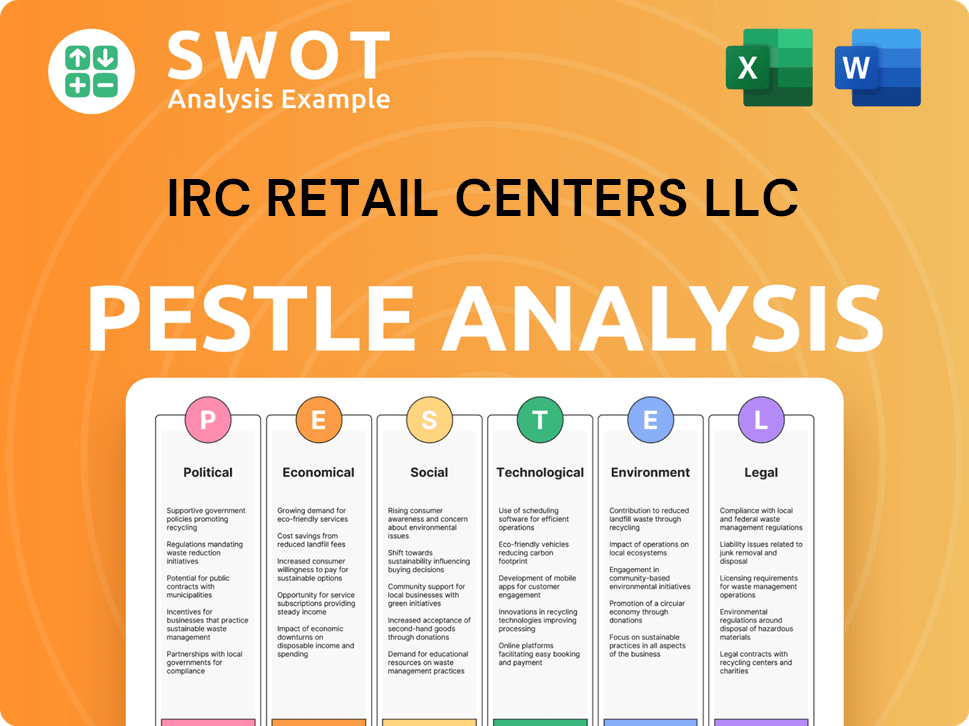

IRC Retail Centers LLC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IRC Retail Centers LLC Bundle

What is included in the product

It examines how external factors influence IRC Retail Centers LLC, covering Political, Economic, etc.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview Before You Purchase

IRC Retail Centers LLC PESTLE Analysis

The preview reflects the complete IRC Retail Centers LLC PESTLE Analysis.

You'll download this exact document immediately.

No edits or modifications needed – it's ready to go.

This professionally crafted analysis is ready for you.

The final, ready-to-use file awaits your purchase.

PESTLE Analysis Template

Uncover how external forces impact IRC Retail Centers LLC with our expert PESTLE Analysis. Explore political shifts, economic trends, and social changes reshaping the market. Gain valuable insights into legal frameworks and technological advancements. This analysis is crucial for investors, analysts, and strategic planners. Download the complete analysis to enhance your strategic planning today!

Political factors

Government regulations and zoning laws are critical for IRC Retail Centers. Recent changes in land use policies, particularly those affecting commercial development, could limit expansion. For example, in 2024, several cities updated zoning to favor mixed-use projects, which could affect IRC's focus on single-use retail spaces. These shifts influence tenant types and operational demands. Such changes could impact property values.

Political stability directly affects IRC's operational environment. Trade policy shifts, like the US-China trade tensions observed in 2024, can significantly alter supply chains. For example, tariffs on imported goods could increase costs, impacting profitability. International relations, as seen with the Russia-Ukraine conflict in 2024-2025, can disrupt global markets, affecting consumer spending and investment confidence.

Government incentives, like tax abatements, can boost IRC Retail Centers' projects. For example, in 2024, several states offered substantial tax breaks for commercial real estate. Corporate tax changes directly impact IRC's profitability; a 1% tax rate shift can alter net income significantly. Property tax laws also matter, as they can increase operating costs.

Infrastructure Development Policies

Government infrastructure investments significantly affect retail center viability. Improved roads and public transport increase accessibility, boosting customer traffic. For example, the U.S. government allocated $1.2 trillion for infrastructure in the Bipartisan Infrastructure Law, which will impact retail locations. Policies either supporting or hindering these developments directly influence foot traffic and tenant appeal. These factors are crucial for IRC Retail Centers LLC's strategic planning and site selection.

- Bipartisan Infrastructure Law: $1.2 trillion allocated.

- Improved Transport: Boosts retail accessibility.

- Policy Impact: Affects foot traffic and appeal.

- Strategic Planning: Crucial for site selection.

Political Climate and Consumer Confidence

The political climate significantly shapes consumer confidence and spending. Stable political environments often boost consumer optimism, leading to higher retail sales and demand for retail space. Conversely, political instability or uncertainty can dampen consumer confidence, causing reduced spending and potentially affecting retail tenants. For instance, in 2024, consumer confidence fluctuated with political developments, impacting retail sales figures. The National Retail Federation reported a 3.5% increase in retail sales in the first half of 2024, influenced by political stability.

- Political stability often correlates with increased consumer spending.

- Uncertainty can lead to decreased retail sales.

- Consumer confidence levels are directly influenced by political events.

- Retailers need to monitor political trends to anticipate market shifts.

Government policies, including zoning, directly impact IRC's expansion and operational costs. Trade policies and global relations, as seen with the US-China trade dynamics in 2024, affect supply chains and profitability.

Government incentives such as tax breaks and infrastructure spending boost IRC's projects and increase accessibility, which drives customer traffic.

Political stability and consumer confidence strongly correlate, impacting retail sales; the National Retail Federation reported a 3.5% sales increase in early 2024.

| Aspect | Impact | Data |

|---|---|---|

| Zoning Laws | Affect expansion | Mixed-use projects increasing. |

| Trade Policies | Impact supply chain | Tariffs increased costs. |

| Consumer Confidence | Affects retail sales | 3.5% sales increase (2024). |

Economic factors

Changes in interest rates are crucial for IRC Retail Centers. In 2024, the Federal Reserve maintained high interest rates, influencing borrowing costs. This impacts IRC's ability to finance new projects and affects investor returns. Higher rates can reduce property values, as seen in the market's reaction to recent rate hikes. The prime rate was at 8.5% as of late 2024.

Inflation directly impacts the cost of goods, influencing consumer spending and retail sales. Elevated inflation can reduce discretionary spending, affecting retail tenant revenue and rent payments. In March 2024, the U.S. inflation rate was 3.5%, impacting consumer behavior. This rise potentially decreases retail sales, as seen in a recent 0.2% drop in March 2024 retail sales.

Robust economic growth and low unemployment typically boost consumer spending, benefiting retail. In 2024, the U.S. GDP grew by 3.1%, while unemployment remained near 3.7%. This economic strength supports retail sales and property values. A thriving economy is crucial for IRC Retail Centers LLC's success.

Retail Market Trends and Vacancy Rates

The retail market's health, influenced by consumer behavior shifts and vacancy rates, is crucial for IRC Retail Centers. E-commerce continues to grow, impacting brick-and-mortar stores; for example, online sales accounted for 15.5% of total retail sales in Q4 2024. Overall retail vacancy rates in the U.S. were around 5.2% as of Q1 2024. These factors affect demand for retail space and rental income.

- E-commerce sales: 15.5% of total retail sales (Q4 2024)

- U.S. retail vacancy rate: ~5.2% (Q1 2024)

Property Values and Acquisition Costs

Economic factors significantly impact property values and acquisition costs for IRC Retail Centers LLC. A robust economy typically drives up acquisition costs due to increased demand and competition. Conversely, an economic downturn can create opportunities for more affordable investments in retail properties. For instance, in 2024, the average cap rate for retail properties was around 6.5%, but it could fluctuate based on economic shifts.

- 2024 retail property values saw fluctuations tied to economic performance.

- Economic downturns may present buying opportunities.

- Cap rates are key indicators of property value.

Interest rates' impact is vital; prime rate reached 8.5% in late 2024. Inflation influences consumer spending; March 2024 saw 3.5% inflation with a 0.2% retail sales drop. Economic growth and unemployment rates significantly influence retail performance; U.S. GDP grew 3.1% with ~3.7% unemployment in 2024. E-commerce's rise affects brick-and-mortar stores; it reached 15.5% of total retail sales in Q4 2024, while the vacancy rate in Q1 2024 was ~5.2%.

| Economic Factor | Data | Impact |

|---|---|---|

| Interest Rates (Late 2024) | Prime Rate: 8.5% | Affects borrowing costs, property values, and investor returns |

| Inflation (March 2024) | 3.5% | Influences consumer spending and retail sales; impacts retail revenue |

| GDP Growth (2024) | 3.1% | Boosts consumer spending, retail sales, and property values |

| Unemployment (2024) | ~3.7% | Indicates economic strength and supports retail performance |

| E-commerce (Q4 2024) | 15.5% of sales | Changes consumer behavior, affects brick-and-mortar, rental income |

| Vacancy Rate (Q1 2024) | ~5.2% | Affects demand for retail space and rental income |

Sociological factors

Shifts in demographics, like population size, age, and income, directly impact IRC's customer base. Growing target demographics can boost demand for retail space. For example, the U.S. population grew by 0.5% in 2024. Higher incomes and diverse populations create more opportunities.

Consumer behavior shifts shape IRC Retail Centers LLC's strategy. Demand for experiences, convenience, and wellness drives tenant choices and center designs. Experiential retail grew, with 2024 spending up 8% YOY. Convenience remains key; online grocery sales rose 12% in Q1 2024. Health-focused retail also expands, with related spending increasing 10%.

Cultural values significantly influence retail success. Community engagement, like events or shared spaces, boosts appeal. For example, centers hosting local farmers' markets see increased foot traffic. In 2024, community-focused retail grew by 15%.

Urbanization and Suburban Growth

Urbanization and suburban growth significantly influence retail center demands. The shift towards suburban living can boost property values, as seen in recent years. These trends dictate retail location strategies and center types. For instance, in 2024, suburban areas showed increased retail spending compared to urban centers.

- Suburban population growth in the U.S. increased by 0.7% in 2024.

- Retail sales in suburban areas grew by 4.2% in 2024.

- Urban retail vacancy rates remained at 8.1% in early 2025.

Income Distribution and Consumer Confidence

Income distribution significantly impacts retail. A more equitable distribution can boost spending across various retail segments. Consumer confidence, shaped by societal trends, is crucial for retail sales. High confidence often leads to increased spending, benefiting retailers. Conversely, economic uncertainty can curb consumer spending.

- US real median household income in 2024 was approximately $77,510.

- Consumer confidence in the US, as of May 2024, showed a slight decrease.

- Retail sales in the US grew by 0.5% in April 2024.

Sociological factors substantially influence IRC's business operations. Demographic shifts and urbanization trends impact the retail landscape significantly. Consumer behavior, including a focus on convenience, shapes strategic decisions.

Cultural values and community engagement, such as hosting local events, directly affect customer traffic. Income distribution and consumer confidence are critical for retail performance.

| Sociological Factor | Impact | 2024 Data |

|---|---|---|

| Suburban Growth | Boosts property values & demand | 0.7% increase in suburban pop. |

| Income Distribution | Affects spending | Median income ~$77,510 |

| Consumer Behavior | Influences tenant choices | Experiential retail up 8% YOY |

Technological factors

E-commerce continues to reshape retail, influencing physical store strategies. Online sales in the U.S. reached $1.1 trillion in 2023, a 7.4% increase year-over-year. This growth prompts retailers to optimize store sizes and offerings. Integrating online and in-store experiences is crucial, with omnichannel strategies driving success.

IRC Retail Centers LLC benefits from adopting new retail technologies. Contactless payments, in-store analytics, and CRM systems improve the customer experience. These tech upgrades boost foot traffic and sales, vital for tenant success. For example, digital signage can increase sales by up to 30%. Inventory management systems also reduce operational costs.

Technological advancements in building management systems, energy efficiency, and security are crucial for IRC Retail Centers LLC. These advancements directly impact operational costs and how appealing properties are to tenants. Efficient property management software enhances operational efficiency. In 2024, smart building tech spending is projected to reach $100 billion globally. Adoption of these technologies is expected to increase property values.

Digital Marketing and Online Presence

Digital marketing and a strong online presence are increasingly crucial for retail success. Technology enables targeted advertising and communication, enhancing customer engagement. In 2024, digital ad spending in the U.S. retail sector is projected to reach $40.57 billion, reflecting its significance. Effective online strategies can boost foot traffic and sales.

- Digital ad spending in the U.S. retail sector is projected to reach $40.57 billion in 2024.

- Social media marketing ROI for retail increased by 15% in 2024.

- Mobile app usage in retail rose by 20% in Q1 2024.

Data Analytics and Market Research

Data analytics is crucial for IRC Retail Centers LLC. It helps understand consumer behavior, market trends, and property performance. This data informs strategic decisions about acquisitions, tenant mix, and property enhancements. Using data allows for better-informed choices, improving overall efficiency. In 2024, the retail sector saw a 5.2% increase in online sales, highlighting the need for data-driven strategies.

- Consumer data analysis helps tailor tenant mix.

- Market trend analysis informs acquisition strategies.

- Property performance data guides improvement decisions.

- Data-driven insights improve ROI.

Technological advancements significantly influence IRC Retail Centers LLC's operational efficiency and property appeal. Integrating digital solutions like smart building tech boosts efficiency, with global spending projected at $100 billion in 2024. Digital marketing, backed by projected $40.57 billion ad spending in 2024, enhances customer engagement. Data analytics also drives strategic decisions for acquisitions and improvements, improving ROI.

| Tech Area | Impact | Data Point (2024) |

|---|---|---|

| E-commerce | Influences store strategies | U.S. online sales reached $1.1T |

| Digital Marketing | Boosts engagement/sales | $40.57B ad spend |

| Building Tech | Improves efficiency/value | $100B smart tech spending (projected) |

Legal factors

Real estate laws and property rights are crucial for IRC Retail Centers. These laws dictate property ownership, land use, and development. For example, in 2024, property tax revenues in the U.S. reached approximately $770 billion. Changes in these laws can impact IRC's property acquisition and management. Understanding these legal aspects is vital for strategic planning.

Lease agreements and tenant laws are crucial for IRC. Tenant rights, obligations, and eviction rules affect IRC's operations. In 2024, legal disputes over commercial leases rose by 15%. Understanding these laws protects IRC's investments. Proper lease management can improve financial outcomes.

IRC Retail Centers LLC must adhere to environmental regulations impacting property development. This includes laws on pollution, waste disposal, and energy efficiency. Compliance can be costly, with potential fines and remediation expenses. For 2024, environmental compliance costs in the real estate sector averaged $1.2 million per property. Regulations are constantly evolving, necessitating ongoing adaptation.

Building Codes and Safety Regulations

IRC Retail Centers LLC must strictly adhere to local, state, and federal building codes, safety regulations, and accessibility standards, ensuring all properties meet current requirements. Compliance is not optional, as failure can lead to hefty fines, project delays, or even legal action. For instance, the Americans with Disabilities Act (ADA) mandates specific accessibility features. Any updates or revisions to these codes, like those seen in the 2024 International Building Code (IBC), could trigger the need for expensive renovations to maintain compliance.

- 2024 IBC updates focus on sustainability and resilience, potentially requiring upgrades.

- ADA compliance is a constant concern, with lawsuits costing businesses millions annually.

- Building code violations can lead to project delays, increasing costs by 10-20%.

Tax Laws and Real Estate Investment Trusts (REITs) Regulations

Tax laws significantly impact real estate investments. Regulations for Real Estate Investment Trusts (REITs) affect investment structures and financial reporting, even though IRC Retail Centers is an LLC. In 2024, changes in tax legislation could alter the profitability of real estate ventures. Understanding these regulations is vital for strategic financial planning.

- Tax rates on capital gains can affect investment returns.

- REIT structures offer tax advantages but require compliance.

- Tax incentives influence real estate development decisions.

- Changes in depreciation rules impact financial reporting.

Legal factors significantly impact IRC Retail Centers LLC's operations. Real estate laws on property rights and lease agreements are vital, affecting property acquisition and tenant management. Compliance with building codes and environmental regulations is mandatory, involving costs like those seen with ADA mandates.

Tax laws, including those affecting REITs, play a critical role in financial planning and investment structures.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Property Rights | Ownership & Use | U.S. property tax: $770B |

| Lease Agreements | Tenant Rights & Disputes | Commercial lease disputes up 15% |

| Building Codes | Compliance & Safety | ADA lawsuits cost millions |

| Tax Laws | Financial Planning | Changes in tax affect profits |

Environmental factors

Climate change fuels more frequent, intense extreme weather. This elevates physical risks for retail properties, causing damage and operational disruptions. Insurance costs are expected to rise, reflecting increased risk exposure.

The demand for sustainable buildings is rising, impacting development decisions. Energy-efficient buildings can boost property value and draw eco-minded tenants. In 2024, green building spending is projected to reach $280 billion globally. Investing in sustainability can lead to higher occupancy rates.

Environmental site assessments are crucial in acquisitions, potentially revealing costly remediation needs. Contaminated properties can significantly increase development costs and project complexities. For example, the EPA estimates cleanup costs range from $50,000 to millions per site. In 2024, environmental liabilities averaged 10-15% of acquisition costs.

Resource Availability and Cost (Water, Energy)

The availability and cost of resources like water and energy are critical for IRC Retail Centers' operational costs. Rising energy prices, influenced by geopolitical events and supply chain issues, increase operating expenses. Water scarcity and related costs in certain regions can also impact profitability. Any shifts in these resources can affect the financial performance of the retail centers.

- Energy costs in the retail sector increased by approximately 15% in 2024.

- Water rates in drought-prone areas have increased by up to 20% in the past year.

- Energy-efficient retrofits can reduce energy consumption by 10-20%.

Waste Management and Recycling Regulations

Waste management and recycling regulations significantly impact retail center operations, necessitating adjustments to comply with environmental standards and consumer expectations. These regulations affect costs, requiring investments in recycling infrastructure and waste reduction strategies. Public perception is also shaped by these practices, influencing brand image and consumer loyalty, especially as sustainability becomes a key factor for consumers. Compliance failures can lead to penalties and reputational damage, making effective waste management crucial for IRC Retail Centers LLC.

- The global waste management market is projected to reach $2.5 trillion by 2028.

- U.S. recycling rates have stagnated around 32% in recent years.

- Businesses face penalties up to $10,000 per day for non-compliance with waste regulations.

- Approximately 60% of consumers prefer brands with sustainable practices.

Environmental factors heavily influence IRC Retail Centers. Extreme weather risks, like floods, are increasing property insurance costs, projected to rise by 10-15% in 2024-2025. Rising energy costs, up approximately 15% in the retail sector in 2024, also significantly affect operating expenses. Strict waste management regulations and consumer preferences toward sustainability further reshape the company’s operations, with global waste market set to hit $2.5 trillion by 2028.

| Factor | Impact | Data |

|---|---|---|

| Extreme Weather | Increased Insurance Costs, Property Damage | Insurance costs up 10-15% (2024-2025 projection) |

| Energy Costs | Higher Operating Expenses | Retail energy cost increase: 15% (2024) |

| Waste Management | Compliance Costs, Reputational Risk | Global waste market: $2.5T by 2028 |

PESTLE Analysis Data Sources

This PESTLE Analysis compiles data from economic databases, government sources, and industry reports. We prioritize accuracy using up-to-date information.