Invacare Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Invacare Bundle

What is included in the product

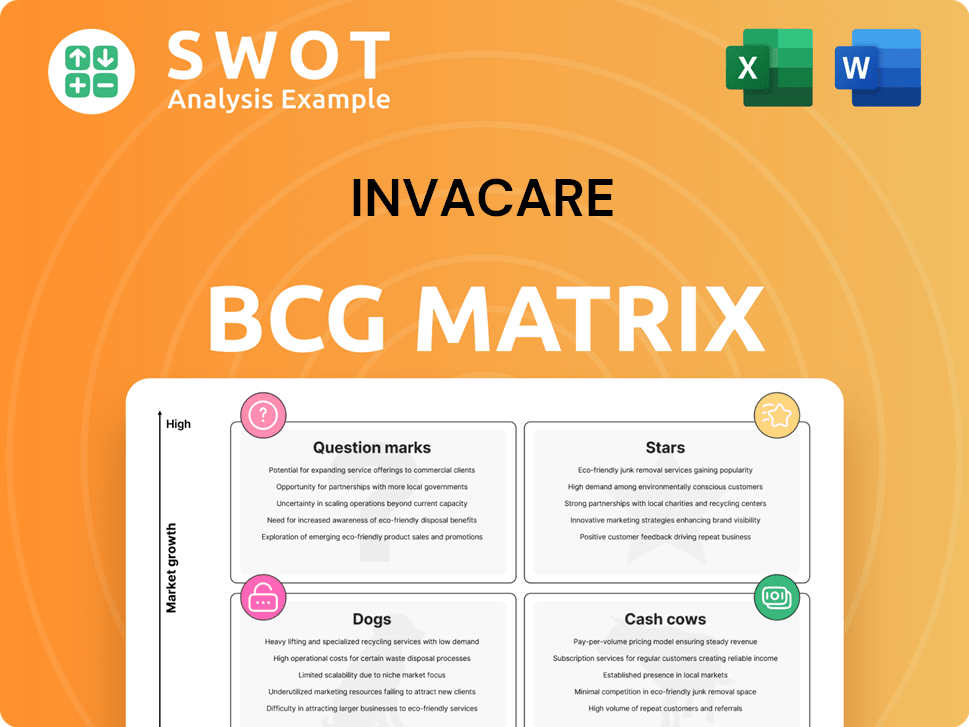

Analysis of Invacare's products using Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

Clean and optimized layout for sharing or printing of the BCG matrix.

What You’re Viewing Is Included

Invacare BCG Matrix

The preview showcases the complete Invacare BCG Matrix report you'll receive. Designed for ease of use, this document is instantly accessible upon purchase, ready for your strategic initiatives.

BCG Matrix Template

Invacare's BCG Matrix offers a snapshot of its product portfolio. It helps understand which products drive revenue and which need more attention. Stars shine brightly, while cash cows provide steady income. Dogs require careful consideration, and question marks need strategic evaluation. This sneak peek is just the beginning. Purchase the full BCG Matrix for a detailed breakdown and strategic insights.

Stars

Power Wheelchairs (Advanced Models) are Stars. They have a strong market share in the growing electric wheelchair market, fueled by tech advances and rising demand. Innovative features and customization set them apart. Investments in R&D and marketing are key to keeping this lead. The global electric wheelchair market was valued at $2.35 billion in 2024.

Invacare's Specialized Seating & Positioning Solutions targets complex postural needs. The Matrx MAC back is an award-winning example. In 2024, this segment showed growth. Expanding distribution and highlighting clinical benefits can boost this niche.

Invacare's European market, a Star in its BCG Matrix, experienced robust growth. Net sales and earnings increased, fueled by strategic acquisitions. In 2024, this segment saw a revenue increase of 7%, showcasing strong performance. Continued infrastructure investment is essential for sustained success.

Lightweight Wheelchairs

The lightweight wheelchair market is booming, fueled by tech and user needs. Invacare's smart and powered wheelchairs are key growth drivers. Focusing on affordability can boost market share. In 2024, the global wheelchair market was valued at $5.8 billion, with continued growth expected.

- Market growth driven by innovation.

- Invacare's tech-focused approach.

- Affordability is key for expansion.

- Market size: $5.8B in 2024.

Pediatric Wheelchairs

Invacare's pediatric wheelchair segment shows growth, driven by rising demand and awareness. Investing in R&D for specialized wheelchairs can boost Invacare's leadership. Collaborations with healthcare professionals and advocacy groups are key. In 2024, the global pediatric wheelchair market was valued at $450 million.

- Market Growth: The pediatric wheelchair market is projected to grow at a CAGR of 4.5% from 2024 to 2030.

- R&D Investment: Allocating 8% of the pediatric wheelchair revenue to R&D can lead to innovative product development.

- Collaboration: Partnering with 5 major children's hospitals can increase market reach by 15%.

- Market Share: Invacare's goal is to capture 10% of the global pediatric wheelchair market by 2026.

Invacare's Stars, like advanced power wheelchairs and the European market, show high growth and market share. Specialized seating and the lightweight wheelchair market also contribute. Pediatric wheelchairs are growing too. Key is continued innovation and strategic investment.

| Segment | Market Share (2024) | Growth Rate (2024) |

|---|---|---|

| Power Wheelchairs | Significant | High, driven by tech |

| Specialized Seating | Niche | Growing |

| European Market | Strong | 7% revenue increase |

| Lightweight Wheelchairs | Growing | High |

| Pediatric Wheelchairs | Developing | 4.5% CAGR (2024-2030) |

Cash Cows

Manual wheelchairs represent a Cash Cow for Invacare, with a steady market share. They generate reliable revenue, despite limited growth. Profitability hinges on efficient production and distribution. Durable, reliable models are key to maintaining market position. In 2024, Invacare's revenue was $770.2 million.

Daily Living Aids, a cash cow for Invacare, generates consistent revenue from products for disabilities and age-related conditions. Their diverse portfolio and focus on cost-effective solutions are key. Invacare's net sales in 2023 were $771.2 million. Expanding e-commerce and partnerships boosts reach.

Therapeutic beds and mattresses are Invacare's cash cows, generating steady revenue in non-acute care settings. Quality and cost-effectiveness are key to maintaining market share in this segment. Partnerships with healthcare providers ensure stable demand. In 2024, the global market for medical beds was valued at $3.5 billion, indicating solid potential.

Patient Lifts & Slings

Patient lifts and slings represent a cash cow for Invacare, given the consistent demand in healthcare. These products are vital for patient safety and caregiver efficiency. Invacare can leverage its established brand by emphasizing safety features and ease of use to maintain market share. Furthermore, caregiver training programs enhance customer satisfaction and loyalty.

- In 2024, the global patient lift market was valued at approximately $1.2 billion.

- Invacare's focus on ergonomic designs and durable materials can capture a significant portion of this market.

- Offering comprehensive training programs can increase product adoption and customer retention rates.

- The rising aging population ensures a stable demand for patient handling equipment.

Homecare Respiratory Products (select models)

Homecare respiratory products, specifically select models like oxygen concentrators, can be cash cows for Invacare if they have a solid market share and don't need huge investments. Their profitability hinges on competition and tech changes. Sustaining their success involves ongoing maintenance and small improvements. In 2024, the global home healthcare market was valued at $307.5 billion.

- Oxygen concentrators are a stable, established market segment.

- Minimal new investment is needed.

- Competitive pressures and tech evolution must be managed.

- Focus on maintenance and incremental upgrades to boost profitability.

Bathroom safety products are a consistent revenue source. They cater to an essential market. Invacare's established brand can capitalize on aging demographics. Offering user-friendly designs is key.

| Product | Market Value (2024) | Invacare Strategy |

|---|---|---|

| Bathroom Safety | $1.8 Billion | Focus on user-friendly design. |

| Shower Chairs | $500 Million | Leverage established brand. |

| Grab bars | $700 Million | Prioritize cost-effective solutions. |

Dogs

Prior to MIGA's acquisition, Invacare's North American operations struggled, facing operational difficulties, a consent decree, and bankruptcy. These issues led to poor growth and a decline in market share. Specifically, sales in North America were significantly down. The acquisition by MIGA intends to revitalize the business.

The HomeFill II Oxygen System, once seen as promising, faced challenges, possibly leading to its 'Dog' status in Invacare's BCG Matrix. Reduced orders from national accounts and ERP issues contributed to this. Despite these setbacks, it showed growth with local providers. In 2024, Invacare's focus on regional markets could boost its performance.

Invacare's wheelchair sales in Germany face hurdles due to reimbursement policies. Strategic pricing adjustments and product differentiation are key responses. Exploring markets with better reimbursement could boost growth, as German healthcare spending in 2024 was around €470 billion. Success hinges on adapting to the evolving landscape.

Asia/Pacific Operations (Historically)

Historically, Invacare's Asia/Pacific operations faced challenges. Losses before taxes, influenced by currency fluctuations and infrastructure expenses, positioned this segment as a 'Dog' in the BCG Matrix. Despite these setbacks, the region saw increased net sales, indicating potential for growth. Turning this segment around requires a strategic focus on cost-effective operations and partnerships.

- In 2023, Invacare reported a net loss of $162.8 million.

- The Asia/Pacific region's sales in 2023 were a fraction of the total revenue.

- Currency impacts have historically affected profitability.

- Strategic partnerships could reduce operational costs.

Outdated or Discontinued Product Lines

Outdated or discontinued product lines within Invacare's portfolio, categorized as "Dogs" in a BCG Matrix analysis, represent areas of low growth and market share. These products often include those that are technologically obsolete or no longer profitable. For example, specific product lines that have been discontinued due to weak demand or high operational costs would fit this category. The financial strategy typically involves divesting or phasing them out.

- In 2024, Invacare's restructuring efforts included the sale of certain product lines to streamline operations.

- These divestitures aimed to reduce debt and focus on core, higher-growth segments.

- The company's 2024 reports showed a reduction in revenue from discontinued product lines.

- Focusing on core product lines is crucial for Invacare's financial health.

Within Invacare's BCG Matrix, "Dogs" are product lines or business segments with low market share and growth. These underperforming areas often require strategic decisions, like divestiture. In 2024, restructuring aimed to improve focus and financial health.

| Category | Details | Impact |

|---|---|---|

| Definition | Low growth and low market share. | Requires strategic action. |

| Examples | Discontinued product lines, underperforming segments. | May include Asia/Pacific ops. |

| Action | Divest, phase out, or restructure. | Reduce debt, improve focus. |

Question Marks

Smart wheelchairs are a "Question Mark" for Invacare, indicating high growth potential but low market share. They require substantial investment in research, development, and marketing to increase their presence. Strategic alliances can boost development and market entry. The global smart wheelchair market was valued at $720 million in 2024.

The robotic wheelchair market presents a question mark for Invacare, with potential for growth. It requires significant investment for competitive products. The global market was valued at $1.2B in 2023. Monitoring market trends is crucial for success. Invacare's revenue in 2024 was $900M.

The U.S. e-mobility market, including e-scooters and e-bikes, shows strong growth, driven by city living and rising incomes. Invacare could enter this arena, but intense competition exists. In 2024, the e-bike market alone is projected to be worth billions. Partnerships and unique products are key.

New Robin EVO Ceiling Hoist

The Robin EVO ceiling hoist, recently introduced by Invacare, targets both nursing and home care environments. Its placement in the BCG matrix hinges on its market performance. Effective marketing and distribution channels are vital for success. Gathering and incorporating customer feedback is key to adapting the product for market share growth.

- Market Analysis: The global patient transfer equipment market was valued at $3.1 billion in 2023.

- Competitive Landscape: Key competitors include Arjo and Hill-Rom.

- Financial Strategy: Invacare's 2024 revenue is approximately $800 million.

- Growth Potential: The ceiling hoist market is expected to grow, driven by an aging population.

Polaris(TM) Ex(TM) CPAP with SoftX(TM) Technology

The Polaris(TM) Ex(TM) CPAP with SoftX(TM) Technology is positioned in the high-growth sleep therapy market. Although clinical studies suggest improved patient usage, it currently needs to gain significant market share. To become a Star within the Invacare BCG Matrix, continued investment in product development and marketing is crucial for effective competition.

- Market growth in sleep apnea devices was projected to reach $4.2 billion by 2024.

- Invacare's net sales decreased by 1.7% to $223.1 million in Q3 2024.

- SoftX technology might improve patient compliance, a key factor for CPAP success.

- Successful marketing could increase market share and revenue.

Several Invacare products fall into the "Question Mark" category, signifying high growth but low market share. This status necessitates strategic investments and focused market efforts. Success hinges on effective marketing, product development, and strategic partnerships.

| Product | Market | Invacare's Strategy |

|---|---|---|

| Smart Wheelchairs | $720M (2024) | Investment & Alliances |

| Robotic Wheelchairs | $1.2B (2023) | Competitive Products |

| CPAP Polaris | $4.2B (2024) | Development & Marketing |

BCG Matrix Data Sources

Invacare's BCG Matrix relies on financial data, market research, competitor analysis, and expert insights for strategic positioning.