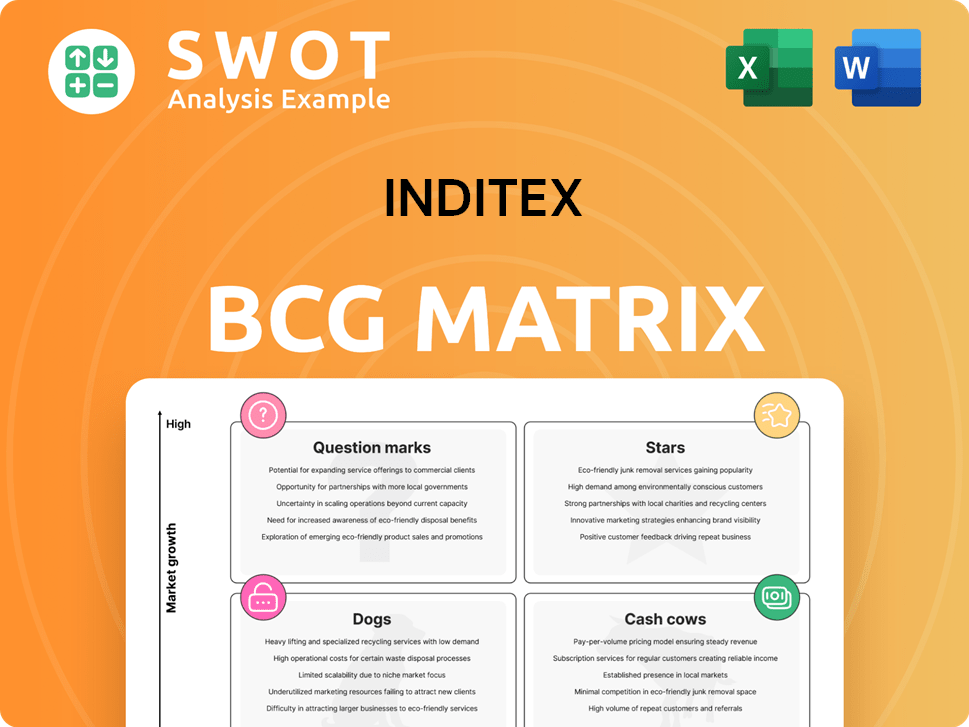

Inditex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inditex Bundle

What is included in the product

This Inditex BCG Matrix analysis examines its brands across quadrants. It offers strategic insights for each, considering competitive forces.

Inditex BCG Matrix offers a clean, distraction-free view optimized for C-level presentation.

Preview = Final Product

Inditex BCG Matrix

The Inditex BCG Matrix displayed is identical to what you'll receive. After purchase, you'll get the complete, analysis-ready document, reflecting Inditex's strategic portfolio. This comprehensive file is directly downloadable—no edits, no hidden content.

BCG Matrix Template

Inditex, the fashion giant, faces a dynamic market. Its BCG Matrix reveals vital product portfolio insights. This analysis classifies brands like Zara. Understand which brands are stars. Identify cash cows funding future growth. Uncover potential dogs and question marks. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Zara, Inditex's flagship brand, remains a "star" due to its substantial revenue contribution and strong global presence. In 2024, Zara's sales are projected to account for over 70% of Inditex's total revenue, showcasing its market dominance. Its fast-fashion model and rapid trend adaptation continue to fuel growth. Zara's efficient supply chain and strategic online platform enhance its competitive edge.

Stradivarius has shown strong sales growth, reflecting its appeal and market share gains. Its success stems from targeting young women with affordable fashion and effective marketing. Stradivarius's expansion, like its 2025 entry into Austria, highlights its growth potential. In 2024, Inditex's sales reached €35.9 billion, with Stradivarius contributing significantly.

Bershka, a key player in Inditex's portfolio, demonstrates robust performance, fueled by its youth-focused fashion. It leverages personalization and social media for strong audience engagement. In 2024, Bershka's sales continued to grow. The brand's expansion, including its 2025 launch in Sweden, highlights its growth potential.

Oysho

Oysho, part of Inditex, is experiencing significant growth, especially in sportswear and lifestyle. The brand expanded into new markets like the Netherlands and Germany in 2025, aiming to capitalize on the sportswear boom. With a modern, minimalist concept, Oysho is strategically positioned in key sportswear hubs, fueling its growth potential. Oysho's strategy has yielded positive results, with sales figures reflecting this upward trajectory.

- Focus on sportswear and lifestyle offerings.

- Expansion into new markets like the Netherlands and Germany in 2025.

- Modern, minimalist concept.

- Presence in key sportswear hubs.

Online Sales

Inditex's online sales are a shining star, showing substantial growth. Online sales represent a significant portion of total revenue, supported by technology investments. Enhanced customer experience through platform improvements drives online sales. The strong growth potential is evident in the increasing app users and online visits.

- Online sales grew 19% in 2024.

- Online sales accounted for 30% of total sales in 2024.

- Active app users increased by 25% in 2024.

Zara, Stradivarius, Bershka, and Oysho are "stars" due to their high market share and growth. These brands have significant revenue contributions and strong market positions. Strong online sales further boost Inditex's "star" status. In 2024, Inditex's online sales grew by 19% and accounted for 30% of total sales.

| Brand | Market Position | Growth Drivers |

|---|---|---|

| Zara | Dominant | Fast-fashion, online platform |

| Stradivarius | Growing | Affordable fashion, marketing |

| Bershka | Growing | Youth-focused, social media |

Cash Cows

Massimo Dutti, part of Inditex, targets a sophisticated audience with classic designs. It consistently generates revenue, though growth isn't explosive. In 2024, Inditex's revenue was €35.9 billion. Massimo Dutti's focus on quality and sustainability ensures its cash cow status.

Pull&Bear, a key brand within Inditex, is a classic Cash Cow. It caters to a youthful demographic with casual, urban fashion, ensuring steady sales. In 2024, Pull&Bear's revenue contributed significantly to Inditex's financial stability. Their sustainable practices and digital marketing keep them relevant, maintaining a strong market position.

Zara Home is a cash cow within Inditex, offering homeware leveraging the Zara brand. It benefits from a stable revenue stream, complementing Inditex's portfolio. In 2024, Zara Home's sales contributed significantly, though exact figures vary. Its focus on quality and design solidifies its cash cow status.

Europe (excluding Spain)

Europe, excluding Spain, is a cash cow for Inditex, generating substantial revenue due to its strong market position. This region benefits from Inditex's extensive store network, online presence, and high brand recognition. Inditex's consistent performance in Europe is supported by its ability to maintain and increase market share. For the fiscal year 2023, Europe (excluding Spain) accounted for a significant portion of Inditex's sales, reflecting its cash cow status.

- Strong Market Presence: Inditex has a significant presence in Europe.

- Established Infrastructure: Inditex has a broad network of stores and online platforms.

- Consistent Performance: Europe consistently delivers strong financial results.

- Revenue Contribution: Europe is a major revenue contributor for Inditex.

Spain

Spain, Inditex's home market, remains a substantial cash cow. Its strong brand and loyal customers provide a steady revenue stream. Inditex's ability to maintain market share solidifies its cash cow status. In 2024, Spain accounted for a significant portion of Inditex's sales.

- Inditex's home market.

- Steady revenue stream.

- Maintain market share.

- Significant sales in 2024.

Bershka, a prominent Inditex brand, operates as a cash cow, appealing to a youth demographic. The brand offers trendy clothing and accessories, ensuring consistent revenue streams. Bershka's strong market presence in 2024 contributed to Inditex's overall financial performance. Their successful digital marketing and agile supply chain bolster their cash cow status.

| Category | Details | Financial Impact (2024) |

|---|---|---|

| Market Segment | Youth and young adults | Steady Revenue |

| Product Range | Trendy clothing, accessories | Significant contribution to Inditex sales |

| Strategic Advantage | Digital marketing, agile supply chain | Maintains strong market position |

Dogs

Uterqüe, once Inditex's premium brand, is now integrated into Massimo Dutti. This strategic move, completed in 2022, indicates Uterqüe's diminished standalone market presence. Without separate financial reporting post-integration, assessing its performance independently is impossible. Therefore, Uterqüe, in its former state, would be classified as a 'Dog' in the BCG matrix.

Inditex faces challenges in certain geographic markets, like the Americas and Asia, where sales contributions have decreased. These regions, showing low growth and declining market share, fit the "Dogs" category. For instance, in 2024, Inditex's sales in the Americas saw a slight decrease compared to the previous year. This decline indicates a need for strategic adjustments.

Outdated product lines at Inditex, characterized by low growth and poor performance, are considered Dogs in the BCG matrix. These lines demand substantial investment for revitalization, possibly exceeding their potential. In 2024, Zara's sales growth slowed, suggesting potential challenges in some product categories. The company might opt to minimize or discontinue these underperforming lines to optimize resource allocation.

Underperforming Store Locations

Some Inditex stores may underperform because of bad demographics, high costs, or shifting consumer tastes. These locations are "Dogs" and may be closed or moved. In 2024, Inditex closed about 100 stores globally. This aligns with its strategy to boost profitability and efficiency. Inditex's focus remains on optimizing its store network.

- Poor locations are a drag on overall performance.

- Inditex actively manages its store portfolio.

- Closures can improve profitability.

- Relocation can target better markets.

Unsuccessful Collaborations

Some of Inditex's collaborations haven't hit the mark, qualifying as "Dogs" in the BCG Matrix. These ventures may have used up resources without boosting sales or brand recognition significantly. For instance, a partnership might not have delivered the expected return on investment. In 2023, Inditex's operating expenses were approximately €15.6 billion, so underperforming collaborations can impact these figures.

- Ineffective partnerships can drain resources.

- They may fail to increase revenue.

- Brand awareness may not improve.

- Poorly performing ventures can affect overall profitability.

Various aspects of Inditex's business can be classified as "Dogs" in the BCG matrix. These include underperforming brands, such as Uterqüe, and poorly performing geographic markets. Also, outdated product lines and underperforming stores or collaborations fit this category. Strategically, Inditex actively manages and optimizes its portfolio, closing locations and ending ventures as needed.

| Category | Examples | Strategic Response |

|---|---|---|

| Brands | Uterqüe (post-integration), some product lines | Re-evaluate, discontinue or integrate |

| Markets | Americas (sales decline in 2024), underperforming stores | Restructure, close, relocate |

| Collaborations | Ineffective partnerships | End partnerships |

Question Marks

Inditex's entry into new markets, like Iraq in 2025, fits the "Question Mark" category in a BCG matrix. These ventures promise high growth but also present considerable risks. Inditex, with a revenue of €35.9 billion in FY2023, must invest heavily in these new areas. Success hinges on effective marketing and supply chain management.

Inditex's El Apartamento, a luxury retail blend of Zara and Zara Home, is a question mark in the BCG Matrix. This concept aims to attract high-end clients and boost brand image, but needs considerable investment. Its success hinges on revenue and brand awareness. For 2024, Inditex's net sales reached €35.9 billion, up 10.4% from 2023.

Inditex's US pre-owned platform launch is a question mark in its BCG matrix. The used clothing market in the US grew by 15% in 2023. To succeed, Inditex must stand out, especially with rivals like ThredUp and Poshmark. This expansion needs significant marketing investment to gain ground.

Weekly Livestreaming Services in the US and UK

Inditex's foray into weekly livestreaming in the US and UK places it in the "Question Mark" quadrant of the BCG matrix. Livestreaming is expanding, with the global market projected to reach $4.5 billion by 2024. Success in fashion remains uncertain, requiring experimentation with content and formats. Inditex must find ways to attract viewers and boost sales through this channel.

- Livestreaming's fashion e-commerce share in the US was 1.5% in 2023.

- The average order value (AOV) via livestreaming in China is $80-$100.

- Inditex's 2023 revenue was €35.9 billion.

- The UK fashion market is valued at approximately £53 billion.

Sustainability Initiatives

Inditex's sustainability initiatives, such as investments in circular fibers and biorecycling startups, are categorized as a question mark in the BCG matrix. These ventures aim to capitalize on the growing consumer demand for sustainable products. However, the financial returns of these initiatives are still uncertain, representing a high-risk, high-reward scenario for Inditex. The company must effectively communicate its sustainability efforts to consumers while ensuring its products remain competitively priced.

- Inditex has committed to using 100% sustainable cotton, linen, and cellulosic fibers by 2023.

- In 2022, Inditex invested in the development of innovative recycling technologies.

- The success of these initiatives depends on consumer acceptance and cost-effectiveness.

- Inditex's sustainability efforts align with its broader strategy to reduce environmental impact.

Inditex's new market entries and innovative projects often fall under the "Question Mark" category, signaling high potential but also significant risk. These ventures, such as El Apartamento, require substantial investment and face uncertain returns. Success depends on effective strategies and capitalizing on emerging trends.

| Initiative | BCG Category | Risk/Reward |

|---|---|---|

| New Markets (Iraq) | Question Mark | High Risk, High Growth |

| El Apartamento | Question Mark | High Risk, Uncertain Returns |

| Sustainability Initiatives | Question Mark | High Risk, Long-Term Rewards |

BCG Matrix Data Sources

This BCG Matrix uses reliable sources such as financial reports, market analysis, and expert opinions to inform its strategic recommendations.