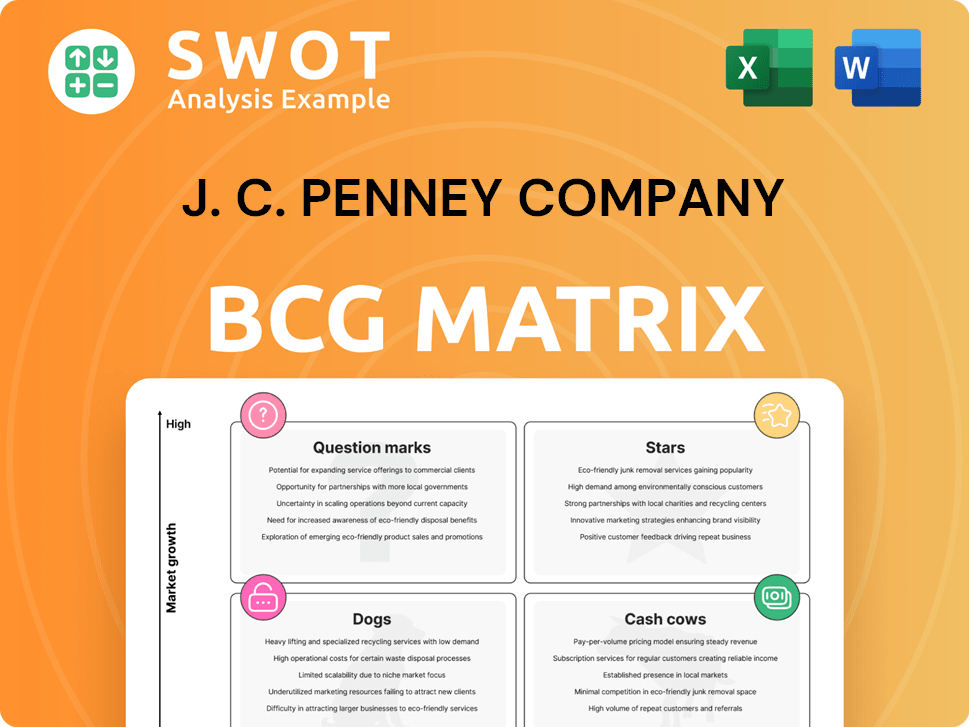

J. C. Penney Company Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J. C. Penney Company Bundle

What is included in the product

J. C. Penney's BCG Matrix analysis reveals investment opportunities and areas for divestment within its product portfolio.

Printable summary optimized for A4 and mobile PDFs for quick analysis and sharing of JCP's portfolio.

What You’re Viewing Is Included

J. C. Penney Company BCG Matrix

The displayed J. C. Penney BCG Matrix preview is identical to the downloadable document you'll receive after purchase. This comprehensive strategic analysis, ready for immediate application, provides key insights into their business units. You'll receive the complete, professional report, optimized for clarity and strategic decision-making, no hidden fees or alterations. The full file is yours to use, customize, and leverage instantly.

BCG Matrix Template

J. C. Penney faces a complex market landscape, with some departments thriving while others struggle. Its apparel lines might be stars, showing growth potential, while certain home goods could be question marks needing more investment. Some established product areas likely function as cash cows, generating steady revenue. Other categories may be dogs.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

JCPenney's Beauty expansion, featuring over 170 brands, targets growth. The concept grew from 10 to 600 stores by Spring 2023. This significant investment aims at a potentially high-growth market. Success could position JCPenney Beauty as a "star," boosting revenue. In 2024, beauty sales are expected to grow by 5%.

JCPenney's private label brands, such as Stafford and Arizona, represent a strategic focus on value. These brands, developed at lower costs, allow for competitive pricing. As of 2024, private labels accounted for a significant portion of JCPenney's sales, demonstrating their importance. Strategic management and quality control are key to their success.

JCPenney's omnichannel strategy, blending online and in-store experiences, aims to meet evolving consumer preferences. This focus on digital capabilities and store enhancements could elevate JCPenney to a "Star" in the BCG Matrix. In 2024, omnichannel retail sales are projected to increase, with companies like JCPenney aiming to capture this growth through seamless integration. JCPenney's investment in this area is crucial for maintaining a competitive edge.

AI-Powered Personalization

JCPenney is leveraging AI to boost customer engagement and sales, positioning it as a "Star" in its BCG Matrix. The company's AI-driven tools, like beauty advisors, are yielding impressive results. For example, the AI skincare advisor has boosted the average order value by 23%. This indicates a strong return on investment in AI.

- AI-powered tools drive significant improvements in key performance indicators.

- The AI skincare advisor led to a 23% increase in average order value.

- Virtual Makeup Try-On tool has increased conversion rates.

- Continued investment in AI and personalization could boost growth.

Loyalty Program Revamp

J. C. Penney's Rewards Program overhaul, launched in April 2024, is showing promise. The company saw a 25% year-over-year jump in enrollment. Over 1.4 million customers have earned a CashPass, indicating strong customer engagement. This initiative could propel JCPenney into a star within the BCG matrix.

- 25% year-over-year increase in enrollment.

- Over 1.4 million customers earned a CashPass.

- Potential to significantly boost customer retention.

- Driving long-term growth.

Stars in J. C. Penney's BCG Matrix include high-growth areas. These include JCPenney Beauty, omnichannel retail, and AI-driven tools. Strong growth and significant investments are key features.

| Initiative | Focus | 2024 Data |

|---|---|---|

| JCPenney Beauty | Expansion | 5% beauty sales growth |

| Omnichannel | Integration | Retail sales projected up |

| AI | Customer Engagement | 23% increase in order value |

Cash Cows

JCPenney's core apparel and accessories, especially women's and family wear, remain key revenue drivers. These categories leverage brand recognition and customer loyalty effectively. In 2024, these segments contributed significantly to overall sales. Focusing on quality, affordability, and trends sustains them as cash cows, yielding steady income with minimal promotional investment.

JCPenney's home goods, like bedding and kitchenware, are cash cows due to consistent demand. These products attract a wide customer base, generating stable revenue. In 2024, home goods sales contributed significantly to JCPenney's overall revenue. Efficient inventory control boosts cash flow, minimizing marketing expenses.

Jewelry, often discounted up to 75%, consistently attracts customers, especially during holidays. This segment, although not experiencing high growth, generates dependable income. J. C. Penney's jewelry sales in 2024 contributed a steady revenue stream, demonstrating its cash cow status. Strategic promotions and inventory control are key to maintaining profitability.

Salon Services

JCPenney's salon services, present in many stores, are a cash cow. These services generate steady revenue with manageable overhead. Customer loyalty and repeat visits bolster this segment's reliability. Strategic partnerships and efficient management enhance profitability.

- In 2024, JCPenney's salon services contributed significantly to overall revenue.

- Customer retention rates for salon services are high, ensuring repeat business.

- The salon segment benefits from cross-selling opportunities within the store.

- Effective cost management is key to maximizing profits in this area.

Optical Centers

J. C. Penney's optical centers are cash cows, generating consistent revenue from eye exams and eyewear sales. These centers leverage the convenience of in-store locations and JCPenney's established brand. Partnerships with vision insurance providers help ensure a steady flow of customers. Efficient operations and customer loyalty support the sustained profitability of these centers.

- In 2023, the vision care market was valued at approximately $49 billion in the United States.

- JCPenney's optical centers likely capture a portion of this market through their convenient in-store locations.

- Strategic partnerships with insurance companies are crucial for maintaining customer traffic.

- Efficient inventory management and customer service are key to profitability.

JCPenney's diverse product lines, including apparel, home goods, and jewelry, consistently generate substantial revenue. These segments benefit from established brand recognition, customer loyalty, and strategic promotions. In 2024, they maintained solid sales, proving their cash cow status.

| Cash Cow Segment | Revenue Contribution (2024) | Key Strategy |

|---|---|---|

| Apparel & Accessories | Significant | Focus on quality and trends |

| Home Goods | Significant | Efficient inventory control |

| Jewelry | Steady | Strategic promotions |

Dogs

Some of J. C. Penney's older store formats in struggling malls are dogs. These locations struggle with low foot traffic and sales, demanding costly, possibly ineffective, turnaround strategies. Divesting from these underperforming stores could redirect resources. In 2024, JCPenney closed several stores, a strategic move to optimize its portfolio.

Certain licensed departments at JCPenney, like underperforming coffee shops, might be dogs. These units often need investment but yield poor returns. In 2024, JCPenney's operating income was $49 million, showing areas for improvement. Divesting from these struggling departments could boost profitability.

Unsuccessful product collaborations at J. C. Penney can be classified as dogs. These initiatives, like those with certain designers, may not attract customers. They require marketing and inventory, yet offer limited returns. In 2024, J. C. Penney's strategy focused on reducing such collaborations, aiming to improve profitability. Discontinuing these quickly minimizes losses.

Clearance Merchandise

Clearance merchandise at J. C. Penney, a "Dog" in the BCG matrix, signals challenges. Large, static clearance areas suggest inventory issues and product selection problems. These sections consume capital without significant returns. Optimizing inventory and product choices can reduce clearance needs and financial losses. In 2024, J. C. Penney faced inventory challenges, impacting profitability.

- Ineffective inventory management leads to clearance sales.

- Clearance sections generate low returns, tying up capital.

- Improved forecasting and product selection are crucial.

- J. C. Penney's 2024 financial reports reflect these issues.

Certain Discontinued Product Lines

Certain discontinued product lines at J.C. Penney can be classified as dogs in the BCG matrix, representing low market share in a low-growth market. These lines, due to dwindling demand, often lead to disposal costs. Managing these lines efficiently is crucial for minimizing losses and improving overall profitability. In 2024, J.C. Penney focused on optimizing its product offerings to better meet consumer needs.

- Discontinued lines face disposal costs.

- Efficient management can improve profitability.

- J.C. Penney optimizes product offerings.

- Focus on consumer needs is key.

Dogs represent areas with low market share in a slow-growth market for J. C. Penney. These include underperforming stores and clearance merchandise, impacting profitability.

Ineffective inventory and discontinued product lines also fall into this category, leading to disposal costs and financial losses.

J. C. Penney focuses on strategies to optimize product offerings and reduce losses, as seen in its 2024 financial reports.

| Category | Impact | 2024 Strategy |

|---|---|---|

| Underperforming Stores | Low traffic, sales, high costs | Store closures, portfolio optimization |

| Clearance Merchandise | Low returns, ties up capital | Inventory optimization, reduce clearance |

| Discontinued Lines | Disposal costs, financial losses | Optimize product offerings, focus on needs |

Question Marks

JCPenney's foray into AI and digital enhancements is a question mark. These tech investments aim to boost sales, but success isn't guaranteed. In 2024, digital sales accounted for roughly 15% of total revenue. Success hinges on customer use and proper execution. Keeping a close watch on performance is crucial.

International ventures for J. C. Penney represent question marks due to high risk. Success hinges on understanding local preferences and regulations. Market research and partnerships are crucial. In 2024, international retail sales are projected to reach $6.7 trillion, highlighting the potential but also the challenges.

Subscription services at J. C. Penney, like styling boxes, are question marks. These require investments in marketing and operations. Demand for these services is unproven. Success hinges on customer engagement and adaptation. In 2024, subscription services represented a small fraction of overall retail revenue.

Pop-Up Shops

For J. C. Penney, pop-up shops represent a question mark in the BCG matrix, given the uncertainty of their success. These temporary retail spaces test new markets and formats, requiring strategic marketing and careful planning to gauge customer interest. The profitability of these pop-ups is uncertain, making performance analysis crucial for future decisions. J. C. Penney's 2024 strategy may include pop-ups to revitalize its brand.

- Pop-up shops test new markets.

- Requires strategic marketing.

- Profitability is uncertain.

- Performance analysis is crucial.

Partnerships with Emerging Brands

Partnerships with emerging brands at J. C. Penney represent a "Question Mark" in the BCG Matrix. These collaborations, while potentially attracting new customers, carry risks due to the unproven market acceptance of the partnered brands. The success of these ventures hinges on effective marketing and the appeal of the emerging brand. Monitoring sales data and customer feedback is crucial to assess the value of these partnerships.

- Unproven Market Acceptance: New brands face challenges in gaining customer trust.

- Marketing Dependency: Successful partnerships require robust promotional efforts.

- Sales Data Monitoring: Tracking sales is vital to evaluate partnership effectiveness.

- Customer Feedback: Gathering insights helps refine strategies.

JCPenney's question marks include emerging brand partnerships. These carry risks because of unproven market acceptance. Success relies on strong marketing and brand appeal. Analyzing sales data is key to assess partnership effectiveness.

| Aspect | Challenge | Action |

|---|---|---|

| Brand Trust | New brands lack customer trust. | Focus marketing to build trust. |

| Promotion | Need strong marketing efforts. | Track sales and customer feedback. |

| Performance | Evaluate partnership value. | Analyze sales data. |

BCG Matrix Data Sources

JCP's BCG Matrix leverages annual reports, financial data, and market growth metrics, enhanced by competitor analyses and industry insights.