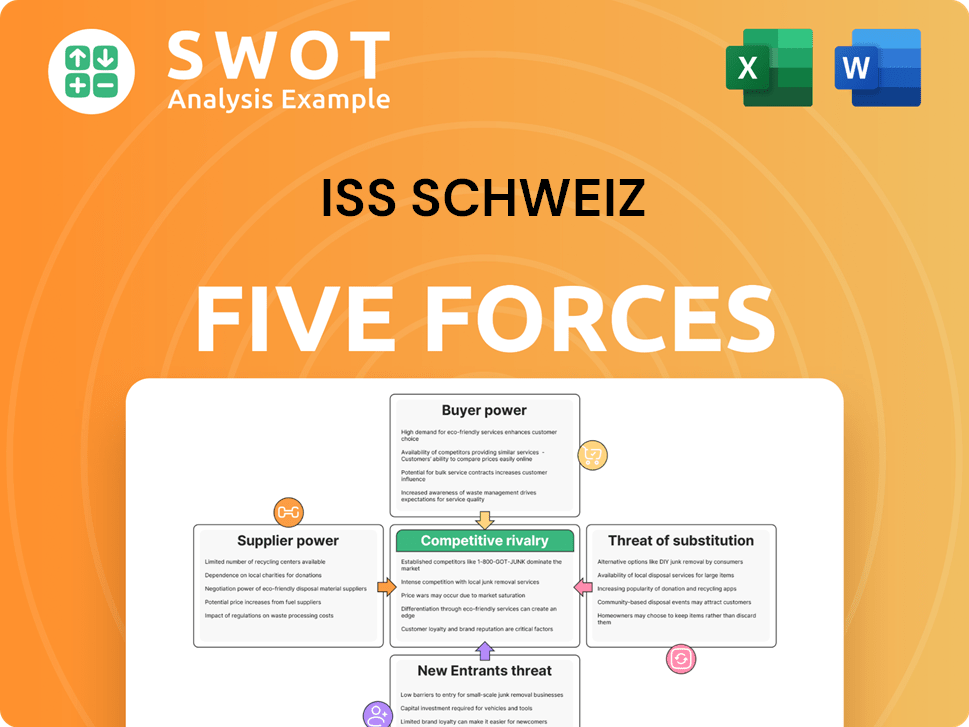

ISS Schweiz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ISS Schweiz Bundle

What is included in the product

Tailored exclusively for ISS Schweiz, analyzing its position within its competitive landscape.

Swap in your own data, labels, and notes to reflect current business conditions.

Preview the Actual Deliverable

ISS Schweiz Porter's Five Forces Analysis

This preview is the complete Porter's Five Forces analysis of ISS Schweiz. The document provides in-depth insights into industry competition, supplier power, and more.

It meticulously assesses the threat of new entrants and the power of buyers, offering a comprehensive market overview.

The analysis is professionally written, ensuring clarity and providing actionable strategic recommendations.

You're getting the exact document you see here, ready for download immediately after your purchase.

No need for extra formatting or any other preparation; it's ready for use.

Porter's Five Forces Analysis Template

ISS Schweiz operates within a competitive landscape shaped by the dynamics of Porter's Five Forces. Buyer power, stemming from client negotiation, significantly impacts profitability. The threat of substitutes, particularly in specialized services, poses a constant challenge. Competitive rivalry among facility management providers is intense, influencing pricing strategies. Supplier power, concerning labor and resources, adds further complexity.

Ready to move beyond the basics? Get a full strategic breakdown of ISS Schweiz’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly influences ISS Schweiz's cost structure. Highly concentrated suppliers, such as those providing specialized cleaning equipment, can exert pricing pressure. ISS Schweiz depends on suppliers for essential resources like cleaning materials and potentially outsourced labor. The fewer the suppliers controlling a large market share, the stronger their bargaining power becomes, which can affect ISS Schweiz's profits. Consider how easy it is to switch to a different supplier.

High switching costs boost supplier power. ISS Schweiz's dependence on specific suppliers, due to costs like retraining or system modifications, strengthens those suppliers' position. This dependence allows suppliers to demand better terms. For instance, if ISS Schweiz relies on proprietary cleaning solutions, changing could be costly.

When suppliers integrate forward, such as offering facility management, their power increases. This shift allows suppliers to become competitors, reducing ISS Schweiz's dependence on them. Forward integration can intensify price competition within the facility management sector. For example, in 2024, several cleaning product suppliers began offering bundled services, impacting ISS's market share.

Impact of Supplier Quality on ISS Schweiz's Services

Superior supplier quality significantly impacts ISS Schweiz's service differentiation. High-quality offerings from suppliers increase their influence. This is especially true if the quality directly enhances client satisfaction and retention. For example, in 2024, ISS Group reported a 7.5% organic revenue growth, partly due to improved service quality.

- Improved quality can lead to higher client retention rates.

- Suppliers with unique, high-quality offerings gain more leverage.

- Client satisfaction directly correlates with supplier quality.

- Superior offerings can justify premium pricing.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts supplier power. If ISS Schweiz faces limited options for essential supplies or services, suppliers gain leverage. This dependence increases costs and reduces negotiation strength for ISS Schweiz. For instance, if specialized cleaning chemicals are only available from a few sources, those suppliers have considerable power.

- Limited substitutes for cleaning chemicals increase supplier bargaining power.

- Dependence on specific equipment suppliers reduces ISS Schweiz's negotiation leverage.

- The fewer eco-friendly product suppliers, the greater their control over pricing and terms.

- Availability of alternative service providers (e.g., waste management) affects supplier dynamics.

Supplier power hinges on concentration and switching costs, affecting ISS Schweiz's expenses. High supplier concentration, like specialized equipment, grants pricing leverage. Dependence on specific suppliers, due to factors like retraining costs, strengthens their position. Forward integration by suppliers, such as offering bundled services, also increases their power.

| Factor | Impact on ISS Schweiz | Example |

|---|---|---|

| Supplier Concentration | Higher costs, reduced negotiation power | Cleaning chemical suppliers |

| Switching Costs | Increased supplier leverage | Proprietary cleaning solutions |

| Forward Integration | Increased competition | Bundled services from cleaning product suppliers |

Customers Bargaining Power

Customer concentration significantly influences ISS Schweiz's bargaining power. If a few major clients generate a substantial part of ISS Schweiz's revenue, these clients wield considerable power. They can dictate terms, potentially leading to reduced prices or demands for extra services. For instance, a 2024 report showed that 10% of the biggest clients accounted for 45% of total revenue, impacting ISS Schweiz’s profitability.

Customers of ISS Schweiz may have considerable bargaining power due to low switching costs. If it's easy and inexpensive for clients to switch to a competitor, they can demand better terms. This power is influenced by contract details and ISS Schweiz's service value.

Informed customers significantly influence ISS Schweiz's pricing power. With access to information, clients negotiate better terms. This shift requires ISS Schweiz to highlight its value. In 2024, facility management costs varied widely, impacting client negotiations. For example, average service costs ranged from CHF 50 to CHF 150 per hour, depending on the service type.

Price Sensitivity of Customers

High price sensitivity strengthens buyer power, especially in competitive markets. Clients often prioritize cost, increasing their leverage. If ISS Schweiz's services are seen as commodities, clients will switch based on price. For instance, the facility services market saw a 3.2% price sensitivity increase in 2024. This means clients are more focused on cost.

- Increased price sensitivity leads to higher buyer power.

- Competitive markets intensify price focus.

- Commoditization makes clients price-driven.

- 2024 data shows rising price sensitivity.

Customer's Ability to Integrate Backwards

Clients' ability to provide their own facility management services significantly boosts their bargaining power. This means they have more leverage when negotiating contracts with ISS Schweiz. Large organizations, especially, can opt to insource these services, increasing their bargaining power. This strategic shift can lead to more favorable terms for clients. In 2024, the facility management market showed a trend of clients exploring in-house solutions, impacting service providers' profitability.

- Insourcing by clients increases their bargaining power.

- Large organizations are more likely to insource.

- This impacts service providers' contract terms.

- Facility management market trends show increased client control.

Customer concentration and switching costs impact ISS Schweiz's negotiation power. High price sensitivity and informed clients increase buyer leverage, which is also impacted by insourcing. In 2024, facility management's price sensitivity rose, influencing client bargaining.

| Factor | Impact on Bargaining Power | 2024 Data |

|---|---|---|

| Customer Concentration | High concentration boosts client power. | Top 10% clients: 45% revenue. |

| Switching Costs | Low costs enhance client leverage. | Easy switching gives clients more options. |

| Price Sensitivity | High sensitivity increases buyer power. | 3.2% price sensitivity rise. |

Rivalry Among Competitors

A fragmented market, like the Swiss facility management sector, increases competition. With many competitors, from global giants to local businesses, the rivalry is fierce. This can drive down prices and squeeze profits. In 2024, the facility management market in Switzerland was estimated to be worth over CHF 10 billion, indicating significant competition.

Slower industry growth intensifies competition. In Switzerland's facility management sector, stagnant growth leads to heightened rivalry. Companies battle fiercely for market share, potentially sparking price wars and impacting service quality. For example, in 2024, the Swiss construction industry, a key indicator, saw a slight slowdown, increasing competition within related sectors like facility management.

Limited product differentiation intensifies rivalry within the facility management sector. If services appear similar, price becomes a primary competitive factor. In 2024, the global facility management market was valued at approximately $1.2 trillion. ISS Schweiz should focus on creating unique service offerings to reduce price competition.

Switching Costs for Customers

Low switching costs significantly amplify competitive rivalry. If clients can easily change service providers, ISS Schweiz faces heightened competition. This scenario demands robust client relationships and continuous value demonstration to ensure customer retention. In 2024, the facility services market saw a 7.2% churn rate, highlighting the importance of client loyalty strategies.

- High churn rates increase competition.

- Building strong client relationships is crucial.

- Demonstrating value is essential for retention.

- Switching costs influence market dynamics.

Exit Barriers

High exit barriers significantly impact competitive rivalry. When companies find it tough to leave the facility management market, perhaps due to long-term contracts or specialized assets, they persist in competing even when profits are low. This situation intensifies rivalry, forcing businesses to fight harder for market share. For instance, in 2024, the facility management industry saw several mergers and acquisitions, indicating firms' struggle to exit or adapt.

- Long-term contracts lock-in companies.

- Specialized assets limit alternative uses.

- Exit costs include severance and contract penalties.

- Intense competition can reduce profitability.

Competitive rivalry in facility management is intense, exacerbated by a fragmented market and slow growth. Low differentiation and high churn rates further fuel competition, pressuring pricing and margins. High exit barriers also keep companies in the fight.

| Factor | Impact | 2024 Data Example |

|---|---|---|

| Market Fragmentation | Increased competition | Over 1000 facility management companies in Switzerland. |

| Industry Growth | Intensifies rivalry in stagnant market | Swiss construction sector slowdown in 2024. |

| Product Differentiation | Price focus if low | Global FM market ~$1.2T in 2024. |

SSubstitutes Threaten

In-house facility management acts as a direct substitute for ISS Schweiz's services. Companies might opt to handle their facility needs internally, especially if they have the resources and expertise. The attractiveness of this alternative hinges on factors like company size and strategic focus. In 2024, a survey showed that 35% of large corporations preferred in-house solutions. This highlights a significant competitive threat.

Technological advancements pose a threat to ISS Schweiz. Technology can substitute traditional services, with automation impacting facility management. The integration of IoT and smart building tech is crucial. For instance, the global smart buildings market was valued at $80.6 billion in 2023. ISS Schweiz must adapt to remain competitive.

The threat from substitutes arises if alternatives offer comparable performance at a lower cost. ISS Schweiz could face challenges from cheaper service providers or alternative technologies. For example, the rise of automated security systems could be a substitute. In 2024, the global security services market was valued at approximately $300 billion.

Customer Propensity to Substitute

The threat of substitutes for ISS Schweiz is heightened by customers' willingness to explore alternatives. If clients readily switch to different facility management solutions, ISS Schweiz faces increased competition. To mitigate this, ISS Schweiz must clearly showcase its unique value proposition and the advantages it offers. This could involve highlighting specialized services or superior efficiency. For instance, in 2024, the facility management market saw a 7% rise in the adoption of integrated solutions, indicating a shift towards alternatives.

- Increased competition from alternative solutions.

- Need to emphasize unique value to retain clients.

- Market shift towards integrated solutions in 2024.

- Client willingness to explore options impacts ISS Schweiz.

Regulatory Changes

Regulatory changes pose a threat to ISS Schweiz by potentially favoring substitutes. New rules in building management or sustainability can open doors for alternative solutions. For example, in 2024, the EU's Corporate Sustainability Reporting Directive (CSRD) increased demand for green building services, which could be a substitute if ISS Schweiz doesn't adapt. ISS Schweiz needs to adapt and capitalize on these shifts.

- CSRD implementation across the EU in 2024 significantly increased demand for sustainable building solutions.

- Stricter labor laws could increase costs, making automated or outsourced services more attractive substitutes.

- Changes in building codes towards energy efficiency favor specialized providers over traditional facility management.

- ISS Schweiz must monitor regulatory trends in each market to identify and mitigate substitution risks.

Substitutes present a notable challenge for ISS Schweiz, fueled by technological advancements and customer openness to alternatives. In-house solutions and automation compete with traditional services. In 2024, the smart buildings market was worth $80.6 billion. Regulatory changes also influence the market, demanding that ISS Schweiz adapts.

| Threat | Impact on ISS Schweiz | 2024 Data Point |

|---|---|---|

| In-house Facility Management | Direct competition | 35% of large corporations preferred in-house solutions |

| Technological Advancements | Substitution of services | Global smart buildings market at $80.6 billion |

| Regulatory Changes | Favoring alternative solutions | EU CSRD increased demand for green building services |

Entrants Threaten

New entrants face moderate capital requirements to enter the facility management industry. While not as high as in some sectors, initial operating costs and marketing demand significant financial resources. For example, in 2024, a new facility management business might need $500,000 to $1 million to start. This financial hurdle acts as a barrier.

Economies of scale significantly impact ISS Schweiz. Existing companies leverage scale advantages in procurement and training. New entrants find it hard to compete with established cost efficiencies. ISS Schweiz, for example, reported CHF 10.2 billion in revenue in 2023, showcasing its scale. This financial strength supports its competitive edge. Smaller firms struggle to match these operational advantages.

Established brands in the facility services sector, like ISS Schweiz, hold a significant advantage. Their strong brand reputation creates a barrier for new entrants. ISS Schweiz's brand recognition, built over years, is a valuable asset. New competitors face the challenge of quickly replicating this trust and awareness. Building a strong brand requires time, resources, and consistent quality; for example, ISS's revenue in 2024 was over CHF 10 billion.

Access to Distribution Channels

For ISS Schweiz, the ability to access established distribution channels presents a notable challenge for new entrants. Existing networks are crucial, with established relationships with key clients and industry players giving incumbents a significant advantage. New competitors must invest heavily in building these essential connections to compete effectively. These channels include direct sales teams, partnerships, and existing contracts, all of which are difficult to replicate quickly. Securing these channels can be expensive, with marketing and sales costs often representing a substantial portion of operational expenses.

- Marketing and sales expenses can represent up to 30% of operational costs for facility services companies.

- The average client retention rate in the facilities management industry is approximately 80%.

- Developing a robust distribution network can take several years, requiring significant upfront investment.

- The contract-based nature of the industry means that new entrants often face long sales cycles.

Government Regulations and Licensing

Regulatory compliance poses a significant barrier for new entrants in the facility management sector. This industry faces stringent regulations concerning labor practices, safety protocols, and environmental standards, increasing operational complexity. New companies must invest time and resources to comply with these rules, which can be costly and time-consuming. Furthermore, the need to obtain necessary licenses adds another layer of difficulty for potential new entrants.

- Compliance costs can be substantial, potentially deterring smaller firms.

- Regulations vary, adding complexity for companies operating across different regions.

- Failure to comply can result in fines and legal issues, increasing business risk.

- Established firms often have a head start due to their existing infrastructure and expertise in compliance.

New entrants face moderate but significant barriers in facility management. Financial requirements, like start-up costs of $500,000 - $1 million in 2024, hinder entry. Established firms like ISS Schweiz leverage brand recognition and economies of scale. Compliance costs and distribution networks further complicate market entry.

| Factor | Impact on New Entrants | Example |

|---|---|---|

| Capital Needs | Moderate Barrier | Start-up costs: $500K-$1M (2024) |

| Economies of Scale | High Barrier | ISS Schweiz revenue (2024): >CHF 10B |

| Brand Recognition | Significant Advantage for Incumbents | ISS's strong brand and client base |

Porter's Five Forces Analysis Data Sources

The analysis incorporates annual reports, market studies, industry publications, and economic indicators for competitive landscape assessments.