Jio Financial Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jio Financial Services Bundle

What is included in the product

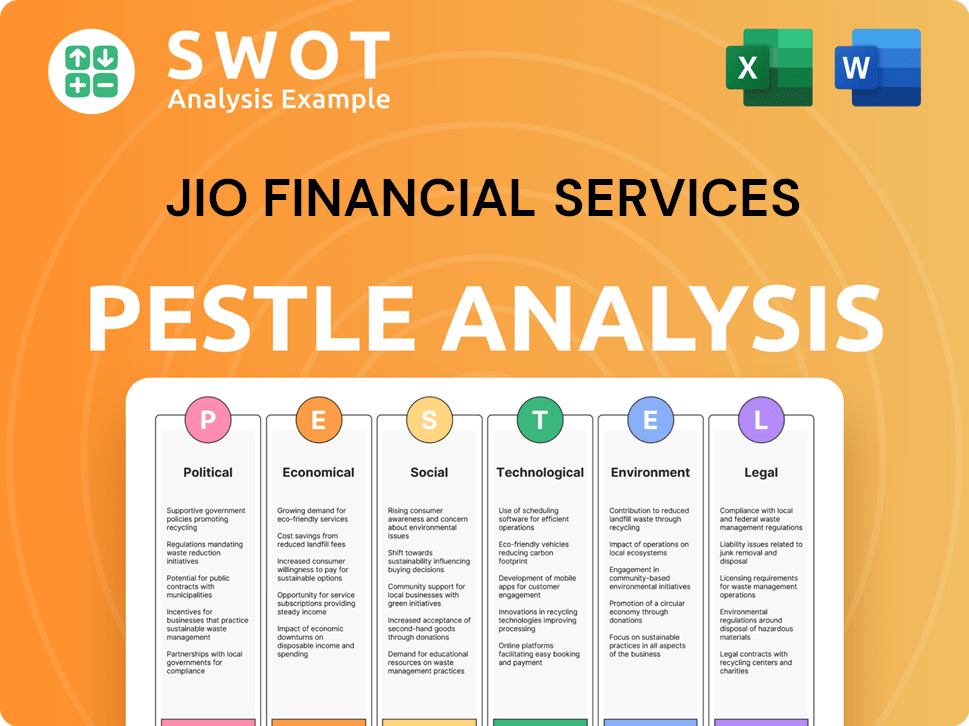

This PESTLE analysis examines external factors impacting Jio Financial Services. It helps identify threats and opportunities.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Jio Financial Services PESTLE Analysis

This preview showcases the complete Jio Financial Services PESTLE Analysis. It details political, economic, social, technological, legal & environmental factors. The content is fully accessible and professionally formatted. You will receive this exact, ready-to-use analysis instantly after purchase.

PESTLE Analysis Template

Jio Financial Services faces a complex external landscape, shaped by factors like India's evolving financial regulations and rapid tech advancements. Analyzing political stability, economic growth, and societal trends is crucial for strategic planning. We’ve assessed these external forces to deliver crucial insights on its performance. Get ahead! Buy the full PESTLE analysis and gain essential intelligence now.

Political factors

Jio Financial Services operates within India's financial sector, heavily shaped by RBI regulations. These rules cover licensing, operations, and consumer protection. In 2024, the RBI introduced stricter KYC norms, affecting digital lenders. Such regulatory shifts necessitate constant adaptation. For example, the RBI increased the risk weights for unsecured loans in November 2023, impacting NBFCs like Jio Financial.

The Indian government's Digital India initiative strongly supports digital financial services. In 2024, the government allocated ₹6,400 crore to promote digital payments infrastructure. Jio Financial Services aligns with these goals, potentially receiving government backing. This focus on financial inclusion offers Jio opportunities for growth, especially in underserved areas. Initiatives like UPI have boosted digital transactions, reaching ₹18.28 trillion in May 2024.

Political stability in India is vital for business. It fosters investor confidence, crucial for companies like Jio Financial Services. Stable conditions support long-term strategic planning and effective execution. India's GDP growth in 2024-2025 is projected at 6.5-7.0%, reflecting stable economic policies.

Relationship with Government

Jio Financial Services' relationship with the Indian government is crucial for its operations. A collaborative approach helps in navigating regulations and aligning with national initiatives. Given its parentage within Reliance Industries, Jio Financial Services likely benefits from pre-existing government relationships. This can streamline approvals and facilitate policy alignment. The Indian financial services market is heavily regulated, making these connections particularly valuable.

- Reliance Industries has received significant government support for various projects, indicating a strong relationship.

- The government's focus on digital financial inclusion aligns with Jio Financial Services' goals.

- Regulatory changes, such as those impacting digital lending, directly affect Jio Financial Services.

Policy Shifts

Policy shifts significantly shape Jio Financial Services. Government regulations on fintech, data privacy, and digital payments directly affect its operations. Staying compliant with evolving policies is crucial for sustained growth. For example, India's digital payments market is projected to reach $10 trillion by 2026.

- Data protection laws like the Digital Personal Data Protection Act, 2023, require compliance.

- Changes in FDI policies can impact foreign partnerships.

- Regulatory changes could affect the company's lending practices.

Political factors strongly influence Jio Financial Services' operations. The Digital India initiative, with a ₹6,400 crore allocation in 2024, supports digital finance. Stable Indian political conditions, coupled with projected 6.5-7.0% GDP growth in 2024-2025, foster investor confidence.

| Aspect | Impact | Example/Data |

|---|---|---|

| Digital India Initiative | Supports growth via government backing | ₹6,400 crore allocated in 2024 |

| GDP Growth | Attracts Investments | Projected 6.5-7.0% (2024-2025) |

| Government Relationship | Streamlines approvals and aligns with national initiatives | Reliance's Projects and focus on financial inclusion |

Economic factors

India's strong economic growth, with a projected GDP increase, sets a positive backdrop. This expansion fuels higher disposable incomes, boosting demand for financial services. Jio Financial Services stands to gain from this as more people seek loans, investments, and insurance. For instance, India's economy is expected to grow by 6.5-7% in fiscal year 2024-2025.

Inflation significantly affects consumer behavior and operational costs. Moderate inflation might boost spending, but high inflation could strain Jio Financial Services' pricing. In India, inflation was at 4.83% in April 2024, impacting financial services' pricing. For 2025, forecasts suggest continued monitoring is crucial for strategic planning.

Interest rates, shaped by the Reserve Bank of India (RBI), are crucial. They impact borrowing costs for both people and businesses. As of May 2024, the repo rate is 6.50%. Lower rates can boost loan demand, benefiting Jio Financial Services. Higher rates could slow down its lending activities.

Consumer Spending Patterns

Consumer spending is shifting, with digital transactions becoming more popular, which benefits Jio Financial Services. E-commerce's growth opens doors for their services, aligning with current trends. In 2024, digital payments in India are projected to reach $1.5 trillion. This shift towards digital and value-focused purchases creates a favorable environment.

- Digital payments in India are expected to hit $1.5 trillion in 2024.

- E-commerce is booming, creating new markets.

- Consumers are increasingly seeking value.

Investment in Infrastructure

Investments in infrastructure are vital for Jio Financial Services to broaden its financial service offerings across India. Reliance Industries, the parent company, has already invested significantly in digital infrastructure, which Jio Financial Services can utilize to improve its service delivery. This includes extensive network coverage and data centers, critical for digital financial transactions. The Indian government's focus on infrastructure development, with planned investments of ₹111 lakh crore under the National Infrastructure Pipeline (NIP), further supports Jio Financial Services' growth.

- ₹111 lakh crore planned under NIP.

- Reliance has invested billions in digital infrastructure.

- Enhanced service delivery through existing infrastructure.

India's GDP growth, estimated at 6.5-7% in fiscal year 2024-2025, supports higher consumer spending on financial services. Digital payments, projected to reach $1.5 trillion in 2024, underscore the shift to digital platforms, favoring Jio Financial Services. Infrastructure investments, backed by ₹111 lakh crore NIP, boost expansion.

| Factor | Impact | Data Point (2024/2025) |

|---|---|---|

| GDP Growth | Positive | 6.5-7% (Fiscal Year 2024-2025) |

| Digital Payments | Positive | $1.5 trillion (Projected 2024) |

| Infrastructure Investment | Positive | ₹111 lakh crore (NIP) |

Sociological factors

Digital literacy and smartphone use are increasing in India, boosting the need for digital financial services. Jio Financial Services' tech-focused approach fits this well. In 2024, India had over 800 million internet users, showing a huge market for digital finance.

Consumer behavior is shifting towards digital financial services. Jio Financial Services should focus on user-friendly, personalized experiences. Gen Z, a tech-savvy demographic, prioritizes digital services. In 2024, mobile banking adoption among Gen Z reached 78%. They still value human interaction for major financial decisions.

Awareness of financial security is rising, boosting demand for products like insurance. Jio Financial Services can capitalize on this. India's insurance market grew by 15% in FY24. This trend offers Jio a chance to broaden its insurance products, reaching more customers. In 2024-2025, expect further growth.

Urbanization and Rural Penetration

Urbanization and rural penetration are key sociological factors for Jio Financial Services. Rapid urbanization coupled with the drive to expand financial services into semi-urban and rural regions presents major growth opportunities. Jio Financial Services can utilize its extensive network to access these underserved markets, providing easy-to-use financial products. This strategy is critical, especially considering the substantial growth in digital financial adoption across India.

- India's urban population is projected to reach 675 million by 2036.

- Rural internet penetration is increasing, with over 300 million rural internet users in 2024.

- Jio's extensive telecom reach provides a platform for financial services penetration.

Trust and Confidence

Building trust and confidence is crucial for Jio Financial Services. They must prioritize robust security measures, transparent practices, and reliable services to succeed. This is especially important in India's financial sector, where digital transactions are rapidly growing. In 2024, the digital payments market in India was valued at approximately $1.2 trillion, showcasing the need for secure systems. Jio Financial Services aims to capture a significant portion of this market, requiring strong customer trust.

- India's digital payments market reached $1.2T in 2024.

- Customer loyalty hinges on security and transparency.

- Jio Financial must compete with established players.

- Reliable services are key to market share growth.

Sociological factors drive Jio Financial Services. Urbanization, with 675M urban Indians expected by 2036, fuels growth. Rural internet, at 300M+ users in 2024, expands digital reach. Consumer trust is crucial in India's $1.2T digital payments market in 2024.

| Factor | Details | Impact for Jio |

|---|---|---|

| Digital Literacy | 800M+ internet users in 2024. | Opportunity to offer user-friendly services |

| Consumer Behavior | Gen Z mobile banking adoption at 78% in 2024. | Needs personalized and user-friendly services. |

| Financial Awareness | India's insurance market grew 15% in FY24. | Chance to widen financial product portfolio. |

Technological factors

The Indian fintech landscape is booming, fueled by AI, blockchain, and digital payments. Jio Financial Services can capitalize on these tech advancements. In 2024, digital payments in India surged, with UPI transactions hitting ₹18.41 trillion in value monthly. This creates opportunities for JFS to expand its digital offerings.

India's digital payment infrastructure, particularly UPI, has seen explosive growth. In 2024, UPI transactions reached a record high, processing over 10 billion transactions monthly. Jio Financial Services can leverage this to offer easy payment solutions. This integration will enhance user experience and drive financial inclusion.

AI and Machine Learning are revolutionizing financial services. They're used for fraud detection, risk assessment, and personalized services. Jio Financial Services can leverage AI/ML. This could improve security and offer tailored solutions. The global AI in fintech market is projected to reach $26.7 billion by 2025.

Data Analytics and Personalization

Data analytics is crucial for financial services to understand customer behavior and personalize offerings. Jio Financial Services can leverage data to offer customized financial products and improve customer engagement, potentially increasing market share. For instance, the global data analytics market in finance is projected to reach $68.4 billion by 2025. This focus allows for tailored services.

- Personalized financial products.

- Improved customer engagement.

- Data-driven decision-making.

- Increased market share.

Cybersecurity

Cybersecurity is crucial for Jio Financial Services due to its digital operations. They need to protect customer data and prevent fraud. Consider the 2024 cybercrime cost projections, estimated at over $10.5 trillion. This includes breaches and financial losses. Robust security measures are vital to maintain customer trust.

- Investment in advanced threat detection systems.

- Regular security audits and penetration testing.

- Employee training on cybersecurity best practices.

- Compliance with data protection regulations.

Jio Financial Services benefits from India's tech boom with AI and digital payments, where UPI transactions hit ₹18.41 trillion monthly in 2024. They can leverage AI for security and personalization; the AI in fintech market could hit $26.7 billion by 2025. Data analytics aids customization, with the financial analytics market projected to reach $68.4 billion by 2025. Cybersecurity investments are crucial amid rising cybercrime, estimated at over $10.5 trillion in 2024.

| Factor | Details | Impact |

|---|---|---|

| Digital Payments | UPI transactions, growth in value. | Increased accessibility, revenue |

| AI/ML | Fraud detection, personalization | Enhanced security and service. |

| Data Analytics | Personalized products and customer data. | Higher engagement, wider reach. |

| Cybersecurity | Protect data. | Trust and data protection. |

Legal factors

Jio Financial Services (JFS) navigates India's financial regulations, primarily under the RBI. Compliance with licensing and capital requirements is crucial. Recent data shows the RBI's focus on fintech, with stricter rules. JFS must adapt to these evolving standards to remain compliant. As of late 2024, regulatory scrutiny has increased.

India's Digital Personal Data Protection Act, 2023, significantly influences Jio Financial Services. This law dictates how they handle customer data, emphasizing consent and data minimization. Compliance is crucial; in 2024, non-compliance can lead to hefty penalties.

Consumer protection laws, including fair practice codes and grievance redressal, are vital for Jio Financial Services. Compliance ensures fair customer treatment. The Reserve Bank of India (RBI) updates consumer protection guidelines regularly; the latest updates were in 2024. Non-compliance can lead to penalties and reputational damage, as seen with various financial institutions.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Norms

Jio Financial Services (JFS) faces stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are crucial for preventing financial crimes and ensuring transparency. JFS must establish comprehensive customer verification and transaction monitoring systems. Compliance is vital; failure can lead to hefty penalties and reputational damage.

- AML compliance costs for financial institutions have risen by approximately 20% in the last year.

- KYC failures can result in fines up to $10 million.

- JFS needs to invest heavily in technology for compliance.

- Regular audits and updates are essential.

Regulatory Sandbox and Innovation Frameworks

India's regulators are actively fostering fintech through regulatory sandboxes and innovation hubs. Jio Financial Services can leverage these frameworks for testing new financial products. This approach allows for controlled experimentation, reducing risks. It also speeds up the deployment of innovative services.

- RBI's Sandbox: 3 cohorts launched, with 27 entities participating (2024).

- Focus areas: Retail payments, lending, cross-border payments, etc.

- Benefits: Reduced regulatory burden, accelerated innovation.

- Impact: Faster product launches, improved market access.

Jio Financial Services (JFS) must comply with evolving Indian financial regulations, overseen primarily by the RBI, which involves licensing, capital requirements, and adapting to fintech-specific rules. The Digital Personal Data Protection Act, 2023 mandates stringent data handling practices to protect customer information, and non-compliance results in penalties. Consumer protection laws and Anti-Money Laundering/Know Your Customer (AML/KYC) regulations also require robust systems for fair treatment and prevention of financial crimes.

Regulators support fintech with sandboxes, aiding innovation.

| Regulation Type | Regulatory Body | Impact on JFS |

|---|---|---|

| AML/KYC | RBI, FIU-IND | Compliance costs rose 20% in 2024. |

| Data Protection | DPDP Act | Focus on data minimization. |

| Consumer Protection | RBI | Ensuring fair practices and redressal. |

Environmental factors

Jio Financial Services (JFS) must consider India's rising sustainable finance trend. The integration of ESG factors into investment decisions is crucial. In 2024, India's green bond market saw significant growth, reflecting this shift. JFS can capitalize on offering green financial products.

Financial institutions are now heavily evaluating the environmental impact of their projects and climate-related risks. Jio Financial Services needs to consider these factors for lending and investments. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) is a key framework. In 2024, about 70% of the world's largest companies support TCFD. This means more scrutiny.

Green lending and investments offer Jio Financial Services opportunities in sustainable projects. These include renewable energy and energy-efficient initiatives. The global green finance market is projected to reach $30 trillion by 2030. Jio can tap into this growth to boost its sustainable finance portfolio. This move aligns with global ESG trends.

Environmental and Social Safeguards

Environmental and social safeguards are increasingly critical for financial institutions. Jio Financial Services (JFS) should consider developing policies to address the potential negative impacts of its financing activities. This includes assessing environmental risks and promoting sustainable practices in projects it supports. Financial institutions globally are facing pressure to integrate ESG factors; for example, in 2024, ESG-focused assets reached approximately $42 trillion worldwide.

- Risk Mitigation: Reduces potential liabilities.

- Regulatory Compliance: Aligns with evolving standards.

- Stakeholder Value: Enhances reputation and investor appeal.

- Sustainable Finance: Supports long-term viability.

Corporate Social Responsibility (CSR) in Environment

Financial institutions like Jio Financial Services face growing pressure to adopt environmental responsibility as part of their Corporate Social Responsibility (CSR) strategies. This involves implementing eco-friendly practices and backing green initiatives to align with stakeholder expectations and regulatory demands. For instance, the global green finance market is projected to reach $30 trillion by 2030, highlighting the increasing importance of sustainable investments. Jio Financial Services could invest in renewable energy projects or offer green financial products to capitalize on this trend.

- Green finance market is projected to reach $30 trillion by 2030.

- Growing stakeholder expectations for environmental responsibility.

- Regulatory pressures to support sustainable practices.

Jio Financial Services (JFS) faces scrutiny regarding environmental impact, especially with ESG integration in investment. The green finance market, expected to hit $30T by 2030, offers opportunities. Compliance and risk mitigation are key benefits for JFS.

| Aspect | Details | Impact for JFS |

|---|---|---|

| Green Finance | Market projected at $30T by 2030 | Opportunities in green products |

| ESG Factors | Focus on environmental impact | Need to assess risks |

| Risk Mitigation | Reduces liabilities. | Enhances value and investor appeal. |

PESTLE Analysis Data Sources

This PESTLE analysis draws from credible financial reports, market research, government data, and policy updates. These are complemented by insights from industry experts.