Ingredion Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ingredion Bundle

What is included in the product

Tailored analysis for Ingredion's product portfolio across BCG Matrix quadrants.

Clean, distraction-free view optimized for C-level presentation, helping executives quickly grasp strategic insights.

Preview = Final Product

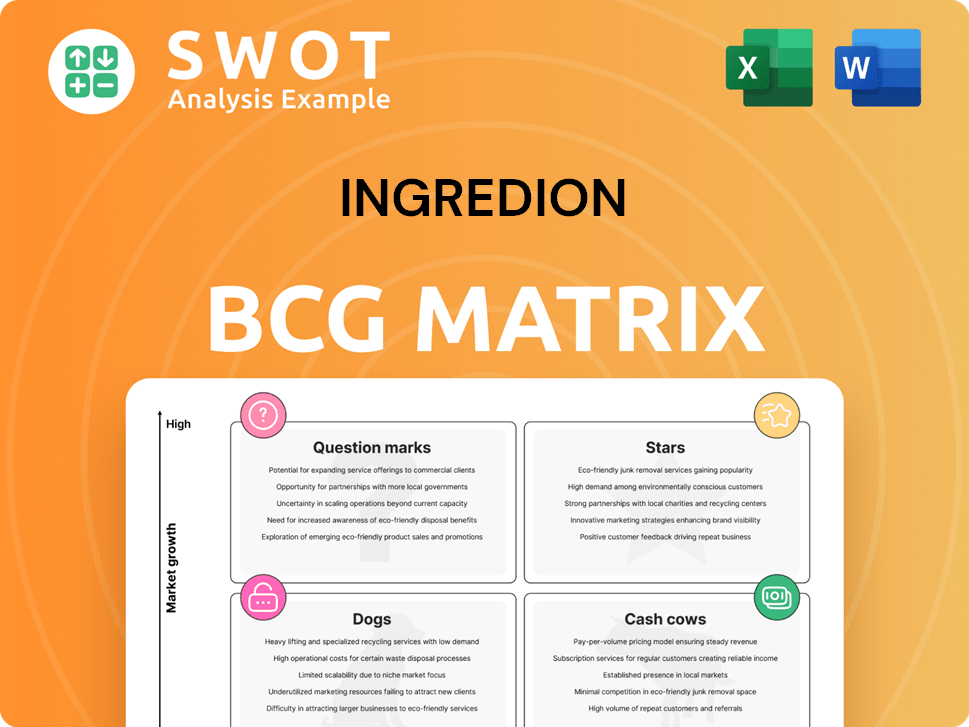

Ingredion BCG Matrix

This preview showcases the complete Ingredion BCG Matrix you'll receive. It's the same polished, strategy-focused report you get upon purchase, ready for immediate application in your business analysis.

BCG Matrix Template

Ingredion's BCG Matrix reveals its product portfolio's market position. This analysis classifies products as Stars, Cash Cows, Dogs, or Question Marks. Identify growth opportunities and resource allocation strategies. Understand which products drive revenue and which need attention. This overview provides a glimpse into Ingredion's competitive landscape. Purchase the full BCG Matrix for a detailed breakdown and strategic insights.

Stars

Ingredion's Texture & Healthful Solutions (T&HS) segment shines brightly, exhibiting robust sales volume growth. Notably, Q4 2024 saw impressive gains, especially in the U.S. and Europe, where double-digit growth was achieved. This segment is a leader, offering innovative ingredient solutions to global customers. T&HS's high market share in a growing market underscores its star status.

Ingredion's Food & Industrial Ingredients (F&II) segments in the US/CAN and LATAM are considered Stars. In 2024, the US/CAN segment benefited from renewed contracts, improving margins. LATAM, especially Mexico and the Andean region, showed robust growth. These segments drive strong market share and growth.

Ingredion's partnership with Lantmännen fuels plant-based protein advancements. This alliance enhances their ability to serve the booming alternative protein market. The collaboration aims to boost Ingredion's market share in this rapidly expanding sector. The global plant-based protein market was valued at $10.36 billion in 2024. Ingredion's strategy targets high growth areas for increased returns.

Clean Label and Sustainable Ingredients

Ingredion's emphasis on clean label and sustainable ingredients is a key strategic move, responding to consumer preferences. Their collaboration with HowGood enhances transparency, offering detailed insights into product sustainability. This approach allows Ingredion to tap into a growing market, driven by demand for ethical and environmentally friendly products. This strategy is critical for long-term growth and market leadership.

- Ingredion's net sales in Q1 2024 were $2.01 billion.

- HowGood's database includes over 35,000 ingredients.

- The clean label market is projected to reach $64 billion by 2028.

Sugar Reduction Solutions

Ingredion shines in sugar reduction, driven by innovation. Their partnership with Oobli for sweet proteins is a key move. PureCircle's CTSS boosts taste and label appeal, solidifying their star status. This focus aligns with the growing health-conscious consumer base. Ingredion's strategic direction is evident in its financial performance.

- 2024 sales in the health and wellness sector are up by 7.5%.

- PureCircle's revenue increased by 4.2% in Q3 2024.

- Ingredion's R&D spending on sugar reduction solutions is up 12% in 2024.

Ingredion's "Stars" are segments showing high market share and growth potential. These include Texture & Healthful Solutions (T&HS), and specific Food & Industrial Ingredients (F&II) regions. Strategic partnerships and innovations in plant-based proteins and sugar reduction drive this growth. These segments benefit from consumer demand for healthier and sustainable options.

| Segment | 2024 Performance Highlights | Key Growth Drivers |

|---|---|---|

| T&HS | Double-digit sales growth in US/Europe in Q4 2024 | Innovative ingredient solutions; High market share |

| F&II (US/CAN) | Margin improvements due to contract renewals in 2024 | Renewed contracts, strong regional growth |

| Plant-Based Protein | Partnered w/ Lantmännen. $10.36B global market (2024) | Expansion in alternative protein market |

Cash Cows

Starch products are a significant part of Ingredion's portfolio. In 2024, these products represented roughly 49% of Ingredion's net sales, demonstrating a solid market position. They're key ingredients in many foods and industrial uses. This consistent demand makes starch products a reliable cash cow for the company.

Sweetener products, including glucose syrups and high fructose corn syrup, were approximately 35% of Ingredion's net sales in 2024. These products hold a significant market share within the food and beverage industry. Ingredion's sweeteners are vital in many food applications, ensuring a stable revenue stream. The market is mature, but Ingredion maintains a strong position.

Ingredion is a cash cow in the U.S. and Canadian industrial markets. It has a strong presence in food, beverage, and pharmaceutical sectors. In 2024, North American net sales were $4.5 billion. This established position in a mature market generates consistent cash flow. Ingredion's diverse applications ensure a stable revenue stream.

Core Ingredients for Brewing Industry in Latin America

Ingredion's Latin American operations are a cash cow, especially regarding the brewing industry. They supply essential ingredients like high maltose corn syrup and starches. This creates consistent revenue due to steady demand from breweries. In 2023, Ingredion's net sales in Latin America were approximately $1.3 billion.

- Key ingredient supplier to breweries.

- High maltose corn syrup and starches.

- Reliable revenue stream from consistent demand.

- 2023 net sales around $1.3B.

Specialty Starches for Paper Industry

Ingredion's specialty starches for the paper industry are a classic cash cow. These starches improve paper drainage, fiber retention, and printability, crucial for paper quality. The consistent demand from paper manufacturers ensures a steady revenue stream. This stable market position makes it a reliable source of cash for Ingredion.

- Specialty starches contribute significantly to Ingredion's revenue.

- The paper industry's ongoing need for these starches ensures steady demand.

- These products provide stable cash flow.

- Ingredion's focus on specialty starches enhances profitability.

Ingredion's cash cows generate steady income with low investment needs. These products have a dominant market share. They include starch and sweetener products which ensured 49% and 35% of net sales in 2024.

| Product Category | 2024 Net Sales Contribution | Key Industries |

|---|---|---|

| Starch Products | ~49% | Food, Industrial |

| Sweeteners | ~35% | Food & Beverage |

| North American Operations | $4.5B | Food, Beverage, Pharma |

Dogs

Ingredion sold its South Korea business, affecting its financial results. The sale likely reflects poor performance and limited growth potential. This strategic move suggests the South Korean operation was classified as a "dog" in the BCG Matrix. In 2024, Ingredion's net sales were $8.05 billion, and operating income was $778 million, influenced by such divestitures.

Ingredion closed its Vanscoy, Canada plant, which produced plant protein concentrates and flour. The closure, costing about $66 million pre-tax, indicates poor performance. This facility likely underperformed, fitting the "dog" category in the BCG matrix. The move reflects strategic adjustments within Ingredion's portfolio.

Ingredion closed its Goole, UK facility as part of a strategic shift. This action indicates the facility was likely underperforming, fitting the "Dog" category in the BCG matrix. The closure aligns with Ingredion's focus on streamlining operations. In 2024, Ingredion's adjusted operating income was approximately $1.1 billion, reflecting these strategic adjustments.

Alcantara, Brazil Facility

Ingredion's strategic shift included closing its Alcantara, Brazil, facility. This action signifies the facility was likely a "Dog" in its BCG matrix. A dog is a business unit with low market share in a low-growth market. Ingredion's 2023 sales were approximately $8.04 billion, but specific financial details for the Alcantara plant's performance aren't available.

- Facility closure indicates underperformance.

- Dogs typically have low profitability.

- Ingredion aims to optimize its portfolio.

Certain Low-Margin Co-product Lines

Certain low-margin co-product lines at Ingredion might be classified as dogs, especially if they don't fit the value-added focus. These products likely face slow growth and have a small market share. Such lines don't significantly boost Ingredion’s overall financial health. For instance, in 2024, Ingredion's focus has been on higher-margin ingredients.

- Low-margin co-products face slow growth and low market share.

- These products do not significantly improve Ingredion’s profitability.

- Ingredion’s 2024 strategy prioritizes value-added ingredients.

- Focus is on high-margin ingredients.

Ingredion's "Dogs" in the BCG matrix include underperforming facilities and low-margin products.

These elements have low market share and slow growth, leading to strategic divestitures and closures.

The 2024 focus on higher-margin ingredients aims to boost profitability, reflecting the company's portfolio optimization. Ingredion's adjusted operating income was approximately $1.1 billion in 2024.

| Category | Characteristics | Ingredion's Actions (2024) |

|---|---|---|

| Dogs | Low market share, slow growth, low profitability | Facility closures (Canada, UK, Brazil), sales of South Korea business |

| Strategic Goal | Improve profitability by focusing on high-margin products | Prioritize value-added ingredients |

| Financial Impact (2024) | Strategic adjustments impacted net sales and operating income | Net sales: $8.05B, operating income: $778M, adjusted operating income: $1.1B |

Question Marks

Ingredion's biomaterials segment, which includes products for various industries, is positioned in the question mark quadrant of the BCG matrix. This segment faces a growing market but may have a low current market share. To capitalize on opportunities, it requires significant investment. For instance, the global bioplastics market is projected to reach $75.9 billion by 2028.

Ingredion is focusing on specialty plant-based concentrates and flours, including those from peas, lentils, and fava beans. While the market is growing, Ingredion's current market share in this area is still emerging. To compete effectively, the company needs to make significant investments in this segment. In 2024, the global plant-based food market was valued at over $36 billion, with projections for continued expansion.

Ingredion's partnership with Oobli to develop sweet protein-based sweeteners is a new venture. The market for sweet proteins is emerging, offering high growth potential. Ingredion currently has a low market share in this area. Significant investment is needed to boost market acceptance and increase its share. In 2024, the global sweetener market was valued at approximately $90 billion.

Regenerative Agriculture Initiatives

Ingredion's regenerative agriculture initiatives, including co-investments with strategic customers, fall into the question mark quadrant of the BCG matrix. These sustainability-focused efforts aim to boost long-term value, but their immediate financial impacts remain unclear. The company's commitment is evident, with plans to expand these practices across 1 million acres by 2030. However, significant investment is still necessary to prove their market leadership potential.

- Ingredion aims to expand regenerative agriculture to 1 million acres by 2030.

- The financial benefits and market share gains are currently uncertain.

- Further investment is needed to demonstrate value.

New Clean Label Citrus Fibers (FIBERTEX® CF 500 and FIBERTEX® CF 100)

Ingredion's FIBERTEX® CF 500 and FIBERTEX® CF 100, multi-benefit citrus fibers, represent a strategic move in the clean label market, initially launched in APAC and EMEA. These products are aimed at meeting the growing demand for natural ingredients in the food and beverage industry. However, the market share and consumer acceptance of these specific citrus fibers are still in the development phase.

- APAC clean label ingredients market is projected to reach $23.5 billion by 2028.

- EMEA clean label market is also experiencing significant growth.

- North America launch is planned, indicating further investment and market penetration efforts.

Ingredion's ventures in the question mark quadrant, like biomaterials and sweet proteins, involve high-growth markets. These areas require significant investments to boost market share and profitability. The company strategically focuses on emerging trends, aiming for future leadership.

| Segment | Market Growth | Ingredion's Share |

|---|---|---|

| Biomaterials | High, with $75.9B market by 2028 | Low, needs investment |

| Plant-Based Foods | Over $36B market in 2024 | Emerging, investment needed |

| Sweet Proteins | Emerging, high potential | Low, requires boosting |

BCG Matrix Data Sources

Ingredion's BCG Matrix uses market data, financial statements, industry reports, and expert opinions to offer reliable insights.