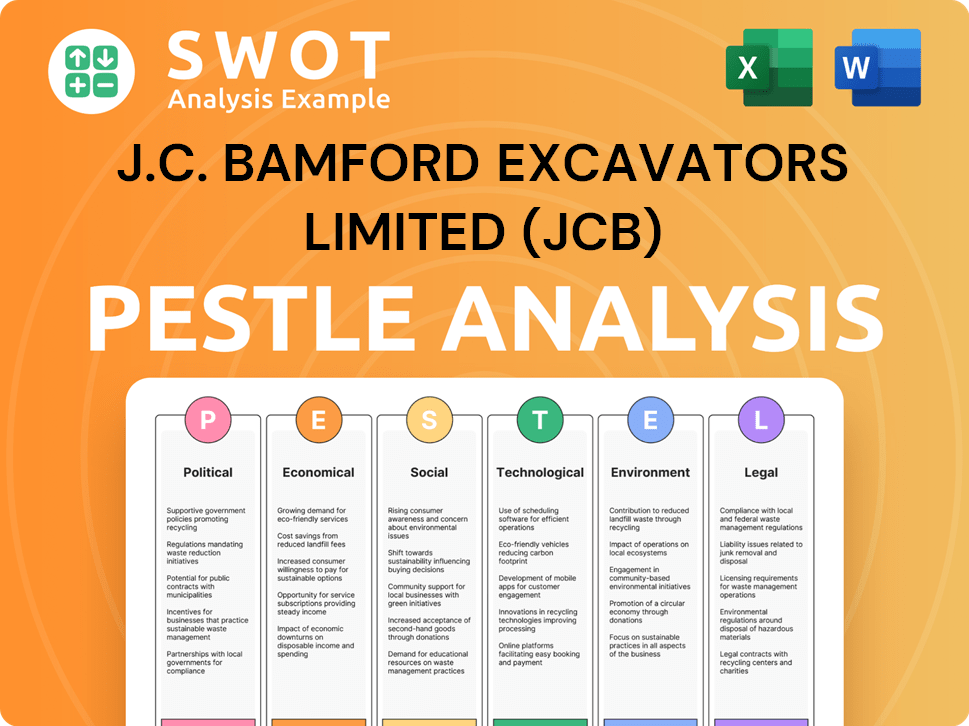

J.C. Bamford Excavators Limited (JCB) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J.C. Bamford Excavators Limited (JCB) Bundle

What is included in the product

Evaluates the macro-environment influencing J.C. Bamford Excavators Limited (JCB) across political, economic, social, tech, environmental, and legal dimensions.

Provides a concise version that can be dropped into PowerPoints for group planning.

What You See Is What You Get

J.C. Bamford Excavators Limited (JCB) PESTLE Analysis

This preview unveils the complete JCB PESTLE analysis. The document explores the political, economic, social, technological, legal, & environmental factors affecting JCB.

Expect detailed insights on each category, as you can see here. No edits are needed to start.

The layout, analysis & structure visible now will download straight after you've purchased it.

PESTLE Analysis Template

J.C. Bamford Excavators Limited (JCB) faces evolving political landscapes with fluctuating trade regulations and governmental support. Economic shifts, including supply chain volatility and inflation, significantly impact its operations. Technological advancements, such as automation and digitalization, drive innovation. A thorough PESTLE analysis is essential. Understand the external factors influencing JCB's strategic trajectory. Purchase the complete analysis to unlock detailed insights instantly. Make informed decisions.

Political factors

Government infrastructure spending is a key political factor affecting JCB. Increased investment in roads and bridges boosts demand for JCB's equipment. For example, in 2024, the U.S. government allocated $1.2 trillion for infrastructure projects. This creates significant market opportunities for JCB. Changes in spending can significantly impact JCB's market size and profitability.

JCB faces risks from shifting trade policies. Changes in tariffs and trade agreements directly influence the company's import/export costs. For example, tariffs on steel (a key component) can raise production expenses. In 2024, the US imposed tariffs on certain steel imports, impacting manufacturers.

Political stability significantly impacts JCB. Conflict zones disrupt supply chains and decrease demand. Geopolitical tensions, like those seen with Russia in 2024, pose export challenges. JCB's revenue in 2024 was £5.7 billion, indicating the scale of operations susceptible to political factors.

Government Regulations and Standards

Governments globally enforce regulations on emissions, safety, and vehicle specifications, impacting JCB's operations. JCB faces the challenge of adapting its products and manufacturing to meet diverse international standards, necessitating significant investment in research and development. For instance, the EU's Stage V emission standards require advanced technologies. Compliance costs can influence product pricing and competitiveness.

- EU Stage V emission standards have led to increased R&D spending.

- Safety regulations necessitate advanced design features.

- Vehicle specifications vary widely across countries.

- Compliance impacts product pricing and market access.

Government Support for Industries

Government backing heavily impacts JCB. Initiatives like tax breaks for eco-friendly equipment significantly boost demand. Infrastructure projects and housing initiatives also drive sales. For instance, in 2024, the UK government allocated £2.5 billion for local road improvements, directly benefiting JCB. This support creates opportunities and shapes market trends.

- UK government allocated £2.5 billion for local road improvements in 2024.

- Incentives for adopting newer, more environmentally friendly equipment.

- Support for housing and infrastructure projects.

Political factors significantly shape JCB’s operational landscape. Government spending on infrastructure, such as the 2024 US allocation of $1.2T, directly affects demand. Shifting trade policies and geopolitical instability pose risks, while stringent regulations like EU Stage V standards impact R&D and pricing.

| Political Factor | Impact on JCB | 2024/2025 Data |

|---|---|---|

| Infrastructure Spending | Boosts demand for equipment | US allocated $1.2T (2024), UK £2.5B road improvement (2024) |

| Trade Policies | Affects import/export costs | Steel tariffs in US (2024) |

| Political Stability | Disrupts supply chains and reduces demand | JCB’s Revenue: £5.7B (2024) |

| Government Regulations | Requires product adaptation | EU Stage V Emission Standards. |

Economic factors

Global economic growth is crucial for JCB. The construction and agricultural sectors, key markets for JCB, are directly affected by economic conditions. A slowdown can reduce project investments and lower demand for machinery. In 2024, global GDP growth is projected at 3.2%, impacting JCB's sales.

High interest rates, a key economic factor, can elevate borrowing costs for JCB, potentially curbing investments in capital equipment. Inflation, another critical element, affects raw material and manufacturing expenses. In 2024, the UK's base rate rose to 5.25%, impacting JCB's operational costs. The UK's inflation rate was 3.2% in March 2024.

JCB faces currency exchange rate risks due to its global operations. A stronger pound can make exports more expensive, potentially reducing sales in key markets. Conversely, a weaker pound boosts export competitiveness, but raises import costs. For instance, in 2024, fluctuations in GBP/USD impacted profitability. These rates are crucial for financial planning.

Raw Material Costs

JCB relies heavily on raw materials like steel and iron for its machinery production, making it vulnerable to price fluctuations. Rising raw material costs directly impact production expenses and profitability, potentially squeezing profit margins. This necessitates careful cost management and pricing strategies to maintain competitiveness. For instance, steel prices have seen volatility, with potential impacts on JCB's operational costs.

- Steel prices can fluctuate significantly, affecting JCB's cost structure.

- Raw material cost increases may necessitate price adjustments for JCB's products.

- Effective supply chain management is crucial to mitigate raw material price risks.

Market Demand in Key Regions

The construction and agricultural sectors' activity in key regions directly influence JCB's product demand. North America, India, and Europe's economic health significantly impacts JCB's sales and revenue. For instance, in 2024, the European construction output grew by about 1.5%. This growth shows positive market conditions for JCB. Strong regional growth is crucial for JCB's financial performance.

- European construction output grew by approximately 1.5% in 2024, showing positive trends.

- India's infrastructure spending is expected to rise, boosting demand.

- North American markets remain strong, supporting JCB's sales.

Global economic growth, particularly in construction and agriculture, is crucial for JCB. In 2024, global GDP is projected at 3.2%. High interest rates and inflation, such as the UK's 3.2% inflation in March 2024, impact JCB's borrowing and operational costs. Currency exchange rates also influence profitability, affecting export competitiveness.

| Factor | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Affects demand | 3.2% (Global) |

| Interest Rates | Influence borrowing | 5.25% (UK base rate) |

| Inflation | Raises costs | 3.2% (UK March 2024) |

Sociological factors

Globally, population growth and urbanization are accelerating. This fuels infrastructure needs, boosting demand for JCB's construction equipment. The UN projects 68% of the world's population will live in urban areas by 2050. JCB can capitalize on this urban expansion.

The construction and agricultural sectors face evolving workforce demographics, impacting technology adoption and machinery demand. JCB must adapt to an aging workforce and potential skills gaps. A 2024 study by the Construction Industry Training Board (CITB) projected a need for 217,000 new workers by 2028. JCB's focus should be on training and development programs.

Safety and health awareness is rising, impacting machinery design. JCB must integrate advanced safety features. This includes protective structures and ergonomic designs. Regulatory compliance is also crucial; for instance, the EU's machinery directive sets safety standards. In 2024, workplace accidents cost the EU €200 billion.

Public Perception and Brand Image

JCB's brand image hinges on public perception, significantly influencing customer loyalty and sales. A strong reputation for quality and reliability boosts market standing, while negative publicity can erode trust. Corporate social responsibility (CSR) efforts, such as JCB's focus on sustainability, play a key role in shaping public opinion. For example, in 2024, JCB invested £100 million in new product development, highlighting their commitment to innovation and quality.

- JCB's brand value was estimated at £3.5 billion in 2024, reflecting its strong reputation.

- Customer satisfaction scores for JCB products averaged 8.5/10 in 2024, indicating high reliability.

- JCB's CSR initiatives saw a 15% increase in positive media mentions during 2024.

Technological Adoption by Users

Customer acceptance of new tech is vital for JCB. Some regions embrace telematics faster than others, impacting sales. For instance, in 2024, North America saw a 20% increase in telematics adoption in construction, while Europe showed 15%. JCB's success hinges on understanding and catering to these varied adoption rates.

- Adoption rates vary globally.

- Telematics are increasingly important.

- Regional differences affect sales.

- JCB needs to adapt its strategy.

Urbanization boosts demand for JCB. Evolving demographics affect tech adoption and machinery needs. Safety awareness rises; JCB must integrate advanced safety features. A strong brand image and customer satisfaction are key, affecting loyalty.

| Factor | Impact | Data (2024) |

|---|---|---|

| Population Growth | Increased demand for equipment | Urban population: 56% (World Bank) |

| Workforce Demographics | Skills gaps, tech adoption | Construction workers needed: 217k (CITB) |

| Safety Awareness | Design and regulatory changes | Workplace accidents cost EU: €200B |

| Brand Perception | Customer loyalty, sales | JCB Brand Value: £3.5B |

Technological factors

JCB must stay ahead by innovating in engine efficiency, telematics, and automation. These advancements boost productivity and safety. For instance, in 2024, JCB invested $100 million in R&D. This included the development of electric and hydrogen-powered equipment.

The push for cleaner energy sources is accelerating the creation of electric, hybrid, and hydrogen-powered construction machinery. JCB is actively investing in hydrogen combustion engines. This strategic move aligns with upcoming environmental standards and responds to market needs. JCB's focus on hydrogen is evident in its prototype hydrogen-powered excavators, showcasing its commitment. JCB's investment in sustainable technology is expected to reach £100 million by the end of 2025.

Digitalization is transforming JCB. The Internet of Things (IoT) and data analytics enable remote monitoring and predictive maintenance. For example, JCB's LiveLink system enhances fleet management. In 2024, the global IoT market in construction was valued at $6.8 billion, growing rapidly.

Manufacturing Technology and Automation

JCB's embrace of advanced manufacturing and automation is crucial. This includes robotics and AI for streamlining production. Automation can boost efficiency, cutting costs, and improving product quality. JCB invested £100 million in new UK factories in 2024.

- Increased Efficiency: Automated processes can reduce production time.

- Cost Reduction: Automation lowers labor and material waste expenses.

- Enhanced Quality: Precision manufacturing improves product reliability.

- Technological Advancement: JCB stays competitive through innovation.

Research and Development Investment

JCB's commitment to Research and Development (R&D) is a cornerstone of its strategy. This investment allows JCB to create innovative products and refine existing ones, crucial for maintaining a competitive edge. In 2024, JCB allocated £280 million to R&D, a 15% increase from the previous year. This focus is driving advancements in areas like electric and hydrogen-powered construction equipment.

- £280 million R&D investment in 2024.

- 15% increase in R&D spending year-over-year.

- Focus on electric and hydrogen-powered equipment.

Technological factors shape JCB's innovation. The firm invests heavily in R&D, allocating £280 million in 2024, a 15% rise from 2023. This fuels development in electric and hydrogen tech. JCB’s strategic moves focus on sustainable technology to reduce costs.

| Technology Area | JCB Investment (2024) | Key Benefit |

|---|---|---|

| Electric/Hydrogen Power | $100 million | Compliance with new regulations |

| Digitalization (IoT) | Ongoing, as needed | Better efficiency & safety |

| Automation/AI | £100 million | Reduces operational costs |

Legal factors

JCB faces rigorous product safety regulations globally. Compliance involves adherence to design, manufacturing, and testing standards for safe machinery operation. In 2024, the construction equipment market saw increased scrutiny on safety, with penalties reaching $1.5 million for non-compliance. JCB's commitment is reflected in its investment in safety features. This ensures its products meet the necessary standards.

JCB faces stringent environmental rules, focusing on emissions and noise. These include regulations like the EU's Stage V for off-road engines. In 2024, JCB invested heavily in electric and hydrogen-powered equipment to meet these standards. Investment in such tech rose by 15% in 2024.

JCB must comply with diverse employment laws globally. In 2024, labor disputes led to production halts in some regions. The company's costs rose due to compliance, with around 7% of operational expenses linked to legal adherence. Furthermore, JCB faces scrutiny regarding worker safety, and in 2025, there is a 10% rise in litigation.

International Trade Laws and Sanctions

JCB must strictly adhere to international trade laws and sanctions, crucial for its global operations. Non-compliance can lead to hefty penalties and reputational harm. Recent data shows that companies face increasingly stringent enforcement. For instance, in 2024, penalties for violating sanctions have risen by 15%.

- Sanctions compliance costs have increased by 10% in 2024.

- Export control violations fines average $2 million.

- Reputational damage can decrease market value by 20%.

Competition Law and Antitrust Regulations

JCB faces scrutiny under competition law and antitrust regulations across its global markets. These laws aim to prevent anti-competitive behaviors that could harm consumers or stifle market competition. For instance, in 2024, the European Commission fined several construction equipment manufacturers for cartel activities, highlighting the importance of compliance. Companies like JCB must adhere to regulations to avoid penalties and maintain fair market practices.

- Compliance includes avoiding price-fixing, bid-rigging, and market allocation agreements.

- Failure to comply can result in significant fines, legal battles, and reputational damage.

- JCB's legal teams must monitor and adapt to evolving regulations globally.

JCB's legal environment includes strict product safety rules, with penalties up to $1.5M for non-compliance. Environmental regulations also pressure JCB to invest in eco-friendly equipment; tech investment rose by 15% in 2024. Moreover, global trade laws and competition rules present further compliance challenges, where sanctions compliance costs have risen by 10% in 2024.

| Legal Area | Compliance Focus | 2024/2025 Impact |

|---|---|---|

| Product Safety | Design & Testing Standards | Penalties up to $1.5M |

| Environmental | Emissions & Noise | Tech investment +15% (2024) |

| Trade/Competition | Sanctions, Antitrust | Compliance costs +10% (2024) |

Environmental factors

Climate change is a significant environmental factor, with rising concerns about carbon emissions impacting industries. JCB addresses this by investing in lower-emission equipment. In 2024, the global market for electric construction equipment was valued at $4.8 billion. JCB's shift to electric and hydrogen-powered machinery aligns with the growing demand for sustainable solutions.

JCB faces environmental pressures regarding resource depletion and material sourcing. The availability and cost of raw materials, like steel, significantly impact production costs. In 2024, steel prices fluctuated, affecting profitability. Sustainable sourcing and the use of recycled materials are vital for reducing environmental impact. JCB's investment in alternative materials is crucial.

JCB must comply with waste management regulations globally, which are constantly evolving. Societal pressure for sustainable practices impacts JCB's product design and manufacturing. In 2024, the UK's waste recycling rate was approximately 45.5%, influencing JCB's initiatives. JCB's recycling and waste reduction strategies also affect operational costs and brand reputation.

Noise and Air Pollution Regulations

Stringent regulations on noise and air pollution significantly influence JCB's product development. These rules necessitate investment in cleaner engines and noise reduction technologies. Complying with these standards impacts production costs and design choices. Specifically, the EU's Stage V emissions standards, fully implemented by 2021, mandate substantial reductions in pollutants from off-road vehicles, affecting JCB's engine designs.

- EU Stage V compliance requires advanced exhaust after-treatment systems.

- Noise regulations impact machinery design and operation.

- These regulations drive innovation in eco-friendly technologies.

- Compliance increases manufacturing expenses.

Sustainability in the Supply Chain

Sustainability is crucial for JCB's supply chain. This involves eco-friendly practices from raw material sourcing to product delivery. In 2024, the construction sector saw a 15% rise in demand for sustainable materials. JCB aims to reduce its carbon footprint by 50% by 2030, focusing on green logistics.

- Sustainable materials are in high demand.

- JCB targets a significant carbon footprint reduction.

- Focus on green logistics is a key strategy.

Environmental factors significantly impact JCB. Climate change spurs a move to electric and hydrogen-powered machinery, with the 2024 market valued at $4.8B. Resource depletion affects costs, influenced by steel price fluctuations, mandating sustainable sourcing.

Waste management regulations and societal pressures influence product design. Noise and air pollution regulations necessitate cleaner engines and eco-friendly tech, which influences production costs. Supply chain sustainability requires green logistics.

| Factor | Impact on JCB | Data |

|---|---|---|

| Climate Change | Demand for low-emission equipment | Electric construction equipment market valued at $4.8B (2024) |

| Resource Depletion | Impact on material sourcing and costs | Steel price fluctuations impact costs (2024) |

| Waste Management & Regulations | Influence product design, operations | UK waste recycling rate ~45.5% (2024) |

PESTLE Analysis Data Sources

Our analysis leverages diverse sources like market research, industry reports, and economic databases, providing data-driven insights.