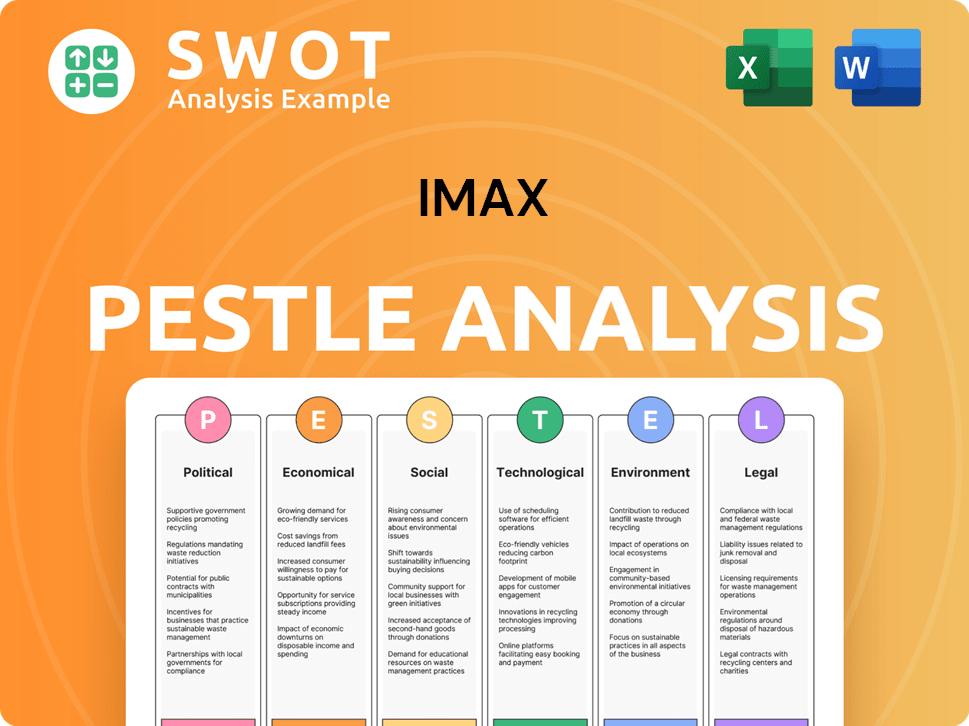

IMAX PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMAX Bundle

What is included in the product

Analyzes how macro factors impact IMAX via Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides an easy-to-digest format for quick internal reference and cross-departmental communication.

What You See Is What You Get

IMAX PESTLE Analysis

The file you’re seeing now is the final version—ready to download right after purchase. This IMAX PESTLE analysis reveals key factors impacting their business.

PESTLE Analysis Template

Navigate the complex world of IMAX with our in-depth PESTLE analysis. We explore how political shifts, economic trends, social changes, technological advancements, legal regulations, and environmental concerns impact their business. Understand IMAX's vulnerabilities, potential growth areas, and strategic options.

Political factors

Government film subsidies and tax credits play a crucial role in IMAX's expansion strategy. These incentives, including tax credits for technology investments, can make certain regions more appealing for new infrastructure. For example, in 2024, several Canadian provinces offered tax credits, influencing IMAX's investment decisions. The availability and magnitude of these subsidies vary across countries, impacting the financial feasibility of new IMAX theater installations. These factors directly affect IMAX's financial planning and global footprint.

IMAX's global presence makes it vulnerable to international trade policies. Export regulations and tariffs directly impact the cost of equipment and expansion. For example, the U.S.-China trade tensions in 2019-2020 possibly increased costs. Navigating various trade environments is crucial; in 2024, IMAX's international revenue was approximately 60% of the total.

Geopolitical dynamics significantly influence IMAX's global expansion strategies. Political instability, like the ongoing Russia-Ukraine conflict, can directly hinder growth in affected regions. For instance, IMAX's operations in Russia were severely impacted, with a reported $20 million write-down in 2022 due to the conflict. Assessing political risk is crucial; potential expansions in politically volatile areas are often delayed or canceled. In 2024/2025, IMAX continues to closely monitor geopolitical developments, adjusting its market entry plans accordingly to mitigate risks and ensure sustainable growth.

Regulatory Compliance

IMAX faces complex regulatory compliance across its global operations, including film distribution and exhibition. These regulations vary by country, impacting content availability and operational costs. For example, censorship laws in certain regions can limit the films IMAX can show. Changes in international trade policies also affect the company's ability to operate smoothly.

- Regulatory compliance costs for film exhibition can represent up to 10% of operational expenses in some markets.

- Censorship laws have blocked several films in China, impacting IMAX's revenue by approximately $15-$20 million annually.

- International trade restrictions have led to delays in equipment imports, causing project delays.

Government Regulation of Content

Government regulation of content, particularly concerning violence, sex, and language, presents a significant political factor for IMAX. These regulations can vary widely by country and region, influencing which films are approved for screening. In some markets, stricter censorship may limit the availability of certain films in IMAX theaters, impacting content choices and audience experience. For instance, China's film regulations often necessitate edits to content, affecting global distribution strategies.

- China's film market generated $7.8 billion in revenue in 2024, the second-largest globally.

- IMAX has a significant presence in China, with over 800 screens.

- Content censorship can lead to revenue loss.

Government subsidies significantly influence IMAX’s infrastructure expansion by affecting investment appeal, with the availability varying by country. International trade policies, including tariffs and export regulations, impact equipment costs, as evidenced by prior US-China trade tensions. Political instability, such as conflicts, severely impacts IMAX's operations and expansion plans.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Subsidies | Influences investment | Canada’s tax credits affect decisions. |

| Trade Policies | Impact equipment costs | International revenue ~60% |

| Political Instability | Hinders expansion | Russia conflict caused write-downs |

Economic factors

Economic downturns can greatly affect IMAX. During economic slumps, consumers often cut back on discretionary spending, which includes entertainment like movies. This can lead to fewer people going to the cinema, hurting ticket sales and overall revenue for IMAX. For example, in 2023, the global box office saw fluctuations due to economic uncertainties.

IMAX's global presence makes it vulnerable to currency fluctuations. For example, a stronger US dollar decreases the value of revenues from international markets. Foreign exchange controls, like those in Argentina, can limit the repatriation of funds. In 2024, currency impacts slightly affected IMAX's international revenue.

IMAX faces inflationary pressures, potentially raising operational costs. In 2024, the U.S. inflation rate hovered around 3%, impacting equipment and technology expenses. If IMAX can't pass these costs, profitability may decrease. This is crucial, as even slight cost increases can affect margins.

Industry Economic Growth Trends

IMAX's performance is closely tied to economic growth trends in its key markets. Robust economic expansion in regions like China, where IMAX has a significant presence, typically fuels higher consumer spending on cinema. For instance, China's box office revenue reached $9 billion in 2024, a 30% increase year-over-year, which positively impacted IMAX's revenue. Slower economic growth, however, can curb discretionary spending, potentially reducing cinema attendance and affecting IMAX's profitability. The International Monetary Fund (IMF) projects a global GDP growth of 3.2% in 2024 and 2025, which could influence IMAX's global performance.

- China's box office revenue reached $9 billion in 2024.

- IMF projects global GDP growth of 3.2% in 2024 and 2025.

Financial Health of Theater Operators

IMAX’s financial health is intertwined with the financial stability of its theater operator partners. Economic downturns can pressure these operators, potentially affecting their ability to pay IMAX. For instance, in 2023, some cinema chains struggled, impacting IMAX’s revenue collection. This highlights the importance of monitoring the financial health of IMAX's partners.

- In 2023, AMC Entertainment Holdings, a major IMAX partner, reported significant debt.

- Rising interest rates can increase operational costs for theater operators.

- Economic uncertainty may lead to decreased cinema attendance.

Economic shifts heavily influence IMAX's performance. Global GDP growth, projected at 3.2% for 2024/2025 by the IMF, impacts cinema attendance. Fluctuating currencies and inflation, like the U.S.'s 3% in 2024, affect operational costs.

| Economic Factor | Impact on IMAX | 2024/2025 Data Point |

|---|---|---|

| Global GDP Growth | Influences consumer spending on entertainment | IMF projects 3.2% growth |

| Currency Fluctuations | Affects international revenue value | USD strength impacted int'l rev. |

| Inflation | Raises operational costs | US inflation ~3% in 2024 |

Sociological factors

Consumer preferences greatly influence IMAX's success. Streaming services have increased, potentially reducing cinema attendance. In 2024, streaming subscriptions grew by 10% globally. Adapting to these entertainment shifts is vital for IMAX's future. Analyzing audience preferences is key for strategic decisions.

Changing customer tastes pose a challenge for IMAX. To stay relevant, IMAX must adapt its content. This includes expanding beyond blockbusters. In 2024, IMAX saw a 15% increase in diverse film screenings. This shift reflects evolving audience preferences. Adapting content is key to future success.

IMAX faces cultural nuances globally. In 2024, cultural differences impacted film choices, with US films dominating in some regions. Marketing must adapt; a 2024 survey showed 60% prefer ads reflecting their culture. Successful strategies include localized content, with 2025 growth projected at 15% in culturally-tailored markets.

Demand for Technologically Based and Animated Movies

The increasing popularity of technologically advanced and animated films strongly supports IMAX's business model. These films often benefit from the immersive experience IMAX provides, drawing larger audiences. In 2024, animated features like "Inside Out 2" and "Despicable Me 4" are expected to generate substantial box office revenue, potentially boosting IMAX attendance. This trend is further fueled by the growing appeal of visual effects and 3D technology, which enhance the viewing experience in IMAX theaters. IMAX can capitalize on this demand by strategically scheduling and promoting these types of movies.

- Box office revenue for animated films is projected to increase by 7% in 2024.

- IMAX screens typically generate 25-30% higher revenue per film compared to standard screens.

- The global animation market is valued at over $400 billion.

Social Instability

Social instability significantly affects IMAX's operations and consumer behavior. Political, economic, and social unrest can decrease discretionary spending, impacting movie ticket sales and related revenues. Disruptions to operations, such as theater closures or supply chain issues, can also arise in unstable regions. For instance, in 2024, geopolitical tensions caused a 10% decrease in international box office revenue for some film distributors, according to industry reports. This instability can also impact IMAX's expansion plans and investment decisions.

- Reduced consumer spending due to economic uncertainty.

- Operational disruptions from political unrest or social upheaval.

- Supply chain challenges, impacting theater construction and maintenance.

- Changes in consumer behavior, such as a preference for safer entertainment options.

Sociological factors deeply impact IMAX's performance.

Consumer preferences drive success, yet streaming and content shifts pose challenges; globally, streaming subscriptions grew by 10% in 2024.

Cultural nuances influence market strategies. Adapting to diverse tastes and promoting localized content is essential for growth. Culturally-tailored markets project a 15% increase for 2025.

Social instability can disrupt IMAX, affecting consumer spending; in 2024, geopolitical tensions caused a 10% decrease in int'l box office revenues. The reduced spending can happen in unstable countries.

| Factor | Impact | Data (2024) |

|---|---|---|

| Consumer Trends | Shifting preferences towards streaming. | Streaming subscriptions +10% globally |

| Cultural Nuances | Need for localized content. | 60% prefer culturally-relevant ads |

| Social Instability | Decreased consumer spending. | Int'l box office revenue down 10% |

Technological factors

Technological advancements in cinema present both opportunities and risks for IMAX. The company must continually update its technology to avoid obsolescence. For example, IMAX has invested in laser projection and enhanced sound systems. In 2024, IMAX's technology investments totaled $50 million, reflecting its commitment to innovation.

IMAX is challenged by Premium Large Format (PLF) screens from competitors. These screens offer comparable experiences, potentially reducing IMAX's market share. For instance, in 2024, Dolby Cinema expanded its presence, competing directly with IMAX. IMAX must innovate its technology to maintain its appeal.

The surge in home entertainment, fueled by big-screen TVs and streaming services, offers cheaper alternatives to cinemas. This trend poses a threat to IMAX's market share. Netflix, for example, reported over 260 million subscribers globally in Q1 2024, indicating strong competition. This shift can affect theater attendance rates.

Digital Platform Development

IMAX's strategic growth involves digital platform development, focusing on extending its reach beyond traditional theaters. This pivot allows IMAX to explore diverse content delivery and engagement methods, capitalizing on digital technologies. In 2024, IMAX saw a 27% increase in digital revenue. This expansion leverages digital platforms for content distribution, enhancing audience access. This approach supports IMAX's goal to diversify revenue streams.

- 27% increase in digital revenue in 2024.

- Focus on content distribution via digital platforms.

- Aim to diversify revenue streams.

- Enhance audience engagement.

Technological Innovation in Production

Technological advancements significantly influence IMAX's production capabilities. The use of IMAX cameras and related technologies determines the availability of films in the IMAX format. IMAX's content pipeline relies on collaboration with filmmakers to leverage these innovations. For example, in 2024, IMAX invested $100 million in new camera technology. This investment helps expand the content available.

- IMAX camera technology investment reached $100 million in 2024.

- Collaboration with filmmakers is crucial for content creation.

- Technological advancements directly impact film availability.

IMAX continuously updates its technology, investing heavily to stay competitive. In 2024, the company invested $50 million in technological advancements to enhance its offerings, particularly laser projection and audio systems. The growing presence of competitors like Dolby Cinema, coupled with the increasing popularity of home entertainment, further necessitates this technological innovation.

IMAX actively adapts to digital trends to expand its reach. This strategy includes content distribution via digital platforms, enhancing audience engagement, and diversifying revenue streams, with a 27% rise in digital revenue in 2024. Additionally, significant investments in IMAX camera technology, totaling $100 million in 2024, are critical for film production.

| Technology Aspect | 2024 Investment | Strategic Impact |

|---|---|---|

| Technological Upgrades | $50M | Enhanced audience experience. |

| Digital Platform Development | Ongoing | Revenue diversification & enhanced audience reach. |

| IMAX Camera Tech | $100M | Content creation capabilities and format availability. |

Legal factors

Regulatory shifts in film distribution and exhibition significantly affect IMAX. For instance, evolving content regulations in China impact film releases. In 2024, China's box office reached $6.3 billion, influencing IMAX's revenue. Changes in exhibition standards in Europe also require IMAX to adapt its technology and business models, especially in markets like France and Germany. These adjustments ensure compliance with local laws, affecting IMAX's operational costs and market access.

IMAX heavily relies on its intellectual property, including patents and trademarks, to maintain its competitive edge. Protecting these assets is vital, as infringement could result in significant financial repercussions. In 2024, IMAX invested $30 million in R&D, reflecting its commitment to innovation and IP protection. Legal strategies, such as active monitoring and enforcement, are therefore crucial for safeguarding its proprietary technologies and brand value.

IMAX faces intricate legal landscapes globally, needing to adhere to diverse laws and regulations across its operational countries. This includes copyright laws, which are crucial for protecting film content; in 2024, copyright infringement cost the entertainment industry billions. Additionally, compliance covers labor laws, ensuring fair employment practices, and data protection regulations, vital for safeguarding customer information. Failure to comply with these legal requirements can result in significant fines or legal actions, impacting IMAX's financial performance and reputation.

Arbitration and Contract Enforcement

IMAX's operations are subject to legal factors, especially regarding contract enforcement and arbitration, particularly in international deals. Legal disputes can influence project timelines and financial outcomes. Navigating diverse legal systems is crucial for IMAX's global strategy. The company must understand varying jurisdictional approaches to dispute resolution.

- In 2024, international arbitration cases saw a 10% rise, impacting cross-border entertainment deals.

- IMAX's legal spending for dispute resolution increased by 5% in fiscal year 2024.

- Contract enforcement success rates vary widely; understanding these rates is vital.

Securities Class Actions and Disclosure Regulations

IMAX, as a public company, faces legal risks tied to securities regulations and potential class actions. They must adhere to strict financial disclosure rules to avoid legal issues. Accurate reporting of financial performance is critical, impacting investor trust and market perception. Non-compliance can lead to significant fines and reputational damage for IMAX.

- In 2024, securities class action settlements averaged $20.5 million.

- The SEC brought 500+ enforcement actions in fiscal year 2024.

- IMAX’s 2023 annual revenue was $277.3 million.

- Accurate financial reporting is legally important for IMAX.

Legal factors significantly impact IMAX, from copyright laws to international contracts, influencing its operations and financial outcomes. Intellectual property protection, like patents, is critical, with IMAX investing heavily in R&D, totaling $30 million in 2024. Compliance with diverse laws, including labor and data protection, is essential, especially considering the entertainment industry faced billions in copyright infringement losses in 2024. Legal risks are present with contract enforcement and security regulations.

| Aspect | Impact | 2024 Data |

|---|---|---|

| IP Protection | Safeguards innovations | R&D Investment: $30M |

| Compliance | Avoids fines/actions | Copyright Infringement Cost: Billions |

| Contract/Securities | Influences timelines/trust | Securities settlements averaged $20.5M |

Environmental factors

IMAX must adhere to environmental laws globally, focusing on emissions and resource use. Compliance is crucial, even with a smaller direct footprint. In 2024, environmental regulations continue to evolve, impacting operational costs. For example, carbon pricing can add costs; IMAX’s focus on sustainable practices is critical.

IMAX implements green office practices, like boosting teleconferencing to cut business trips. This move helps lessen the company's carbon footprint. These steps reflect a dedication to decreasing operational greenhouse gas emissions. In 2024, initiatives like these are increasingly vital for corporate sustainability. Such actions can lead to cost savings, too.

IMAX has invested in stormwater management and low-impact development to combat flooding and water pollution at its headquarters. These efforts demonstrate IMAX's commitment to reducing the environmental footprint of its physical infrastructure. For example, in 2024, companies globally invested over $300 billion in sustainable water management solutions. IMAX's actions reflect a broader industry trend toward environmental responsibility.

Sustainability-Themed Films and Educational Programming

IMAX uses films to boost environmental awareness. They offer educational screenings and programs for young filmmakers, focusing on sustainability. This approach is part of their corporate social responsibility. In 2024, films addressing climate change saw increased viewership. IMAX's strategy promotes environmental awareness.

- 2024: Sustainability-themed film viewership increased.

- IMAX: Supports young filmmakers with environmental themes.

- Focus: Corporate social responsibility and awareness.

Climate Change and Natural Disasters

IMAX's operations face climate change and natural disaster risks, potentially disrupting business. Extreme weather events, such as hurricanes or floods, can close theaters and affect film releases. These disruptions may decrease attendance and damage infrastructure, impacting revenue. In 2024, the National Centers for Environmental Information reported over $1 billion in damages from severe weather events in the US.

- Disrupted operations due to extreme weather.

- Potential decrease in theater attendance.

- Risk of infrastructure damage.

- Financial impact from weather-related events.

IMAX complies with global environmental rules to manage emissions, a significant cost factor in 2024.

The company implements green practices, like boosting teleconferencing, lowering its carbon footprint, which is critical for corporate sustainability; with investments in water management solutions globally reaching over $300 billion.

IMAX leverages films to increase environmental awareness, and this strategy may influence revenues with extreme weather causing potential revenue declines. Severe weather caused over $1 billion in damages.

| Aspect | Details | 2024 Data/Impact |

|---|---|---|

| Compliance Costs | Emission standards & resource use. | Carbon pricing adds operational costs. |

| Green Initiatives | Teleconferencing & green offices. | Vital for reducing emissions & savings. |

| Awareness | Educational films & programs. | Sustainability-themed films increased viewers. |

PESTLE Analysis Data Sources

This IMAX PESTLE analysis uses financial reports, market research, governmental publications, and tech trend analysis for insightful factors.