Jeronimo Martins Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jeronimo Martins Bundle

What is included in the product

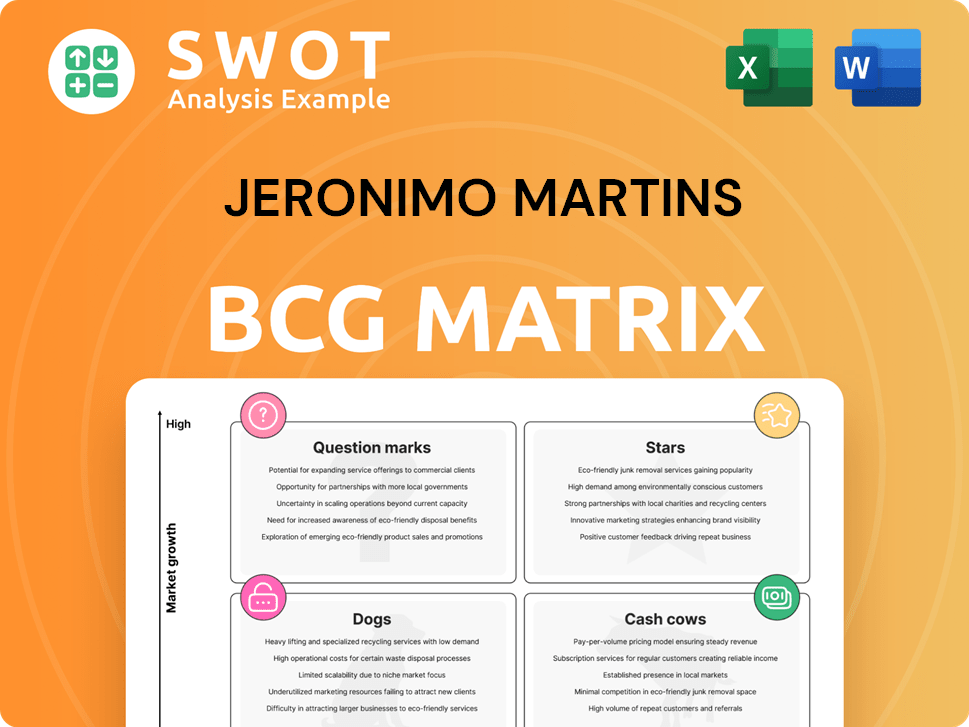

Jeronimo Martins' BCG Matrix: analysis by Stars, Cash Cows, Question Marks, and Dogs.

Export-ready design for quick drag-and-drop into PowerPoint, helping communicate Jeronimo Martins' strategic vision quickly.

Delivered as Shown

Jeronimo Martins BCG Matrix

The BCG Matrix preview mirrors the final document delivered after purchase, showcasing Jeronimo Martins' strategic portfolio analysis. This is the complete, ready-to-use report; no hidden content or alterations exist in the full version. You'll receive the identical, professionally-formatted file, instantly available for your strategic needs. Designed with precision, it aids in informed decision-making for your business.

BCG Matrix Template

Explore Jeronimo Martins' product portfolio through the lens of the BCG Matrix. This analysis categorizes their offerings as Stars, Cash Cows, Dogs, or Question Marks, revealing their market potential. This preview offers a glimpse into their strategic landscape, highlighting key strengths and areas for improvement. Understanding these dynamics is crucial for informed investment decisions. Discover how Jeronimo Martins allocates resources across its diverse brands. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Biedronka, the leading supermarket chain in Poland, is a star within Jeronimo Martins' portfolio, driving significant revenue and EBITDA. In 2024, Biedronka's sales reached €17.8 billion, reflecting its strong market position. With plans to open 130-150 new stores in Poland in 2025, Biedronka is poised for continued growth. The expansion into Slovakia further enhances its potential.

Ara has shown robust growth in Colombia, even amid economic hurdles; in 2024, sales rose, and the EBITDA margin improved. The brand's focus on affordable food and social programs, like '1 Million Reasons,' boosts its appeal. Integrating former Colsubsidio stores and opening over 150 new stores will help Ara gain more market share. In 2023, Ara's sales in Colombia reached €2.2 billion.

Hebe, a star in Jeronimo Martins' portfolio, saw remarkable sales growth and market expansion, notably into Czechia. Its specialized health and beauty retail strategy, coupled with a strong e-commerce presence, fuels its growth. The chain plans around 30 new Polish store openings this year, emphasizing its digital channel. In 2024, Hebe's sales increased by 18.7%.

Agri-food Business

Jeronimo Martins is eyeing significant growth in the agri-food sector, potentially establishing a new business arm within the food industry. This strategic move aims to capitalize on the rising consumer demand for sustainable and high-quality food options. The company's current agribusiness ventures and investments lay a solid foundation for expansion and increased market relevance. This expansion could be a great opportunity for Jeronimo Martins.

- Agri-food market projected to reach $8.3 trillion by 2025.

- Jeronimo Martins reported a revenue of €30.6 billion in 2023.

- The company's investments in agribusiness are growing.

- Diversification into agri-food can boost revenue streams.

Sustainable Finance Initiatives

Jeronimo Martins shines in sustainable finance, boasting inclusion in over 140 sustainability indices. Roughly 25% of its financial debt is in sustainable finance, boosting its appeal to green investors. This commitment, coupled with efforts to cut its carbon footprint, strengthens its brand.

- Sustainability indices: Included in over 140.

- Sustainable debt: Approximately 25% of financial debt.

Biedronka, Hebe, and Ara are key Stars. These segments drive revenue growth and market expansion. Jeronimo Martins invests heavily to sustain their success. The agri-food sector also shows Star potential.

| Segment | 2024 Sales (€ Billions) | Key Growth Drivers |

|---|---|---|

| Biedronka | 17.8 | Store expansion, market leadership. |

| Ara (Colombia) | 2.2 | Affordable pricing, new store openings. |

| Hebe | N/A | E-commerce, market expansion. |

Cash Cows

Pingo Doce, a major supermarket chain in Portugal, is a cash cow for Jeronimo Martins. It boasts a strong market position in a mature retail sector. The chain’s steady, reliable revenue stream is supported by its customer loyalty. In 2024, Pingo Doce celebrated 45 years of serving generations of customers.

Recheio, Jeronimo Martins' cash & carry arm in Portugal, is a cash cow. It caters to the out-of-home consumption sector. Despite limited growth, its strong market position and efficiency initiatives ensure steady cash flow. In 2023, Recheio's sales were €1.7 billion. The remodelling of cash-and-carry stores and Amanhecer expansion are strategic moves.

Jeronimo Martins' private label products are cash cows, especially in Portugal and Poland. These products drive profitability and customer loyalty through quality and affordability. By 2023, over 90% of their Private Brand products in these countries were free of artificial colorants. This focus on quality and sustainability enhances their appeal.

Real Estate Assets

Jeronimo Martins leverages its real estate portfolio, including stores and distribution centers, as a consistent value driver. Investments in store upgrades and new distribution centers boost asset value. By 2024, over 2,000 locations featured photovoltaic cells, reinforcing their commitment to sustainability. Jerónimo Martins maintained its A-list status in the CDP Climate assessment.

- Real estate portfolio provides a stable source of value.

- Ongoing investments enhance asset value.

- Over 2,000 locations with photovoltaic cells.

- A-list company in the CDP Climate assessment.

Strong Supplier Relationships

Jeronimo Martins' "Cash Cows" status benefits from strong supplier relationships. This is particularly evident in Portugal and Poland, where the company secures a reliable supply of quality products. These relationships also enable favorable pricing terms. Jeronimo Martins' commitment to local communities further strengthens these ties.

- Over 90% of products in mature markets come from local suppliers.

- This strategy ensures supply chain resilience.

- It also supports local economies.

- Favorable pricing terms enhance profitability.

Jeronimo Martins' Cash Cows generate steady revenue and strong cash flow. They hold dominant market positions in mature sectors. This allows consistent reinvestment and supports long-term stability.

| Cash Cow | Key Characteristics | 2024 Data Highlights |

|---|---|---|

| Pingo Doce | Strong market position; customer loyalty. | 45 years serving customers, stable revenue streams. |

| Recheio | Cash & carry; out-of-home consumption. | 2023 sales: €1.7 billion; remodeling efforts. |

| Private Label | Quality; affordability; customer loyalty. | 90%+ products without artificial colorants in key markets. |

Dogs

Jeronymo and Hussel, as specialized retail banners, might struggle with market share and growth. These brands, part of the Specialised retail, could need substantial investment. In 2024, specialized retail saw a 2.5% decline in sales. Divestiture might be an option if performance doesn't improve.

In Jeronimo Martins' BCG Matrix, operations in highly volatile regions, such as those with geopolitical instability, are considered Dogs. These operations face low growth and market share due to external factors. The company is aware of European market volatility, expecting it to continue into at least the first half of 2024. For example, in 2023, the company's performance was impacted by economic challenges.

Underperforming franchised stores within Jeronimo Martins' network, consistently missing sales goals, fit the "Dogs" category in a BCG matrix. Turnaround strategies are often costly and ineffective. In 2024, specific store closures or restructuring may occur if performance doesn't improve. According to recent reports, the company has been focusing on optimizing its store portfolio.

Products with declining demand

Dogs within Jeronimo Martins' portfolio include product lines with declining demand or facing strong competition. These offerings, in low-growth markets with low market share, often need substantial marketing investment. Alternatively, they might be phased out to focus resources on more promising areas. In 2024, specific product categories like certain non-essential food items or less popular private-label brands could fall into this category.

- Declining sales or market share.

- Low growth markets.

- Potential need for high marketing costs.

- Risk of being phased out.

Inefficient Distribution Centers

Inefficient distribution centers, characterized by high costs and low throughput, pose a challenge for Jeronimo Martins. These centers, which may need modernization or consolidation, are considered "Dogs" in the BCG matrix. Dogs have low market share and growth, often just breaking even. For example, in 2023, logistics costs represented approximately 2.5% of Jeronimo Martins' revenue.

- Inefficient operations lead to increased expenses.

- These centers may require capital for upgrades.

- They typically have minimal impact on cash flow.

- Strategic decisions are needed to enhance efficiency.

In Jeronimo Martins' BCG matrix, "Dogs" represent underperforming areas. These may include product lines or operations with low growth and market share. Such as, underperforming franchised stores. These often require significant restructuring or are phased out.

| Category | Examples | Characteristics |

|---|---|---|

| Operational Inefficiency | Inefficient distribution centers | High costs, low throughput, minimal cash flow. |

| Market Challenges | Operations in volatile regions | Low growth, market share affected by external factors. |

| Product Underperformance | Declining product lines | Low demand, high marketing costs, potential for phasing out. |

Question Marks

Jeronimo Martins' Slovakian venture, under the Biedronka banner, is a question mark in its BCG matrix. The company is investing heavily, with about 1.1 billion euros planned for 2025, mirroring 2024's investment. They aim for at least 50 stores in Slovakia by 2026. Market reception and competition will determine its future.

New product launches are question marks in Jeronimo Martins' BCG Matrix, aiming to tap into new segments and adapt to consumer trends. Success hinges on marketing, distribution, and consumer acceptance. In 2024, consider the impact of new private label goods, a key strategy for market penetration.

Jeronimo Martins' online retail ventures, like e-commerce platforms and delivery services, are question marks in its BCG Matrix. Their success hinges on customer experience, pricing, and logistics. Hebe's online sales were nearly 20% of its revenue. Hebe's sales went up to €583 million in 2024 with a 24.3% surge.

Investments in Technology

Investments in tech, like automation and AI, position Jeronimo Martins as a question mark. These investments aim to boost efficiency and tailor customer experiences. The success hinges on seamless integration and effective execution within existing systems. Question marks are characterized by high investment needs but potentially low returns due to limited market share.

- In 2024, Jeronimo Martins' capital expenditure reached €797 million.

- The company is investing heavily in digital transformation initiatives.

- These include projects to improve logistics and supply chain management.

- The focus is on leveraging data analytics for smarter decision-making.

Ventures into New Geographies

Ventures into new geographic markets would position Jeronimo Martins in the "Question Marks" quadrant of the BCG Matrix. This is because these expansions necessitate substantial investment and pose inherent risks. The company's existing operations are primarily in Portugal, Poland, and Colombia, with plans to enter Slovakia in November. Expansion into new territories requires careful assessment of market dynamics.

- Geographic Focus: Portugal, Poland, Colombia, and upcoming Slovakia.

- Expansion Risk: High investment and market uncertainty.

- Strategic Importance: "Motherland" status for Portugal.

- Market Analysis: Crucial for success in new regions.

Jeronimo Martins' Slovakian expansion and new product launches are question marks due to high investment needs and uncertain returns. Online retail ventures face challenges in customer experience and logistics. Investments in technology aim to boost efficiency, but success depends on integration and execution.

| Aspect | Status | Key Considerations |

|---|---|---|

| Slovakia Expansion | Question Mark | Investment: €1.1B (2025), Market Reception |

| New Products | Question Mark | Marketing, Distribution, Consumer Acceptance |

| Online Retail | Question Mark | Customer Experience, Pricing, Logistics |

BCG Matrix Data Sources

The Jeronimo Martins BCG Matrix relies on public financial filings, retail sector reports, and market share analysis.