James Hardie Industries Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

James Hardie Industries Bundle

What is included in the product

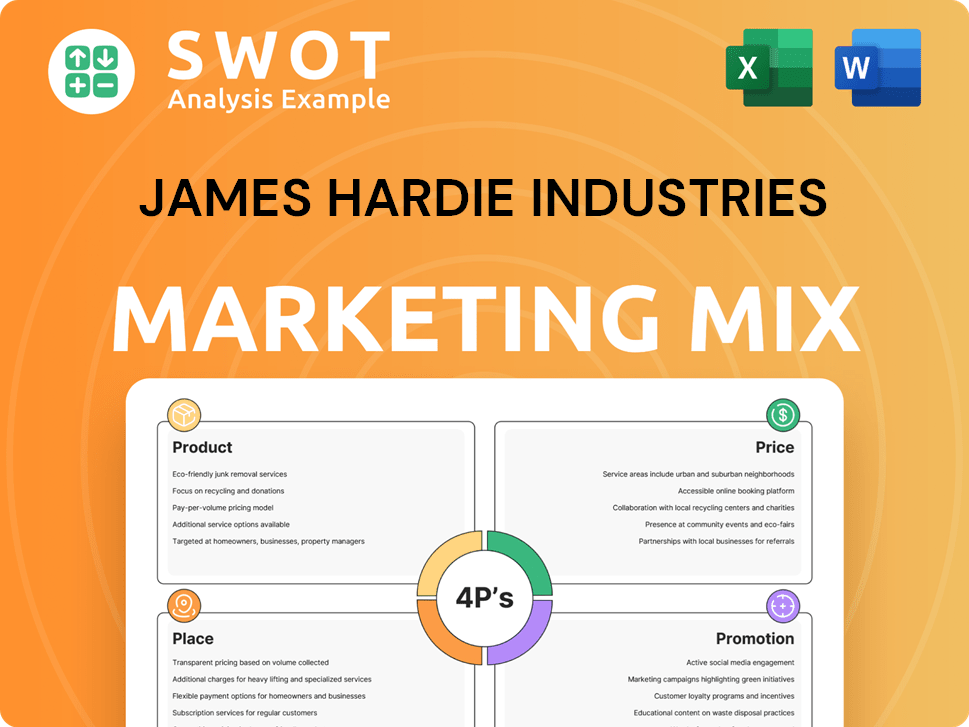

Provides a comprehensive 4P analysis, breaking down James Hardie's marketing with real-world examples and strategic insights.

Summarizes the 4Ps of James Hardie for efficient reviews and clear communication of key strategies.

What You See Is What You Get

James Hardie Industries 4P's Marketing Mix Analysis

The preview mirrors the finished James Hardie 4Ps Marketing Mix document you'll download instantly. This ensures complete transparency, so you know exactly what to expect. All details included are ready for your immediate use.

4P's Marketing Mix Analysis Template

James Hardie Industries is a leader in building materials, but what makes its marketing so successful? Understanding its product offerings, pricing, distribution, and promotional efforts is key.

We've broken down James Hardie's marketing approach in a concise 4Ps analysis. This includes insights into how they position products like fiber cement siding in the market.

This is just a sneak peek! The full, ready-to-use Marketing Mix Analysis digs much deeper. It provides actionable insights and structured thinking.

The comprehensive report is ready for immediate download. Access detailed, editable analysis in a business-ready format, saving you valuable time and effort.

Dive into James Hardie's strategies. Buy the full Marketing Mix analysis now!

Product

James Hardie excels in fiber cement and gypsum solutions. These products suit exteriors and interiors for homes and businesses. Since the 1980s, they've led in fiber cement tech. In fiscal year 2024, James Hardie's net sales were approximately $4.2 billion.

James Hardie's product line is extensive. It features lap siding, shingle siding, and vertical siding. The portfolio also contains trim boards, soffit panels, and backer board, and architectural panels. In 2024, James Hardie's revenue was approximately $4.1 billion, reflecting the broad appeal of its product offerings.

James Hardie's focus is on innovative, durable materials. Their products, like fiber cement siding, offer longevity and require minimal upkeep. These materials are engineered to withstand harsh conditions, including moisture, fire, and termites. For example, in 2024, James Hardie's revenue was over $4 billion, reflecting strong demand for its resilient products.

Focus on Sustainability

James Hardie's sustainability efforts are central to its product strategy. The company emphasizes reducing CO2 emissions and using recycled materials. Their fiber cement products consist of cement, sand, cellulose fibers, and water. James Hardie aims to lower its environmental impact and meet evolving market demands. This approach aligns with global trends favoring sustainable construction practices.

- Commitment to sustainable product development.

- Focus on reducing CO2 emissions.

- Incorporating recycled content in products.

- Fiber cement composition: cement, sand, cellulose fibers, water.

Acquisition of AZEK

James Hardie's acquisition of AZEK, announced in late 2024, significantly impacts its product strategy. This move broadens James Hardie's portfolio beyond fiber cement siding to include sustainable outdoor living products. The deal, valued at approximately $1.4 billion, aims to capitalize on the growing demand for eco-friendly building materials.

- Product: Expanded to include decking, railing, and pergolas.

- Price: AZEK's revenue in 2024 was about $1.6 billion.

- Place: Distribution channels likely to integrate AZEK's network.

- Promotion: Marketing will highlight both brands' sustainability.

James Hardie's products feature durable fiber cement siding, trim, and architectural panels, crucial for home exteriors and interiors. The strategic AZEK acquisition expands offerings to include outdoor living solutions. These offerings target markets with eco-friendly products, driving sustainable growth.

| Aspect | Details | 2024 Data |

|---|---|---|

| Product Expansion | Beyond fiber cement, includes decking, railing. | AZEK Revenue: ~$1.6B |

| Sustainability | Focus on reducing emissions, recycled content. | |

| Materials | Fiber cement: cement, sand, cellulose, water. | James Hardie Sales: ~$4.2B |

Place

James Hardie boasts a strong global presence, with major operations in North America, Europe, Australia, New Zealand, and the Philippines. The company's strategic locations include its management team in Chicago, Illinois, and its headquarters in Ireland. In 2024, James Hardie's international sales accounted for a significant portion of its revenue, reflecting its worldwide reach. This expansive footprint allows James Hardie to capitalize on diverse market opportunities and mitigate regional economic risks.

James Hardie strategically positions its manufacturing facilities near distribution centers and raw materials to cut transportation expenses. In 2023, the company managed 20 manufacturing plants globally, optimizing its supply chain. This approach helps in maintaining cost efficiency and supports quicker delivery times. For instance, this strategic setup enables James Hardie to better serve regional markets.

James Hardie's extensive distribution network is a cornerstone of its marketing strategy. They leverage major retailers like The Home Depot and Lowe's in North America, and Bunnings Warehouse in Australia. This widespread reach ensures product availability for both professional contractors and DIY homeowners. James Hardie's net sales for FY2024 were $4.29 billion, highlighting the effectiveness of their distribution channels.

Direct Sales and Customer Support

James Hardie Industries emphasizes direct sales and robust customer support. They maintain dedicated sales teams and customer service networks to assist distributors and contractors. Outbound telemarketing is also utilized to engage potential customers. This strategy ensures direct engagement and support throughout the sales process. In fiscal year 2024, James Hardie's sales increased, reflecting the effectiveness of its customer-focused approach.

- Dedicated sales teams for direct support.

- Customer service infrastructure across key markets.

- Outbound telemarketing for lead generation.

- Focus on distributor and contractor relationships.

Strategic Partnerships

James Hardie strategically partners with distributors and construction firms to broaden its market presence. They collaborate with architects and engineers to promote product adoption. These partnerships are crucial for market penetration and brand visibility. In fiscal year 2024, James Hardie reported that 60% of its revenue came from North America, showing the impact of these strategies.

- Distribution partnerships are key for product availability.

- Collaboration with architects influences product specifications.

- Partnerships with construction firms ensure market reach.

- These strategies support revenue growth.

James Hardie's strategic place includes global manufacturing sites. They use locations like the US and Australia, as well as, an efficient supply chain for better market reach. Direct partnerships also expand the customer base. In 2024, they had revenue from North America, and had solid distribution networks, too.

| Place Element | Details | Impact |

|---|---|---|

| Manufacturing Footprint | 20 plants worldwide as of 2023; strategically located | Reduces transport costs, supports timely delivery |

| Distribution Network | Partnerships with retailers like The Home Depot, Lowe's | Broadens reach; $4.29B net sales in FY2024 |

| Market Penetration | Focus on direct sales & partnerships | Drives growth, as 60% revenue from North America in 2024 |

Promotion

James Hardie's marketing now targets homeowners. This shift boosts brand recognition and homeowner-led choices. In 2024, direct-to-consumer marketing saw a 15% rise in engagement. This change aligns with a 20% increase in homeowner-initiated projects.

James Hardie utilizes integrated marketing campaigns, blending TV, digital ads, social media, PR, and influencers. The 'It's Possible' campaign exemplifies this strategy. In 2024, digital ad spend rose, reflecting the shift. This approach aims for broad reach and consistent messaging. Integrated campaigns boost brand awareness effectively.

James Hardie focuses on specific demographics, including female homeowners aged 35-54, who are often key decision-makers. This targeted marketing aims to boost consumer interest. By focusing on this group, they gain greater control over their value proposition. In 2024, James Hardie's marketing spend was approximately $100 million, reflecting their commitment to these efforts.

Emphasis on Product Value Proposition

James Hardie's promotional efforts strongly focus on the value proposition of its products. They highlight durability, design flexibility, and low maintenance. Marketing also emphasizes the long-term product and paint warranties. In 2024, the company's advertising spend reached $150 million, reflecting this emphasis.

- Focus on value, durability, and design.

- Promote low maintenance features.

- Highlight long product and paint warranties.

- Allocate significant advertising budget.

Sales and Marketing Investments

James Hardie dedicates significant resources to sales and marketing to fuel expansion and back homeowner and trade marketing endeavors. In fiscal year 2024, the company's selling and marketing expenses amounted to $422.7 million, reflecting its commitment to these areas. This investment is crucial for brand awareness and driving sales. The focus includes digital marketing and channel support.

- $422.7 million in selling and marketing expenses in fiscal year 2024.

- Focus on digital marketing and channel support.

James Hardie's promotion emphasizes value, durability, and warranties to attract customers. They focus on homeowners via integrated campaigns and target specific demographics, investing heavily in advertising, reaching $150 million in 2024. This marketing push aligns with their $422.7 million in selling and marketing expenses in fiscal year 2024, highlighting their commitment to growth through brand awareness and sales.

| Aspect | Details | Financials (2024) |

|---|---|---|

| Marketing Spend | Focus on homeowner-led choices, integrated campaigns | $150 million (Advertising) |

| Targeting | Female homeowners (35-54), emphasizing value | $100 million (Marketing spend) |

| Selling & Marketing Expenses | Digital marketing, channel support | $422.7 million |

Price

James Hardie's pricing strategy reflects its premium product positioning. They focus on value, not just cost, in both residential and commercial sectors. In 2024, the company's revenue reached approximately $4.2 billion, reflecting strong demand for its products. This premium approach allows for higher margins.

James Hardie strategically raised prices, boosting its average net sales price (ASP). In FY24, the company's North America Fiber Cement segment saw a 9% ASP increase. This pricing strategy helped offset cost inflation and enhance profitability. The company continues to evaluate pricing in response to market dynamics.

James Hardie's focus on premium products significantly boosts profitability. For instance, the architectural range commands higher prices, enhancing margins. In fiscal year 2024, James Hardie reported a gross profit margin of 31.5%, reflecting the impact of these high-value offerings. This strategic shift towards prepainted products, which also command premium pricing, further supports margin growth.

Consideration of Costs and Market Conditions

James Hardie's pricing strategies carefully weigh variable costs, including raw materials and energy. Market dynamics, such as demand and competition, are also crucial. Economic conditions, like inflation, heavily influence pricing decisions. In 2024, rising material costs and supply chain issues continue to impact pricing.

- Variable costs: cement, pulp, sand, energy, fuel, logistics.

- Market factors: demand, competitor pricing, economic conditions.

- 2024 impact: rising costs and supply chain issues.

Impact of Acquisitions on Financial Profile

The AZEK acquisition is set to boost James Hardie's growth and profitability. This strategic move is expected to lead to higher revenue and earnings. The company's focus on premium products should allow for strong pricing power. This acquisition is anticipated to enhance shareholder value.

- Revenue growth expected to accelerate post-acquisition.

- Profitability margins are projected to improve.

- Enhanced market position and pricing strategy.

- Increased shareholder value creation.

James Hardie employs a premium pricing strategy, boosting profitability. This approach supports higher margins, reflected in a 31.5% gross profit margin in FY24. Price adjustments counter cost inflation and market dynamics.

| Metric | FY24 | Notes |

|---|---|---|

| Revenue | ~$4.2B | Reflects strong product demand |

| ASP Increase (North America Fiber Cement) | 9% | Supports profitability. |

| Gross Profit Margin | 31.5% | Illustrates pricing effectiveness. |

4P's Marketing Mix Analysis Data Sources

The 4P analysis uses James Hardie's reports, SEC filings, and industry data. It analyzes marketing campaigns, product details, and distribution strategies.