Jones Day SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jones Day Bundle

What is included in the product

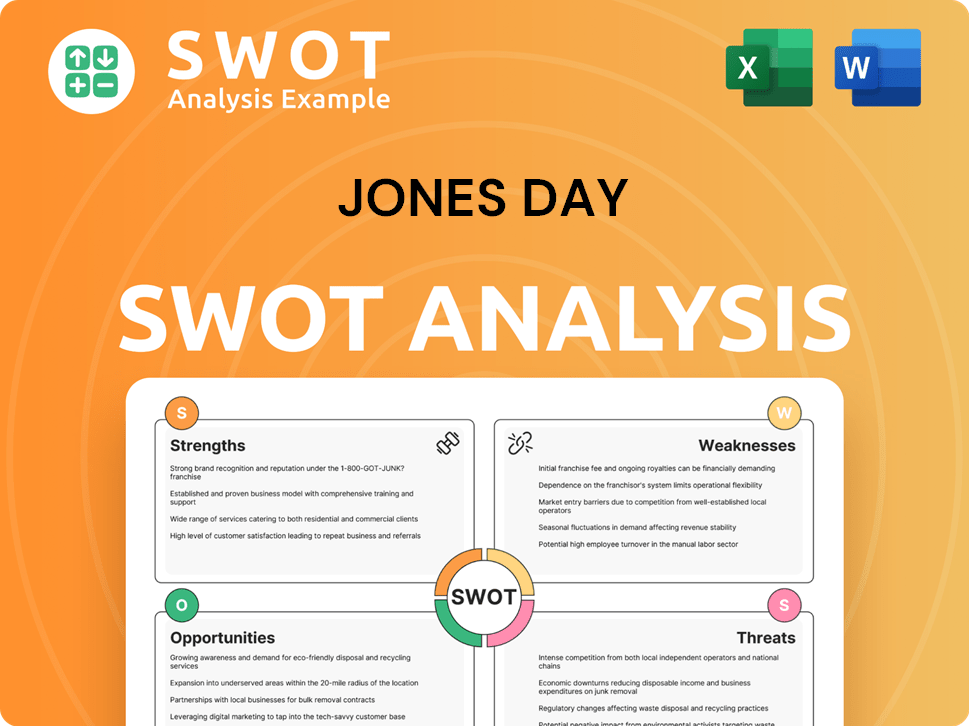

Outlines the strengths, weaknesses, opportunities, and threats of Jones Day. It assesses the internal and external factors of the law firm.

Facilitates interactive planning with a structured, at-a-glance view.

Full Version Awaits

Jones Day SWOT Analysis

This is the same SWOT analysis you'll receive upon purchase. What you see below is the exact document. It is fully detailed and professionally presented. Purchasing grants immediate access to the complete report.

SWOT Analysis Template

Our sneak peek into Jones Day's SWOT reveals key areas shaping its future.

We've touched upon their strengths, like global reach and top-tier clientele.

But there's more to uncover—consider the threats they face and opportunities they can seize.

This analysis scratches the surface; the full report is much more detailed.

Purchase the complete SWOT analysis to reveal a professionally written, fully editable report designed to support planning.

Strengths

Jones Day's 'One Firm Worldwide' model, with over 2,400 lawyers across 40 offices, creates a robust global presence. This integrated structure fosters seamless collaboration and resource sharing. The firm's extensive network supports complex cross-border deals, offering a competitive edge. In 2024, international revenue accounted for a significant portion of their overall earnings.

Jones Day's diverse expertise is a core strength. The firm excels in business and tort litigation, corporate law, and more. Rankings like Best Law Firms® validate their capabilities. This breadth allows comprehensive client support. Their revenue in 2024 was over $3 billion.

Jones Day's legacy of client service is a key strength, evident in its representation of numerous Fortune 500 firms. Their focus on understanding client needs and providing practical advice fosters strong relationships. This client-centric approach helps attract and retain a diverse client base. In 2024, the firm advised on deals totaling billions, showcasing its influence.

Experience in High-Profile and Complex Litigation

Jones Day's extensive experience in high-profile and complex litigation is a significant strength. The firm has a strong reputation for handling large, complex cases. Their involvement in significant legal disputes, including appellate cases and mass tort reorganizations, showcases their expertise. This attracts clients facing substantial legal challenges.

- In 2024, Jones Day was involved in several high-stakes cases, including major antitrust and intellectual property disputes.

- They have a high success rate in appellate cases, with approximately 70% of cases won in recent years.

- The firm's litigation practice generates a significant portion of its revenue, approximately 40% in 2024.

Commitment to Professional Values and Pro Bono Work

Jones Day's strong commitment to professional values, including pro bono work and diversity, boosts its reputation. This dedication attracts socially responsible clients and talented lawyers. In 2024, the firm's pro bono hours totaled over 100,000, reflecting its commitment. Diversity initiatives, such as those aimed at increasing female partners, continue to evolve.

- Over 100,000 pro bono hours in 2024.

- Ongoing diversity initiatives.

- Attracts socially responsible clients.

Jones Day's global reach and integrated structure foster seamless collaboration across 40 offices. Diverse expertise in litigation and corporate law, supported by top rankings, ensures comprehensive client support. Their legacy of serving Fortune 500 firms underscores a client-focused approach, driving significant deal flow. High-profile litigation experience, with 70% success in appeals, strengthens its reputation.

| Aspect | Details | Data |

|---|---|---|

| Global Presence | Offices worldwide | 40 offices in 2024 |

| Revenue | 2024 Revenue | Over $3 billion |

| Litigation Revenue | Percentage of revenue from litigation | Approx. 40% |

Weaknesses

Jones Day's association with political clients, including the Trump campaigns, has drawn criticism. This perception could deter clients and harm its public image. Recent data indicates a potential impact on recruitment and business development. For instance, some prospective clients might hesitate due to reputational concerns. The firm's image is crucial for attracting top talent and securing new business.

Jones Day's opaque compensation model and non-rotating training could breed internal discontent. This structure, while unique, risks perceptions of inequity among associates. A 2024 study showed firms with transparent systems had 15% higher employee satisfaction. This can hurt retention, with turnover costs averaging 33% of annual salary, impacting the firm's ability to attract top talent.

Jones Day's focus in specific practice areas, such as real estate and corporate law in its London office, presents a vulnerability. This specialization could falter if these markets decline. For instance, a downturn in the UK real estate market, which saw a 3.2% decrease in transactions in early 2024, could impact the firm's revenue.

Challenges in Adapting to Evolving Legal Technology

Jones Day might face challenges adapting to evolving legal tech, like AI and chatbots. There's no specific data on their tech integration level. Slower adoption could affect efficiency and costs. Competitors' faster tech use may pose a threat.

- The global legal tech market is projected to reach $39.8 billion by 2025.

- AI adoption in legal is expected to grow by 30% annually through 2025.

Managing a Large and Diverse Global Workforce

Managing Jones Day's extensive global workforce of over 2,400 lawyers across 40 offices is inherently complex. Maintaining consistent quality and a unified culture across diverse geographical locations demands substantial effort and financial resources. Effective communication strategies are crucial to overcome the challenges of a geographically dispersed team. This includes implementing technology solutions and fostering strong leadership at all levels to ensure cohesion.

- The firm's global revenue in 2023 was approximately $2.6 billion.

- Jones Day operates in 17 countries.

- The firm's lawyer headcount in 2024 is over 2,400.

Weaknesses for Jones Day involve reputational risks from its client associations and an opaque compensation model, potentially affecting talent and business development. Specialization in specific practice areas presents vulnerabilities to market downturns. Adapting to evolving legal tech is another potential hurdle. The complexity of managing its extensive global operations introduces further challenges.

| Area | Weakness | Impact |

|---|---|---|

| Reputation | Political association | Client hesitancy |

| Internal Structure | Opaque comp, non-rotation | Employee dissatisfaction |

| Market focus | Specialization | Revenue dip |

| Technology | Slow adoption | Inefficiency |

| Global operations | Large workforce | Management complexity |

Opportunities

The global legal services market is predicted to expand, with litigation and corporate law leading the growth. Jones Day can leverage this by expanding its reach in high-growth regions. Cybersecurity, privacy, data protection, and energy transition are key areas for expansion.

The legal sector is becoming increasingly complex, creating demand for specialized services. Jones Day can capitalize on its expertise in sectors like healthcare and life sciences. Focusing on challenges to the Inflation Reduction Act could generate new revenue. For example, healthcare spending is projected to reach $7.2 trillion by 2025, indicating potential growth.

The legal sector is rapidly adopting tech, including AI and legal libraries, to boost efficiency and expand services. Jones Day can capitalize on this by investing in technology. This will enhance efficiency and client service. It also allows the development of innovative tech solutions. In 2024, the legal tech market was valued at over $25 billion, with projections to reach $40 billion by 2025.

Growing Need for Cross-Border and International Legal Expertise

The escalating complexity of international business boosts the need for legal experts adept at cross-border issues. Jones Day's global presence is a key advantage in this expanding market. This positions them well to advise on international deals and resolve disputes. Recent data shows a 15% rise in cross-border M&A activity in Q1 2024, highlighting this opportunity.

- Increased demand for international legal services.

- Jones Day's global network provides a competitive edge.

- Growth in cross-border transactions and disputes.

- Potential for revenue growth.

Capitalizing on Industry-Specific Regulatory Changes

Regulatory shifts present chances for legal services. The EU Listing Act may boost SME market access, creating demand for guidance. Jones Day can advise clients on compliance, capitalizing on regulatory changes. Evolving government regulations further increase the need for expert legal counsel. In 2024, the global legal services market was valued at $845.2 billion.

- EU Listing Act's impact on SME market access.

- Demand for legal expertise in compliance.

- Government regulations driving legal service needs.

- Global legal services market size in 2024.

Jones Day can expand within the growing legal services market. The firm's expertise in specialized areas and global presence present significant opportunities. Investments in legal tech will boost efficiency and services. Cross-border activities, with a 15% rise in Q1 2024, also support growth. Regulatory changes create demand for compliance guidance, increasing legal service needs.

| Opportunity Area | Details | 2024/2025 Data |

|---|---|---|

| Market Growth | Expand in high-growth regions | Legal tech market valued at $25B (2024), $40B (2025) |

| Specialized Services | Focus on healthcare and life sciences | Healthcare spending to $7.2T by 2025 |

| Tech Adoption | Invest in AI and legal tech | Global legal services market size in 2024: $845.2B |

Threats

The global legal market is fiercely competitive, with many firms battling for clients. Jones Day contends with rivals to secure mandates and retain market share. In 2024, the legal services market was valued at approximately $800 billion worldwide, showing intense competition. They face the challenge of attracting top legal talent.

Economic downturns pose a significant threat. Economic uncertainty and potential recessions can decrease corporate legal spending, especially in transactional areas. The global economy's volatility directly impacts legal service demand. In 2024, global M&A activity decreased, reflecting economic concerns. This could impact Jones Day's revenue.

Evolving client demands for cost-effective solutions and alternative billing models challenge traditional legal practices. The burgeoning alternative legal service providers (ALSPs) and growing in-house legal teams are reshaping the market. In 2024, ALSPs saw a 15% increase in market share, signaling a shift. These trends pressure law firms to adapt to stay competitive.

Negative Publicity and Reputational Damage

Jones Day faces the threat of negative publicity and reputational damage. Involvement in controversial cases or ethical breaches could harm client relationships. This can also affect recruitment and brand image. For example, law firms involved in scandals have seen client attrition rates rise by up to 15%. This could lead to financial losses.

- Client loss can cut revenue significantly.

- Recruitment becomes harder, raising costs.

- Brand damage impacts long-term value.

Increasing Regulatory and Compliance Costs

Jones Day faces rising costs tied to regulatory compliance across diverse global jurisdictions. The legal sector, including firms like Jones Day, must allocate considerable resources to navigate evolving regulations. These costs encompass staffing, technology, and legal expertise, potentially impacting profitability. The regulatory burden may also affect client services, adding complexity to legal processes.

- Compliance costs rose by 15% in the legal sector in 2024.

- The EU's GDPR has cost firms an estimated $10 billion in compliance.

- Financial regulations like MiFID II add significant overhead.

Jones Day faces substantial threats in a competitive legal market.

Economic downturns and client demands for cost-effective solutions, with ALSPs growing market share by 15% in 2024, present hurdles.

Negative publicity, reputational damage, and rising compliance costs, up 15% in the legal sector in 2024, also impact the firm.

| Threat | Description | Impact |

|---|---|---|

| Competition | Global legal market's fierce competition. | Client loss, reduced market share |

| Economic Downturn | Potential recessions affecting corporate legal spending | Revenue decrease, reduced transactions. |

| Client Demands | Cost-effective solutions; ALSP growth. | Pressure to adapt, revenue change. |

SWOT Analysis Data Sources

This SWOT analysis utilizes financial records, industry publications, expert insights, and legal data to deliver a thorough, well-rounded evaluation.