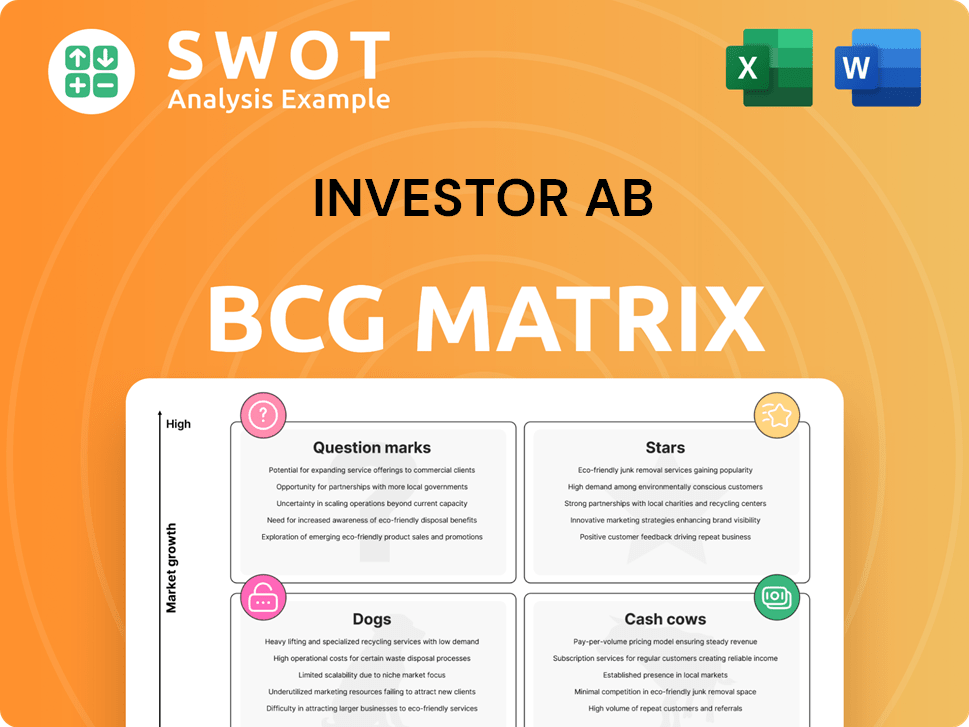

Investor AB Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Investor AB Bundle

What is included in the product

Investor AB's portfolio analyzed using the BCG Matrix, highlighting investment, holding, and divestment strategies.

Quickly visualize portfolio strengths and weaknesses with the Investor AB BCG Matrix to make informed investment decisions.

What You See Is What You Get

Investor AB BCG Matrix

The Investor AB BCG Matrix report you're viewing now is the complete document you'll receive after purchase. It's designed for strategic decision-making, with fully formatted data and analysis, ready for use.

BCG Matrix Template

Investor AB's BCG Matrix reveals its product portfolio's strategic health. See which businesses are stars, cash cows, dogs, or question marks. This snapshot gives you a glimpse into their market positioning. Understand resource allocation and growth potential. Uncover strategic insights in a digestible format.

Stars

Patricia Industries' subsidiaries shine, indicating star potential within Investor AB's portfolio. They've shown strong sales growth, with organic growth in constant currency. This signals robust demand and market acceptance. For instance, in 2024, several subsidiaries saw EBITA improvements. Continued investment can turn these stars into cash cows.

EQT Ventures, a part of Investor AB, demonstrates high growth potential, fitting the star category. Its innovative approach to private equity and venture capital supports a high-growth trajectory. EQT's strategic investments and active management could increase market share. As of 2024, the firm has over €2.8B in assets under management, indicating significant growth.

AstraZeneca shines as a star in Investor AB's portfolio due to its robust market position and consistent performance. The company significantly boosts Investor AB's profits, contributing substantially to its financial health. AstraZeneca's dedication to research and development is set to maintain its leadership. In 2024, AstraZeneca's revenue reached $45.8 billion, reflecting its strong market presence.

ABB

ABB shines as a "Star" within Investor AB's BCG matrix, demonstrating robust performance and growth. In 2023, ABB reported a 10% increase in comparable order growth, highlighting its market strength. Focusing on automation and electrification, ABB capitalizes on key global trends. Strategic investments, like the $1.5 billion share buyback program announced in 2023, will likely boost future growth. This solidifies ABB's role as a major contributor to Investor AB's success.

- Comparable order growth reached 10% in 2023.

- ABB's focus areas include electrification and automation.

- Share buyback program of $1.5 billion was announced in 2023.

- ABB is a key contributor to Investor AB's success.

Saab

Saab shines as a star within Investor AB's portfolio, fueled by rising defense spending and global instability, leading to impressive growth in operating profits. This growth is supported by strategic investments in technology and market expansion. The company's strong position indicates a promising trajectory for sustainable growth. Saab's potential to evolve into a cash cow solidifies its value.

- Operating profit growth: Increased by 18% in 2023.

- Order intake: Reached SEK 48.5 billion in 2023.

- Market expansion: Significant contracts in multiple international markets.

- Technology investment: Ongoing R&D in advanced defense systems.

Stars in Investor AB’s portfolio show high growth and market strength. They require significant investment to maintain their position. These companies, like ABB and AstraZeneca, are key profit contributors. With robust growth potential, they are crucial to Investor AB's success.

| Company | 2024 Revenue/Order Intake | Key Strategy |

|---|---|---|

| ABB | Comparable order growth: 10% (2023) | Automation, Electrification |

| AstraZeneca | $45.8B (Revenue, 2024) | R&D in pharmaceuticals |

| Saab | SEK 48.5B (Order Intake, 2023) | Defense tech, market expansion |

Cash Cows

Atlas Copco, a cash cow in Investor AB's portfolio, thrives due to its strong market position and consistent profitability. It provides Investor AB with a steady stream of cash, essential for funding other ventures. In 2023, Atlas Copco reported revenues of approximately SEK 64.5 billion, highlighting its financial strength. Its focus on sustainable productivity ensures enduring relevance. This makes it a dependable, low-maintenance asset.

SEB, a financial services leader, is a cash cow for Investor AB due to its stable income. It consistently delivers dividends, reflecting its financial health. SEB's focus on long-term client relationships supports its market leadership. In 2024, SEB's net profit reached SEK 24.7 billion, underscoring its profitability. Investments in digital and sustainable finance ensure future growth.

Mölnlycke, a leader in wound care and surgery solutions, is a cash cow for Investor AB. In 2023, Mölnlycke's sales were SEK 21.7 billion, with strong profitability. Its focus on innovation and global expansion ensures steady income. This supports Investor AB's investments.

Wärtsilä

Wärtsilä, a key holding for Investor AB, fits the cash cow profile due to its strong position in marine and energy markets. It generates steady cash flow, fueled by its established presence and reliable services. The company's focus on sustainable solutions, like LNG and hybrid technologies, ensures continued demand and profitability. Strategic moves, such as the 2024 acquisition of Atlas Copco's gas and process division, support this.

- 2024 revenue increased, driven by service and equipment orders.

- Order intake remained strong, boosting the order book.

- Wärtsilä's commitment to sustainability is a key driver.

- Focus on lifecycle solutions and services.

Husqvarna

Husqvarna, a recognized brand, firmly holds its market position, classifying it as a cash cow for Investor AB. Its strong brand recognition ensures a consistent revenue stream, making it a reliable asset. Maintaining Husqvarna's status involves minimal investment, focusing on adapting to evolving consumer demands.

- Market Position: Strong brand recognition and established market presence.

- Financial Performance: Consistent revenue generation with high profitability.

- Investment Needs: Low, primarily focused on innovation and adaptation.

- Strategic Focus: Sustaining current market position and minor product updates.

Cash cows, vital in Investor AB's portfolio, are profitable, mature businesses. These companies generate consistent cash flow. They need minimal investment for maintenance. This supports Investor AB's other ventures.

| Company | Sector | 2024 Revenue (Approx.) |

|---|---|---|

| Atlas Copco | Industrial | SEK 67 Billion |

| SEB | Financial Services | SEK 25 Billion Net Profit |

| Mölnlycke | Healthcare | SEK 22.5 Billion |

Dogs

3 Scandinavia, operating in a fiercely competitive telecom market, is categorized as a dog within Investor AB's BCG Matrix. The telecom industry requires a lot of investments. The company faces challenges with profitability and market share. In 2024, the telecom sector saw intense competition, impacting margins. Without strategic shifts, it might underperform.

Electrolux, within Investor AB's portfolio, is categorized as a "dog" due to intense competition in the appliance market. The company has faced profitability issues, with its 2024 operating margin being under pressure. Electrolux's market share growth has been limited, and it struggles to adapt to economic shifts. This makes it a less attractive investment.

Sobi, in the Investor AB BCG matrix, could be seen as a dog. Its focus on specialty pharmaceuticals involves high R&D expenses. This can lead to volatile profitability due to pipeline success and market access. The company faces regulatory risks and competition. In 2024, Sobi's revenue was approximately SEK 20 billion.

Aleris

Aleris, within Investor AB's portfolio, is categorized as a "Dog" due to its operations in the healthcare sector, which is intensely competitive and heavily regulated. This environment presents significant hurdles for consistent profitability and expansion. The healthcare industry demands continuous investment in technology and quality improvements to remain competitive. Without a sharp strategic focus and operational efficacy, Aleris might struggle to generate substantial returns for Investor AB.

- Healthcare sector growth in Europe is projected at 3-4% annually (2024).

- Aleris's revenue in 2023 was approximately SEK 10 billion.

- Regulatory changes can significantly impact healthcare providers' profitability.

- Competition from both public and private healthcare providers is fierce.

BraunAbility

BraunAbility, a provider of mobility solutions, operates within a niche market, which can limit its growth potential. The company's focus on products for people with disabilities means its market size is inherently restricted. This sector is also susceptible to economic fluctuations and regulatory changes, impacting sales. As of 2024, the global market for mobility aids is valued at approximately $6 billion.

- Market Size: The mobility aids market was valued at $6 billion in 2024.

- Niche Focus: Specialization in mobility solutions for people with disabilities.

- Growth Constraints: Limited by market size and economic sensitivity.

- Strategic Implication: Requires diversification or expansion for growth.

Dogs within Investor AB's portfolio, such as 3 Scandinavia, Electrolux, Sobi, Aleris, and BraunAbility, face challenges. These companies operate in competitive or niche markets. They often struggle with profitability, market share, or growth due to sector-specific dynamics.

| Company | Sector | Challenges (2024) |

|---|---|---|

| 3 Scandinavia | Telecom | Intense Competition, Margin Pressure |

| Electrolux | Appliances | Profitability Issues, Market Share |

| Sobi | Pharma | R&D Costs, Regulatory Risks |

| Aleris | Healthcare | Competition, Regulation |

| BraunAbility | Mobility | Market Size, Economic Sensitivity |

Question Marks

Investor AB's AI and automation investments are question marks, implying high growth risk. These sectors evolve quickly, potentially disrupting industries. In 2024, global AI spending reached $194 billion. Success hinges on tech advancements and market acceptance.

Investor AB's healthcare ventures are question marks, facing industry complexities and regulatory issues. These ventures need significant upfront investments, with uncertain profit timelines. Success hinges on innovation and market access, navigating regulations. Strategic adjustments are crucial for maximizing potential; for example, in 2024, healthcare saw $20.6 billion in venture capital investments.

Investor AB's sustainable energy investments are question marks because the market is changing fast. These investments need a lot of money and time. Success relies on government rules, tech, and demand. In 2024, renewable energy investments hit $366 billion, showing high potential but also risk.

Advanced Instruments (after Nova Biomedical acquisition)

Advanced Instruments, post-Nova Biomedical acquisition (expected Q3 2025), fits the question mark category in Investor AB's BCG matrix. This move introduces uncertainty due to integration challenges and evolving market conditions. The acquisition's success hinges on how well these factors are managed. This strategic shift presents both opportunities and risks for Investor AB.

- Acquisition value: Undisclosed, but significant.

- Market growth for acquired technologies: Projected at 5-7% annually.

- Integration timeline: 12-18 months post-closing.

- Risk factors: Market competition, integration costs, and regulatory hurdles.

Grand Group

The Grand Group, as part of Investor AB's BCG Matrix, represents a collection of smaller companies with growth potential. These entities currently face an uncertain market position, requiring strategic investments to improve market share. Active management is crucial for navigating market acceptance and technological advancements. Their success hinges on effective competitive positioning.

- Focus on strategic investments to boost market presence.

- Active management is key to navigating market challenges.

- Success depends on strong competitive positioning.

- Investor AB's portfolio in 2024 includes diverse sectors.

Investor AB's question marks represent high-growth, high-risk investments needing strategic focus. These include AI, healthcare, and sustainable energy, all with uncertain futures. Success depends on innovation and market conditions. In 2024, these sectors saw significant, yet volatile, investments.

| Sector | Investment Type | 2024 Investment |

|---|---|---|

| AI | Global Spending | $194 billion |

| Healthcare | Venture Capital | $20.6 billion |

| Renewable Energy | Worldwide | $366 billion |

BCG Matrix Data Sources

The Investor AB BCG Matrix is based on comprehensive market research, annual reports, and industry data for actionable strategies.