Johnson Controls International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Johnson Controls International Bundle

What is included in the product

Analysis of Johnson Controls' units within the BCG Matrix, guiding investment, hold, or divest decisions.

Clean and optimized layout for sharing or printing, providing quick insights.

What You’re Viewing Is Included

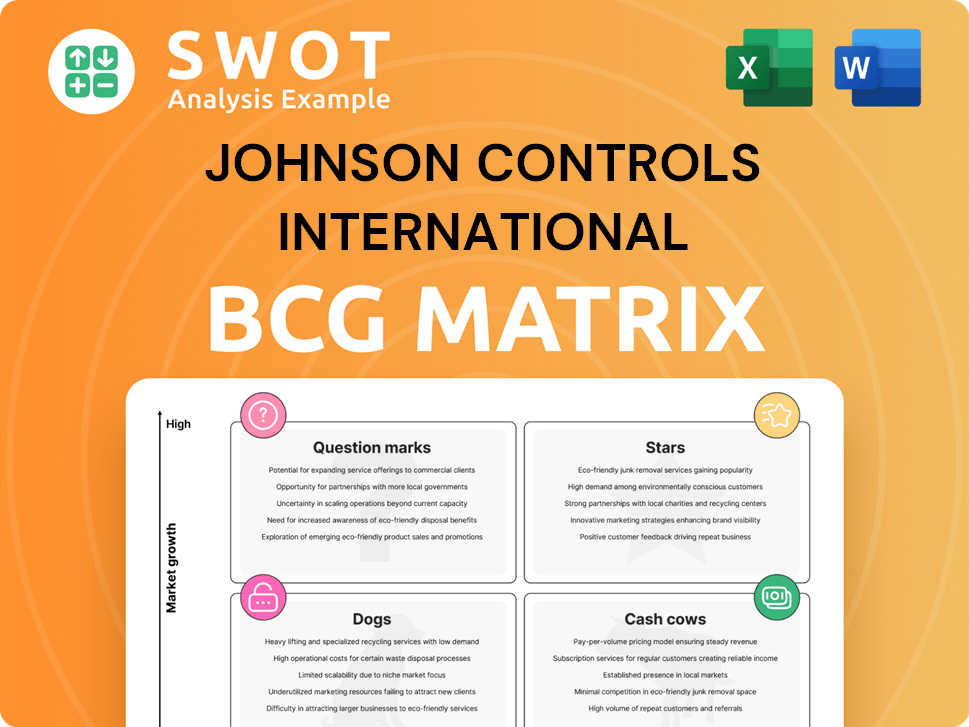

Johnson Controls International BCG Matrix

The preview showcases the complete Johnson Controls International BCG Matrix report you'll receive after buying. No hidden content or alterations; this is the ready-to-use, professionally formatted analysis. Instantly downloadable, it's perfect for immediate strategic application.

BCG Matrix Template

Johnson Controls International (JCI) operates in diverse markets, from building technologies to energy efficiency. Its BCG Matrix reveals where each business unit thrives. Question Marks highlight areas for potential growth and investment. Learn about JCI's Cash Cows, crucial for steady revenue. Stars showcase the company's market leaders. See how JCI manages its Dogs.

Purchase the full BCG Matrix to receive a detailed Word report + a high-level Excel summary. It’s everything you need to evaluate, present, and strategize with confidence.

Stars

Johnson Controls' OpenBlue Digital Platform, a star in its BCG Matrix, leads in smart building tech. It uses AI for better performance, reducing energy use, and optimizing spaces. OpenBlue's integration with diverse systems drives significant growth. In 2024, Johnson Controls reported a 7% organic revenue growth, fueled by platforms like OpenBlue.

HVAC solutions for data centers are a Star for Johnson Controls. Data center demand is soaring, and Johnson Controls leads in cooling solutions. Orders more than doubled in 2024, reflecting strong growth. These custom solutions require close customer partnerships; 2024 revenue reached $8.5B.

The Global Products segment of Johnson Controls, a star in the BCG Matrix, showed robust performance in 2024. It achieved organic sales growth and expanded margins, fueled by innovative HVAC solutions and controls. A focus on long-cycle backlog and higher-margin jobs, like those in North America, is expected to boost revenue. For instance, the company's total revenue in the second quarter of fiscal year 2024 was $6.8 billion.

Building Automation Systems in North America

Building automation systems in North America are experiencing strong growth, primarily due to energy efficiency and sustainability efforts. Johnson Controls is a major player, capturing a significant market share. The company's backlog is increasing, especially in services and systems like fire and security. This growth is supported by a strong focus on smart building technologies.

- Johnson Controls' North American revenue increased by 8% in fiscal year 2024.

- The building automation market in North America is projected to reach $90 billion by 2028.

- Fire and security systems account for over 40% of Johnson Controls' North American backlog growth.

- Energy efficiency projects drive about 60% of the building automation demand.

Applied HVAC and Controls

Johnson Controls' applied HVAC and controls business is a star, particularly in North America. This segment is benefiting from strong demand in data centers and healthcare. Applied HVAC solutions are custom-engineered, fostering strong customer partnerships. The company's focus on energy-efficient solutions aligns with market trends.

- North America HVAC & Controls organic sales growth was up 11% in fiscal year 2024.

- Data center projects contributed significantly to this growth.

- Applied HVAC solutions are crucial for new energy projects.

- Johnson Controls sees continued strong growth in this area.

OpenBlue Digital Platform, HVAC solutions for data centers, Global Products, Building automation in North America, and Applied HVAC are Stars. They show strong growth and market leadership. Driven by AI, data center demand, and energy efficiency, these segments boost Johnson Controls' revenue. In 2024, the North America HVAC & Controls segment had 11% organic sales growth.

| Segment | Key Driver | 2024 Performance |

|---|---|---|

| OpenBlue Digital Platform | AI-driven smart buildings | 7% organic revenue growth |

| Data Center HVAC | Soaring demand | Orders more than doubled |

| Global Products | Innovative HVAC | Organic sales growth & margin expansion |

| Building Automation (NA) | Energy efficiency | 8% revenue increase |

| Applied HVAC (NA) | Data centers & healthcare | 11% organic sales growth |

Cash Cows

Commercial HVAC systems are a cash cow for Johnson Controls. These systems provide a consistent revenue stream due to their essential role in commercial buildings. In 2024, the HVAC & Controls segment generated $26.5 billion in revenue. This demonstrates the financial stability of this business.

Johnson Controls' fire and security solutions are categorized as "Cash Cows" within its BCG matrix. These systems are essential for building safety and compliance, securing a solid market share. The company's focus is on enterprise fire safety, integrating advanced sensor tech with cloud monitoring. In fiscal year 2024, the security segment generated approximately $11.8 billion in revenue.

Building Management Systems (BMS) are a cornerstone for Johnson Controls, driving substantial revenue. They are crucial for facility management, boosting operational efficiency. The Metasys system enhances building performance and sustainability. In 2024, the global BMS market was valued at approximately $90 billion. Johnson Controls reported over $25 billion in sales in 2024, with BMS significantly contributing.

Installation and Design Services

Johnson Controls' installation and design services for fire protection systems are a reliable revenue stream, fitting the "Cash Cows" category. These services are essential due to stringent regulations and the necessity for specialized knowledge. The segment profits from rising investments in installations and services, along with improvements in reliability and installation rates. The company's fire detection and suppression business saw a 7% organic revenue growth in 2024.

- Steady Revenue: Consistent demand due to compliance needs.

- Expertise Driven: Relies on specialized skills and knowledge.

- Investment Growth: Benefiting from increased spending in the sector.

- Operational Efficiency: Improved reliability and higher installation rates.

Service Agreements

Long-term service agreements are a cornerstone of Johnson Controls' financial stability, offering a steady revenue stream. These agreements, vital for building systems maintenance, ensure consistent cash flow. Johnson Controls' services success stems from these long contracts, a global presence, and AI integration. In 2024, service revenue accounted for a significant portion of total revenue, around $13 billion, showcasing its importance.

- Predictable Revenue: Provides stable income.

- Maintenance & Support: Ensures ongoing system health.

- Key Drivers: Long contracts, global reach, and AI.

- Financial Impact: Contributes billions in revenue.

Cash Cows generate consistent revenue for Johnson Controls, like HVAC systems, fire and security solutions, and building management systems. These segments benefit from essential services and compliance needs, ensuring stable income. Services, including long-term agreements, contribute significantly to the company's financial stability.

| Segment | 2024 Revenue (USD billions) | Key Features |

|---|---|---|

| Commercial HVAC | 26.5 | Essential systems, stable demand |

| Fire & Security | 11.8 | Compliance, enterprise focus |

| BMS | 25+ | Operational efficiency, sustainability |

| Services | 13 | Long-term agreements, AI integration |

Dogs

The Residential & Light Commercial HVAC, divested to Bosch in Q4 2024, is a "Dog" in JCI's BCG matrix. This segment had lower growth prospects. The sale, finalized in late 2024, allows JCI to concentrate on faster-growing sectors. The divestiture generated $2.6 billion in proceeds.

Industrial refrigeration faces challenges, with sales declines signaling a weaker market position. Johnson Controls might need to invest heavily to improve it or consider selling this segment. In 2024, the company prioritized areas with better growth prospects, such as sustainable buildings. The segment's revenue was down 7% in Q3 2024.

Outdated legacy systems at Johnson Controls, like older HVAC units, are in the "Dog" quadrant. These systems struggle against modern, energy-efficient competitors. The company addresses this by retrofitting buildings. In 2024, Johnson Controls invested heavily in smart building tech, aiming for growth. The goal is to replace old systems with advanced alternatives.

Commoditized Products

In the HVAC sector, commoditized products like certain applied commercial HVAC offerings may face pricing challenges and reduced profit margins. To stay competitive, Johnson Controls must focus on efficient cost management. The company is utilizing its engineering expertise to tackle complex issues for data center clients, aiming to increase value. This strategic shift helps mitigate the impact of commoditization.

- In 2024, Johnson Controls reported a gross margin of 30.6% in its building solutions business, indicating the importance of cost control.

- The company's focus on data centers is driven by an expected market growth of 10-15% annually in that segment.

- Johnson Controls is investing $500 million in digital solutions and sustainability initiatives, aiming to enhance its offerings and value.

Low-Margin System Jobs

Low-margin system jobs at Johnson Controls are projects with slim profit margins that can strain resources. These projects may not offer sufficient returns. The company is emphasizing long-cycle backlog and higher-margin jobs to boost revenue and profitability. In 2024, Johnson Controls saw a focus on these strategic initiatives, aiming to improve overall financial performance.

- Low-margin projects can tie up resources.

- The company is prioritizing higher-margin work.

- This strategy aims to improve financial returns.

- Focus on long-cycle backlog in 2024.

Several segments within Johnson Controls are classified as "Dogs" in the BCG matrix, indicating low growth and market share. These include the divested Residential & Light Commercial HVAC, older HVAC units, and commoditized products. These areas face challenges such as declining sales, outdated technology, or pricing pressures.

| Segment | Challenge | JCI Action |

|---|---|---|

| Residential HVAC | Divested in Q4 2024 | Focus on growth areas. |

| Industrial Refrigeration | Sales declines, weaker market position | Invest or consider sale. |

| Older HVAC systems | Outdated, energy inefficiency | Retrofitting, focus on smart tech. |

Question Marks

AI-powered building management is a Question Mark for Johnson Controls. This area has high growth potential but needs significant investment. Johnson Controls is boosting AI in its OpenBlue suite. These moves set the stage for more AI improvements in 2025. The company's revenue was $25.2 billion in fiscal year 2024.

Johnson Controls' OpenBlue Net Zero Buildings as a Service is a Star in its BCG matrix, indicating high growth potential. This initiative leverages digital solutions and AI to boost building efficiency and cut emissions. In 2024, the focus is on investing in this service to prove its value and attract clients. The company aims to help buildings achieve net-zero emissions, which is a growing market.

Energy-efficient retrofits are gaining traction, especially with older buildings. Johnson Controls is actively marketing its solutions to tap into this expanding market. These efforts involve sales and marketing strategies to boost market reach. For instance, in 2024, the global energy efficiency services market was valued at $30.1 billion, with significant growth expected. Johnson Controls offers comprehensive retrofit solutions, aiming to capitalize on the increasing demand for sustainable building practices.

Integration of IoT and Smart Sensors

Johnson Controls' embrace of IoT and smart sensors is crucial. These technologies are vital for building automation, allowing for real-time data analysis. Investment in these areas is key to staying competitive, offering energy savings and cost reductions. This also boosts occupant comfort, a key benefit for clients.

- By 2024, the global smart building market is projected to reach $80.6 billion.

- Johnson Controls' revenue in 2023 was approximately $25.1 billion.

- IoT adoption in commercial buildings is expected to grow by 20% annually.

- Smart sensors can reduce energy consumption by up to 30%.

Cybersecurity Solutions

Cybersecurity solutions are a question mark for Johnson Controls within the BCG Matrix. With increased connectivity in building systems, these solutions are becoming increasingly crucial. Johnson Controls must invest in robust security measures to protect its systems and data from rising cyber threats. Maintaining and improving the security of Johnson Controls' enterprise IT infrastructure is vital to long-term success.

- Johnson Controls' revenue for fiscal year 2023 was $25.1 billion.

- Cybersecurity spending in the building automation sector is expected to grow.

- The company faces risks from data breaches and cyberattacks.

- Investing in cybersecurity can protect its assets.

Cybersecurity for Johnson Controls is a Question Mark. High growth potential exists, but requires substantial investment in a competitive market. Cyber threats could affect operations. In 2024, they face the need to protect their assets.

| Aspect | Details | Impact |

|---|---|---|

| Market Growth | Cybersecurity spending in building automation is growing. | Increased need for robust solutions. |

| Investment | Significant investments are needed to stay competitive. | Potential for high returns, but high risk. |

| Risks | Data breaches and cyberattacks pose significant risks. | Potential financial losses and reputational damage. |

BCG Matrix Data Sources

The Johnson Controls BCG Matrix relies on financial reports, market studies, and industry analysis for well-founded insights.