Intuit Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intuit Bundle

What is included in the product

Intuit's BCG Matrix analysis: strategic insights, investment recommendations, and competitive landscape overview.

Visual strategic planning tool, helping analyze and prioritize products and services, improving focus.

Delivered as Shown

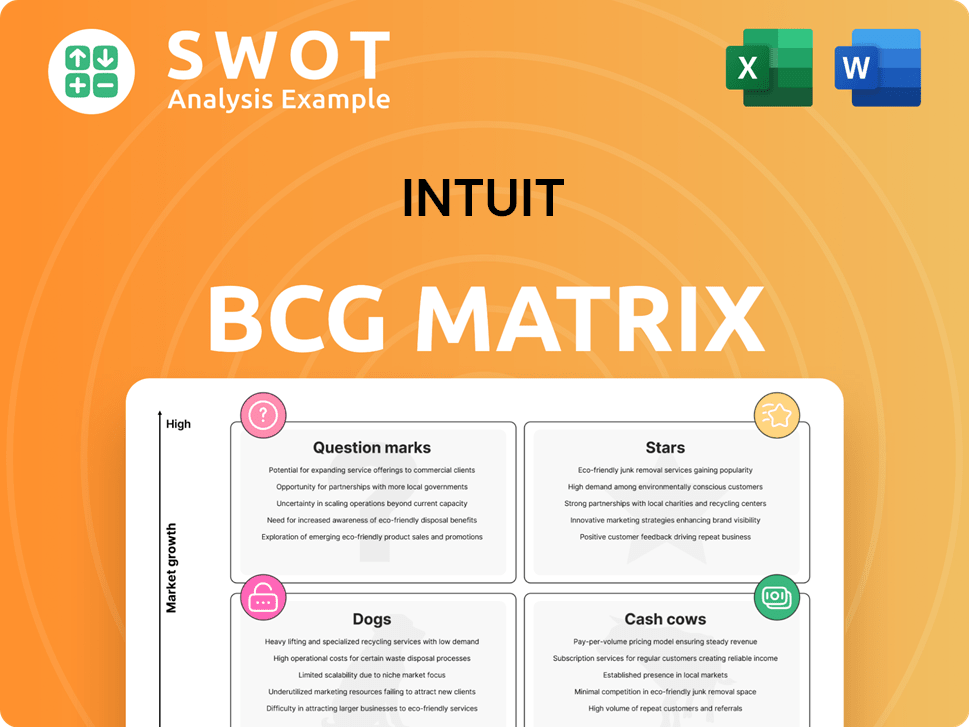

Intuit BCG Matrix

The BCG Matrix displayed here is identical to the document you'll download upon purchase. It's a complete, ready-to-use report with professional formatting and insightful analysis, designed for immediate integration into your strategic planning.

BCG Matrix Template

The Intuit BCG Matrix showcases their product portfolio's market performance. See which offerings are Stars, Cash Cows, Dogs, and Question Marks. This snapshot provides a glimpse into Intuit's strategic landscape. Understand their resource allocation and growth potential. Unlock deeper insights and strategic recommendations. Purchase the full version for comprehensive analysis and data-driven decisions.

Stars

QuickBooks Online thrives in the expanding cloud accounting market, holding a significant market share. The platform's robust revenue growth is fueled by a growing customer base and smart pricing. Intuit's AI and platform enhancements strengthen QuickBooks Online's leadership, with 2024 revenue reaching $7.8 billion.

Credit Karma is thriving, fueled by strong gains in personal loans, auto insurance, and credit cards. Its integration with Intuit's products, like TurboTax, builds a unified financial hub. Intuit's emphasis on personalized data strengthens Credit Karma's growth. Credit Karma had 136 million members as of 2024. In fiscal year 2024, Credit Karma's revenue grew by 20%.

Intuit Enterprise Suite, designed for mid-market businesses, is a "Star" in Intuit's BCG Matrix. It offers a scalable, integrated, cloud-based platform, attracting growing businesses. Its accessible price point and robust features are competitive. In 2024, the cloud ERP market is projected to reach $77.7 billion.

AI-Driven Expert Platform

Intuit's AI-driven expert platform is a shining star in its portfolio, dramatically improving customer benefit delivery. The integration of AI across QuickBooks and TurboTax streamlines processes and boosts user satisfaction. This AI-centric strategy places Intuit at the cutting edge of financial technology.

- In 2024, Intuit reported a 13% increase in Small Business & Self-Employed revenue, boosted by AI features.

- TurboTax's AI-powered features helped process over 100 million tax returns in 2024.

- Intuit's R&D spending in 2024 reached $3 billion, heavily focused on AI.

Global Business Solutions Group

Global Business Solutions Group, including QuickBooks, is a star for Intuit. This segment significantly boosts Intuit's revenue, supported by strong demand for QuickBooks Online. The group's online ecosystem is rapidly growing. International expansion and mid-market strategies are key drivers.

- In fiscal year 2023, Small Business & Self-Employed Group revenue grew by 17% to $6.2 billion.

- QuickBooks Online accounting revenue increased by 22% in fiscal year 2023.

- International revenue grew by 28% in fiscal year 2023.

- Intuit's total revenue for fiscal year 2023 was $14.4 billion.

Several Intuit products are "Stars" in the BCG Matrix, highlighting strong growth and market leadership.

These include QuickBooks Online, Credit Karma, and Intuit Enterprise Suite, all demonstrating significant revenue increases. AI-driven platforms and Global Business Solutions further fuel Intuit's success, driving innovation.

Investing in these areas positions Intuit for continued expansion and dominance.

| Product | Key Feature | 2024 Performance |

|---|---|---|

| QuickBooks Online | Cloud Accounting | $7.8B Revenue |

| Credit Karma | Financial Hub | 20% Revenue Growth |

| Enterprise Suite | Cloud ERP | Expanding Market |

Cash Cows

TurboTax, a cash cow in Intuit's portfolio, dominates the tax preparation software market. It generates significant cash flow, even with moderate revenue growth in this mature market. In 2024, TurboTax held over 70% of the DIY tax software market. Intuit uses its scale and brand to succeed in both DIY and assisted tax services.

QuickBooks Desktop, though shifting to subscriptions, is a cash cow for Intuit. It serves many small businesses preferring desktop software. Intuit aims to migrate Desktop users to recurring subscriptions. This strategy stabilizes revenue, with subscriptions expected to grow. In 2024, Intuit's small business and self-employed group generated significant revenue.

ProTax Group, a part of Intuit, is a cash cow, providing stable revenue from professional accountants in the US and Canada. While growth is moderate, it supports small businesses and tax preparation. Intuit aims for a connected platform for accountants and clients, using AI for better decisions. In fiscal year 2024, Intuit's Small Business and Self-Employed Group, which includes ProTax, generated $8.3 billion in revenue.

QuickBooks Payments

QuickBooks Payments is a steady cash generator for Intuit, leveraging its core accounting software user base. This segment benefits from the integration of payment processing with financial management tools. Intuit's focus on innovation, like dispute protection, strengthens its market position. The payment system is a key element of Intuit's ecosystem.

- 2024: QuickBooks Payments processed $150+ billion in payment volume.

- 2024: Revenue from payments grew by double digits, reflecting strong adoption.

- Intuit offers revenue-sharing programs for accountants who refer clients to QuickBooks Payments.

Payroll Solutions

Intuit's payroll solutions, deeply integrated with QuickBooks, are a cash cow, serving a vast SMB customer base. The growing complexity of payroll as businesses scale drives demand for Intuit's services. In 2024, Intuit's Small Business and Self-Employed segment, which includes payroll, generated approximately $6.5 billion in revenue. Intuit focuses on providing payroll and workforce solutions for mid-market customers, offering features like automated tax withdrawals and streamlined compensation management.

- Revenue from Intuit's Small Business and Self-Employed segment was around $6.5 billion in 2024.

- Intuit's payroll solutions cater to SMBs with integrated features.

- The services include automated payroll tax withdrawals.

Intuit's Cash Cows generate consistent revenue with modest growth. These include TurboTax, QuickBooks Desktop, and ProTax Group, which all secure a sizable share of the tax preparation and accounting software markets.

QuickBooks Payments and payroll solutions provide steady revenue, due to their integration with QuickBooks and SMB demand.

In 2024, the Small Business and Self-Employed segment brought in roughly $14.8 billion for Intuit, showcasing the strength of its cash cows.

| Cash Cow | 2024 Revenue (Approx.) | Market Position |

|---|---|---|

| TurboTax | Included in $8.3B (SBE) | 70%+ DIY Tax |

| QuickBooks Desktop | Included in $8.3B (SBE) | Significant Share |

| ProTax Group | Included in $8.3B (SBE) | Key US/Canada |

| QuickBooks Payments | Double-digit growth | $150B+ processed |

| Payroll Solutions | Included in $6.5B (SBE) | SMB Focused |

Dogs

Mint.com, a personal finance tool owned by Intuit, might be a 'dog' in its portfolio. It possibly faces slower growth and lower revenue compared to other Intuit products. Intuit could re-evaluate Mint's strategy or consider selling it. Data from 2024 suggests a decline in active users compared to earlier years.

QuickBooks Simple Start, aimed at the smallest businesses, could be a 'dog' in Intuit's BCG Matrix. It has a low price, and its limited features might not bring in much revenue. In 2024, Intuit's revenue was about $15.9 billion. Simple Start needs to prove its value as a customer entry point. If not, it could hurt profits.

The Desktop Ecosystem, once a cash cow, sees declining revenue due to Intuit's online shift. This segment is now a 'dog', with low growth and revenue dips. In fiscal year 2024, Desktop revenue decreased. Intuit projects low single-digit growth by Q2 2025, aiming for a turnaround. The goal is to revitalize this segment.

Legacy Products

Legacy products, like older Intuit software versions, can be 'dogs' in the BCG matrix. These versions have smaller user bases, yet still need support and maintenance. Intuit might consider phasing these out to concentrate on their main products. This shift could help Intuit allocate resources more efficiently. In 2024, Intuit reported $15.9 billion in revenue, so streamlining operations is important.

- Older software versions need resources.

- They have smaller user bases.

- Intuit could sunset these products.

- Focus on core offerings.

Unsuccessful Acquisitions

Intuit's "Dogs" in the BCG matrix include past acquisitions that underperformed. These deals may have struggled with integration or failed to deliver projected returns. For instance, some acquisitions could have diluted Intuit's financial performance. Intuit must assess these underperforming assets to improve resource allocation and financial outcomes.

- In 2023, Intuit's net revenue was $14.4 billion, while some acquisitions might not have significantly contributed to this growth.

- Failed integrations can lead to a decline in shareholder value.

- Poorly performing acquisitions might need restructuring or divestiture.

- Intuit's strategic focus is on acquisitions that boost its core platforms.

Intuit's "Dogs" also include underperforming acquisitions. Some deals may have struggled with integration or returns. By 2024, poorly performing acquisitions can hurt financial outcomes. Intuit must assess these assets.

| Category | Impact | 2024 Data |

|---|---|---|

| Acquisition Performance | Dilution of financial returns. | $15.9B revenue, some acquisitions underperformed. |

| Integration Issues | Decline in shareholder value. | Failed integrations can be costly. |

| Strategic Focus | Resource Misallocation. | Focus on core platforms is key. |

Question Marks

Mailchimp, purchased by Intuit in 2021, is a question mark within the Intuit BCG Matrix. The platform presents opportunities for cross-selling and marketing automation. Mailchimp's churn rates among smaller clients pose a challenge. Intuit is focused on product improvements and integration, aiming to boost its value.

Intuit's international expansion is a question mark in its BCG matrix. The company faces hurdles adapting products to local regulations and competing with existing firms. Intuit is targeting both established and emerging markets to fuel global growth. In 2024, Intuit's international revenue was approximately $1.8 billion, representing about 15% of total revenue.

QuickBooks Online Advanced, aimed at larger small businesses, is a question mark in Intuit's BCG Matrix. Despite offering advanced features, it competes with established ERP systems. Intuit is investing in it, aiming to capture the mid-market. In Q1 2024, Intuit's Small Business and Self-Employed Group revenue grew by 15%, showing potential for growth.

AI-Powered Financial Assistant (Intuit Assist)

Intuit Assist, a generative AI financial assistant within QuickBooks, is positioned as a question mark in Intuit's BCG Matrix. It has significant potential due to its features aimed at saving time and boosting cash flow. However, its current impact and user adoption remain unclear, signaling uncertainty. Intuit is actively integrating agentic AI across its platforms.

- Intuit reported 10.5 million QuickBooks users in 2024.

- Generative AI is expected to contribute significantly to the SaaS market.

- The adoption rate of new AI features is currently being assessed.

GoCo Integration

GoCo, acquired by Intuit, is currently classified as a question mark within the BCG matrix. Its success hinges on the effective integration of GoCo's HR and benefits solutions into Intuit's ecosystem, particularly QuickBooks Payroll and the Enterprise Suite. This integration aims to provide a complete Human Capital Management (HCM) solution, but its market impact is yet unconfirmed. The financial performance will be observed.

- Acquisition of GoCo by Intuit.

- Integration into QuickBooks Payroll and Enterprise Suite.

- Goal to provide a complete HCM solution.

- Market Impact.

Question marks in Intuit's BCG Matrix include Mailchimp and international expansion, signaling growth potential but also challenges. QuickBooks Online Advanced and Intuit Assist, leveraging AI, are also question marks. GoCo, integrated for HCM, awaits market validation. Intuit's strategic investments and focus aim to convert these to stars.

| Category | Examples | Status |

|---|---|---|

| Products/Services | Mailchimp, QuickBooks Online Advanced, Intuit Assist, GoCo, International Expansion | High growth potential, low market share |

| Challenges | Churn rates, competition, integration complexities, uncertain adoption rates | Requires strategic investment and focus |

| Intuit's Strategy | Product improvements, integrations, international expansion, AI adoption | Aims to increase market share |

BCG Matrix Data Sources

This Intuit BCG Matrix uses trusted data. It pulls from financial statements, market analysis, and competitor data for clear quadrant placements.