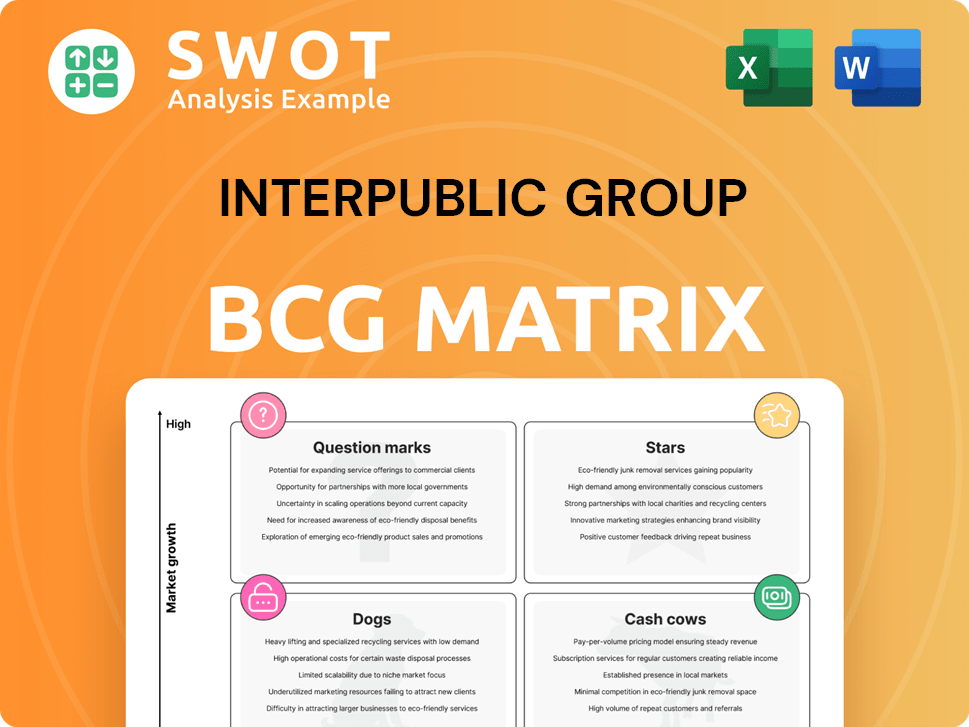

Interpublic Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interpublic Group Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Simplified output saves time. Get a clear overview of Interpublic's businesses for strategic decisions.

Delivered as Shown

Interpublic Group BCG Matrix

This preview presents the identical Interpublic Group BCG Matrix document you will receive after purchase. It's a complete, ready-to-implement strategic tool, designed for clear market analysis and decision-making.

BCG Matrix Template

Uncover the Interpublic Group's product portfolio dynamics with our BCG Matrix analysis. See how their diverse offerings perform across the market. Stars, Cash Cows, and Dogs are identified, offering strategic views. Understand resource allocation priorities and growth potential. This peek is just the start. Purchase now for in-depth insights!

Stars

Acxiom, within Interpublic Group, is a star due to its strong growth and high market share in data and analytics. In 2024, Acxiom's revenue significantly contributed to IPG's overall financial health. IPG is actively investing in Acxiom to maintain its competitive edge and drive further innovation. This strategic focus aims to strengthen Acxiom's leadership in the market.

IPG Mediabrands is a "Star" in Interpublic Group's portfolio, showing robust growth. It's a major revenue generator and a top player in media planning and buying. In 2024, IPG Mediabrands saw a revenue increase of 4.5%, highlighting its strong market position. The focus should be on maintaining its competitive advantage and broadening its services.

Golin's ambition to be the first AI-integrated PR agency is a bold strategy, potentially setting a new industry standard. This innovative approach could significantly boost its appeal to clients seeking cutting-edge solutions. Such initiatives are crucial for growth, especially in a market where PR spending is projected to reach $97 billion by the end of 2024. Supporting Golin's AI integration is vital for its future success within Interpublic Group.

Deutsch

Deutsch, a key agency within Interpublic Group (IPG), has demonstrated robust performance. It brings strong creative and strategic skills to the table. In 2024, IPG's organic growth was approximately 4%, with Deutsch contributing significantly. To maintain its momentum, nurturing its creative talent and attracting more clients is crucial.

- 2024 Organic growth for IPG: Approximately 4%

- Deutsch's role: Key agency with strong creative capabilities

- Focus for success: Nurturing talent and expanding client base

Specialized Digital Marketing Services

Specialized digital marketing services are a "Star" within Interpublic Group's BCG matrix, reflecting high growth and market share. These services are crucial for clients aiming to boost their online presence and interaction. Investment in these areas is vital to capture the expanding digital advertising market, which is projected to reach $876 billion by 2024.

- Digital ad spending in 2024 is expected to grow by approximately 10%.

- Interpublic Group's digital revenue has shown a steady increase year-over-year.

- The demand for digital transformation services continues to rise.

Interpublic Group's (IPG) "Stars" like Acxiom and Mediabrands lead in growth and market share. These entities are key revenue drivers, with Mediabrands achieving a 4.5% revenue increase in 2024. Continued investment is critical to maintaining their competitive positions.

| Star | Key Feature | 2024 Impact |

|---|---|---|

| Acxiom | Data & Analytics | Significant revenue contribution to IPG |

| IPG Mediabrands | Media Planning/Buying | 4.5% revenue increase |

| Digital Marketing | Specialized services | Growing digital ad spend |

Cash Cows

McCann Worldgroup, part of Interpublic Group (IPG), functions as a Cash Cow. This well-known global network generates consistent revenue for IPG. In 2024, IPG's revenue was around $11.1 billion. Focusing on operational efficiency and client retention is key. Continuous optimization helps maximize cash flow.

FCB, part of Interpublic Group, is a well-established agency known globally. It consistently brings in revenue through advertising and marketing services, acting as a cash cow. The focus should be on operational efficiency and utilizing its strong brand recognition to keep its market share. In 2024, Interpublic Group's revenue was over $11 billion, showing FCB's contribution. Innovation within the existing structure is crucial for sustained success.

Weber Shandwick, a key part of Interpublic Group (IPG), offers public relations and communications services. It's a reliable "Cash Cow" for IPG, providing consistent revenue. In 2024, IPG's revenue was $11.14 billion. Client retention and operational efficiency are crucial to maintain its financial stability. Adapting to digital media is key for its future.

UM

UM, a global media agency within Interpublic Group (IPG) Mediabrands, is a cash cow due to its established client base and market presence. In 2024, IPG's revenue reached approximately $11.17 billion, with Mediabrands contributing significantly. UM should prioritize maintaining its market position by refining its media buying strategies to ensure consistent revenue. This focus helps sustain its cash-generating status within IPG's portfolio.

- Market Position: UM is a key player in the global media agency landscape.

- Revenue Contribution: A significant portion of IPG's revenue comes from its media agencies.

- Strategic Focus: Optimizing media buying is crucial for consistent revenue.

- Financial Stability: UM’s established status supports IPG's financial health.

Initiative

Initiative, a media agency within IPG Mediabrands, is a key "Cash Cow." It consistently generates revenue, crucial for IPG's financial stability. Initiative's focus remains on operational efficiency and high client satisfaction. Adapting to new media platforms is a must for continued success.

- IPG's Q3 2023 revenue was $2.63 billion.

- Initiative's role contributes significantly to this.

- Client retention rates are a key performance indicator.

- Investment in digital media is ongoing.

R/GA, part of IPG, also functions as a Cash Cow, consistently generating revenue. In 2024, IPG's revenue was approximately $11.17 billion. Maintaining its client base and ensuring operational efficiency are key. Adapting its digital services is vital for sustained financial performance.

| Cash Cows | Strategic Focus | |

|---|---|---|

| R/GA | Client retention, digital adaptation | |

| UM | Media buying optimization | |

| Initiative | Operational efficiency, client satisfaction |

Dogs

Experiential offerings at Interpublic Group (IPG) have shown some weakness. Soft results and shifts in the market impacted these areas. IPG's experiential revenue in 2023 was $2.6 billion. Restructuring or divestiture might be necessary. Careful evaluation is essential to manage losses.

Traditional advertising segments, like print and broadcast, face challenges adapting to digital shifts, potentially becoming "dogs" in Interpublic Group's BCG matrix. These segments typically exhibit low growth and market share. In 2024, print ad revenue declined, with the US newspaper ad revenue dropping to $1.9 billion, signaling ongoing struggles. Digital integration or strategic shifts are vital for these areas. Divestment may be a strategic consideration if segments continually underperform.

R/GA and Huge, previously categorized as 'held for sale,' signaled they weren't central to IPG's long-term goals. Huge was sold, aligning with IPG's strategic shift. Underperforming assets require careful evaluation, with potential divestiture. Focus should be on core strengths to enhance shareholder value.

Struggling Regional Operations

Interpublic Group's regional operations facing economic headwinds or fierce competition are deemed dogs. These require close monitoring and possible restructuring or consolidation. This strategic move aims to optimize resource allocation for improved profitability. For example, in 2024, some European operations faced challenges.

- 2024: Economic slowdown in Europe impacted ad spending.

- Competitive pressures from digital platforms increased.

- Restructuring may involve layoffs or office closures.

- Consolidation could merge underperforming agencies.

Outdated Service Offerings

Outdated service offerings at Interpublic Group, those that haven't adapted, fall into the "Dogs" category of the BCG Matrix. These services, due to tech or market shifts, risk further losses and need a serious overhaul or elimination to stop bleeding money. Focus should be on reinvention. In 2024, Interpublic's revenue was $11.13 billion, and stagnant services would drag this down.

- Technological obsolescence is a key factor.

- Market demand changes dictate service relevance.

- Revamping or phasing out is essential for profitability.

- Innovation and adaptation are crucial strategies.

Dogs within Interpublic Group (IPG) represent underperforming business units with low market share and growth. These units often require strategic actions, such as restructuring or divestiture. Examples include traditional advertising segments or outdated service offerings. Focusing on core strengths and adapting to market shifts are key to mitigating losses.

| Category | Description | Strategic Action |

|---|---|---|

| Experiential | Weak offerings, impacted by market shifts. | Restructure or divest. |

| Traditional Ads | Low growth, face digital challenges. | Digital integration, divest. |

| Regional Ops | Economic headwinds or competition. | Restructure, consolidate. |

| Outdated Services | Haven't adapted, risk losses. | Revamp or eliminate. |

Question Marks

Interpublic Group's (IPG) AI-driven marketing tech shows high growth but low market share. These require significant investment for scaling. IPG's 2023 revenue was $10.9 billion. Strategic partnerships are key to boosting these technologies. Targeted marketing is crucial for wider adoption and turning them into stars.

Interpublic Group (IPG) views retail media as a question mark in its BCG Matrix. This sector shows high growth potential, mirroring the overall retail media market, which is forecasted to reach $160 billion by 2024. IPG is strategically investing to build its presence. This includes acquisitions and partnerships to bolster its capabilities and capture market share in this evolving space.

New digital platforms and services are question marks for Interpublic Group (IPG). These platforms offer growth potential, but success isn't guaranteed. IPG invested $200 million in digital initiatives in 2024. Strategic investment and monitoring are vital, given the market's volatility.

Innovative Content Creation

Innovative content creation at Interpublic Group (IPG) is key for attracting clients and boosting revenue. It demands continuous experimentation to align with evolving consumer tastes. A robust portfolio showcasing successful campaigns is crucial for demonstrating value. IPG's focus on digital content and data-driven strategies reflects this emphasis. In 2024, IPG saw a 3.2% organic revenue growth, partly due to strong content performance.

- Investment in content creation is a key driver for new business.

- Adaptability to consumer trends is essential for relevance.

- A strong campaign portfolio showcases IPG's capabilities.

- Data-driven strategies enhance content effectiveness.

E-commerce Marketing Solutions

E-commerce marketing solutions represent a question mark for Interpublic Group (IPG) in its BCG matrix. The e-commerce sector's growth offers substantial opportunities, necessitating specialized marketing strategies. Success hinges on data analytics, personalization, and strong customer engagement skills. Strategic investments in this area could lead to considerable growth for IPG.

- E-commerce sales in the US reached $1.1 trillion in 2023, up 7.5% year-over-year.

- Personalized marketing can increase conversion rates by up to 10%.

- Data analytics spending in marketing is projected to reach $103 billion by 2024.

- IPG's revenue in Q3 2023 was $2.63 billion.

Retail media is a question mark, with a market forecast of $160B by 2024. IPG is investing in acquisitions and partnerships. Digital platforms and services, also question marks, demand strategic investments. IPG invested $200M in digital in 2024. E-commerce, with $1.1T US sales in 2023, is another focus.

| Area | Status | Strategy |

|---|---|---|

| Retail Media | Question Mark | Investments, partnerships |

| Digital Platforms | Question Mark | Strategic Investment, monitoring |

| E-commerce | Question Mark | Data analytics, engagement |

BCG Matrix Data Sources

The BCG Matrix leverages public financial records, market assessments, and industry analysis to provide strategic clarity. These sources offer dependable insight for quadrant positioning.