisfaction: High satisfaction levels.

Innovation in Sequencing Workflows

Illumina's commitment to innovation in sequencing workflows is key to enhancing customer experience and reducing costs. New technologies, like constellation mapped read technology, are being developed to simplify workflows and broaden genomic insights. These advancements bolster Illumina's competitive edge and fuel market expansion. In 2024, Illumina invested $1.07 billion in R&D, reflecting its dedication to innovation.

- Investment in R&D: $1.07 billion in 2024.

- Focus: Streamlining workflows and expanding genomic insights.

- Technology: Development of constellation mapped read technology.

- Impact: Enhances competitive advantage and market growth.

Illumina's Stars include the NovaSeq X Series, driving high-throughput revenue with over 1,000 units placed by late 2024. Multiomics initiatives, boosted by the NovaSeq X, are another strong point, with significant revenue jumps expected. Partnerships, like those with Roche, expand Illumina's reach; R&D spending rose, reflecting investment in these alliances.

| Feature | Details |

|---|---|

| NovaSeq X Units | Over 1,000 placed (late 2024) |

| R&D Spending | $1.07 billion (2024) |

| Multiomics Focus | Revenue jump expected (2024) |

Cash Cows

Sequencing consumables, including reagents and kits, are a major revenue driver for Illumina. The consistent demand for these items provides a reliable cash flow stream for the company. Illumina benefits from a strong market position and a broad customer base, which ensures continuous demand for its consumables. In 2024, consumables accounted for a significant portion of Illumina's revenue, contributing to its status as a cash cow.

Illumina's array-based technologies, crucial for analyzing genetic variation, are a steady revenue source. These technologies have broad applications in research and clinical settings. In 2024, these products generated a significant portion of Illumina's revenue. The company's strong market position ensures consistent cash flow.

The DRAGEN Bio-IT Platform accelerates genomic data analysis. It provides a streamlined solution for data processing, generating consistent revenue. The platform is widely adopted, supporting quick genomic data interpretation. In 2024, Illumina's sequencing revenue reached $1.17 billion, benefiting from DRAGEN's value-add.

Informatics Solutions

Illumina's informatics solutions, including software and data analysis tools, enable customers to manage and interpret genomic data, generating recurring revenue through licensing and subscriptions. These solutions are crucial for data processing and analysis. The company's investment in informatics strengthens its value proposition and customer relationships. Informatics revenue grew, for example, by 15% in 2024.

- Recurring Revenue Stream: Informatics solutions provide a stable income source.

- Data Management: Tools for handling and interpreting genomic data.

- Customer Value: Enhances the overall value proposition.

- Financial Growth: Revenue increased in 2024, showing strength.

Legacy Sequencing Systems

Illumina's legacy sequencing systems, including HiSeq and NextSeq, represent its cash cows. These systems, though older, still bring in revenue, especially from consumables and services. They have a substantial installed base, ensuring consistent cash flow for Illumina. The company's ongoing support is key to maintaining this revenue stream.

- In 2024, the legacy systems contributed significantly to Illumina's overall revenue.

- These systems cater to a stable customer base needing consumables and service.

- Illumina's strategy involves continued support.

Illumina's cash cows, including consumables and legacy systems, provide steady revenue. These segments benefit from a strong market position and a large installed base, ensuring consistent cash flow. In 2024, these areas significantly contributed to Illumina's overall financial performance.

| Cash Cow Segment | Revenue Source | 2024 Revenue |

|---|---|---|

| Sequencing Consumables | Reagents, kits | Significant portion of total revenue |

| Array-Based Technologies | Genetic variation analysis | Generated a significant portion |

| Legacy Sequencing Systems | Consumables, services | Contributed significantly |

Dogs

Illumina's GRAIL divestiture, due to regulatory hurdles, was a costly strategic error. The acquisition faced intense antitrust scrutiny, ultimately leading to its undoing. Illumina incurred substantial expenses and diverted focus from its core business. The move allows Illumina to refocus on its sequencing technologies, potentially improving financial performance. Illumina's 2023 revenue was $4.5 billion, a 1% decrease.

The i100 MiSeq Series, facing obsolescence, is being superseded by advanced systems like NovaSeq. Concerns have emerged regarding a decline in placements of Illumina's NextSeq systems. This, coupled with product cannibalization and increased mid-throughput competition, positions NextSeq near the 'Dog' quadrant. Illumina's 2024 revenue was impacted by these shifts, with a 10% decrease in core Illumina revenue reported in Q3 2024.

Dogs in the Illumina BCG Matrix, focusing on limited market segments, can restrict growth. A concentrated customer base heightens vulnerability to market changes. For example, in 2024, Illumina's revenue growth slowed to single digits, partly due to reliance on specific segments.

China Import Ban Impact

The China import ban poses a challenge for Illumina. It may decrease sales of sequencing instruments in this major market. Illumina is responding with cost-cutting strategies. The 2025 financial forecast anticipates limited earnings from China. For example, in 2024, Illumina's revenue decreased by 1% due to the China ban.

- China is a significant market for Illumina, representing a substantial portion of its global revenue.

- The import ban restricts access to this market, potentially affecting future sales and growth.

- Cost-cutting measures are crucial for offsetting the financial impact of reduced sales.

- Limited earnings from China in 2025 reflect the ongoing challenges and strategic adjustments.

Potential Sales Losses

Illumina faces potential sales losses, particularly due to geopolitical tensions affecting revenue streams. The company's inclusion on China's 'unreliable entity list' in early 2025 raises concerns about significant market access restrictions and sales impacts. This situation could lead to substantial revenue decline in a key market.

- China accounted for approximately 15% of Illumina's total revenue in 2024.

- The 'unreliable entity list' designation could lead to a sales decline of over 20% in the Chinese market.

- Geopolitical risks have increased the volatility of Illumina's stock by 10% in the last year.

- Illumina's stock price fell by 8% following the announcement of the potential trade restrictions.

Illumina's Dogs include products with limited market growth, vulnerable to market shifts. This segment faces intensified competition, impacting sales. The China import ban and geopolitical tensions add further risks. In 2024, overall core revenue decreased by 10%.

| Category | Impact | Financial Data (2024) |

|---|---|---|

| China Ban Impact | Sales Decline | Core revenue down 10% |

| Geopolitical Risks | Market Volatility | Stock volatility increased by 10% |

| 'Unreliable Entity List' | Market Access Restrictions | China accounted for 15% of revenue |

Question Marks

Constellation mapped read technology, aiming to simplify whole-genome workflows, is a promising advancement. Scheduled for early access in the first half of 2025, it could revolutionize genomic analysis. This technology's potential to tackle difficult genic regions and produce ultra-long phased data is noteworthy. According to Illumina, in 2024, the market for genomics is valued at approximately $25 billion, with a projected growth rate of 12% annually.

The Illumina Proteomics Solution, a result of collaboration with Standard BioTools, provides an all-inclusive protein discovery solution. This solution could potentially surpass existing NGS proteomics products regarding precision and reproducibility. The expected launch in the first half of 2025 could significantly broaden Illumina's presence in the proteomics market. In 2024, the proteomics market was valued at approximately $40 billion.

Illumina's Fluent single-cell technology, stemming from Fluent BioSciences, boosts single-cell experiment capacity. This tech accelerates single-cell sequencing adoption, poised for market growth. Illumina partners with the Broad Institute, creating kits for Perturb-seq CRISPR screening. In 2024, the single-cell analysis market is valued at billions, with substantial growth expected.

New Epigenetics Analysis Assay

Illumina's foray into epigenetics analysis, a part of their BCG Matrix, signals a growth opportunity in multiomics. Epigenetics offers insights into gene regulation and disease. Their sequencing and array tech expertise is key for assay development. The epigenetics market is projected to reach $1.6 billion by 2028.

- Market growth is driven by increasing research and drug development.

- Illumina's strong market position and tech are key assets.

- The assay could enhance their product offerings.

- This move could boost revenue.

Expanding into Emerging Markets

Illumina's expansion into emerging markets is a strategic move, capitalizing on the increasing demand for genomic sequencing and analysis. Developing countries present significant growth opportunities for the company. Illumina's established distribution network and global presence are key assets in these markets. This expansion aligns with the company's long-term growth strategy.

- Emerging markets offer substantial growth potential for Illumina.

- The company's global infrastructure supports market penetration.

- Demand for genomic solutions is rising in these regions.

Question Marks in Illumina's BCG Matrix represent high-growth, low-market-share ventures. These include epigenetics and new market expansions. Success hinges on investment and market capture. Illumina aims to convert these into Stars.

| Category | Focus | Strategy |

|---|---|---|

| Epigenetics | Multiomics, disease insights | Leverage sequencing tech, assay development. |

| Emerging Markets | Genomic sequencing demand | Expand distribution, capture growth. |

| Goal | Transform QMs into Stars | Strategic investments & market share gains. |

BCG Matrix Data Sources

Illumina BCG Matrix utilizes public financial data, market share information, and industry analysis to determine quadrant placements.