Intermex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intermex Bundle

What is included in the product

Intermex's BCG Matrix analysis unveils strategic recommendations for portfolio optimization.

Export-ready design for drag-and-drop into presentations to quickly share portfolio insights.

Full Transparency, Always

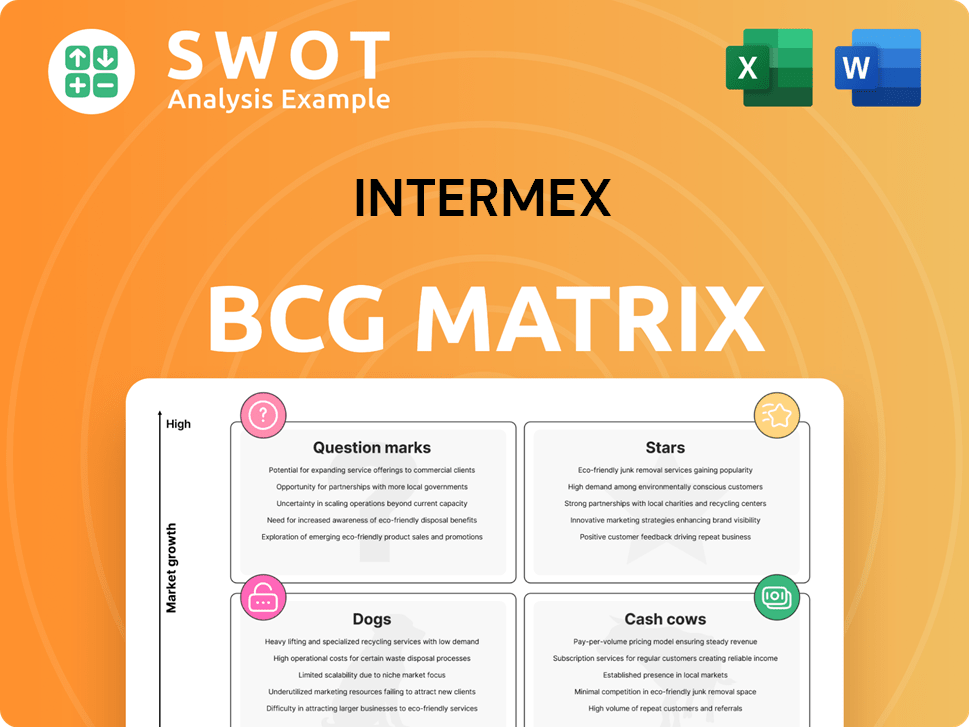

Intermex BCG Matrix

The displayed preview showcases the complete Intermex BCG Matrix you'll receive post-purchase. This is the exact, ready-to-use document, optimized for immediate strategic planning and market analysis.

BCG Matrix Template

Uncover Intermex's strategic landscape with a glimpse of its BCG Matrix. See where their products fall: Stars, Cash Cows, Dogs, or Question Marks. This preview only scratches the surface of their market positioning.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Intermex is heavily investing in digital platforms. This includes a new mobile app and collaborations like WhatsApp integration, aiming for a bigger share of digital remittances. Their digital focus sets them up well as digital use rises. Digital revenue jumped 48.3% in Q4 2024, showing strong growth.

Intermex's strategic acquisitions, like La Nacional and Amigo Paisano, have broadened its market presence and service range. This proactive growth strategy strengthens their competitive edge in 2024. These moves have demonstrably increased transaction volumes, with Q3 2024 revenue up by 15% YoY. This expansion is key for sustained growth.

Intermex's robust agent network, especially in key corridors like the US to Latin America, is a major revenue source. They actively manage this network to boost profitability. The retail sector significantly fuels Intermex's financial performance, contributing a large portion of its yearly income. In 2024, retail transactions accounted for approximately 70% of Intermex's total revenue.

Focus on Key Corridors

Intermex's "Focus on Key Corridors" strategy, a key part of its BCG Matrix assessment, involves concentrating on high-volume remittance routes. They've built a strong position in corridors like the US to Mexico, Guatemala, Honduras, and El Salvador. This focused strategy allows for efficient resource allocation and high market share in targeted areas. In 2024, Intermex processed over $40 billion in remittances globally.

- Strategic Focus: Prioritizes key remittance corridors.

- Market Share: Holds a significant share in core corridors.

- Efficiency: Enables efficient resource allocation.

- 2024 Data: Processed over $40 billion in remittances.

Innovative Services

Intermex is expanding its services with international mobile top-ups and WhatsApp wire transfers, showcasing a customer-centric approach. These new services aim to boost convenience and attract users. Such initiatives are anticipated to strengthen customer engagement and loyalty. In 2024, Intermex processed $26.3 billion in money transfers, with digital transactions rising by 15%.

- International mobile top-ups offer easy access to funds.

- WhatsApp transfers enhance user convenience.

- These services boost customer engagement.

- Digital transactions are experiencing growth.

Stars in Intermex's BCG Matrix, represent high-growth, high-share business units. Intermex's digital platforms and strategic acquisitions, such as La Nacional, drive growth. The focus on key remittance corridors, including the US to Mexico, fuels its "Star" status. In 2024, digital revenue increased significantly, indicating strong performance.

| Aspect | Description | 2024 Data |

|---|---|---|

| Digital Growth | Expansion of digital services & platforms. | 48.3% increase in Q4 digital revenue |

| Strategic Acquisitions | Expanding market presence. | La Nacional acquisition |

| Key Corridors | Focus on high-volume remittance routes. | $40B+ processed globally |

Cash Cows

Intermex's US-to-Latin America remittances are a cash cow, a core business. This established market provides a stable revenue foundation. The company has strong brand recognition. In 2024, remittances to Latin America and the Caribbean are expected to exceed $150 billion. Intermex's consistent performance in this sector validates its cash cow status.

Intermex's retail money transfer network remains a cash cow, contributing significantly to its revenue. This established infrastructure provides a consistent and reliable income stream. In 2024, retail transactions likely contributed a substantial portion of the $4.5 billion in money transfers Intermex processed. The company strategically invests in this segment to ensure its ongoing profitability and market presence.

Intermex's focus on operational efficiency has led to strong earnings and margins. This efficiency allows the firm to generate significant cash flow. Intermex has shown robust EPS growth. In 2024, Intermex increased its revenue to $767.8 million. The company's adjusted EBITDA increased to $131.9 million.

Strong EBITDA Margins

Intermex exemplifies a "Cash Cow" in the BCG matrix due to its robust financial performance. The company's ability to maintain strong EBITDA margins, showcasing effective cost management and profit generation, is a key indicator. This financial resilience is crucial for navigating market volatility. In Q3 2024, Intermex achieved an impressive 19.7% adjusted EBITDA margin, underscoring its profitability.

- Consistent profitability.

- Effective cost management.

- Financial resilience.

- Strong Q3 2024 EBITDA margin.

Share Repurchase Program

Intermex's share repurchase program showcases dedication to shareholder value and financial strength. This initiative often elevates earnings per share, making the stock more attractive. In Q3 2024, Intermex spent $20.3 million on share repurchases. This strategic move reflects a positive outlook on the company's future.

- Share repurchases signal confidence.

- Boosts earnings per share.

- $20.3M spent in Q3 2024.

- Positive outlook for Intermex.

Intermex's consistent revenue and strong market position in US-to-Latin America remittances and retail money transfers define it as a "Cash Cow". Stable income and effective cost management, supported by robust EBITDA margins, highlight its profitability. The company's strategic share repurchases further signal financial strength and shareholder value.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Total income | $767.8 million |

| Adjusted EBITDA Margin | Profitability measure | 19.7% (Q3) |

| Share Repurchases | Investment in company stock | $20.3 million (Q3) |

Dogs

The retail remittance market's slowdown in Latin America poses a challenge for Intermex, potentially impacting its core business. Intermex's Q4 2024 revenue saw a 4% decrease, highlighting the need for adaptation. This shift necessitates diversification to maintain financial health. The company must explore new avenues for revenue generation to offset the retail decline.

Intermex's stock faced headwinds due to sale uncertainty. The strategic review suspension, though announced, leaves the door open for future deals. This ambiguity likely affected investor confidence in 2024. For instance, in 2024, the stock price showed volatility tied to these announcements.

Intermex's reliance on Latin American remittances creates vulnerability. Economic and political instability in the region directly impacts the company. In 2024, Intermex saw 65% of its revenue from Latin America. Downturns in these markets would significantly hurt performance. Revenue growth is tied to Latin America's economic health.

Decline in Principal Sent

The "Dogs" quadrant in Intermex's BCG matrix highlights areas of concern. The total principal sent from remittance activity slightly declined in 2024, signaling potentially softer demand for their services. This trend warrants close monitoring to understand its impact on Intermex's financial performance. Intermex reported a 0.8% decrease in annual principal sent in FY 2024, a key indicator of this trend.

- Decrease in total principal sent in 2024.

- Indicates potentially weakening demand.

- Requires close monitoring.

- FY 2024 saw a 0.8% decline.

Competition from Digital-First Players

Digital-first remittance companies, such as Remitly and Wise, are increasingly taking market share, which challenges Intermex's established business model. These competitors commonly provide lower fees and more convenient online platforms, attracting customers. Intermex must keep investing in its digital services to stay competitive in the evolving market. The digital remittance market is projected to reach $49.7 billion by 2024.

- Remitly's revenue grew by 25% in 2023.

- Wise processed £89.3 billion in cross-border payments in fiscal year 2024.

- Intermex's digital transaction volume increased by 40% in 2023.

Intermex's "Dogs" represent underperforming segments in its BCG matrix.

A decline in total principal sent and fierce competition from digital platforms mark key issues in 2024.

These factors signal challenges, requiring strategic adjustments to improve the company's performance and market position.

Intermex's strategic challenges need immediate attention, especially given that digital remittance is projected to reach $49.7 billion by 2024.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| Total Principal Sent (Decline) | N/A | -0.8% |

| Digital Remittance Market | $40.2 B | $49.7 B |

| Intermex Revenue (Q4 Decline) | N/A | -4% |

Question Marks

Intermex's European expansion, targeting Germany, France, and the UK, is a question mark in its BCG Matrix. This move presents high potential for growth but also comes with substantial risks and requires significant investment. The company's acquisition of a UK license is a key step in supporting this expansion. Success depends on effective market penetration and adaptation to local regulations. In 2024, Intermex's revenue was $680.3 million.

Intermex's WhatsApp integration for wire transfers is a bold move. This could transform how customers send money, especially in key markets. Successful adoption and marketing are critical for driving growth. In 2024, Intermex processed $28.8 billion in transfers.

Intermex's international top-up service, launched with Ding, presents a "Question Mark" in its BCG Matrix. This service broadens Intermex's offerings and aims to boost customer value. While it targets a global market of over 130 countries, its profitability is uncertain. In Q3 2023, Intermex's revenue was $170.3 million, and the top-up service's contribution needs assessment.

Intermex SOMA App

Intermex's SOMA app, launched for store owners, is a question mark in the BCG matrix. This app aims to boost agent engagement and operational efficiency. Its ability to significantly impact Intermex's overall business growth is still uncertain. The app offers agents real-time insights into their business performance.

- SOMA app's launch in 2024 aims to streamline agent operations.

- Real-time performance data is a key feature for agents.

- Its impact on Intermex's revenue is under evaluation.

- Agent adoption and usage rates are crucial for success.

Partnerships and Integrations

Intermex strategically forges partnerships and integrations, like the Visa Direct collaboration, aiming to broaden its market presence and service range. These alliances are crucial for expanding Intermex's money transfer capabilities to various countries and financial institutions. Successful execution and alignment with market needs are vital for these collaborations to yield positive outcomes. These partnerships will help Intermex to improve its market position.

- Visa Direct partnership enables money transfers to eligible cards and bank accounts across new countries.

- Effective execution and market demand are key for successful collaborations.

- Partnerships contribute to expanding Intermex's service offerings.

Intermex faces question marks in its portfolio across various initiatives. Expansion in Europe and WhatsApp integration show high growth potential. The international top-up service and SOMA app's impact are under evaluation. Successful execution is crucial for all.

| Initiative | Status | Key Metric |

|---|---|---|

| European Expansion | High potential, high risk | 2024 Revenue: $680.3M |

| WhatsApp Integration | Bold move | 2024 Transfers: $28.8B |

| International Top-up | Uncertain profitability | Q3 2023 Revenue: $170.3M |

BCG Matrix Data Sources

The Intermex BCG Matrix leverages financial reports, market analyses, and industry benchmarks, ensuring reliable strategic assessments.