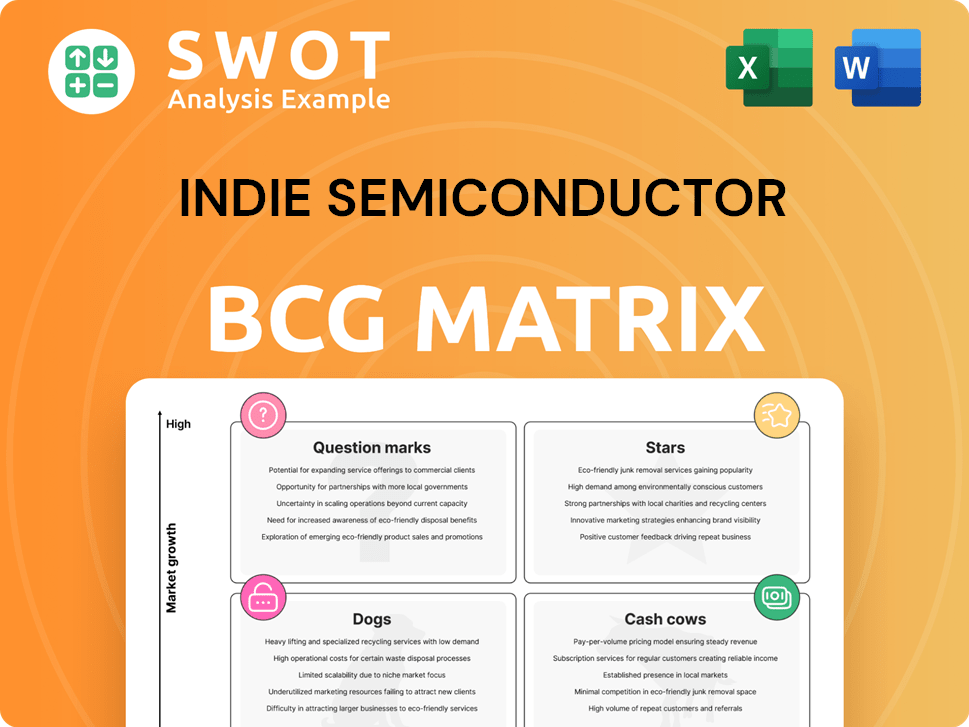

indie semiconductor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

indie semiconductor Bundle

What is included in the product

BCG Matrix overview, tailored for Indie Semiconductor's portfolio across the four quadrants. Strategic recommendations for growth.

Printable summary optimized for A4 and mobile PDFs: Quickly grasp Indie's strategy on any device.

Preview = Final Product

indie semiconductor BCG Matrix

The preview showcases the complete Indie Semiconductor BCG Matrix you'll receive after purchase. It's a fully editable document, ready for your analysis and strategic planning with no hidden content.

BCG Matrix Template

Indie Semiconductor's BCG Matrix paints a fascinating picture of its diverse product portfolio. We've analyzed its offerings, identifying potential Stars, Cash Cows, Dogs, and Question Marks. This preview offers a glimpse into how Indie is positioned in its competitive landscape. Understanding these dynamics is crucial for strategic decisions. Discover the full BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Indie Semiconductor's ADAS solutions, specializing in radar and vision systems, are experiencing robust design win momentum. These systems are expected to fuel substantial revenue growth in the upcoming years. With a considerable strategic backlog, the company is well-positioned to capitalize on the rising demand for automotive safety features. In 2024, the ADAS market is projected to reach $100 billion.

indie Semiconductor's electrification components, such as power management ICs and ASIL-D certified solutions, are crucial for the EV market. The demand for EVs is surging, and indie's products are directly aligned with this expansion. Recent data shows a 30% year-over-year growth in EV component demand, making this a high-potential area for indie. The company's partnerships with major automotive OEMs further solidify its position.

Indie Semiconductor's in-cabin user experience solutions, including connectivity and infotainment, are vital. These systems enhance the driving experience, addressing the rising demand for advanced in-car tech. Design wins show market acceptance; in 2024, the global automotive infotainment market was valued at $33.6 billion. This area promises substantial growth.

Strategic Backlog

The strategic backlog, standing at $7.1 billion, highlights substantial future revenue prospects for indie Semiconductor. This robust backlog is fueled by fresh ADAS program wins, offering a clear view of upcoming revenue streams. It signifies indie Semiconductor's success in securing substantial long-term contracts within the automotive sector.

- $7.1 billion backlog demonstrates future financial stability.

- New ADAS program wins drive the backlog's growth.

- Long-term contracts boost revenue visibility.

- Growing demand for indie's solutions is evident.

Vision Processors

Indie Semiconductor's vision processors, like the iND880 family, are crucial in the automotive sector. They're essential for advanced driver-assistance systems (ADAS) and interior monitoring, showing strong market adoption. Securing design wins with major players, such as a Korean and several Chinese OEMs, highlights their competitive edge. These wins are a solid indicator of their success and market penetration.

- iND880 Vision Processor family is vital for ADAS applications.

- Design wins with major OEMs, like Korean and Chinese automakers, validate performance.

- Success is measured by securing deals with leading automotive manufacturers.

- Vision processors are key for front sensing and interior monitoring.

Indie Semiconductor's "Stars," like ADAS and electrification components, showcase high growth and market share. ADAS market is projected to hit $100 billion in 2024, highlighting their potential. The strategic backlog of $7.1 billion further supports this, ensuring revenue.

| Component | Market Growth (2024) | Indie's Position |

|---|---|---|

| ADAS | $100B | Strong design wins |

| Electrification | 30% YoY growth | Strategic partnerships |

| In-Cabin UX | $33.6B market | Growing demand |

Cash Cows

Indie Semiconductor's legacy products, like older automotive semiconductors, function as cash cows. These generate stable revenue, even with slower market growth. For instance, in 2024, the automotive semiconductor market grew by about 8%, a more mature rate. These products provide crucial financial stability. Specific revenue figures for these products aren't detailed in the provided information.

Indie Semiconductor's power management ICs (PMICs) could be cash cows if they dominate established automotive markets. These PMICs likely generate steady revenue with minimal new investment. Automotive PMICs are crucial, and mature products can ensure a dependable income stream. In 2024, the automotive PMIC market was valued at approximately $8 billion.

CAN and LIN transceivers are crucial for in-vehicle communication, linking ECUs. If indie has strong products in this space, they might be cash cows. These transceivers ensure smooth data exchange within a vehicle's systems. In 2024, the automotive semiconductor market is worth billions, with communication chips a key segment.

Custom Networking Solutions

Indie Semiconductor's custom networking solutions could be cash cows if they hold a strong market position and stable demand. These solutions, often integrated into long-term vehicle platforms, generate consistent revenue. While their growth might be limited, they ensure profitability. For example, in 2024, the automotive Ethernet market was valued at approximately $2.5 billion, with Indie Semiconductor likely capturing a segment of this.

- Steady Revenue: Consistent income from established custom solutions.

- Long-Term Contracts: Embedded in vehicle platforms ensures continued demand.

- Profitability: Contributes positively to the financial bottom line.

- Market Position: Strong presence in the automotive networking sector.

In-Car Networking

In-car networking solutions, vital for modern vehicles, could be cash cows for Indie Semiconductor if they hold a strong market position, generating steady revenue. These solutions, enabling in-vehicle communication and data transfer, support features like infotainment and safety systems. A robust market presence alongside consistent customer relationships underpins the stability of this product category. The automotive Ethernet market is projected to reach $2.6 billion by 2024.

- Market growth: The automotive Ethernet market is expected to reach $2.6 billion by 2024.

- Revenue generation: In-car networking provides consistent revenue.

- Customer relationships: Established relationships add stability.

- Functionality: It supports infotainment and safety systems.

Indie Semiconductor's cash cows include legacy and mature automotive semiconductors, like CAN transceivers, that generate stable, predictable revenue with minimal new investment. Power management ICs (PMICs) and custom networking solutions also function as cash cows if they have a strong market presence. The automotive PMIC market was valued at roughly $8 billion in 2024, and automotive Ethernet reached about $2.5 billion.

| Product Category | Market Value (2024) | Revenue Stability |

|---|---|---|

| Automotive PMICs | $8 Billion | High |

| Automotive Ethernet | $2.5 Billion | High |

| CAN/LIN Transceivers | Billions | High |

Dogs

Low-margin products, like some older semiconductors, face challenges. These items often have minimal profit margins and slow growth. In 2024, some mature semiconductor lines saw margins below 10%. Divesting or discontinuing these could boost profits.

Products in small, specialized markets with limited growth are "Dogs." These products may not warrant further investment. Assessing the market size and growth is crucial. In 2024, niche semiconductor sales totaled ~$5 billion, with low single-digit growth. Strategic value must be determined.

Outdated technologies in Indie Semiconductor's portfolio, like those tied to older automotive systems, fall into the "Dogs" quadrant. These products face shrinking demand as the industry shifts towards advanced driver-assistance systems (ADAS) and electric vehicles (EVs). Data from 2024 shows a 15% decline in demand for legacy automotive components. Sunsetting these can redirect resources.

Products Facing Intense Competition

Products facing intense competition and lacking differentiation are often categorized as "Dogs" in the BCG Matrix. These products can struggle to maintain market share and profitability in a crowded market. For instance, in 2024, numerous consumer electronics, like some budget smartphones, faced this challenge. Assessing the competitive landscape and seeking differentiation are crucial for these products to survive.

- Market share erosion is common for "Dogs," as seen with certain generic product brands in 2024.

- Profit margins are typically squeezed due to price wars in competitive markets.

- Differentiation strategies could include niche marketing or enhanced features.

- Financial data from 2024 showed many "Dogs" experiencing revenue declines.

Unsuccessful Product Lines

Unsuccessful product lines within Indie Semiconductor's portfolio, often categorized as "Dogs" in a BCG matrix, represent areas where market penetration has been weak. These products may struggle to secure design wins, despite the company's investment. A critical evaluation is essential to decide whether to continue funding or to phase them out to improve resource allocation. In 2024, about 15% of tech companies struggled with product failures, highlighting the importance of strategic reviews.

- Poor market traction indicates a need for strategic reassessment.

- Significant investment without returns signals potential losses.

- Thorough review should determine further investment or discontinuation.

- Focusing on core strengths is key for financial health.

In the BCG Matrix, "Dogs" represent products with low market share and growth. These lines often have shrinking demand and squeezed margins. In 2024, many "Dogs" faced revenue declines, prompting strategic reassessment. Divestiture or discontinuation can free resources.

| Category | Characteristics | 2024 Impact |

|---|---|---|

| Market Share | Low; eroded by competition | Generic brands declined |

| Profitability | Struggling due to price wars | Margins below 5% |

| Strategic Actions | Divest, discontinue, or niche | 10% portfolio reduction |

Question Marks

Indie Semiconductor's 120 GHz radar targets in-cabin applications. These solutions, used for occupant monitoring, are in their early stages. Market adoption and potential remain uncertain. Investment and validation are key for market share. In 2024, the in-cabin radar market was valued at $1.2 billion, growing annually by 15%.

The LiDAR optical engine, a design win for indie Semiconductor, lands in the Question Mark quadrant of the BCG Matrix. This segment, crucial for ADAS and autonomous driving, promises high growth but faces market share uncertainty. The LiDAR market, valued at $1.9 billion in 2024, is competitive, requiring substantial investment. Success hinges on deployment and carving a niche in this evolving landscape.

New vision processors, like those from indie Semiconductor, are targeting emerging applications such as eMirror and multi-channel vision systems. Market adoption is still early, with uncertain market share, yet these processors address growing automotive needs. Securing design wins and demonstrating performance advantages are crucial for growth. The automotive vision market is projected to reach $20 billion by 2028, driving demand.

Turnkey Optical Component Integration

Indie Semiconductor's turnkey optical component integration is a Question Mark in its BCG Matrix. This new offering, targeting automotive applications, faces uncertain market demand. Its success hinges on gaining market acceptance and achieving profitability. Further investment and successful customer projects are vital.

- Market for automotive optical components is projected to reach $10.8 billion by 2028.

- Indie's revenue in Q3 2024 was $24.3 million.

- Gross margin for Indie in Q3 2024 was 30%.

- The company's stock price has fluctuated significantly in 2024.

Ultrasound Solutions

Ultrasound solutions represent a "question mark" in indie Semiconductor's portfolio. These solutions, primarily used for short-range applications like parking assist, have a smaller market share compared to radar, lidar, and computer vision. This positioning suggests a need for further market analysis and investment evaluation to assess long-term viability.

- Ultrasound applications focus on short-range sensing.

- Market share is smaller compared to radar, lidar, and computer vision.

- Further analysis is needed to determine long-term growth.

- Investment decisions depend on market potential.

Indie Semiconductor's ultrasound solutions are positioned as "Question Marks." They focus on short-range sensing, with a smaller market share compared to other technologies. Further analysis and investment decisions are needed to assess their long-term growth prospects. The ultrasound market is a fraction of the broader automotive sensor market, with limited current impact.

| Category | Details | 2024 Data |

|---|---|---|

| Market Focus | Short-range sensing | Parking assist, etc. |

| Market Share | Smaller compared to radar, lidar, and vision | Lower adoption rate |

| Strategic Need | Further analysis and investment evaluation | Determine long-term viability |

BCG Matrix Data Sources

The indie semiconductor BCG Matrix utilizes public financial statements, market share reports, and industry analyst predictions.