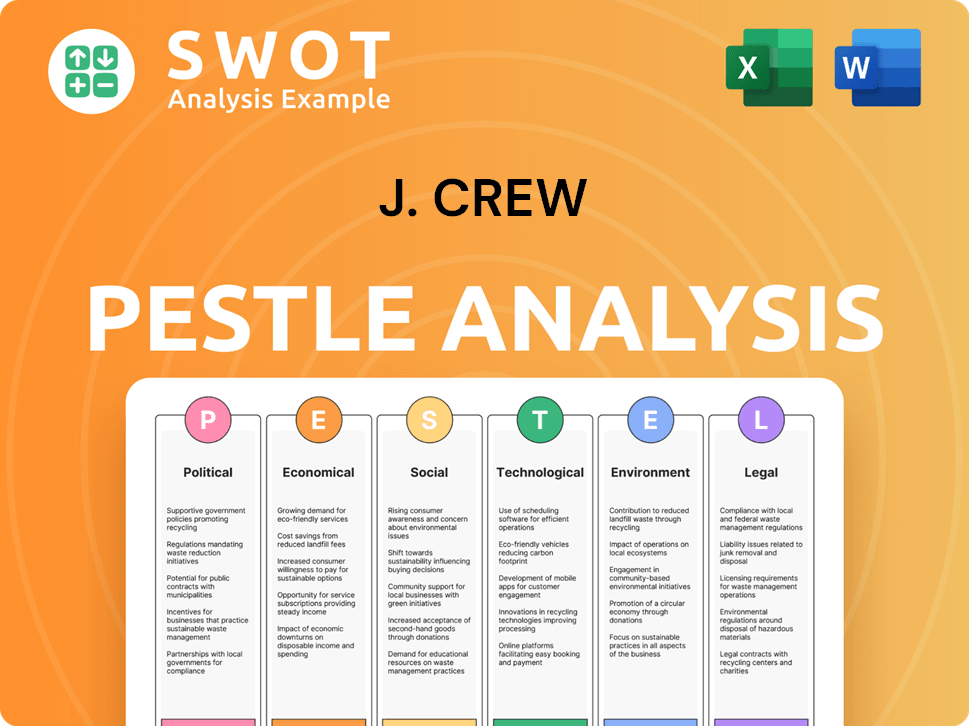

J. Crew PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J. Crew Bundle

What is included in the product

Analyzes how macro-environmental factors affect J. Crew across political, economic, social, technological, environmental, and legal dimensions.

Helps facilitate robust discussions on how external factors may affect strategy and market placement.

Full Version Awaits

J. Crew PESTLE Analysis

We're showing you the real product. After purchase, you'll instantly receive this J. Crew PESTLE analysis.

This in-depth report assesses key factors influencing J. Crew's business.

The Political, Economic, Social, Technological, Legal & Environmental aspects are all analyzed.

Explore industry trends and insights with the same document displayed here.

The analysis is comprehensive, structured, and ready to download!

PESTLE Analysis Template

Uncover the forces shaping J. Crew's future with our comprehensive PESTLE analysis. We explore political and economic factors impacting their operations and profitability.

Learn about social and technological shifts that influence consumer preferences and business strategies. Delve into legal and environmental considerations crucial for sustained growth.

Our expert analysis offers actionable insights, perfect for investors and business professionals. Ready-to-use insights will refine your strategies for success in the fashion industry. Purchase the full analysis today.

Political factors

Changes in trade policies, like those impacting apparel, significantly affect J.Crew's costs. Tariffs can increase prices; for example, in 2023, tariffs on imported textiles from China affected many US retailers. Political stability in manufacturing regions is crucial. The US-Mexico-Canada Agreement (USMCA) affects J.Crew's sourcing.

J.Crew's global sourcing strategy is sensitive to political climates. Political instability in sourcing countries like China, Vietnam, or India can disrupt production. For instance, in 2024, political tensions impacted supply chains, leading to increased costs. Any governmental changes or trade policy shifts can also affect J.Crew's operational expenses.

J.Crew faces political risks tied to labor regulations, particularly concerning minimum wage and working conditions. Complying with varying labor laws across its operational and manufacturing locations impacts costs. In 2024, the U.S. federal minimum wage remains $7.25, but many states and cities have higher rates, affecting J.Crew's store operations. Ethical sourcing and compliance are crucial to avoid legal issues and maintain brand reputation.

Taxation Policies

Changes in corporate tax rates significantly impact J.Crew's financial strategies. For instance, the 2017 Tax Cuts and Jobs Act in the U.S. lowered the corporate tax rate from 35% to 21%, potentially boosting J.Crew's profitability. Fluctuations in international tax laws also affect its global operations and tax liabilities. Effective tax planning is crucial for J.Crew to optimize its financial performance.

- Corporate tax rate changes can directly affect J.Crew's bottom line.

- International tax regulations influence global operations.

- Tax planning is a key financial strategy.

Political Influence on Consumer Confidence

Political factors significantly influence consumer confidence, which directly affects discretionary spending on items like apparel. Economic uncertainty stemming from political events can cause consumers to cut back on non-essential purchases. For instance, shifts in trade policies or tax regulations can impact consumer sentiment and spending habits. The apparel industry, including J. Crew, is sensitive to these fluctuations.

- Consumer confidence index in the U.S. has shown volatility during election years, impacting retail sales.

- Changes in import tariffs can raise costs, affecting pricing strategies and consumer demand for apparel.

Political factors critically impact J.Crew. Trade policies affect costs and sourcing; USMCA is key. Labor regulations and tax rates also influence operations and finances. Consumer confidence, linked to political events, affects spending.

| Political Factor | Impact | 2024/2025 Data/Example |

|---|---|---|

| Trade Policies | Affects costs, sourcing, and pricing. | Tariffs on Chinese textiles, USMCA trade deals. |

| Labor Regulations | Impacts operational costs and brand reputation. | U.S. federal minimum wage $7.25; state variations. |

| Tax Policies | Influences financial strategies and profitability. | Corporate tax rates; international tax regulations. |

Economic factors

J.Crew's success heavily relies on consumer spending habits and disposable income within its customer base. During economic downturns, like the 2023-2024 period, discretionary spending on apparel often declines. High inflation, which averaged 3.1% in 2024, can also squeeze budgets, impacting sales.

J.Crew faces currency risks due to its global presence. A stronger dollar increases import costs, impacting profitability. In 2024, the USD's strength against the Euro and Yen impacted retail margins. Currency volatility requires hedging strategies to stabilize financials. Changes in exchange rates directly affect pricing strategies and international competitiveness.

Inflation remains a key concern for J.Crew. Rising inflation rates in 2024, hovering around 3-4% in the US, increase production costs. This can squeeze profit margins if J.Crew can't fully pass these costs to consumers. Reduced consumer spending due to inflation impacts sales, as apparel is often a discretionary purchase.

Economic Growth and Recession

Economic growth and recession are pivotal for J.Crew. Strong economic growth typically boosts consumer spending, benefiting retailers. Conversely, a recession can curb discretionary spending, impacting sales and profitability. The U.S. GDP grew by 3.3% in Q4 2023, showing resilience. However, interest rate hikes could slow down growth in 2024/2025.

- U.S. retail sales increased by 0.6% in January 2024.

- Consumer confidence, as measured by the Conference Board, was at 114.8 in February 2024.

- Economists predict a possible slowdown in the second half of 2024.

Interest Rates

Interest rate fluctuations significantly influence J.Crew's financial strategy. Changes in rates directly affect the cost of borrowing for investments like new stores. For example, in late 2024, the Federal Reserve held interest rates steady, impacting J.Crew’s expansion plans. High rates can increase expenses, potentially delaying projects.

- Federal Reserve held rates steady in late 2024.

- Higher rates may delay expansion plans.

J.Crew's performance is directly tied to consumer spending; retail sales rose 0.6% in January 2024. Inflation pressures and fluctuating interest rates impact costs and expansion strategies. Economists anticipate a possible slowdown in the latter half of 2024, affecting financial planning.

| Economic Factor | Impact on J.Crew | 2024/2025 Data |

|---|---|---|

| Consumer Spending | Influences sales | U.S. retail sales +0.6% Jan 2024 |

| Inflation | Raises costs, impacts margins | Averaged 3.1% in 2024 |

| Interest Rates | Affect borrowing costs | Federal Reserve held rates steady late 2024 |

Sociological factors

Consumer preferences are always changing, impacting J.Crew. Fashion trends and lifestyle shifts require the brand to adapt. In 2024, the athleisure market is still growing, with a 6% increase expected. J.Crew must stay relevant. This is essential for sustained success.

Changing demographics significantly influence J.Crew's consumer base. The aging population, with increased disposable income, presents opportunities, as does the growing multicultural market. In 2024, the median age in the U.S. is about 39 years, and household incomes vary widely. J.Crew must adapt product lines and marketing to reflect these shifts. These changes require nuanced strategies for success.

Social media and fashion influencers heavily impact consumer trends. J.Crew must leverage these channels for marketing. As of early 2024, influencer marketing spending hit $21.1 billion globally. Effective use can boost brand visibility and sales.

Consumer Awareness of Sustainability and Ethical Practices

Consumers are increasingly prioritizing sustainability, ethical sourcing, and corporate social responsibility, influencing their buying decisions. J.Crew's brand image and appeal are significantly impacted by its commitment to these areas. A 2024 study revealed that 70% of consumers prefer brands with sustainable practices. Ignoring these trends could lead to a decline in sales and brand loyalty. Companies like J.Crew must adapt to meet evolving consumer values.

- 70% of consumers favor sustainable brands (2024).

- Ethical sourcing is a key consumer demand.

- CSR affects brand perception and loyalty.

- J.Crew's actions shape its market position.

Lifestyle Changes and Casualization of Dress

Lifestyle changes, including a broader societal shift towards casual dress codes, pose a challenge for J.Crew. The demand for traditional tailored clothing may decrease. To stay relevant, J.Crew must adapt its product mix. This includes offering more casual, versatile options. The global casual wear market is projected to reach $400 billion by 2025.

- Casual wear market growth.

- Adaptation of product lines.

- Consumer preference shifts.

- Impact on tailored clothing.

Changing social values are key. Consumer choices are swayed by sustainability and ethical practices. J.Crew's brand image heavily depends on its stance, 70% of consumers prefer sustainable brands.

| Aspect | Details |

|---|---|

| Sustainability Preference | 70% favor sustainable brands (2024). |

| Market Demand | Casual wear market projected to $400B (2025). |

| Influencer Impact | $21.1B spent on influencer marketing (early 2024). |

Technological factors

E-commerce is vital for J.Crew's success. With online sales growing, a robust digital presence is crucial. J.Crew needs to enhance its platforms and mobile experience. In 2024, e-commerce accounted for 40% of total retail sales. Investment in digital marketing is also necessary.

Supply chain tech advancements boost efficiency. Inventory systems and logistics upgrades cut costs. J.Crew could see faster, reliable deliveries. In 2024, supply chain tech spending hit $22.9B. Expect further gains by 2025.

J.Crew leverages data analytics to understand customer behavior, personalizing marketing. This includes tailored product recommendations and shopping experiences. In 2024, personalized marketing spending hit $3.5 billion, reflecting its importance. J.Crew can improve customer engagement and sales with data-driven strategies. This boosts customer lifetime value.

In-store Technology

In-store technology plays a crucial role for J. Crew. By 2024, they've integrated tech like POS systems and inventory tracking. This boosts efficiency and customer satisfaction. These tools allow for features like endless aisle.

- POS systems streamline transactions.

- Inventory tracking reduces stockouts.

- Customer experience is enhanced.

Social Media and Digital Marketing Platforms

J.Crew must harness social media and digital marketing. These tools are key for brand awareness and driving sales. In 2024, digital ad spending hit $225 billion, a 12% increase. Effective campaigns can boost online traffic significantly. The company should focus on data analytics to refine its strategies.

- Digital ad spending is projected to reach $250 billion by 2025.

- Social media marketing budgets grew by 15% in 2024.

- E-commerce sales account for 40% of J.Crew's revenue.

E-commerce is vital, with online sales being 40% of retail revenue in 2024. Supply chain tech, a $22.9B industry in 2024, enhances efficiency through inventory systems. Data analytics, with $3.5B spent on personalized marketing in 2024, personalizes customer experiences and boosts engagement. In-store tech like POS systems and inventory tracking is also important.

| Technology Area | 2024 Spend (USD) | Impact for J.Crew |

|---|---|---|

| E-commerce | 40% of retail sales | Key sales channel |

| Supply Chain Tech | $22.9B | Efficient operations |

| Personalized Marketing | $3.5B | Enhanced customer experience |

Legal factors

J.Crew faces legal obligations related to labor laws, encompassing minimum wage, working hours, and benefits. These regulations vary significantly across different countries and states, impacting operational costs. For instance, the U.S. federal minimum wage is $7.25 per hour, but many states and cities have higher rates. J.Crew must adapt to these diverse legal landscapes to avoid penalties and ensure compliance.

J.Crew must adhere to consumer protection laws, including product safety regulations, advertising standards, and consumer rights. The U.S. Federal Trade Commission (FTC) and similar agencies globally enforce these laws, impacting product design, marketing, and sales. In 2024, the FTC reported over $3.4 billion in refunds to consumers due to deceptive practices. J.Crew's compliance ensures consumer trust and avoids legal penalties.

J.Crew must adhere to international trade regulations. This includes customs rules and tariffs impacting material sourcing and product sales. For instance, in 2024, the US imposed tariffs on certain Chinese goods, affecting apparel imports. These tariffs can significantly increase costs, impacting profitability. Compliance is vital to avoid penalties and ensure smooth supply chain operations.

Data Privacy and Security Laws

J.Crew's online operations require strict adherence to data privacy laws like GDPR and CCPA to safeguard customer data. Non-compliance can lead to hefty fines; for instance, GDPR fines can reach up to 4% of a company’s annual global turnover. In 2024, data breaches cost companies an average of $4.45 million globally. This necessitates robust data protection measures.

- GDPR fines can be up to 4% of global turnover.

- Average cost of a data breach in 2024: $4.45M.

Intellectual Property Laws

J.Crew heavily relies on intellectual property laws to safeguard its brand. This includes trademarks for its name and logos, as well as copyrights for its unique designs and marketing materials. Protecting these assets is vital for preventing counterfeiting and maintaining customer trust. In 2024, the brand faced legal challenges related to intellectual property, underscoring the importance of robust protection. These legal battles can impact J.Crew's financial performance and brand image.

- Trademark Infringement: Legal actions against counterfeiters.

- Copyright Protection: Securing original designs.

- Brand Identity: Maintaining unique market position.

- Financial Impact: Legal costs and revenue protection.

Legal factors shape J.Crew's operations, from labor laws impacting wages to consumer protection. Adherence to international trade regulations is essential for sourcing and sales. Data privacy compliance, especially under GDPR and CCPA, protects customer information. J.Crew must actively manage these legal aspects to ensure smooth business functions.

| Legal Area | Regulation | Impact on J.Crew |

|---|---|---|

| Labor Laws | Minimum Wage | $7.25/hour federal |

| Consumer Protection | FTC Compliance | $3.4B in refunds (2024) |

| Data Privacy | GDPR/CCPA | Data breach cost $4.45M (2024) |

Environmental factors

J.Crew faces pressure to adopt sustainable practices. Consumers increasingly favor eco-friendly brands. In 2024, the sustainable fashion market grew, with ethical sourcing a key factor. J.Crew must reduce waste and ensure fair labor to stay competitive.

Climate change poses risks to J.Crew's supply chain. Rising sea levels and extreme weather could disrupt the availability of raw materials. For instance, cotton prices saw fluctuations in 2024 due to weather-related harvest issues. Store operations may be affected by severe weather.

J.Crew must focus on waste management and recycling to lessen its environmental footprint. This includes recycling programs in stores and warehouses. The fashion industry, with J.Crew included, faces increasing pressure to reduce waste. In 2024, the global waste management market was valued at $2.1 trillion. Compliance with regulations is key for J.Crew.

Water Usage and Conservation

The apparel industry, including J.Crew, faces scrutiny regarding water usage. J.Crew's commitment to water conservation in its supply chain is a key environmental factor. Reducing water consumption is critical for sustainability and cost management. Water scarcity in manufacturing regions impacts operations.

- Textile dyeing and finishing are particularly water-intensive processes.

- Water footprint reduction is a focus of sustainability reports.

- J.Crew may collaborate with suppliers to implement water-saving technologies.

- Investments in water treatment and recycling systems can also be expected.

Chemical Usage and restricted Substances

J.Crew must navigate stringent regulations and consumer concerns related to chemical usage in textile production. The brand needs to comply with evolving environmental standards, such as the European Union's REACH regulation, which restricts harmful substances. Failure to adhere to these regulations can result in significant financial penalties and damage to brand reputation. Increased consumer awareness of sustainable practices demands that J.Crew ensures its supply chain avoids restricted substances.

- REACH regulation compliance is essential to avoid penalties.

- Consumer demand for eco-friendly products is growing.

- Supply chain transparency is crucial for building trust.

J.Crew must adapt to growing environmental pressures to stay relevant. Climate risks threaten supply chains, with cotton price fluctuations rising due to weather. Sustainable practices, waste reduction, and water conservation are critical, backed by a $2.1 trillion waste management market in 2024. J.Crew must also adhere to chemical usage regulations like REACH to mitigate penalties.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Sustainability Market | Consumer Preference | Grew, Ethical sourcing is a key factor |

| Waste Management Market | Regulatory Compliance | $2.1 trillion global value |

| Water Issues | Production and Operations | Textile dyeing/finishing |

PESTLE Analysis Data Sources

J.Crew's PESTLE relies on diverse sources: market research firms, government reports, industry publications, and financial analysis. This provides a robust perspective.