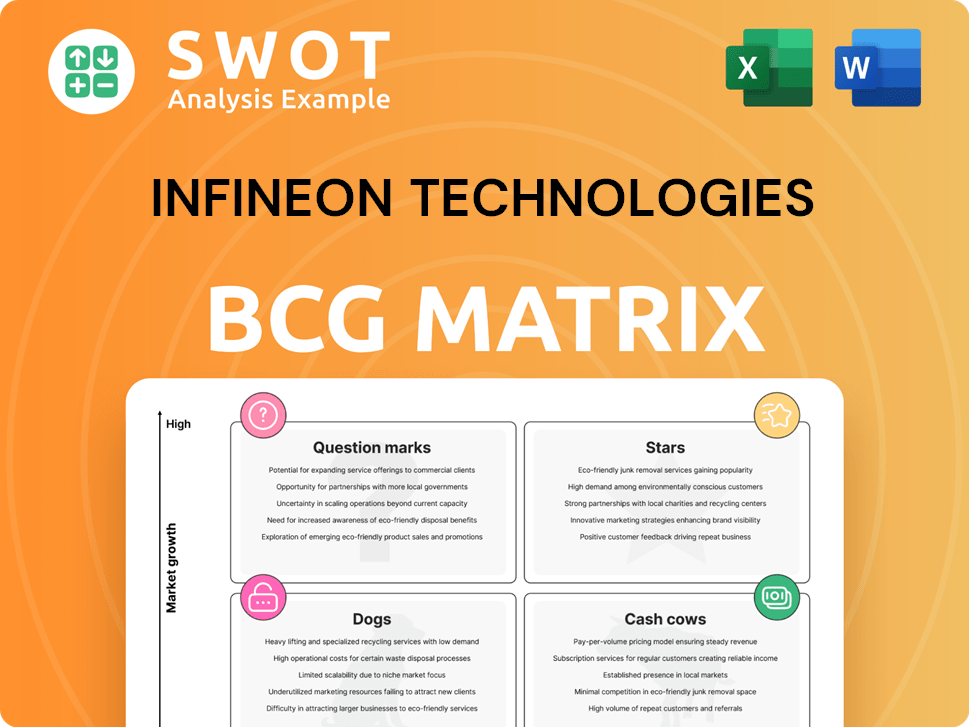

Infineon Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infineon Technologies Bundle

What is included in the product

Detailed analysis of Infineon's products within BCG Matrix quadrants, outlining strategic recommendations.

Infineon's BCG Matrix delivers a clear view for quick market strategy. Optimized layout for efficient executive meetings.

What You See Is What You Get

Infineon Technologies BCG Matrix

The preview shown is the complete Infineon Technologies BCG Matrix you'll receive. This means the downloadable file is identical to what you see, fully formatted and ready for your strategic analysis. Get the exact same high-quality report, no hidden content or modifications required. The complete analysis is available instantly upon purchase.

BCG Matrix Template

Infineon Technologies navigates a dynamic semiconductor landscape. Its diverse product portfolio likely spans multiple BCG Matrix quadrants. Identifying Stars, Cash Cows, Question Marks, and Dogs is crucial for strategic decisions. Understanding this positioning reveals growth potential and areas needing investment. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Infineon's automotive semiconductors are a star in its BCG matrix. It leads with a 13.5% global market share in 2024. This is due to the growing digitalization and decarbonization trends in vehicles. The company's dominance is particularly strong in Europe and North America.

Infineon dominates the microcontroller market, holding a significant 21.3% share in 2024. This leadership is crucial, as microcontrollers are vital for automotive and IoT applications. Their strong position is further highlighted by a 32% share in automotive microcontrollers.

Infineon's power supply solutions are experiencing high demand in AI data centers. This sector is a significant growth driver, fueled by AI's expansion. The company anticipates approximately €600 million in AI power-related revenue for FY25. This aligns with digitalization and decarbonization trends. In 2024, the demand is already high.

GaN Power Semiconductors

GaN power semiconductors represent a strategic growth area for Infineon, aligning with the push for energy efficiency and decarbonization. Infineon leverages GaN technology to enhance products across sectors like consumer electronics and data centers. GaN’s advantages include improved efficiency, reduced size, and lower costs, making it attractive. In 2024, the power GaN market is valued at approximately $150 million, projected to reach $1 billion by 2028.

- Market Growth: The power GaN market is growing rapidly, with projections indicating significant expansion in the coming years.

- Applications: GaN is being implemented in various applications, including fast chargers, power supplies, and data centers.

- Competitive Advantage: Infineon's GaN solutions offer superior performance and efficiency compared to traditional silicon-based technologies.

- Investment: Infineon is investing in R&D and production capacity to meet the increasing demand for GaN power semiconductors.

Security Solutions

Infineon's security solutions, a star in its BCG matrix, are experiencing robust growth, especially in contactless payments. They've maintained the top market share for seven years, a testament to their dominance. TEGRION security controllers offer superior hardware security, efficiency, and ease of use. This success is reflected in the financial performance, with security solutions contributing significantly to overall revenue.

- Infineon holds the number one market share in the contactless payment industry for the past seven years.

- TEGRION security controllers are highlighted for providing unparalleled hardware security.

- Security solutions significantly contribute to Infineon's revenue.

Infineon's stars include automotive semiconductors and security solutions. Automotive semiconductors hold a 13.5% global market share in 2024, driven by digitalization. Security solutions, including TEGRION controllers, have led in contactless payments for seven years.

| Feature | Description | 2024 Data |

|---|---|---|

| Automotive Semiconductors | Market Share | 13.5% Global |

| Microcontrollers | Market Share | 21.3% Overall |

| Security Solutions | Market Leadership | 7 Years #1 |

Cash Cows

Infineon's automotive business in China is a cash cow, leveraging its dominant 13.9% market share. This strong position ensures consistent revenue, crucial for reinvestment. China's massive EV market fuels demand, supporting Infineon's financial stability. In 2024, the Chinese automotive semiconductor market is estimated at billions.

The Power & Sensor Systems (PSS) segment is a cash cow for Infineon, representing a significant portion of their revenue. In fiscal year 2024, PSS contributed a substantial amount to Infineon's net sales. These semiconductors are essential for various applications, ensuring a stable demand.

Infineon is a key player in smart card ICs, vital for secure authentication and payments. The market is expanding; Infineon's presence ensures stable cash flow. In 2024, the smart card IC market was worth billions. Infineon's revenue from this segment showed consistent growth.

Industrial Applications

Infineon's semiconductors are vital in industrial applications like automation, renewable energy, and power generation. The industrial sector, though cyclical, benefits from the rise of automation and sustainable energy sources. This trend fuels sustained demand for Infineon's offerings, making it a steady revenue stream. In 2024, Infineon reported significant revenue from its industrial power control segment.

- Industrial Power Control segment contributed significantly to Infineon's revenue in 2024.

- The growth in renewable energy and automation drives demand for Infineon's products.

- Infineon's industrial applications offer a stable, albeit cyclical, revenue source.

Legacy Silicon Products

Infineon's Legacy Silicon Products are the cash cows in its BCG matrix. These established semiconductor products provide consistent revenue across many applications. They leverage Infineon's manufacturing strength and customer base. In 2024, these products likely contributed significantly to the company's stable financial performance.

- Steady Revenue: Generating consistent income.

- Broad Applications: Serving diverse market needs.

- Manufacturing & Relationships: Benefit from Infineon's strengths.

- Financial Stability: Supporting overall company performance.

Infineon's cash cows generate stable revenue, critical for reinvestment and growth. These products include automotive, power systems, and industrial applications, demonstrating consistent financial performance. They provide a strong foundation for Infineon’s strategic initiatives and market leadership, as shown in the financial data of 2024.

| Segment | 2024 Revenue (Est.) | Market Share/Position |

|---|---|---|

| Automotive (China) | Billions | 13.9% (Leading) |

| Power & Sensor Systems (PSS) | Significant Portion | Strong Market Presence |

| Smart Card ICs | Billions | Key Player |

Dogs

The consumer electronics market, excluding AI, faces weak demand and inventory adjustments. This segment, marked by seasonality and intense competition, is seeing reduced investment. In 2024, sales in this area are expected to decline. Infineon’s strategy likely involves resource reallocation to AI-focused ventures.

The computing and communications segment, excluding AI, struggles. This area shows only slight recovery signs after bottoming out, indicating a Dogs classification in the BCG Matrix. Inventory adjustments persist, slowing growth. Infineon's Q1 2024 revenue in this segment was down, reflecting ongoing challenges.

Infineon likely has low-margin commodity products. These products, facing tough price competition, might not boost profitability much. In 2024, Infineon's focus is on high-value offerings. These could be candidates for selling off or stopping production.

Older Generation Automotive Semiconductors

Infineon's older automotive semiconductor generations, while still in use, might be "dogs" in its BCG matrix. These products, offering lower performance, could see decreasing demand as the industry shifts towards advanced technologies. Focusing on more profitable, cutting-edge products could be more lucrative for Infineon. In 2024, the automotive semiconductor market is projected to be worth over $60 billion, highlighting the need for Infineon to optimize its product portfolio.

- Declining demand for older tech.

- Focus on high-growth areas is key.

- Market value of $60B in 2024.

- Optimize the product portfolio.

Markets with Declining Growth

Infineon might have "Dogs" in its portfolio, meaning markets with shrinking growth. These could be areas facing tech obsolescence or fierce competition. For instance, the market for certain automotive components, a key Infineon sector, saw a growth slowdown in late 2023, with only a 5% increase compared to the prior year's 10%. Strategic focus should shift towards high-growth sectors.

- Automotive semiconductor market growth slowed in late 2023.

- Technological shifts can render markets obsolete.

- Competition erodes profitability in declining markets.

- Prioritize investment in growing segments for better returns.

Infineon's "Dogs" include consumer electronics and older automotive tech. These segments suffer from weak demand and tough competition. Slow growth or declines lead to lower profitability, and strategic moves are needed. A strategic pivot towards high-growth areas is crucial in 2024.

| Segment | Characteristics | Infineon's Strategy |

|---|---|---|

| Consumer Electronics | Weak demand, intense competition | Reallocate resources to AI and high-growth ventures |

| Older Automotive Tech | Slowing growth, tech obsolescence | Focus on advanced tech, optimize portfolio |

| Low-Margin Products | Tough price competition | Possible sell-off or production halt. |

Question Marks

Infineon is introducing RISC-V based automotive microcontrollers, expanding its AURIX offerings. RISC-V, an open-source ISA, is emerging in the automotive sector. Its success hinges on market uptake and ecosystem expansion. In 2024, the automotive microcontroller market was valued at approximately $30 billion.

Infineon's IoT sector faces high growth potential but uncertain market share in areas like smart homes and industrial IoT. Strategic investments are key, as the global IoT market was valued at $212.1 billion in 2019 and is projected to reach $1.386 trillion by 2027. Success hinges on partnerships and adaptability, as IoT revenue grew by 12.7% in 2023.

Infineon is boosting its Silicon Carbide (SiC) semiconductor offerings, ideal for high-power tasks. SiC's growth in new sectors is evolving, yet challenges remain. Cost and supply chain efficiency are key for SiC's expansion. Infineon's revenue in fiscal year 2024 was about €16.3 billion.

GaN in High-Power Automotive Applications

In the high-power automotive sector, GaN's potential is significant, particularly for traction inverters. Currently, GaN is still emerging in this market, with silicon dominating. Overcoming reliability and performance hurdles is key to wider adoption. The automotive GaN market was valued at $20 million in 2023.

- Market Size: The automotive GaN market was estimated at $20 million in 2023.

- Adoption: The adoption of GaN in this area is still in its early phases.

- Challenges: Reliability and performance issues need to be addressed.

- Competition: Silicon-based solutions currently dominate the market.

Advanced Driver Assistance Systems (ADAS) SoCs and Memories

Advanced Driver Assistance Systems (ADAS) SoCs and memories are a "question mark" for Infineon Technologies in its BCG matrix. This is because while the market for semiconductors in ADAS is booming, especially for SoCs and memories, Infineon needs to invest more in these areas. Although Infineon has a strong presence in microcontrollers for ADAS, expanding into SoCs and memories requires strategic market penetration. This could mean significant investments in research and development or strategic acquisitions to gain a stronger foothold.

- The ADAS market is expected to reach $91.8 billion by 2028.

- Infineon's automotive segment generated €5.5 billion in revenue in fiscal year 2023.

- SoCs and memories are critical components for advanced ADAS functions like autonomous driving.

- Successful market entry requires competitive pricing and technology.

Advanced Driver Assistance Systems (ADAS) SoCs and memories are "question marks" for Infineon's BCG matrix, with high growth potential. The ADAS market is projected to reach $91.8 billion by 2028. Infineon’s focus on microcontrollers is key, but it needs strategic investment in SoCs and memories.

| Aspect | Details | Data |

|---|---|---|

| Market Growth | ADAS market | $91.8B by 2028 |

| Infineon's Focus | Microcontrollers | €5.5B automotive revenue in 2023 |

| Strategic Need | Expand into SoCs/memories | Requires Investment |

BCG Matrix Data Sources

The Infineon BCG Matrix uses annual reports, market analysis, competitive data, and financial metrics, ensuring trustworthy strategic positions.