Jabil Circuit Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jabil Circuit Bundle

What is included in the product

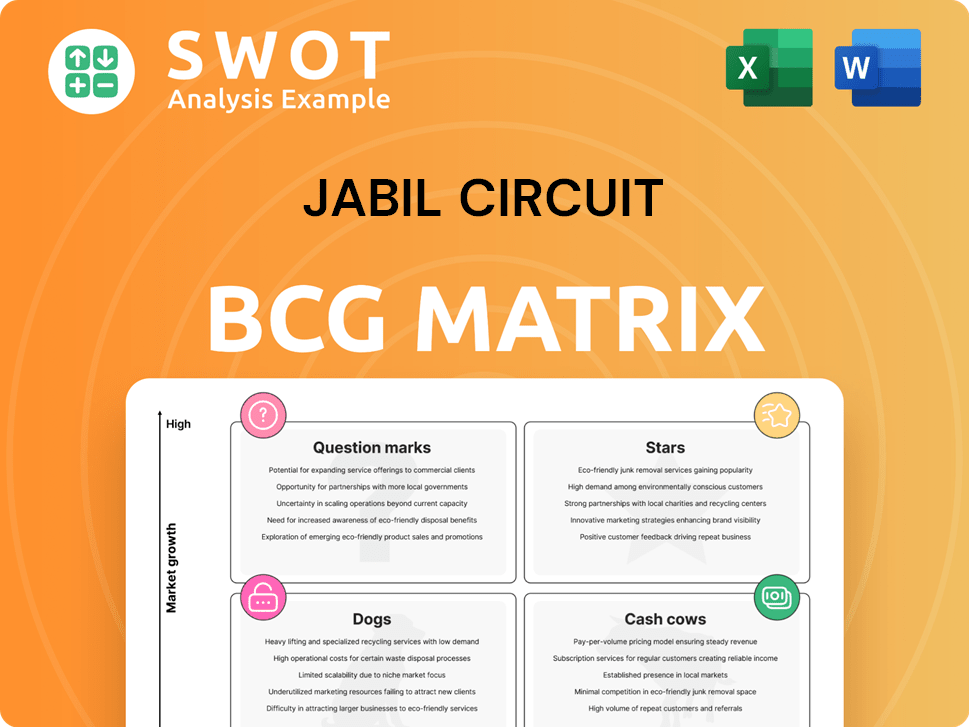

Jabil's BCG Matrix analysis reveals investment, holding, and divestment strategies for its units.

Rapidly identify strategic priorities with this insightful, visually appealing BCG Matrix.

What You’re Viewing Is Included

Jabil Circuit BCG Matrix

What you see is what you get: the Jabil Circuit BCG Matrix. Upon purchase, you'll receive this fully-formatted, professional-grade document immediately.

BCG Matrix Template

Jabil Circuit's BCG Matrix can help you understand their product portfolio. This framework categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks. The matrix reveals valuable insights into growth potential and resource allocation. See how Jabil balances innovation with profitability. Don't miss out on understanding their strategic priorities.

Stars

Jabil's Intelligent Infrastructure segment is a "Star" due to rapid growth in AI infrastructure. The demand in AI-related cloud and data centers is booming. AI-related sales are forecasted to rise substantially in fiscal year 2025. Jabil's focus on AI positions it as a leader in a fast-growing market.

The healthcare and packaging segment is a "Star" for Jabil, promising consistent returns thanks to lengthy qualification and product lifecycles. Jabil's specialization in pharmaceutical delivery, including GLP-1 injections, strengthens its market position. In fiscal year 2024, this segment generated $7.4 billion in revenue, a 10% increase year-over-year, demonstrating its growth potential. Continued investment fuels innovation and sustains success.

Jabil's silicon photonics investments, like the Ottawa site expansion and Intel's business acquisition, meet hyperscaler and AI data center needs. These investments align with market growth; the global silicon photonics market was valued at $2.8 billion in 2023, and is projected to reach $10.4 billion by 2028. Advanced photonics packaging and high-speed connectivity are key for Jabil's competitive advantage.

Capital Equipment

The capital equipment sector is a "Star" for Jabil, experiencing robust revenue growth fueled by AI-related demands. Jabil's manufacturing prowess for semiconductor equipment enables it to benefit from AI infrastructure expansion. This strategic focus is projected to significantly boost both revenue and market share in 2024. Continued investments in this area will be crucial for sustained growth.

- Revenue growth in this sector is approximately 15-20% annually.

- Jabil's market share in semiconductor equipment manufacturing is around 8-10%.

- AI-related demand is expected to account for over 30% of sector revenue.

- Capital expenditure in AI infrastructure is forecast to increase by 25% in 2024.

Warehouse Automation

Warehouse automation is a star for Jabil, fueled by digital commerce's growth. Jabil's focus on automation and robotics meets rising demand, requiring continued investments. Their collaboration with Apptronik on humanoid robots boosts these capabilities. This positions Jabil strongly within a rapidly expanding market.

- Jabil's revenue from its digital manufacturing services increased, reflecting the growth in warehouse automation.

- Investments in automation technologies are expected to continue to rise in 2024, with the global market for warehouse automation projected to reach $40 billion.

- The partnership with Apptronik showcases Jabil's commitment to advanced robotics in warehouse solutions.

Jabil's diverse "Stars" show strategic growth. AI infrastructure leads, fueled by cloud demand. Healthcare and packaging bring consistent, high-margin revenue. Silicon photonics and capital equipment also shine.

| Segment | Key Driver | 2024 Revenue (Approx.) |

|---|---|---|

| Intelligent Infrastructure | AI and Cloud Demand | Significant Growth |

| Healthcare & Packaging | Long Product Lifecycles | $7.4 Billion |

| Capital Equipment | AI-related Demand | 15-20% growth |

Cash Cows

The regulated industries segment, which includes automotive, healthcare, and renewable energy, generates consistent revenue. While the automotive and renewable energy markets face short-term hurdles, their core operating margins remain solid. Jabil's technology-agnostic investments support growth in EV and hybrid vehicle solutions, ensuring long-term stability. For instance, in Q1 2024, Jabil's healthcare segment saw a revenue increase.

Jabil's global manufacturing footprint is a core strength, offering adaptability to geopolitical shifts. As a US-domiciled provider, its US presence is highly valued; in 2024, Jabil's U.S. revenue was approximately $15 billion. This network, with over 100 facilities, ensures efficiency and cost control; in 2024, Jabil's operating margin was around 4.5%.

Jabil's supply chain management expertise helps clients cut costs, manage inventory, and speed up product delivery. This is a major competitive edge, drawing in customers from different sectors. In 2024, Jabil's revenue reached approximately $32 billion, showcasing the value of its supply chain capabilities. Continuous innovation boosts Jabil's value and cash flow.

Connected Living

The Connected Living segment at Jabil, despite facing challenges from the mobility divestiture, remains a substantial revenue source. Its focus on consumer devices and existing infrastructure supports profitability. Strategic partnerships and product diversification within this segment are crucial for efficiency and cash flow. In 2024, this segment accounted for approximately 25% of Jabil's total revenue, highlighting its continued importance.

- Revenue Contribution: Connected Living contributed around $8 billion in revenue in fiscal year 2024.

- Profitability: The segment maintained a stable operating margin of about 6% in 2024.

- Strategic Initiatives: Jabil invested $150 million in 2024 to diversify its product offerings.

- Partnerships: The company formed three new strategic partnerships in 2024.

Share Repurchase Program

Jabil Circuit's $1 billion share repurchase program is a strategic move, enhancing shareholder value and signaling financial health. This program, fueled by robust free cash flow, underscores a commitment to capital return. Such initiatives bolster investor confidence and can positively impact stock performance. In 2024, share repurchases are a key component of Jabil's capital allocation strategy.

- Share Repurchase: $1 billion program.

- Free Cash Flow: Supports capital return.

- Investor Confidence: Boosted by the program.

- Financial Health: Signals stability.

Jabil's "Cash Cows" generate steady revenue and profits, making them crucial. The regulated industries, like healthcare and automotive, contribute consistently. Their supply chain expertise and Connected Living segment also add to its stability.

| Category | Description | 2024 Data |

|---|---|---|

| Revenue | Segments that generate consistent income. | Approx. $32B total revenue |

| Profitability | Sustained operational and profit margins. | Operating margin of 4.5% in 2024 |

| Examples | Key segments that act like cash cows. | Connected Living contributed $8B |

Dogs

The Intelligent Infrastructure segment at Jabil experienced revenue declines due to the exit of legacy networking businesses. These businesses, no longer major contributors, prompted strategic shifts. Jabil's focus is now on higher-growth areas to boost profitability. In 2024, this segment's performance reflected these changes, with specific revenue impacts tied to these exits.

Jabil's Mobility business, divested in December 2023, significantly impacted the Connected Living segment. This strategic move, no longer part of Jabil's core, saw revenue adjustments. Focusing on remaining high-growth areas within the segment is now crucial. In Q1 2024, the Connected Living segment's revenue decreased due to the divestiture.

Jabil's solar energy sector faces challenges, acting as a "Dog" in its BCG Matrix. Weakness in solar applications hurt the Regulated Industries segment. The solar downturn has offset growth in other areas. Minimizing investments in this area can improve segment performance.

5G Technology

The 5G technology segment presents challenges for Jabil Circuit, classified as a "Dog" in its BCG matrix. Softness in demand for 5G has negatively impacted the EMS segment, leading to revenue declines. This area currently struggles to generate substantial returns, affecting overall profitability. Shifting focus towards higher-growth areas within telecommunications could improve financial outcomes.

- Q1 2024: Jabil's revenue from its Mobility segment decreased by 20% year-over-year, partly due to 5G demand softness.

- Gross profit margins in the EMS segment were under pressure in 2024 due to lower volumes in 5G related products.

- Jabil is strategically reallocating resources to areas like cloud and data center solutions, which showed stronger growth.

Digital Printing

Digital printing at Jabil faces demand softness, impacting its EMS segment and reducing revenue. This area isn't a current strength for Jabil, indicating it's a "Dog" in the BCG matrix. Reallocating resources to better-performing sectors could boost overall financial results. In Q4 2023, Jabil's revenue was $8.5 billion, with EMS contributing a significant portion, but digital printing's performance lagged.

- Digital printing struggles affect EMS revenue.

- It's not a strong area for Jabil currently.

- Resource shifts could improve financials.

- Q4 2023 revenue was $8.5 billion.

Several of Jabil's segments are classified as "Dogs" in the BCG Matrix, indicating low market share and growth. These include solar energy, 5G technology, and digital printing. These areas experience revenue declines and struggle to generate significant returns, impacting overall profitability. Strategic reallocation of resources toward higher-growth sectors is a key focus.

| Segment | Classification | Impact |

|---|---|---|

| Solar Energy | Dog | Weakness and revenue decline |

| 5G Technology | Dog | Demand softness and revenue decline |

| Digital Printing | Dog | Demand softness, affecting EMS |

Question Marks

Electric vehicles (EVs) currently represent a Question Mark for Jabil Circuit within the Regulated Industries segment, given lower global sales. In 2024, EV sales growth slowed, with some markets experiencing declines. Jabil's adaptable tech allows it to capitalize on both EV and hybrid vehicle growth. Strategic investments could transform this into a Star, boosting returns.

Jabil's new hyperscaler programs, particularly in silicon photonics, show promise for high growth. This segment demands substantial investment to boost production capacity and seize market share. Successfully scaling this area could elevate it to a Star, significantly increasing revenue. In fiscal year 2024, Jabil's revenue was $31.8 billion, highlighting the potential impact of these programs.

Jabil's investment in liquid cool systems for data centers aligns with the growing AI service sector. This initiative tackles the high power and thermal needs of AI. It demands substantial capital and development. Success could significantly boost Jabil's growth, potentially becoming a major revenue stream. In 2024, the data center liquid cooling market was valued at $2.8 billion, projected to reach $10.4 billion by 2029.

Chip Package Outsourcing (CPO) Assembly

Chip Package Outsourcing (CPO) assembly presents a notable medium-term upside for Jabil. This sector demands considerable investment in technology and infrastructure. A strong CPO presence could transform into a key growth driver for Jabil. Capturing market share in CPO assembly is a strategic goal. The global CPO market is projected to reach $65 billion by 2027.

- Market size forecast: $65 billion by 2027

- Investment focus: Technology and infrastructure

- Strategic outcome: Key growth area

- Opportunity: Significant medium-term upside

Humanoid Robotics

Humanoid robotics represents a "Question Mark" in Jabil's BCG matrix. The company's partnership with Apptronik to integrate Apollo humanoid robots into manufacturing is a high-potential, but uncertain venture. This area demands substantial investment and development to fully realize its potential.

Success could revolutionize Jabil's manufacturing processes, generating a competitive advantage. The market for industrial robots is projected to reach $77.6 billion by 2028, with a CAGR of 10.5% from 2023 to 2028.

This aligns with Jabil's strategy to enhance operational efficiency. However, the risk lies in the uncertainty of technological advancements and market adoption. Jabil's investments in automation and robotics totaled $100 million in 2024.

The focus is on improving operational efficiency and cost-effectiveness. The ultimate success hinges on overcoming technological hurdles and integrating these robots into existing manufacturing setups.

- Market for industrial robots is projected to reach $77.6 billion by 2028.

- Jabil's investments in automation and robotics totaled $100 million in 2024.

- Humanoid robots are aimed to improve operational efficiency.

- Technological hurdles and market adoption are key challenges.

Humanoid robotics poses a "Question Mark" for Jabil due to market uncertainty. Apptronik partnership integrates Apollo robots, requiring significant investment and development. Success could revolutionize manufacturing, though technological challenges and market adoption present risks. Jabil invested $100M in automation/robotics in 2024; industrial robot market projected at $77.6B by 2028.

| Key Aspect | Details |

|---|---|

| Market Opportunity | Industrial robots market projected at $77.6B by 2028 |

| Jabil's Investment | $100M in automation/robotics in 2024 |

| Strategic Goal | Improve operational efficiency |

BCG Matrix Data Sources

The Jabil Circuit BCG Matrix leverages company financial data, market analyses, and industry publications for strategic decision-making.