Infosys Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infosys Bundle

What is included in the product

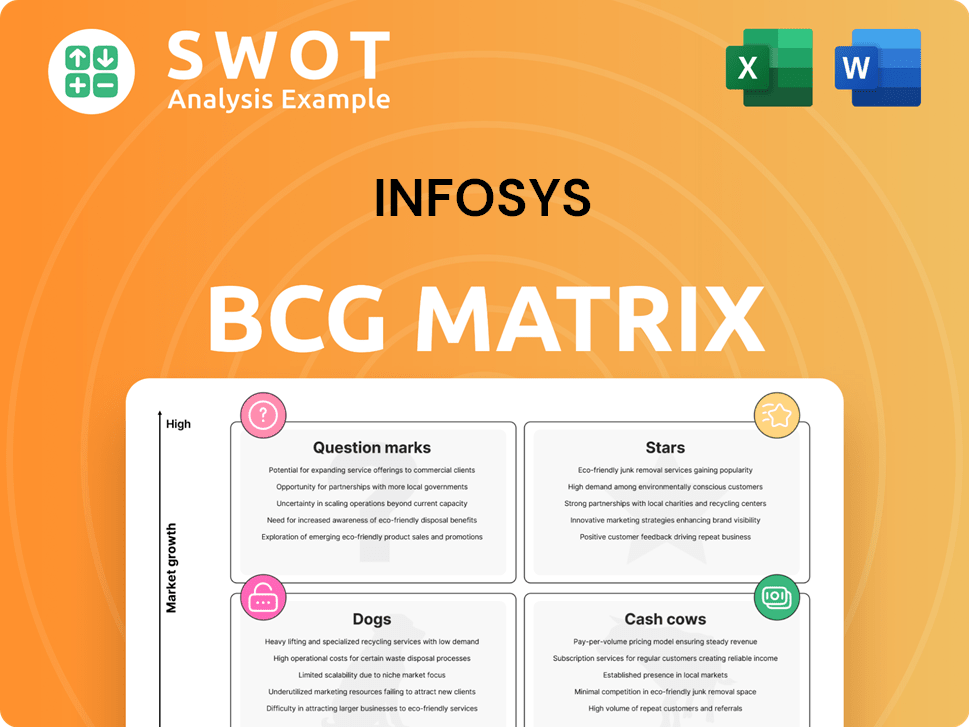

Infosys' BCG Matrix analysis evaluates its units across quadrants, guiding investment, holding, or divest decisions.

Printable summary optimized for A4 and mobile PDFs, presenting Infosys' BCG Matrix in a concise format.

What You’re Viewing Is Included

Infosys BCG Matrix

The preview mirrors the exact Infosys BCG Matrix you'll receive post-purchase. This downloadable document offers a comprehensive analysis, ready for immediate use in strategic planning and business decision-making.

BCG Matrix Template

The Infosys BCG Matrix offers a snapshot of its diverse portfolio. It categorizes its services into Stars, Cash Cows, Dogs, and Question Marks. This framework reveals growth potential, market share, and resource allocation needs. Understanding these quadrants is key for strategic decision-making. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Infosys is a leader in AI solutions, having launched over 100 AI agents. Client demand for AI-led transformation is rising. Infosys Topaz and generative AI services are key. The AI segment is a high-growth, high-share area. Infosys's revenue grew by 1.3% in constant currency in Q3 FY24.

Infosys' Cloud Services are a "Star" in its BCG Matrix, driven by the Infosys Cobalt platform. In fiscal year 2024, cloud services contributed significantly to Infosys' revenue, with cloud-related deals totaling $4.6 billion. Strategic alliances with AWS, Azure, and Google Cloud boost its market presence. This sector continues to show robust growth.

Infosys is a key player in digital transformation, serving clients across 50+ countries. In 2024, Infosys saw significant growth in cloud services, with a 25% increase in revenue. Their focus on AI and cybersecurity helps businesses boost performance and sustainability. Infosys' digital services revenue reached $4.5 billion in FY24.

Cybersecurity Services

Infosys is investing in cybersecurity, recognizing it as a high-growth area. Their strategy includes acquisitions like The Missing Link to boost their offerings. The global cybersecurity market is expanding, with projections estimating it will reach $345.7 billion in 2024. Infosys aims to provide comprehensive cybersecurity solutions to capitalize on this growth.

- Infosys acquired The Missing Link to strengthen its cybersecurity portfolio.

- The global cybersecurity market is forecasted to grow significantly.

- Infosys is focusing on delivering full-stack cybersecurity solutions.

- This strategy aligns with the increasing demand for cybersecurity services.

Large Deal Wins

Infosys excels in securing large deals, showcasing client confidence in its digital and AI solutions. These substantial wins fuel revenue expansion, solidifying its market position, particularly in key service sectors. For example, Infosys signed a deal with Danske Bank in 2024, valued at $454 million. This trend highlights Infosys's strong market share and growth potential.

- Significant deals boost revenue.

- Strong market presence.

- Focus on digital and AI.

- Client trust in services.

Infosys' AI solutions are a "Star" in the BCG Matrix. AI-led transformation demand is rising, with Infosys Topaz and generative AI services as key drivers. Infosys's revenue from AI segment is growing, marking it as a high-growth area. Revenue grew by 1.3% in Q3 FY24.

| Segment | Growth | Example |

|---|---|---|

| AI | High | Topaz, Generative AI |

| Cloud | Robust | Cobalt Platform |

| Digital | Significant | 25% Revenue Increase (2024) |

Cash Cows

Infosys' traditional IT services, like application development and maintenance, remain a key revenue source. In 2024, these services generated a substantial portion of the company’s $18.5 billion revenue. This steady income stream allows Infosys to fund its digital transformation initiatives, acting as a financial foundation.

Infosys' application development and maintenance services are a cornerstone of its revenue, serving diverse clients. These services are mature and stable, ensuring a steady income stream, classifying them as a cash cow. In fiscal year 2024, Infosys reported a revenue of $18.2 billion, with a significant portion derived from these services. This segment consistently delivers solid profitability, supporting investments in other business areas.

Infosys's infrastructure management services are a solid "Cash Cow." This segment offers IT infrastructure support and maintenance. In 2024, it generated substantial revenue. It has a reliable cash flow with minimal reinvestment needs. The revenue from infrastructure management services contributed significantly to Infosys's overall financial performance.

Testing Services

Infosys' testing services, including quality engineering, are indeed cash cows. These services consistently generate revenue by ensuring software reliability. They provide a stable income stream, crucial for financial health. For 2024, Infosys' revenue from digital services, which includes testing, remained a significant portion of its total revenue, around 60%.

- Testing services provide a steady income source.

- These services ensure software reliability and performance.

- Digital services account for a significant portion of Infosys' revenue.

- Around 60% of Infosys revenue is from digital services.

BPO Services

Infosys BPM (Business Process Management) offers outsourcing services across various sectors. These services are a reliable source of revenue for Infosys, fitting the cash cow category. They generate substantial cash with low investment needs, a key cash cow characteristic. Infosys's BPM segment saw a revenue of $1.1 billion in FY24. This illustrates its strong, consistent financial performance.

- Steady Revenue:BPM services provide a consistent revenue stream.

- Low Investment: The cash cow model needs little additional investment.

- Financial Performance: Infosys BPM has a strong financial performance.

- FY24 Revenue: $1.1 billion revenue in FY24.

Infosys' cash cows, like traditional IT services, are key revenue sources, generating a substantial portion of the company’s revenue. In fiscal year 2024, these segments provided consistent financial support. This allows Infosys to fund its digital transformation initiatives and maintain financial stability.

| Service | Description | FY24 Revenue (approx.) |

|---|---|---|

| Application Development & Maintenance | Mature, stable services | Significant portion of $18.5B |

| Infrastructure Management | IT infrastructure support | Substantial |

| Testing Services | Quality engineering, software reliability | Part of 60% of digital services |

| BPM | Business Process Management outsourcing | $1.1B |

Dogs

Infosys's "Dogs" in the BCG Matrix, like legacy system integration, face headwinds. Demand may wane as cloud solutions rise, potentially eroding profitability. For instance, in 2024, the legacy IT market saw a 5% decline. This shift impacts services, requiring adaptation.

Infosys' on-premise infrastructure support faces challenges. Cloud computing's rise diminishes its relevance, potentially slowing growth. Profitability may decrease as clients adopt cloud solutions. In 2024, on-premise IT spending growth is projected at 3%, significantly less than cloud's 20%. Infosys must adapt to maintain market share.

Traditional data center management is increasingly challenged by cloud adoption. The market for these services is shrinking. Data shows a 10% decrease in traditional data center spending in 2024, as per Gartner. Infosys needs to adapt to this shift, or the business may decline.

Outdated Technology Training

Outdated technology training at Infosys, classified as a "Dog" in the BCG Matrix, faces declining relevance. Demand for skills in older technologies diminishes as the tech landscape evolves rapidly. These training programs risk becoming obsolete, necessitating strategic adjustments. For instance, in 2024, the demand for legacy system skills dropped by 15% compared to the previous year.

- Reduced demand for legacy system skills by 15% in 2024.

- Need to revamp or phase out programs.

- Shifting market needs require alignment.

- Risk of obsolescence for outdated training.

Commoditized IT Support

Commoditized IT support, like basic help desk services, falls into the "Dogs" quadrant of Infosys' BCG matrix, facing challenges. These services often experience pricing pressure, impacting profitability. As clients seek advanced solutions, these basic services become less strategically important. For instance, the global IT services market, valued at $1.04 trillion in 2023, shows a shift towards more specialized services.

- Pricing pressure reduces profitability.

- Basic services become less strategic.

- Market shift towards specialized services.

- Infosys may need to reduce investments.

Infosys' "Dogs" struggle with declining demand and profitability. Legacy IT and on-premise infrastructure are less relevant due to cloud adoption. Outdated training programs also face obsolescence as the tech landscape evolves. Commoditized IT support sees pricing pressure.

| Category | Challenge | 2024 Data |

|---|---|---|

| Legacy Systems | Demand decline | 5% market decline |

| On-Premise Support | Cloud competition | 3% growth vs 20% cloud |

| Data Center | Market Shrinkage | 10% spending decrease |

| Outdated Training | Skill obsolescence | 15% drop in demand |

| Commoditized IT | Pricing Pressure | Shift to specialized |

Question Marks

Infosys is strategically investing in quantum computing solutions, leveraging Quantum Living Labs (QLL) to drive innovation. The quantum computing market, projected to reach $1.6 billion by 2024, represents significant growth potential. However, its early stage means Infosys' market share is currently uncertain, classifying it as a question mark in the BCG Matrix. Despite the uncertainty, Infosys' investment signals a commitment to future technological advancements.

Infosys' CMO Radar 2024 report highlights a mixed picture for AI in marketing. Although many companies are using AI, about 47% aren't seeing the expected business benefits. This positions AI-driven marketing as a question mark in the BCG Matrix. It has high growth potential but currently low market share.

Infosys is developing industry-specific SLMs for generative AI. This area is considered a "question mark" within the BCG Matrix due to high growth potential but evolving application. The global generative AI market was valued at $20.6 billion in 2023 and is projected to reach $109.3 billion by 2029. This signifies significant growth opportunities, particularly in specialized sectors. However, the practical implementation and market acceptance across industries are still developing.

AI-Powered Customer Service

AI's customer service potential is huge, but many projects struggle. This makes it a "question mark" in the BCG Matrix. High growth is expected, yet market share is currently low. Infosys needs to invest carefully here.

- 2024: The global AI in customer service market was valued at $5.3 billion.

- 2024: Projected to reach $28.5 billion by 2029.

- Challenges: Implementation costs and integration issues.

- Opportunities: Enhanced customer experience and efficiency gains.

Sustainability Services

Infosys' sustainability services fall into the "Question Mark" quadrant of the BCG matrix. This positioning reflects the company's focus on ESG (Environmental, Social, and Governance) factors, a rapidly expanding area. While sustainability offers high growth potential, its current market share may be smaller than Infosys' more established business lines.

- Infosys is investing in responsible AI to address C-suite concerns.

- Infosys is focusing on sustainability services to capitalize on growth.

- The market share for sustainability services is relatively low.

Infosys faces uncertainty with question marks in its BCG Matrix. These areas, like quantum computing and AI marketing, have high growth but low market share. Investments require careful planning and strategic resource allocation. The goal is to convert these question marks into stars.

| Initiative | Market Growth | Market Share |

|---|---|---|

| Quantum Computing | High (projected $1.6B in 2024) | Uncertain |

| AI in Marketing | High (mixed results in 2024) | Low (47% not seeing benefits) |

| Generative AI | High ($20.6B in 2023, $109.3B by 2029) | Evolving |

| AI in Customer Service | High ($5.3B in 2024, $28.5B by 2029) | Low |

| Sustainability Services | High (ESG focus) | Relatively Low |

BCG Matrix Data Sources

The Infosys BCG Matrix uses financial data, industry reports, and market analysis for a well-researched overview. This approach helps with insightful and dependable strategic insights.